Global Recovery Footwear Market Forecast

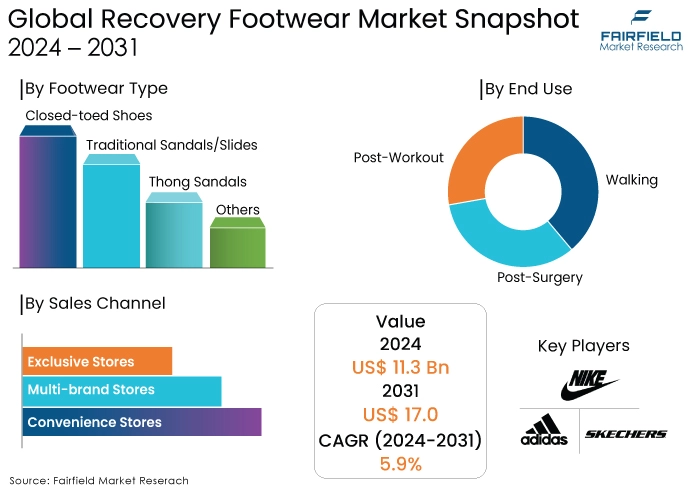

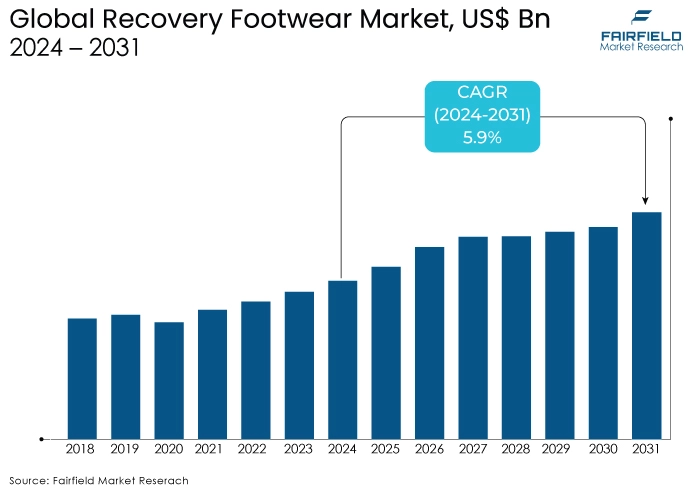

- Global market for recovery footwear to witness a rise in revenue from US$11.3 Bn in 2024 to US$17.0 Bn by 2031-end

- Recovery footwear market size poised to exhibit a CAGR of 5.9% over the projection period of 2024-2031

Quick Report Digest

- Recovery footwear market has boomed due to increased health consciousness, rising disposable incomes and market reaching beyond professional athletes.

- Regulations are minimal but could focus on sustainability and biodegradability in the future.

- Shifting consumer preferences and technological advancements are key growth drivers.

- High price point and limited awareness are growth barriers.

- Convergence of comfort and style and personalized recovery solutions are key trends.

- Closed-toe shoes dominate the market but sandals are gaining traction.

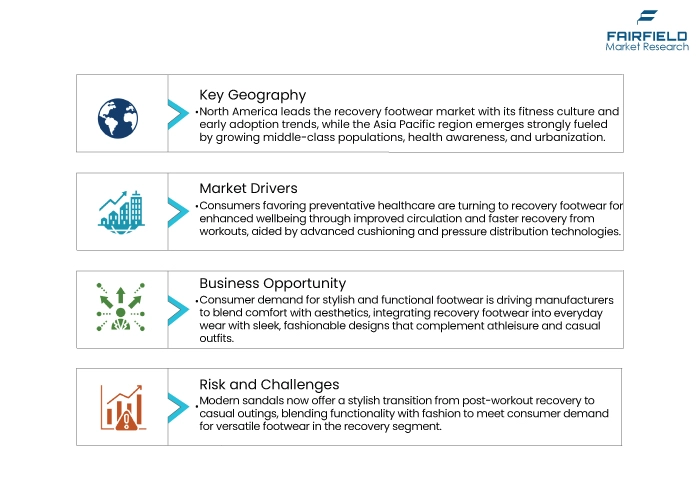

- North America is the leader but Asia Pacific is expected to see the fastest growth.

A Look Back and a Look Forward - Comparative Analysis

Pre-2023, the recovery footwear market experienced steady growth at around 5% annually, primarily driven by professional athletes and fitness enthusiasts seeking faster recovery and injury prevention. However, post-2024, the market has exploded with a significant CAGR. This surge is fueled by several factors, including increased health consciousness of consumers, increasing affluence, and market reach beyond professional athletes.

Consumers are prioritizing preventative healthcare and holistic well-being, leading them to seek products that enhance recovery and reduce muscle fatigue. Growing financial resources allow more people to invest in specialized footwear for post-activity needs. The market is no longer limited to professional athletes. Everyday people seeking improved comfort and post-workout recovery are driving significant growth.

Key Growth Determinants

- Shifting Consumer Preferences

Consumers are increasingly prioritizing preventative healthcare and products that enhance overall wellbeing. Recovery footwear aligns perfectly with this trend by promoting improved circulation, and faster recovery. Advanced cushioning and pressure distribution technologies can significantly reduce post-workout muscle soreness and fatigue.

Certain materials and designs can enhance circulation, aiding in faster recovery and reducing swelling. This footwear prioritizes comfort with features like arch support and plush materials, appealing to a broader consumer base seeking improved foot health and well-being.

- Technological Advancements

Innovation is a key driver in the recovery footwear market. Advancements in biomechanics, material sciences, and data integration are pushing innovation in this market.

New materials offer superior cushioning, breathability, and pressure distribution for targeted support. Research on foot mechanics leads to improved designs for better arch support, stability, and natural foot movement. Emerging technologies like integrated pressure sensors could track user data and suggest personalized recovery routines, creating a more holistic approach to post-activity care.

Key Growth Barriers

- High Price Point

Recovery footwear can be significantly more expensive than traditional footwear due to advanced materials and technologies. This can be a barrier for budget-conscious consumers, limiting market penetration. However, manufacturers are addressing this by highlighting long-term benefits, and introducing budget-friendly product line-ups.

Manufacturers if consider offering entry-level footwear with core functionalities can attract price-sensitive consumers. Moreover, educating consumers about the long-term benefits like reduced injuries and improved performance can justify the initial investment pressure.

- Limited Awareness

While awareness is growing, some consumers might not fully understand its benefits. This can hinder market expansion. To address this, manufacturers and retailers can invest in educational campaigns, and emphasize in-store education.

Highlighting the scientific benefits and showcasing testimonials from athletes and healthcare professionals can raise awareness, further translating into sales. Retail staff trained on the benefits of recovery footwear can educate customers and recommend suitable options.

Key Trends and Opportunities to Look at

- Convergence of Comfort and Style

Consumers are demanding footwear that offers both functionality and aesthetics. This trend is pushing manufacturers to create stylish yet comfortable designs, further integrating recovery footwear into everyday wear. This convergence is evident in fashionable designs. Recovery footwear is no longer limited to clunky silhouettes. Manufacturers are introducing sleek and stylish designs that complement athleisure wear and casual outfits.

As far as collaboration with fashion brands in concerned, partnerships between recovery footwear brands and fashion houses are creating trendy and functional footwear options, appealing to a broader fashion-conscious audience. The focus on color and patterns is also increasing recently. Moving beyond basic black, it is now available in a variety of colors and patterns, allowing consumers to express their personal style.

- Personalized Recovery Solutions

The rise of connected wearable technology presents an exciting opportunity for personalized recovery solutions. Recovery footwear with integrated sensors could track data such as the steps taken, heart rate, and pressure distribution to monitor activity levels to help in tailoring recovery recommendations, obtain personalized cool-down routines and recovery activities, and analyse pressure points on the foot to facilitate personalized recommendations on footwear features for optimal support.

Considering these projections, and user profiles and preferences could create a more holistic recovery experience. Imagine recovery footwear suggesting optimal post-workout routines, massage recommendations, or personalized stretching exercises based on individual needs. This level of personalization has the potential to significantly enhance the appeal and effectiveness.

How is Regulatory Scenario Shaping this Industry?

The recovery footwear industry faces minimal regulations. However, existing standards govern footwear materials and general product labelling. Looking ahead, potential regulations could focus on sustainability, and biodegradability.

Emerging regulations might mandate the use of eco-friendly materials in production, impacting costs but aligning with the growing demand for sustainable products. Emphasis on biodegradable materials could encourage innovation and potentially limit the environmental footprint. While regulations might increase production costs, manufacturers can leverage them as a marketing advantage to attract environmentally conscious consumers.

Fairfield’s Ranking Board

Top Segments

- Closed-toe Shoes Account for 64% Market Value Share

The recovery footwear market is segmented by type, with two distinct categories vying for consumer preference, viz., closed-toe shoes, and sandals. Closed-toe shoes currently hold the lion's share of the market, capturing approximately 64% of total sales. This dominance can be attributed to several key advantages.

Firstly, closed-toe shoes provide superior support and protection for the foot and ankle. This enhanced stability is particularly valuable during post-workout recovery activities like walking or light exercise. The additional structure helps to minimize strain and potential injuries while the foot remains in a healing state.

Secondly, closed-toe shoes offer the benefit of warmth retention. This makes them a more suitable choice for colder climates or situations where maintaining foot warmth is crucial for optimal recovery. Athletes training in cold weather conditions or individuals seeking post-workout relief in cooler environments can benefit significantly from the insulating properties of closed-toe footwear.

Finally, versatility plays a significant role in the dominance of closed-toe recovery shoes. Many designs offer a stylish aesthetic that can seamlessly transition from post-workout recovery to casual wear. This eliminates the need for consumers to switch between dedicated footwear and everyday shoes, offering a practical and convenient solution.

- Sandals All Set for Ascending Sales Growth

On the other hand, sandals are not to be underestimated. They are steadily gaining traction in the market, currently accounting for around 35% of the total share. This rise in popularity can be attributed to several factors that cater to a different set of consumer preferences.

The primary advantage of sandals lies in their breathability. This makes them ideal for warmer climates or post-workout scenarios where allowing the foot to breathe is a priority. The increased airflow promotes faster evaporation of sweat and moisture, contributing to a more comfortable recovery experience.

Furthermore, sandals offer a lightweight and relaxed option for post-workout recovery. The open design minimizes bulk and weight, allowing for a more carefree and comfortable experience. This is particularly appealing to individuals who prioritize a more relaxed and casual approach to recovery after strenuous activity.

Finally, the evolving design of sandals allows for a stylish transition from post-workout recovery to casual outings. Modern sandals are no longer limited to purely functional designs. Stylish and fashionable options are readily available, catering to consumers who desire a recovery solution that complements their everyday attire. This convergence of functionality and style is a major driver of growth in the sandal segment of the recovery footwear market.

As the market continues to evolve, both closed-toe shoes and sandals will likely maintain their positions as dominant segments. Understanding the unique advantages of each type allows consumers to make informed choices based on their specific needs and preferences.

Regional Frontrunners

As the global recovery footwear market continues to evolve, North America is likely to maintain its position as a dominant leader due to its established fitness culture and early adoption tendencies. However, the rapid rise of the Asia Pacific region, fueled by a growing middle class, increasing health awareness, and urbanization, cannot be ignored. This region is poised to become a major force in the market in the years to come.

- 40% of Global Consumption Concentrates in North America

The market is a geographically diverse landscape, with distinct regional leaders and growth patterns. Currently, North America holds the largest market share, capturing around 40% of the total sales. This dominance can be attributed to several key factors that have fostered a strong foundation for the recovery footwear industry in the region.

Firstly, North America boasts a well-established fitness culture. A significant portion of the population actively participates in regular exercise and athletic pursuits. This ingrained culture of physical activity creates a natural demand for specialized footwear that caters to post-workout recovery needs. Athletes and fitness enthusiasts readily adopt new technologies and trends in recovery footwear, driving market growth.

Secondly, the region enjoys relatively high disposable incomes compared to other parts of the world. This financial flexibility allows consumers to invest in specialized footwear dedicated to improving their recovery experience. With a greater willingness to spend on health and wellness products, North America offers fertile ground for the premium-priced segment of the recovery footwear market.

Finally, North America has a history of early adoption when it comes to innovative products and trends. This is particularly true for the fitness industry. Consumers are receptive to new technologies and embrace the potential benefits of recovery footwear. This early adoption has spurred further development and innovation within the market, solidifying North America's position as a leader.

- Asia Pacific Gears up to Surpass 20% Revenue Share

Asia Pacific is poised for the fastest growth in the recovery footwear market, with a projected CAGR exceeding 20%. This rapid expansion can be attributed to several key drivers unique to the region. The region is experiencing a significant rise in its middle class. This growing population segment enjoys increasing disposable incomes, creating a larger consumer base with the financial means to invest. As the focus on health and wellness increases, consumers are becoming more receptive to preventative healthcare solutions like recovery footwear.

Secondly, a growing awareness of health and wellness trends is sweeping across the Asia Pacific region. Consumers are becoming more informed about the importance of recovery and are actively seeking products that can enhance their overall wellbeing. This shift in consumer consciousness presents a significant opportunity for the recovery footwear market.

Finally, the rapid urbanization of the region is playing a crucial role in driving growth. As cities expand, walking and public transportation become more prevalent forms of daily activity. This increased level of physical exertion creates a demand for comfortable and supportive footwear, making it a compelling option for many consumers in the Asia Pacific region.

Fairfield’s Competitive Landscape Analysis

The recovery footwear market is becoming increasingly competitive with established footwear brands like Hoka One One, Brooks, and Under Armour battling for market share alongside innovative start-ups like Oofos, and Kuru. This competition is driving continuous product development, improved designs, and a focus on personalized recovery solutions. The race is on to create the most comfortable, stylish, and technologically advanced recovery footwear, ultimately benefiting consumers with a wider range of high-quality options.

Who are Leading Companies in Recovery Footwear Space?

- Nike, Inc.

- Adidas AG

- Skechers USA, Inc.

- Reebok International Ltd.

- Bauerfeind AG

- Under Armour, Inc.

- ASICS Corporation

- Ossur hf.

- New Balance Athletics, Inc.

- Aetrex Worldwide, Inc.

- Brooks Sports, Inc.

- Hoka One

- Saloman S.A.S.

- Newton Running

- 2XU Pty Ltd.

Global Recovery Footwear Market is Segmented as:

By Footwear Type

- Closed-toed Shoes

- Traditional Sandals/Slides

- Thong Sandals

- Others

By Consumer Orientation

- Women

- Men

- Unisex

By End Use

- Walking

- Post-Surgery

- Post-Workout

- Work Shift

By Sales Channel

- Convenience Stores

- Multi-brand Stores

- Exclusive Stores

- Hypermarkets/Supermarkets

- Online Retailers

- Independent Stores

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middles East & Africa

1. Executive Summary

1.1. Global Recovery Footwear Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Recovery Footwear Market Outlook, 2024 - 2031

3.1. Global Recovery Footwear Market Outlook, by Product Type, Value (US$ Bn), 2024 - 2031

3.1.1. Key Highlights

3.1.1.1. Flip-Flop/Thong Sandals

3.1.1.2. Slides/Traditional Sandals

3.1.1.3. Closed-toed Shoes

3.1.1.4. Others

3.2. Global Recovery Footwear Market Outlook, by Consumer Orientation, Value (US$ Bn), 2024 - 2031

3.2.1. Key Highlights

3.2.1.1. Men

3.2.1.2. Women

3.3. Global Recovery Footwear Market Outlook, by End Usage, Value (US$ Bn), 2024 - 2031

3.3.1. Key Highlights

3.3.1.1. After Foot Surgery

3.3.1.2. After Workout

3.3.1.3. Work Shift

3.3.1.4. Walking

3.3.1.5. Others

3.4. Global Recovery Footwear Market Outlook, by Sales Channel, Value (US$ Bn), 2024 - 2031

3.4.1. Key Highlights

3.4.1.1. Hypermarkets/Supermarkets

3.4.1.2. Convenience Stores

3.4.1.3. Multi-Brand Stores

3.4.1.4. Exclusive Stores

3.4.1.5. Online Retailers

3.4.1.6. Independent Small Stores

3.4.1.7. Others

3.5. Global Recovery Footwear Market Outlook, by Region, Value (US$ Bn), 2024 - 2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America3.5.1.5. Middle East & Africa

4. North America Recovery Footwear Market Outlook, 2024 - 2031

4.1. North America Recovery Footwear Market Outlook, by Product Type, Value (US$ Bn), 2024 - 2031

4.1.1. Key Highlights

4.1.1.1. Flip-Flop/Thong Sandals

4.1.1.2. Slides/Traditional Sandals

4.1.1.3. Closed-toed Shoes

4.1.1.4. Others

4.2. North America Recovery Footwear Market Outlook, by Consumer Orientation, Value (US$ Bn), 2024 - 2031

4.2.1. Key Highlights

4.2.1.1. Men

4.2.1.2. Women

4.3. North America Recovery Footwear Market Outlook, by End Usage, Value (US$ Bn), 2024 - 2031

4.3.1. Key Highlights

4.3.1.1. After Foot Surgery

4.3.1.2. After Workout

4.3.1.3. Work Shift

4.3.1.4. Walking

4.3.1.5. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Recovery Footwear Market Outlook, by Sales Channel, Value (US$ Bn), 2024 - 2031

4.4.1. Key Highlights

4.4.1.1. Hypermarkets/Supermarkets

4.4.1.2. Convenience Stores

4.4.1.3. Multi-Brand Stores

4.4.1.4. Exclusive Stores

4.4.1.5. Online Retailers

4.4.1.6. Independent Small Stores

4.4.1.7. Others

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Recovery Footwear Market Outlook, by Country, Value (US$ Bn), 2024 - 2031

4.5.1. Key Highlights

4.5.1.1. U.S. Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

4.5.1.2. U.S. Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

4.5.1.3. U.S. Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

4.5.1.4. U.S. Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

4.5.1.5. Canada Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

4.5.1.6. Canada Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

4.5.1.7. Canada Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

4.5.1.8. Canada Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Recovery Footwear Market Outlook, 2024 - 2031

5.1. Europe Recovery Footwear Market Outlook, by Product Type, Value (US$ Bn), 2024 - 2031

5.1.1. Key Highlights

5.1.1.1. Flip-Flop/Thong Sandals

5.1.1.2. Slides/Traditional Sandals

5.1.1.3. Closed-toed Shoes

5.1.1.4. Others

5.2. Europe Recovery Footwear Market Outlook, by Consumer Orientation, Value (US$ Bn), 2024 - 2031

5.2.1. Key Highlights

5.2.1.1. Men

5.2.1.2. Women

5.3. Europe Recovery Footwear Market Outlook, by End Usage, Value (US$ Bn), 2024 - 2031

5.3.1. Key Highlights

5.3.1.1. After Foot Surgery

5.3.1.2. After Workout

5.3.1.3. Work Shift

5.3.1.4. Walking

5.3.1.5. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Recovery Footwear Market Outlook, by Sales Channel, Value (US$ Bn), 2024 - 2031

5.4.1. Key Highlights

5.4.1.1. Hypermarkets/Supermarkets

5.4.1.2. Convenience Stores

5.4.1.3. Multi-Brand Stores

5.4.1.4. Exclusive Stores

5.4.1.5. Online Retailers

5.4.1.6. Independent Small Stores

5.4.1.7. Others

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Recovery Footwear Market Outlook, by Country, Value (US$ Bn), 2024 - 2031

5.5.1. Key Highlights

5.5.1.1. Germany Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

5.5.1.2. Germany Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

5.5.1.3. Germany Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

5.5.1.4. Germany Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

5.5.1.5. U.K. Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

5.5.1.6. U.K. Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

5.5.1.7. U.K. Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

5.5.1.8. U.K. Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

5.5.1.9. France Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

5.5.1.10. France Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

5.5.1.11. France Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

5.5.1.12. France Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

5.5.1.13. Italy Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

5.5.1.14. Italy Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

5.5.1.15. Italy Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

5.5.1.16. Italy Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

5.5.1.17. Turkey Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

5.5.1.18. Turkey Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

5.5.1.19. Turkey Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

5.5.1.20. Turkey Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

5.5.1.21. Russia Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

5.5.1.22. Russia Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

5.5.1.23. Russia Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

5.5.1.24. Russia Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

5.5.1.25. Rest of Europe Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

5.5.1.26. Rest of Europe Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

5.5.1.27. Rest of Europe Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

5.5.1.28. Rest of Europe Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Recovery Footwear Market Outlook, 2024 - 2031

6.1. Asia Pacific Recovery Footwear Market Outlook, by Product Type, Value (US$ Bn), 2024 - 2031

6.1.1. Key Highlights

6.1.1.1. Flip-Flop/Thong Sandals

6.1.1.2. Slides/Traditional Sandals

6.1.1.3. Closed-toed Shoes

6.1.1.4. Others

6.2. Asia Pacific Recovery Footwear Market Outlook, by Consumer Orientation, Value (US$ Bn), 2024 - 2031

6.2.1. Key Highlights

6.2.1.1. Men

6.2.1.2. Women

6.3. Asia Pacific Recovery Footwear Market Outlook, by End Usage, Value (US$ Bn), 2024 - 2031

6.3.1. Key Highlights

6.3.1.1. After Foot Surgery

6.3.1.2. After Workout

6.3.1.3. Work Shift

6.3.1.4. Walking

6.3.1.5. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Recovery Footwear Market Outlook, by Sales Channel, Value (US$ Bn), 2024 - 2031

6.4.1. Key Highlights

6.4.1.1. Hypermarkets/Supermarkets

6.4.1.2. Convenience Stores

6.4.1.3. Multi-Brand Stores

6.4.1.4. Exclusive Stores

6.4.1.5. Online Retailers

6.4.1.6. Independent Small Stores

6.4.1.7. Others

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Recovery Footwear Market Outlook, by Country, Value (US$ Bn), 2024 - 2031

6.5.1. Key Highlights

6.5.1.1. China Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

6.5.1.2. China Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

6.5.1.3. China Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

6.5.1.4. China Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

6.5.1.5. Japan Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

6.5.1.6. Japan Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

6.5.1.7. Japan Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

6.5.1.8. Japan Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

6.5.1.9. South Korea Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

6.5.1.10. South Korea Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

6.5.1.11. South Korea Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

6.5.1.12. South Korea Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

6.5.1.13. India Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

6.5.1.14. India Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

6.5.1.15. India Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

6.5.1.16. India Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

6.5.1.17. Southeast Asia Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

6.5.1.18. Southeast Asia Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

6.5.1.19. Southeast Asia Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

6.5.1.20. Southeast Asia Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

6.5.1.21. Rest of Asia Pacific Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

6.5.1.22. Rest of Asia Pacific Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

6.5.1.23. Rest of Asia Pacific Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

6.5.1.24. Rest of Asia Pacific Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Recovery Footwear Market Outlook, 2024 - 2031

7.1. Latin America Recovery Footwear Market Outlook, by Product Type, Value (US$ Bn), 2024 - 2031

7.1.1. Key Highlights

7.1.1.1. Flip-Flop/Thong Sandals

7.1.1.2. Slides/Traditional Sandals

7.1.1.3. Closed-toed Shoes

7.1.1.4. Others

7.2. Latin America Recovery Footwear Market Outlook, by Consumer Orientation, Value (US$ Bn), 2024 - 2031

7.2.1. Key Highlights

7.2.1.1. Men

7.2.1.2. Women

7.3. Latin America Recovery Footwear Market Outlook, by End Usage, Value (US$ Bn), 2024 - 2031

7.3.1. Key Highlights

7.3.1.1. After Foot Surgery

7.3.1.2. After Workout

7.3.1.3. Work Shift

7.3.1.4. Walking

7.3.1.5. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Recovery Footwear Market Outlook, by Sales Channel, Value (US$ Bn), 2024 - 2031

7.4.1. Key Highlights

7.4.1.1. Hypermarkets/Supermarkets

7.4.1.2. Convenience Stores

7.4.1.3. Multi-Brand Stores

7.4.1.4. Exclusive Stores

7.4.1.5. Online Retailers

7.4.1.6. Independent Small Stores

7.4.1.7. Others

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Recovery Footwear Market Outlook, by Country, Value (US$ Bn), 2024 - 2031

7.5.1. Key Highlights

7.5.1.1. Brazil Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

7.5.1.2. Brazil Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

7.5.1.3. Brazil Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

7.5.1.4. Brazil Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

7.5.1.5. Mexico Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

7.5.1.6. Mexico Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

7.5.1.7. Mexico Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

7.5.1.8. Mexico Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

7.5.1.9. Argentina Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

7.5.1.10. Argentina Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

7.5.1.11. Argentina Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

7.5.1.12. Argentina Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

7.5.1.13. Rest of Latin America Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

7.5.1.14. Rest of Latin America Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

7.5.1.15. Rest of Latin America Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

7.5.1.16. Rest of Latin America Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Recovery Footwear Market Outlook, 2024 - 2031

8.1. Middle East & Africa Recovery Footwear Market Outlook, by Product Type, Value (US$ Bn), 2024 - 2031

8.1.1. Key Highlights

8.1.1.1. Flip-Flop/Thong Sandals

8.1.1.2. Slides/Traditional Sandals

8.1.1.3. Closed-toed Shoes

8.1.1.4. Others

8.2. Middle East & Africa Recovery Footwear Market Outlook, by Consumer Orientation, Value (US$ Bn), 2024 - 2031

8.2.1. Key Highlights

8.2.1.1. Men

8.2.1.2. Women

8.3. Middle East & Africa Recovery Footwear Market Outlook, by End Usage, Value (US$ Bn), 2024 - 2031

8.3.1. Key Highlights

8.3.1.1. After Foot Surgery

8.3.1.2. After Workout

8.3.1.3. Work Shift

8.3.1.4. Walking

8.3.1.5. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Recovery Footwear Market Outlook, by Sales Channel, Value (US$ Bn), 2024 - 2031

8.4.1. Key Highlights

8.4.1.1. Hypermarkets/Supermarkets

8.4.1.2. Convenience Stores

8.4.1.3. Multi-Brand Stores

8.4.1.4. Exclusive Stores

8.4.1.5. Online Retailers

8.4.1.6. Independent Small Stores

8.4.1.7. Others

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Recovery Footwear Market Outlook, by Country, Value (US$ Bn), 2024 - 2031

8.5.1. Key Highlights

8.5.1.1. GCC Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

8.5.1.2. GCC Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

8.5.1.3. GCC Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

8.5.1.4. GCC Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

8.5.1.5. South Africa Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

8.5.1.6. South Africa Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

8.5.1.7. South Africa Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

8.5.1.8. South Africa Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

8.5.1.9. Egypt Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

8.5.1.10. Egypt Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

8.5.1.11. Egypt Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

8.5.1.12. Egypt Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

8.5.1.13. Nigeria Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

8.5.1.14. Nigeria Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

8.5.1.15. Nigeria Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

8.5.1.16. Nigeria Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

8.5.1.17. Rest of Middle East & Africa Recovery Footwear Market by Product Type, Value (US$ Bn), 2024 - 2031

8.5.1.18. Rest of Middle East & Africa Recovery Footwear Market by Consumer Orientation, Value (US$ Bn), 2024 - 2031

8.5.1.19. Rest of Middle East & Africa Recovery Footwear Market by End Usage, Value (US$ Bn), 2024 - 2031

8.5.1.20. Rest of Middle East & Africa Recovery Footwear Market by Sales Channel, Value (US$ Bn), 2024 - 2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Type vs by Consumer Orientation Heat map

9.2. Manufacturer vs by Consumer Orientation Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Nike, Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Adidas AG

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Under Armour, Inc.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Össur hf.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. ASICS Corporation

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Skechers USA, Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Aetrex Worldwide, Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Bauerfeind AG

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. New Balance Athletics, Inc.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Olivanation

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Reebok International Ltd.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Hoka One

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. 2XU Pty Ltd.

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Brooks Sports, Inc.

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Salomon S.A.S.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. Newton Running

9.5.16.1. Company Overview

9.5.16.2. Product Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Business Strategies and Development

9.5.17. Others

9.5.17.1. Company Overview

9.5.17.2. Product Portfolio

9.5.17.3. Financial Overview

9.5.17.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Footwear Type Coverage |

|

|

Consumer Orientation Coverage |

|

|

End Use Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |