Global Recombinant Cell Culture Supplements Market Forecast

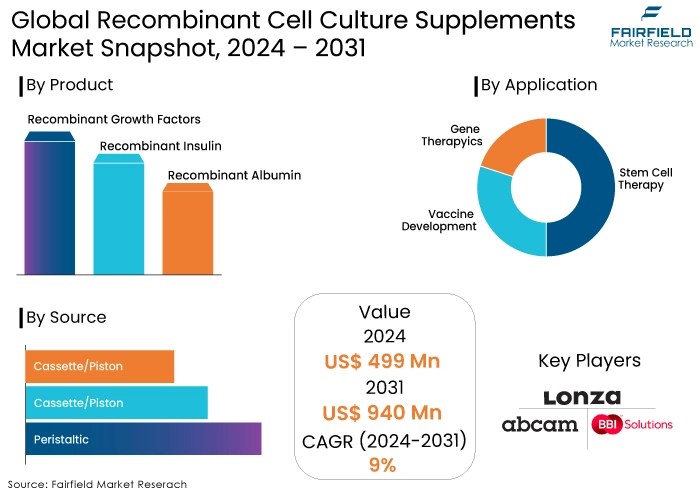

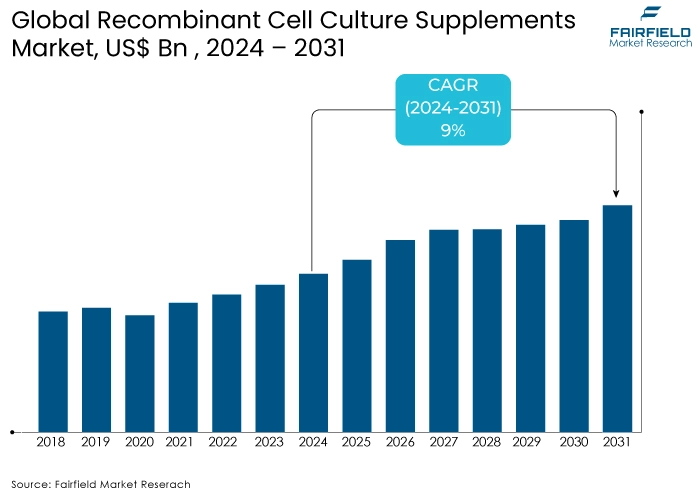

- Recombinant cell culture supplements market size poised to reach US$940 Mn in 2031, up from US$499 Mn estimated in 2024

- Global recombinant cell culture supplements market revenue projected to witness a CAGR of 9% during 2024-2031

Quick Report Digest

- Recombinant cell culture supplements are primarily utilized in creating bioprocesses, gene therapy, and stem cell research.

- Stem cells are provided with nutrients and growth factors to promote their differentiation into specific cell types or to enhance their culture expansion.

- Cell culture supplements are essential ingredients for growth media and are necessary for cells' healthy reproduction or proliferation.

- Mammalian cells require additional chemicals in addition to the basal medium. These substances comprise proteins, carbs, vitamins, and amino acids.

- In recent years, there has been a significant surge in the demand for recombinant cell culture additives.

- Furthermore, the increasing fascination with oncology and stem cell research has created opportunities for manufacturers.

- Recombinant products offer advantages such as the ability to produce growth factors and supplements on a large scale, reducing production expenses.

- Recombinant DNA technology has altered the pharmaceutical industry's methodology for developing medicines and items that aid in research.

- The recombinant cell culture supplements market has experienced significant growth due to the emergence of sophisticated medicines and biopharmaceuticals, also known as biologics.

- Throughout the projected period, demand is expected to increase substantially due to drug discovery endeavors. The biopharmaceutical industry is anticipated to be transformed due to the increasing demand for biologics and animal-free products.

A Look Back and a Look Forward - Comparative Analysis

The recombinant cell culture supplements market has shown notable growth leading up to 2023 and is poised for accelerated expansion post-2024. Pre-2023, the market's growth was driven by the increasing demand for biologics and biosimilars, advancements in biopharmaceutical production, and the need for consistent, high-quality cell culture media. Recombinant cell culture supplements, derived from genetically engineered organisms, offer superior consistency and reduced risk of contamination compared to traditional animal-derived supplements. This quality advantage significantly fueled market adoption, especially as regulatory agencies imposed stricter guidelines on the use of animal-derived components in pharmaceutical production.

During this period, the biopharmaceutical industry's focus on producing vaccines, monoclonal antibodies, and regenerative medicines contributed significantly to the demand for recombinant supplements. The growth in personalized medicine and cell and gene therapy also played a crucial role in driving market expansion. Post-2024, the market is expected to accelerate further due to several factors. The increasing prevalence of chronic diseases and the advancements in biologics and biosimilar will continue to drive demand for high-quality cell culture supplements.

Technological advancements in recombinant protein production and the expansion of bio manufacturing capacities globally will further boost market growth. Additionally, the rising adoption of animal-free, sustainable, and ethically produced supplements will align with the growing emphasis on ethical sourcing and environmental sustainability in the biopharmaceutical industry. Strategic collaborations and investments in R&D will likely bring innovative products to market, enhancing growth prospects. The continuous evolution of the biopharmaceutical sector, with an emphasis on precision medicine and novel therapeutic approaches, will ensure sustained growth for the recombinant cell culture supplements market.

Key Growth Determinants

- Increasing Demand for Biopharmaceuticals

One of the primary growth drivers for the recombinant cell culture supplements market is the escalating demand for biopharmaceuticals. Biopharmaceuticals, including monoclonal antibodies, vaccines, and gene therapies, require sophisticated cell culture techniques for production. Recombinant cell culture supplements are essential in this process as they provide the necessary nutrients and growth factors for cell cultures, ensuring high yield and quality of the final product.

The biopharmaceutical industry has been growing rapidly due to the rising prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders. This growth has created a substantial demand for reliable and efficient cell culture supplements. Recombinant supplements, being animal-free and consistent in quality, are preferred over traditional supplements, thus driving market growth. As the biopharmaceutical sector continues to expand and innovate, the demand for high-quality cell culture supplements is expected to increase, further propelling the market.

- Advancements in Biotechnology and Cell Culture Techniques

Advancements in biotechnology and cell culture techniques are significantly driving the growth of the recombinant cell culture supplements market. Innovations in genetic engineering and recombinant DNA technology have enabled the production of more precise and efficient cell culture supplements. These advancements allow for the creation of supplements tailored to specific cell lines and applications, enhancing the productivity and efficacy of biopharmaceutical manufacturing processes.

Additionally, improvements in cell culture techniques, such as the development of serum-free and chemically defined media, have increased the reliance on recombinant supplements. These modern techniques reduce the risk of contamination and variability associated with animal-derived components, making recombinant supplements a more attractive option. As biotechnological research progresses and new cell culture methods are developed, the demand for advanced, high-quality recombinant cell culture supplements is expected to rise, driving market growth.

Key Growth Barriers

- High Cost of Development and Production

A significant restraint for the recombinant cell culture supplements market is the high cost associated with the development and production of these supplements. Recombinant supplements are produced using advanced genetic engineering techniques and sophisticated bioprocessing technologies, which require substantial investment in research, equipment, and skilled labour.

The complexity of ensuring consistent quality and scalability of production further adds to the costs. These high production costs translate into higher prices for recombinant supplements, making them less affordable for smaller biopharmaceutical companies and research institutions. This financial barrier can limit market adoption, particularly in emerging markets where cost constraints are more pronounced. Additionally, the ongoing need for innovation and improvement in recombinant technologies to stay competitive adds to the financial burden, potentially slowing market growth.

- Technical Challenges, and Limited Expertise

Technical challenges and limited expertise in recombinant technology and cell culture processes also restrain the growth of the recombinant cell culture supplements market. Producing high-quality recombinant supplements requires specialized knowledge and expertise in genetic engineering, molecular biology, and bioprocessing. However, there is a shortage of skilled professionals with experience in these areas, which can hinder the development and optimization of recombinant supplements.

Technical issues such as maintaining product stability, ensuring batch-to-batch consistency, and scaling up production without compromising quality are significant challenges. These technical complexities can lead to delays in product development and commercialization. Moreover, smaller companies and research institutions may lack the necessary resources and expertise to effectively utilize recombinant supplements, limiting their adoption and contributing to slower market growth. Addressing these technical challenges requires ongoing investment in education, training, and technological advancements, which can be both time-consuming and costly.

Recombinant Cell Culture Supplements Market Trends and Opportunities

- Shift Towards Chemically Defined and Serum-Free Media

One of the most significant trends in the recombinant cell culture supplements market is the shift toward chemically defined and serum-free media. Traditional cell culture methods often relied on serum, such as fetal bovine serum (FBS), which contains a complex mix of growth factors, hormones, and nutrients.

However, serum-based media pose several challenges, including batch-to-batch variability, risk of contamination, ethical concerns, and supply chain issues.

In response, the biopharmaceutical industry is increasingly adopting chemically defined and serum-free media, which provide a controlled and consistent environment for cell growth. Chemically defined media are composed of known quantities of pure components, eliminating the variability and ethical issues associated with animal-derived products. This trend is driven by the need for reproducible and high-quality biopharmaceutical production processes and regulatory pressures to minimize the use of animal-derived components.

Recombinant cell culture supplements play a crucial role in this transition by providing essential nutrients and growth factors in a defined and consistent manner. As the industry continues to move towards more standardized and ethical production methods, the demand for recombinant supplements is expected to grow, further driving market expansion.

- Expansion Opportunity in Developing Regional Markets

The recombinant cell culture supplements market has a significant opportunity for expansion into emerging markets. Countries in regions such as Asia Pacific, Latin America, and the Middle East are experiencing rapid growth in their biopharmaceutical sectors, driven by increasing healthcare investments, growing prevalence of chronic diseases, and rising demand for advanced medical treatments. These regions are also witnessing improvements in healthcare infrastructure and regulatory frameworks, creating a conducive environment for the adoption of innovative biopharmaceutical technologies. Developing markets present a substantial opportunity for companies to expand their presence and tap into a large and underserved patient population. Pharmaceutical and biotechnology companies can leverage this opportunity by forming strategic partnerships with local players, conducting region-specific clinical trials, and tailoring their product offerings to meet the unique needs and regulatory requirements of these markets.

Additionally, efforts to make recombinant supplements more affordable and accessible through differential pricing strategies, local manufacturing, and distribution networks can enhance market penetration. By capitalizing on the growth potential of developing and emerging markets, companies can not only increase their market share but also contribute to improving healthcare outcomes in these regions. This opportunity aligns with the broader goal of achieving global health equity and ensuring that advanced biopharmaceutical technologies are accessible to all patients, regardless of geographic location.

How is Regulatory Scenario Shaping this Industry?

The regulatory landscape significantly shapes the growth of the recombinant cell culture supplements market. Bodies like the FDA, EMA, and other regional authorities impose stringent standards for product safety, efficacy, and manufacturing processes. Compliance with these regulations is crucial for market entry and commercial success.

While these regulations ensure product quality and patient safety, they can also increase development costs and time-to-market. However, robust regulatory oversight can boost industry credibility and consumer confidence, ultimately driving market growth. Additionally, harmonization of regulatory standards across different regions can facilitate global market expansion for these supplements.

Segments Covered in Recombinant Cell Culture Supplements Market Report

- Recombinant Growth Factors to be the Leading Product Category

Recombinant growth factors represent the dominant segment within the product category. These proteins play a pivotal role in regulating cell growth, differentiation, and proliferation. Their consistent and defined composition, compared to growth factors derived from animal or human sources, makes them highly desirable for cell culture applications. The demand for recombinant growth factors in the recombinant cell culture supplements market is particularly robust in research, drug discovery, and cell therapy.

- Stem Cell Therapy Spearheads by Application

Stem cell therapy is the leading application segment for recombinant cell culture supplements. Stem cells require a specific microenvironment to maintain their pluripotency or differentiate into desired cell types. Recombinant growth factors, cytokines, and other supplements are essential for creating optimal culture conditions. The growing interest in regenerative medicine and cell-based therapies is directly driving the demand for these products in this segment of the recombinant cell culture supplements market.

Recombinant cell culture supplements are increasingly employed in stem cell therapy due to their ability to provide essential cytokines, growth factors, and nutrients that enhance the growth, specialization, and maintenance of stem cells.

These supplements play a significant role in creating optimal conditions for the growth and cultivation of stem cells, thus enhancing the effectiveness and success rate of stem cell treatment. The demand for high-quality recombinant cell culture supplements is rising due to the expansion of stem cell treatment research and clinical applications.

- Microorganisms Remain the Top-Sought Source for Cell Culture

Microorganisms are the predominant source of recombinant cell culture supplements. Microorganisms offer several advantages, including rapid growth, high productivity, and ease of genetic manipulation. They are commonly used to produce a wide range of recombinant proteins, including growth factors, enzymes, and antibodies. Additionally, the production process using microorganisms is generally more cost-effective compared to other sources.

Increasing utilization in bioreactors and cell culture systems for enhanced cell growth and productivity will drive the dominance of this segment in the recombinant cell culture supplements market. Because of the significant role that they play in a wide variety of biotechnological and medical applications, recombinant cell culture supplements that are generated from microorganisms are experiencing a surge in demand. To supply essential nutrients, growth factors, and other biomolecules that promote the development, maintenance, and production of various cell lines, these supplements are utilized in bioreactors and cell culture systems.

Regional Analysis

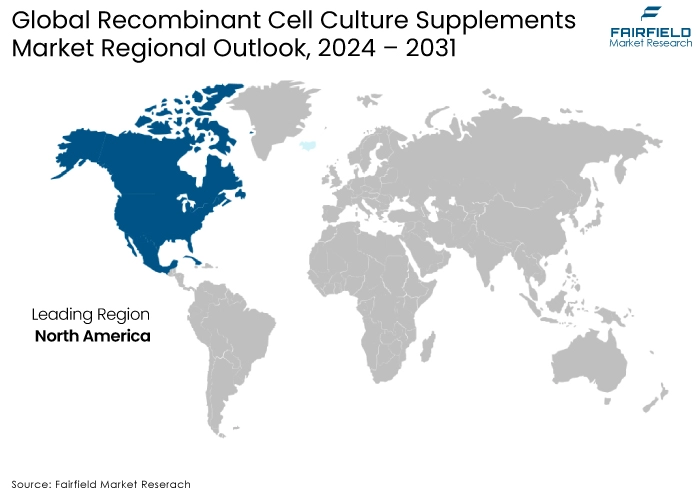

- North America Retains the Largest Revenue Share in Global Market

North America, particularly the US, is the dominant region in the recombinant cell culture supplements market for recombinant cell culture supplements. The region's leadership is driven by a well-established biopharmaceutical industry, significant investment in research and development, and a strong focus on innovation. The presence of numerous leading biotechnology and pharmaceutical companies, coupled with top-tier research institutions and universities, fosters a conducive environment for advancements in cell culture technology.

Additionally, North America has a robust regulatory framework that supports the adoption of high-quality, animal-free, and sustainable cell culture supplements. The region's commitment to ethical and sustainable bio-manufacturing practices further drives demand for recombinant supplements. Government initiatives and funding for biomedical research, especially in personalized medicine and regenerative therapies, also contribute to the market's growth. Higher prevalence of chronic diseases in the region creates a continuous need for biopharmaceuticals, thereby sustaining the demand for recombinant cell culture supplements.

Fairfield’s Competitive Landscape Analysis

The recombinant cell culture supplements market is competitive, featuring key players such as Thermo Fisher Scientific, Merck KGaA, Corning Inc., and Sartorius AG. These companies dominate the market through extensive product portfolios and significant investments in R&D to develop advanced, high-quality supplements. The competitive landscape is characterized by a focus on innovation, with companies introducing new formulations and technologies to meet evolving industry needs.

Strategic partnerships, acquisitions, and collaborations are common as firms seek to expand their market presence and enhance their offerings. Smaller biotech firms and start-ups also contribute to the dynamic market, often specializing in niche applications or novel technologies. The competition drives continuous improvement and differentiation, fuelling market growth and advancement.

Key Market Companies

- Lonza Group AG

- Abcam PLC.

- BBI Solutions

- Biocon

- STEMCELL Technologies Inc.

- Thermo Fisher Scientific

- Hi-Media Laboratories

- Merck KGaA

- Fujifilm Corporation

- InVitria

- Novozymes

Recent Industry Developments

- In September 2022, Sino Biological Inc. unveiled a novel selection of animal-free cell culture media.

- In March 2022, FUJIFILM Irvine Scientific, Inc. bought Shenandoah Biotechnology, Inc. to enhance its expertise in bioprocessing and cell culture solutions.

- In January 2022, Cytiva, a subsidiary of Danaher Corporation, announced a partnership with Nucleus Biologics to provide tailored culture medium solutions for gene and cell therapy.

An Expert’s Eye

- The increasing emphasis on biopharmaceutical development, coupled with advancements in cell culture technologies, is driving significant growth in the recombinant cell culture supplements market.

- The market is expected to benefit from the expanding applications of cell-based therapies, such as regenerative medicine and immunotherapy.

- Challenges related to regulatory hurdles, high production costs, and the need for specialized expertise may temper growth rates in the short term.

- The long-term outlook remains positive due to the critical role of these supplements in modern biotechnology.

Global Recombinant Cell Culture Supplements Market is Segmented as Below -

By Product

- Recombinant Growth Factors

- Recombinant Insulin

- Recombinant Albumin

By Application

- Stem Cell Therapy

- Gene Therapy

- Vaccine Development

By Source

- Animals

- Microorganisms

- Humans

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Recombinant Cell Culture Supplements Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Recombinant Cell Culture Supplements Market Outlook, 2019 - 2031

3.1. Global Recombinant Cell Culture Supplements Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Recombinant Growth Factors

3.1.1.1.1. Transforming Growth Factor

3.1.1.1.2. Epidermal Growth Factor

3.1.1.1.3. Platelet-Derived Growth Factors

3.1.1.1.4. Fibroblast Growth Factor

3.1.1.1.5. Vascular Endothelial Growth Factors (VEGFs)

3.1.1.1.6. Interleukins

3.1.1.1.7. Recombinant Stem Cell Factor

3.1.1.1.8. Other Growth Factors

3.1.1.2. Recombinant Insulin

3.1.1.3. Recombinant Albumin

3.1.1.4. Recombinant Transferrin

3.1.1.5. Recombinant Trypsin

3.1.1.6. Recombinant Aprotinin

3.1.1.7. Recombinant Lysozyme

3.1.1.8. Others

3.2. Global Recombinant Cell Culture Supplements Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Stem Cell Therapy

3.2.1.2. Gene Therapy

3.2.1.3. Bioprocess Application

3.2.1.4. Vaccine Development

3.2.1.5. Others

3.3. Global Recombinant Cell Culture Supplements Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Animals

3.3.1.2. Microorganisms

3.3.1.3. Human

3.4. Global Recombinant Cell Culture Supplements Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. Academic and Research Institutes

3.4.1.2. Biopharmaceutical Companies

3.4.1.3. Cancer Research Centers

3.4.1.4. Contract Research Centers (CROs)

3.5. Global Recombinant Cell Culture Supplements Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Recombinant Cell Culture Supplements Market Outlook, 2019 - 2031

4.1. North America Recombinant Cell Culture Supplements Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Recombinant Growth Factors

4.1.1.1.1. Transforming Growth Factor

4.1.1.1.2. Epidermal Growth Factor

4.1.1.1.3. Platelet-Derived Growth Factors

4.1.1.1.4. Fibroblast Growth Factor

4.1.1.1.5. Vascular Endothelial Growth Factors (VEGFs)

4.1.1.1.6. Interleukins

4.1.1.1.7. Recombinant Stem Cell Factor

4.1.1.1.8. Other Growth Factors

4.1.1.2. Recombinant Insulin

4.1.1.3. Recombinant Albumin

4.1.1.4. Recombinant Transferrin

4.1.1.5. Recombinant Trypsin

4.1.1.6. Recombinant Aprotinin

4.1.1.7. Recombinant Lysozyme

4.1.1.8. Others

4.2. North America Recombinant Cell Culture Supplements Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Stem Cell Therapy

4.2.1.2. Gene Therapy

4.2.1.3. Bioprocess Application

4.2.1.4. Vaccine Development

4.2.1.5. Others

4.3. North America Recombinant Cell Culture Supplements Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Animals

4.3.1.2. Microorganisms

4.3.1.3. Human

4.4. North America Recombinant Cell Culture Supplements Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Academic and Research Institutes

4.4.1.2. Biopharmaceutical Companies

4.4.1.3. Cancer Research Centers

4.4.1.4. Contract Research Centers (CROs)

4.5. North America Recombinant Cell Culture Supplements Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. U.S. Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

4.5.1.2. U.S. Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

4.5.1.3. U.S. Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

4.5.1.4. U.S. Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

4.5.1.5. Canada Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

4.5.1.6. Canada Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

4.5.1.7. Canada Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

4.5.1.8. Canada Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Recombinant Cell Culture Supplements Market Outlook, 2019 - 2031

5.1. Europe Recombinant Cell Culture Supplements Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Recombinant Growth Factors

5.1.1.1.1. Transforming Growth Factor

5.1.1.1.2. Epidermal Growth Factor

5.1.1.1.3. Platelet-Derived Growth Factors

5.1.1.1.4. Fibroblast Growth Factor

5.1.1.1.5. Vascular Endothelial Growth Factors (VEGFs)

5.1.1.1.6. Interleukins

5.1.1.1.7. Recombinant Stem Cell Factor

5.1.1.1.8. Other Growth Factors

5.1.1.2. Recombinant Insulin

5.1.1.3. Recombinant Albumin

5.1.1.4. Recombinant Transferrin

5.1.1.5. Recombinant Trypsin

5.1.1.6. Recombinant Aprotinin

5.1.1.7. Recombinant Lysozyme

5.1.1.8. Others

5.2. Europe Recombinant Cell Culture Supplements Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Stem Cell Therapy

5.2.1.2. Gene Therapy

5.2.1.3. Bioprocess Application

5.2.1.4. Vaccine Development

5.2.1.5. Others

5.3. Europe Recombinant Cell Culture Supplements Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Animals

5.3.1.2. Microorganisms

5.3.1.3. Human

5.4. Europe Recombinant Cell Culture Supplements Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Academic and Research Institutes

5.4.1.2. Biopharmaceutical Companies

5.4.1.3. Cancer Research Centers

5.4.1.4. Contract Research Centers (CROs)

5.5. Europe Recombinant Cell Culture Supplements Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. Germany Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.2. Germany Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

5.5.1.3. Germany Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.5.1.4. Germany Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

5.5.1.5. U.K. Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.6. U.K. Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

5.5.1.7. U.K. Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.5.1.8. U.K. Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

5.5.1.9. France Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.10. France Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

5.5.1.11. France Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.5.1.12. France Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

5.5.1.13. Italy Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.14. Italy Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

5.5.1.15. Italy Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.5.1.16. Italy Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

5.5.1.17. Turkey Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.18. Turkey Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

5.5.1.19. Turkey Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.5.1.20. Turkey Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

5.5.1.21. Russia Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.22. Russia Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

5.5.1.23. Russia Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.5.1.24. Russia Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

5.5.1.25. Rest of Europe Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.26. Rest of Europe Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

5.5.1.27. Rest of Europe Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

5.5.1.28. Rest of Europe Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Recombinant Cell Culture Supplements Market Outlook, 2019 - 2031

6.1. Asia Pacific Recombinant Cell Culture Supplements Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Recombinant Growth Factors

6.1.1.1.1. Transforming Growth Factor

6.1.1.1.2. Epidermal Growth Factor

6.1.1.1.3. Platelet-Derived Growth Factors

6.1.1.1.4. Fibroblast Growth Factor

6.1.1.1.5. Vascular Endothelial Growth Factors (VEGFs)

6.1.1.1.6. Interleukins

6.1.1.1.7. Recombinant Stem Cell Factor

6.1.1.1.8. Other Growth Factors

6.1.1.2. Recombinant Insulin

6.1.1.3. Recombinant Albumin

6.1.1.4. Recombinant Transferrin

6.1.1.5. Recombinant Trypsin

6.1.1.6. Recombinant Aprotinin

6.1.1.7. Recombinant Lysozyme

6.1.1.8. Others

6.2. Asia Pacific Recombinant Cell Culture Supplements Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Stem Cell Therapy

6.2.1.2. Gene Therapy

6.2.1.3. Bioprocess Application

6.2.1.4. Vaccine Development

6.2.1.5. Others

6.3. Asia Pacific Recombinant Cell Culture Supplements Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Animals

6.3.1.2. Microorganisms

6.3.1.3. Human

6.4. Asia Pacific Recombinant Cell Culture Supplements Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Academic and Research Institutes

6.4.1.2. Biopharmaceutical Companies

6.4.1.3. Cancer Research Centers

6.4.1.4. Contract Research Centers (CROs)

6.5. Asia Pacific Recombinant Cell Culture Supplements Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. China Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

6.5.1.2. China Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

6.5.1.3. China Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

6.5.1.4. China Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

6.5.1.5. Japan Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

6.5.1.6. Japan Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

6.5.1.7. Japan Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

6.5.1.8. Japan Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

6.5.1.9. South Korea Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

6.5.1.10. South Korea Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

6.5.1.11. South Korea Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

6.5.1.12. South Korea Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

6.5.1.13. India Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

6.5.1.14. India Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

6.5.1.15. India Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

6.5.1.16. India Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

6.5.1.17. Southeast Asia Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

6.5.1.18. Southeast Asia Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

6.5.1.19. Southeast Asia Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

6.5.1.20. Southeast Asia Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

6.5.1.21. Rest of Asia Pacific Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

6.5.1.22. Rest of Asia Pacific Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

6.5.1.23. Rest of Asia Pacific Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

6.5.1.24. Rest of Asia Pacific Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Recombinant Cell Culture Supplements Market Outlook, 2019 - 2031

7.1. Latin America Recombinant Cell Culture Supplements Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Recombinant Growth Factors

7.1.1.1.1. Transforming Growth Factor

7.1.1.1.2. Epidermal Growth Factor

7.1.1.1.3. Platelet-Derived Growth Factors

7.1.1.1.4. Fibroblast Growth Factor

7.1.1.1.5. Vascular Endothelial Growth Factors (VEGFs)

7.1.1.1.6. Interleukins

7.1.1.1.7. Recombinant Stem Cell Factor

7.1.1.1.8. Other Growth Factors

7.1.1.2. Recombinant Insulin

7.1.1.3. Recombinant Albumin

7.1.1.4. Recombinant Transferrin

7.1.1.5. Recombinant Trypsin

7.1.1.6. Recombinant Aprotinin

7.1.1.7. Recombinant Lysozyme

7.1.1.8. Others

7.2. Latin America Recombinant Cell Culture Supplements Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Stem Cell Therapy

7.2.1.2. Gene Therapy

7.2.1.3. Bioprocess Application

7.2.1.4. Vaccine Development

7.2.1.5. Others

7.3. Latin America Recombinant Cell Culture Supplements Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Animals

7.3.1.2. Microorganisms

7.3.1.3. Human

7.4. Latin America Recombinant Cell Culture Supplements Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Academic and Research Institutes

7.4.1.2. Biopharmaceutical Companies

7.4.1.3. Cancer Research Centers

7.4.1.4. Contract Research Centers (CROs)

7.5. Latin America Recombinant Cell Culture Supplements Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Brazil Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

7.5.1.2. Brazil Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

7.5.1.3. Brazil Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

7.5.1.4. Brazil Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

7.5.1.5. Mexico Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

7.5.1.6. Mexico Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

7.5.1.7. Mexico Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

7.5.1.8. Mexico Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

7.5.1.9. Argentina Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

7.5.1.10. Argentina Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

7.5.1.11. Argentina Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

7.5.1.12. Argentina Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

7.5.1.13. Rest of Latin America Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

7.5.1.14. Rest of Latin America Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

7.5.1.15. Rest of Latin America Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

7.5.1.16. Rest of Latin America Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Recombinant Cell Culture Supplements Market Outlook, 2019 - 2031

8.1. Middle East & Africa Recombinant Cell Culture Supplements Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Recombinant Growth Factors

8.1.1.1.1. Transforming Growth Factor

8.1.1.1.2. Epidermal Growth Factor

8.1.1.1.3. Platelet-Derived Growth Factors

8.1.1.1.4. Fibroblast Growth Factor

8.1.1.1.5. Vascular Endothelial Growth Factors (VEGFs)

8.1.1.1.6. Interleukins

8.1.1.1.7. Recombinant Stem Cell Factor

8.1.1.1.8. Other Growth Factors

8.1.1.2. Recombinant Insulin

8.1.1.3. Recombinant Albumin

8.1.1.4. Recombinant Transferrin

8.1.1.5. Recombinant Trypsin

8.1.1.6. Recombinant Aprotinin

8.1.1.7. Recombinant Lysozyme

8.1.1.8. Others

8.2. Middle East & Africa Recombinant Cell Culture Supplements Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Stem Cell Therapy

8.2.1.2. Gene Therapy

8.2.1.3. Bioprocess Application

8.2.1.4. Vaccine Development

8.2.1.5. Others

8.3. Middle East & Africa Recombinant Cell Culture Supplements Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Animals

8.3.1.2. Microorganisms

8.3.1.3. Human

8.4. Middle East & Africa Recombinant Cell Culture Supplements Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Academic and Research Institutes

8.4.1.2. Biopharmaceutical Companies

8.4.1.3. Cancer Research Centers

8.4.1.4. Contract Research Centers (CROs)

8.5. Middle East & Africa Recombinant Cell Culture Supplements Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. GCC Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

8.5.1.2. GCC Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

8.5.1.3. GCC Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

8.5.1.4. GCC Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

8.5.1.5. South Africa Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

8.5.1.6. South Africa Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

8.5.1.7. South Africa Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

8.5.1.8. South Africa Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

8.5.1.9. Egypt Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

8.5.1.10. Egypt Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

8.5.1.11. Egypt Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

8.5.1.12. Egypt Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

8.5.1.13. Nigeria Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

8.5.1.14. Nigeria Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

8.5.1.15. Nigeria Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

8.5.1.16. Nigeria Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

8.5.1.17. Rest of Middle East & Africa Recombinant Cell Culture Supplements Market by Product, Value (US$ Bn), 2019 - 2031

8.5.1.18. Rest of Middle East & Africa Recombinant Cell Culture Supplements Market by Application, Value (US$ Bn), 2019 - 2031

8.5.1.19. Rest of Middle East & Africa Recombinant Cell Culture Supplements Market by Source, Value (US$ Bn), 2019 - 2031

8.5.1.20. Rest of Middle East & Africa Recombinant Cell Culture Supplements Market by End User, Value (US$ Bn), 2019 - 2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. by Source vs by Application Heatmap

9.2. Manufacturer vs by Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Merck KGaA

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Lonza Group AG

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. F. Hoffmann-La Roche

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Hi-Media Laboratories

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Becton, Dickinson and Company

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. STEMCELL Technologies Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Fujifilm Corporation

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. InVitria

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Biocon

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Cell Sciences, Inc

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Application Coverage |

|

|

Source Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |