Global Recycled Pet Market Forecast

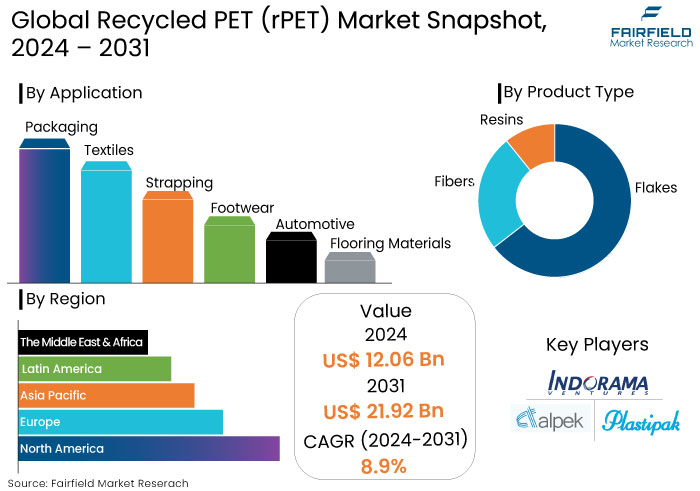

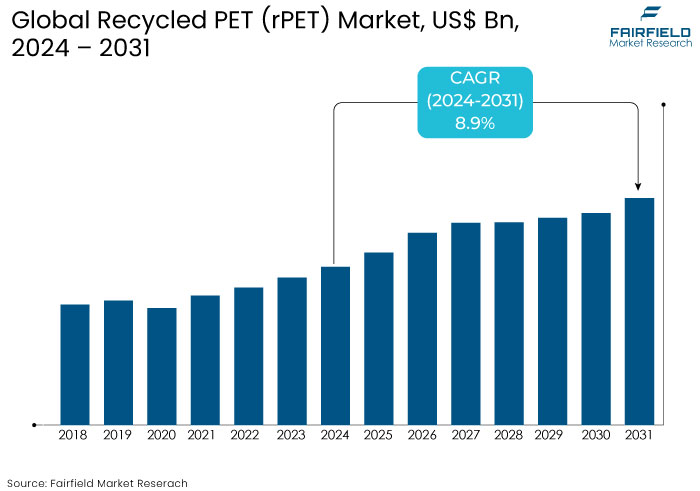

- The recycled PET (rPET) market is projected to reach a size of US$21.92 Bn by 2031, showing significant growth from the US$12.06 Bn achieved in 2024.

- The market for recycled pet market is likely experience a significant expansion rate, with projected CAGR of 8.9% from 2024 to 2031.

Recycled Pet Market Insights

- Packaging holds the largest market share, driven by the rising demand for eco-friendly materials.

- The textile sector is witnessing rapid adoption of rPET for sustainable fashion solutions.

- rPET flakes are the most preferred form due to their versatility in applications, particularly in packaging.

- Innovations in chemical recycling are improving the quality and scope of rPET usage.

- China and the U.S. are key markets, supported by robust recycling policies and demand for sustainable products.

- Increasing awareness and preference for eco-friendly products are driving recycled PET (rPET) market

- Investments in recycling infrastructure in developing economies are opening new opportunities.

- Government mandates, such as recycled content requirements, are boosting market expansion.

A Look Back and a Look Forward - Comparative Analysis

The recycled PET (rPET) market witnessed steady growth during the period from 2019 to 2023, fueled by government regulations targeting plastic waste reduction and the rising adoption of circular economy principles.

Brands across industries, particularly in packaging, textiles, and consumer goods, increasingly opted for rPET due to its eco-friendly and cost-effective properties. However, challenges such as inconsistent recycling infrastructure and limited consumer awareness in developing regions somewhat restrained the full potential of the market.

The market is poised for accelerated growth over the forecast period, primarily driven by technological advancements in recycling processes, such as chemical recycling and enhanced sorting techniques. These innovations are expected to improve yield and quality, broadening the application scope of rPET.

Stron global mandates on carbon footprint reduction and corporate sustainability commitments are likely to fuel demand further. Emerging economies are also expected to contribute as governments invest in recycling infrastructure and consumer education campaigns.

Key Growth Determinants

- Regulatory Momentum Drives Growth in the Recycled Plastic Market

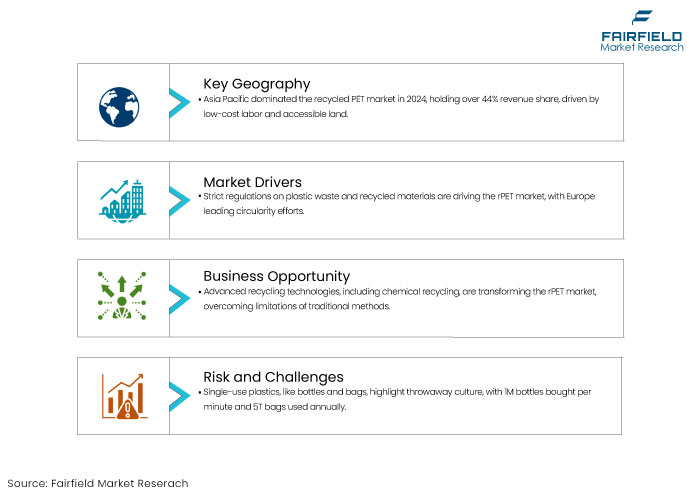

The growing stringency of regulations targeting plastic waste management and promoting the use of recycled materials is a significant driver for the driving the recycled PET (rPET) market. In 2022 and 2023, multiple legislative measures were enforced globally, with Europe leading initiatives to enhance circularity and reduce reliance on virgin plastics.

The European Union's (EU) Single-Use Plastics Directive (SUPD), which has been active since 2019, has continued to pressure member states to meet recycling and reduction targets. Although the transposition of this directive has faced delays in some countries, the EU remains committed to achieve 25% recycled content in PET beverage bottles by 2025, a pivotal milestone.

National targets, such as Spain's 50% reduction in plastic packaging by 2026 and Germany's upcoming plastic tax in 2025, demonstrate the region's commitment to sustainability.

The Food Contact Materials (FCM 2022/1616) regulations introduced by the European Commission mandate stricter controls on recycled plastics for food applications, ensuring safety and quality standards. These directives set benchmarks that influence global practices, as seen with the UK and Norway aligning their regulations with the EU.

- Global Initiatives and Corporate Commitments Fuel the Sales

The recycled PET (rPET) market is undergoing a significant transformation due to increased environmental consciousness, legislative demands, and widespread sustainability pledges within the business. The advocacy of governments, environmental organizations, and leading corporations for sustainable solutions propels the widespread usage of recycled plastic.

The initiative for a circular economy is progressively advancing, propelled by advocacy efforts, governmental demands, and ambitious business objectives. The Plastics Industry Association (PLASTICS) initiated the "Recycling Is Real" campaign in September 2023. The campaign seeks to refute assertions on the ineffectiveness of plastic recycling, highlighting the feasibility of large-scale plastic recycling.

Critics contend that the low recycling rates in nations such as the U.S. (now under 6%) and the intricate composition of plastics, which includes several resins and additives, render extensive recycling unfeasible. This argument underscores the persistent issues the recycling industry encounters, especially in regions with underdeveloped recycling infrastructure.

The industry aims to alter the public image. At the same time, environmental organizations emphasize the necessity for extensive recycling solutions and stringent legislative frameworks to facilitate the transition to sustainable plastic utilization.

Key Growth Barriers

- Single-use Plastics (SUPs) Create Major Problem of Throwaway Culture

Single-use plastics (SUPs) are a glaring example of the problems with throwaway culture and society. Packaging items comprise the largest portion (40%), including cups, plates, spoons, knives, bowls, plastic straws, forks, stirrers, and plastic liquid/water bottles. Worldwide, one million plastic drinking bottles are purchased every minute, while 5 trillion single-use plastic bags are used annually.

Plastics have recently gathered much attention due to their ubiquity in the global economy. Between the 1950s and 2019, an estimated 9.4 billion tons of plastic have been manufactured. Of this, a little more than 25% is still in use, and only 600 million tons have been recycled. About 5 billion tons have ended up as waste in landfills or have simply ended up in the environment. Between 5 and 13 million tons of plastic enter the oceans.

We will be producing almost 26 billion tons of plastic waste by 2050, with total plastic production projected to triple from the current levels of ~350 million tons, thus accounting for 20% of the global oil consumption.

According to a recent study, 20 companies are responsible sources for 55% of the single-use plastic waste. Nearly all the single-use plastic manufactured by these companies, ~98%, is made from virgin feedstocks rather than recycled materials.

- Global Economic Viability and Regulatory Challenges Hinder Market Growth

The recycled PET (rPET) market is currently facing significant economic and regulatory challenges that hinder its growth potential. The decline in plastic production in 2023, with a sharp 8.3% drop, reflects broad issues within the global recycling efforts.

Mechanical recycling, a crucial process in the circular economy, saw a 7.8% reduction in output. It signals that the industry needs to scale up fast to meet the growing demand for sustainable plastic solutions. The downturn is compounded by high production costs, including rising energy prices and expensive feed stocks, which are driving up the overall cost of recycling.

Economic pressures threaten the long-term viability of the recycled plastics market and could slow progress toward sustainability goals. A key factor in these challenges is the growing reliance on plastic imports from regions with less stringent environmental regulations.

Recycled Pet Market Trends and Opportunities

- Adoption of Advanced Recycling Technologies Spurs Sales

The advancement of recycling technologies is revolutionizing the recycled PET (rPET) market. While effective, traditional mechanical recycling methods have limitations, such as the degradation of material quality over repeated cycles. New technologies like chemical recycling are emerging as game-changers.

Chemical recycling processes break PET down into its original monomers, which can then be re-polymerized to produce rPET that is indistinguishable from virgin PET. This innovation allows the creation of food-grade rPET and eliminates impurities, making it suitable for high-value applications like beverage bottles, pharmaceutical packaging, and more.

Enhanced sorting techniques, including AI-driven sorting systems, further improve recycling efficiency by minimizing contamination and ensuring better quality rPET output. These advancements are particularly appealing to industries like packaging and textiles, which require consistent and high-grade materials to meet stringent regulatory and consumer standards.

By addressing quality constraints, advanced recycling technologies not only expand the usability of rPET but also attract investments from governments and corporations. These aim to meet sustainability goals and consequently driving market growth.

- Sustainability-Driven Consumer Preferences

Consumer preferences are shifting toward sustainable and eco-conscious products, creating a substantial opportunity for the driving recycled PET (rPET) market. Growing awareness of the environmental impacts of plastic waste and the role of circular economy practices is prompting consumers to seek products made with recycled materials.

The trend is particularly evident in the packaging and fashion industries, where brands are integrating rPET to meet the demand for eco-friendly solutions. In packaging, leading brands are transitioning to rPET for bottles, containers, and other applications, replacing virgin PET to reduce carbon footprints.

Several global beverage companies have committed to using 50-100% recycled content in their packaging by 2030. Similarly, the fashion industry is embracing rPET for clothing, footwear, and accessories, with a focus on reducing textile waste and promoting circularity.

The shift is not merely a trend but a competitive advantage, as consumers increasingly reward brands that prioritize sustainability. As a result, companies across sectors are heavily investing in rPET integration to align with consumer expectations, further driving demand and fostering innovation in the rPET market.

How Does Regulatory Scenario Shape the Industry?

The regulatory landscape is a significant driver for the recycled PET (rPET) market, with governments worldwide implementing stringent measures to reduce plastic waste and promote sustainability.

Policies like extended producer responsibility (EPR) require manufacturers to manage the end-of-life cycle of their products, incentivizing the use of recycled materials such as rPET. Mandates for incorporating minimum recycled content in packaging are gaining traction, particularly in regions like Europe and North America.

Globally, bans on single-use plastics and initiatives to curb greenhouse gas emissions are encouraging companies to adopt rPET to meet compliance requirements and corporate sustainability goals. Governments in emerging economies, such as China and India, are investing in recycling infrastructure and implementing policies to boost rPET production.

Regulations ensure the steady supply and demand of rPET and foster innovation in recycling technologies. By creating a favorable framework for sustainability, the regulatory scenario is positioning rPET as a cornerstone of global efforts to transition to a circular economy.

Segments Covered in the Report

- Demand to Remain High for Flakes with Growing Demand for Recycled Materials in Packaging & Textile Industry

Flakes are projected to dominate the global recycled PET (rPET) market, achieving a growth rate of 9.8% and a valuation of US$ 11.6 Bn by 2031. The rising demand for premium recycled materials across diverse sectors, including packaging and textiles, is propelling the expansion of the flakes segment.

Flakes are extensively utilized owing to their adaptability, capacity to uphold high-quality requirements, and compatibility with many manufacturing procedures. Innovations in recycling processes, including molecular and mechanical recycling, enhance the quality of rPET flakes, increasing their demand.

The increasing focus on sustainability, regulatory demands for diminishing plastic waste, and a transition toward circular economy practices drive market growth.

- Packaging Industry to Stand Out with Rising Demand for Sustainable Packaging

The packaging sector is anticipated to expand at a rate of 8.6%, attaining a valuation of US$ 8.5 Bn by 2031, fueled by the rising demand for sustainable packaging alternatives.

There is a substantial movement towards utilizing recycled materials in packaging with the increasing eco-consciousness of businesses and customers to mitigate plastic waste. Progress in recycling technologies, including molecular recycling and novel methods like dissolving technology, is enhancing the quality of recovered plastics.

Collaborations, exemplified by Dow and Procter & Gamble, along with innovations in molecular recycling, as evidenced by Eastman’s new facility, are expediting the integration of rPET in packaging.

Regional Analysis

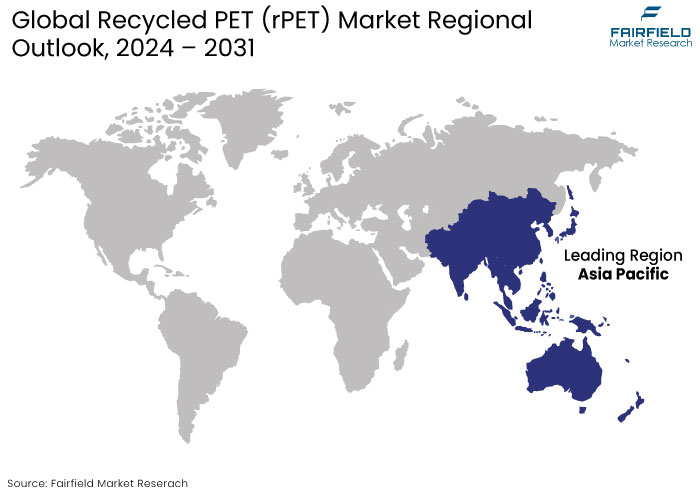

- Asia Pacific Grew Substantially with 44% of Market Share

Asia Pacific led the global recycled PET market, comprising over 44% of the revenue share in 2024. The regional market features multiple participants. This regional market is distinguished by an abundance of low-cost skilled labor and readily accessible land.

The transition in production to emerging economies, especially China and India, is anticipated to impact market growth throughout the projection period positively. The region hosts numerous fast-growing industries, including construction, automotive, and electronics, which offer significant opportunities for rPET makers.

China's market is well-established; however, the import ban on plastic garbage is anticipated to impede its expansion. Prior to the ban in December 2018, China was the foremost importer of plastic garbage globally.

In July 2017, citing environmental and health concerns at the World Trade Organization, the country declared its intention to stop the importation of 24 categories of garbage, including five distinct types of plastic. This has diverted substantial amounts of plastic waste to Southeast Asian nations, prompting recyclers in China to migrate to these countries.

- North America Recycled PET (rPET) Market Turns Highly Lucrative with Substantial Growth Rate

North America market is projected to expand at a rate of 8.6% by 2031, propelled by rising consumer demand for sustainable products and improvements in recycling infrastructure.

Plastic garbage is a considerable challenge, with over 100 billion plastic shopping bags utilized each year in the U.S., necessitating enormous resources for their production. Retailers such as Target are tackling this issue by implementing efforts like incentives for utilizing reusable bags, demonstrating an increasing emphasis on sustainability.

Government-supported initiatives bolster this expansion, exemplified by Eastman's proposal to establish a molecular recycling facility in Longview, Texas, with the capacity to handle 110,000 metric tons of plastic trash each year. The Plastics Industry Association's advocacy campaign "Recycling Is Real" emphasizes the significance of recycling and promotes the extensive utilization of recovered materials.

Despite obstacles such as inadequate recycling rates and intricate waste processes, initiatives like Bank of America's transition to recycled plastic credit cards and legislation advocating Extended Producer Responsibility (EPR) are expediting the adoption of rPET in North America. These activities underscore the region's dedication to mitigating plastic waste and promoting sustainable practices.

Fairfield’s Competitive Landscape Analysis

The recycled PET (rPET) market is marked by intense competition among global and regional players focusing on innovation, sustainability, and cost efficiency. Key companies, including Indorama Ventures, Far Eastern New Century Corporation, and Plastipak Holdings, dominate the market with extensive recycling facilities and advanced technologies like chemical recycling.

Emerging players are leveraging regional expertise and government incentives to establish a foothold. Strategic initiatives such as mergers, acquisitions, and partnerships are common as companies aim to expand their market presence and enhance recycling capabilities.

The rising demand for high-quality food-grade rPET is driving investments in research and developmen and technology upgrades. The competitive landscape remains dynamic, fueled by regulatory pressures and corporate commitments to sustainability.

Key Market Companies

- Indorama Ventures

- Alpek

- Plastipak Packaging

- Phoenix Technologies International, LLC

- Biffa

- Extrupet Group (Pty) Ltd

- Alpla

- JP Recycling Ltd

- Evergreen Plastics, Inc.

- PolyQuest

- Iterum (PET Baltija)

- Ganesha Ecosphere Ltd.

Recent Industry Developments

- In September 2023, Indorama Ventures announced an augmentation of PET recycling capacity at their facility in Juiz de Fora, Minas Gerais, Brazil, from 9,000 tons to 25,000 tons annually.

- In March 2023, SK Chemicals entered into a USD 98.4 million agreement to purchase a chemical recycling and PET production facility from Shuye Environmental Technology. The facility allows SK Chemicals to manufacture chemically recycled PET at an annual capacity of 50,000 tons.

An Expert’s Eye

- The shift toward a circular economy and stringent environmental regulations are key drivers for the rPET market growth.

- Advancements in chemical recycling and AI-driven sorting systems are revolutionizing the production of high-quality rPET, broadening its applications.

- Growing consumer preference for eco-friendly products is pushing brands to adopt rPET in packaging and textiles.

- Policies like extended producer responsibility (EPR) and mandates for recycled content are shaping the competitive dynamics of the market.

Global Recycled Pet Market is Segmented as-

By Product Type

- Flakes

- Fibers

- Resins

By Application

- Packaging

- Textiles

- Strapping

- Footwear

- Automotive

- Flooring Materials

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Recycled PET (rPET) Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Recycled PET (rPET) Market Outlook, 2019 - 2031

3.1. Global Recycled PET (rPET) Market Outlook, by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Flakes

3.1.1.2. Fibers

3.1.1.3. Resins

3.2. Global Recycled PET (rPET) Market Outlook, by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Packaging

3.2.1.1.1. Food & Beverage

3.2.1.1.2. Pharma

3.2.1.1.3. Personal Care

3.2.1.1.4. Misc. (Agrochemicals, etc.)

3.2.1.2. Textiles

3.2.1.3. Strapping

3.2.1.4. Footwear

3.2.1.5. Automotive

3.2.1.6. Flooring Materials

3.2.1.7. Misc. (Engineered Resins, etc.)

3.3. Global Recycled PET (rPET) Market Outlook, by Region, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Recycled PET (rPET) Market Outlook, 2019 - 2031

4.1. North America Recycled PET (rPET) Market Outlook, by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Flakes

4.1.1.2. Fibers

4.1.1.3. Resins

4.2. North America Recycled PET (rPET) Market Outlook, by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Packaging

4.2.1.1.1. Food & Beverage

4.2.1.1.2. Pharma

4.2.1.1.3. Personal Care

4.2.1.1.4. Misc. (Agrochemicals, etc.)

4.2.1.2. Textiles

4.2.1.3. Strapping

4.2.1.4. Footwear

4.2.1.5. Automotive

4.2.1.6. Flooring Materials

4.2.1.7. Misc. (Engineered Resins, etc.)

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Recycled PET (rPET) Market Outlook, by Country, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. U.S. Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

4.3.1.2. U.S. Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

4.3.1.3. Canada Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

4.3.1.4. Canada Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Recycled PET (rPET) Market Outlook, 2019 - 2031

5.1. Europe Recycled PET (rPET) Market Outlook, by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Flakes

5.1.1.2. Fibers

5.1.1.3. Resins

5.2. Europe Recycled PET (rPET) Market Outlook, by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Packaging

5.2.1.1.1. Food & Beverage

5.2.1.1.2. Pharma

5.2.1.1.3. Personal Care

5.2.1.1.4. Misc. (Agrochemicals, etc.)

5.2.1.2. Textiles

5.2.1.3. Strapping

5.2.1.4. Footwear

5.2.1.5. Automotive

5.2.1.6. Flooring Materials

5.2.1.7. Misc. (Engineered Resins, etc.)

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Recycled PET (rPET) Market Outlook, by Country, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Germany Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.1.2. Germany Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.1.3. U.K. Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.1.4. U.K. Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.1.5. France Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.1.6. France Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.1.7. Italy Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.1.8. Italy Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.1.9. Spain Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.1.10. Spain Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.1.11. Russia Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.1.12. Russia Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2031

5.3.1.13. Rest of Europe Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.1.14. Rest of Europe Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Recycled PET (rPET) Market Outlook, 2019 - 2031

6.1. Asia Pacific Recycled PET (rPET) Market Outlook, by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Flakes

6.1.1.2. Fibers

6.1.1.3. Resins

6.2. Asia Pacific Recycled PET (rPET) Market Outlook, by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Packaging

6.2.1.1.1. Food & Beverage

6.2.1.1.2. Pharma

6.2.1.1.3. Personal Care

6.2.1.1.4. Misc. (Agrochemicals, etc.)

6.2.1.2. Textiles

6.2.1.3. Strapping

6.2.1.4. Footwear

6.2.1.5. Automotive

6.2.1.6. Flooring Materials

6.2.1.7. Misc. (Engineered Resins, etc.)

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Recycled PET (rPET) Market Outlook, by Country, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. China Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.3.1.2. China Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.3.1.3. Japan Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.3.1.4. Japan Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.3.1.5. South Korea Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.3.1.6. South Korea Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.3.1.7. India Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.3.1.8. India Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.3.1.9. Southeast Asia Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.3.1.10. Southeast Asia Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.3.1.11. Rest of Asia Pacific Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.3.1.12. Rest of Asia Pacific Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Recycled PET (rPET) Market Outlook, 2019 - 2031

7.1. Latin America Recycled PET (rPET) Market Outlook, by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Flakes

7.1.1.2. Fibers

7.1.1.3. Resins

7.2. Latin America Recycled PET (rPET) Market Outlook, by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Packaging

7.2.1.1.1. Food & Beverage

7.2.1.1.2. Pharma

7.2.1.1.3. Personal Care

7.2.1.1.4. Misc. (Agrochemicals, etc.)

7.2.1.2. Textiles

7.2.1.3. Strapping

7.2.1.4. Footwear

7.2.1.5. Automotive

7.2.1.6. Flooring Materials

7.2.1.7. Misc. (Engineered Resins, etc.)

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Recycled PET (rPET) Market Outlook, by Country, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Brazil Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

7.3.1.2. Brazil Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

7.3.1.3. Mexico Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

7.3.1.4. Mexico Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

7.3.1.5. Argentina Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

7.3.1.6. Argentina Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

7.3.1.7. Rest of Latin America Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

7.3.1.8. Rest of Latin America Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Recycled PET (rPET) Market Outlook, 2019 - 2031

8.1. Middle East & Africa Recycled PET (rPET) Market Outlook, by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Flakes

8.1.1.2. Fibers

8.1.1.3. Resins

8.2. Middle East & Africa Recycled PET (rPET) Market Outlook, by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Packaging

8.2.1.1.1. Food & Beverage

8.2.1.1.2. Pharma

8.2.1.1.3. Personal Care

8.2.1.1.4. Misc. (Agrochemicals, etc.)

8.2.1.2. Textiles

8.2.1.3. Strapping

8.2.1.4. Footwear

8.2.1.5. Automotive

8.2.1.6. Flooring Materials

8.2.1.7. Misc. (Engineered Resins, etc.)

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Recycled PET (rPET) Market Outlook, by Country, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. GCC Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

8.3.1.2. GCC Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

8.3.1.3. South Africa Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

8.3.1.4. South Africa Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

8.3.1.5. Rest of Middle East & Africa Recycled PET (rPET) Market by Product Type, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

8.3.1.6. Rest of Middle East & Africa Recycled PET (rPET) Market by Application, Value (US$ Bn) And Volume (Tons) , 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Application Heatmap

9.2. Company Market Share Analysis, 2023

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Indorama Ventures Public Company Limited

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Phoenix Technologies International, LLC

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Biffa

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Alpek

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Plastipak Holdings, Inc

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Clear Path Recycling, LLC

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. ALPLA Group

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Phoenix Technologies, Inc.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. UltrePet LLC

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. JP Recycling Ltd

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Extrupet Group (Pty) Ltd

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Evergreen Plastics, Inc.

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. PolyQuest

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. DuFor

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Applications Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |