Global Refurbished Medical Equipment Market Forecast

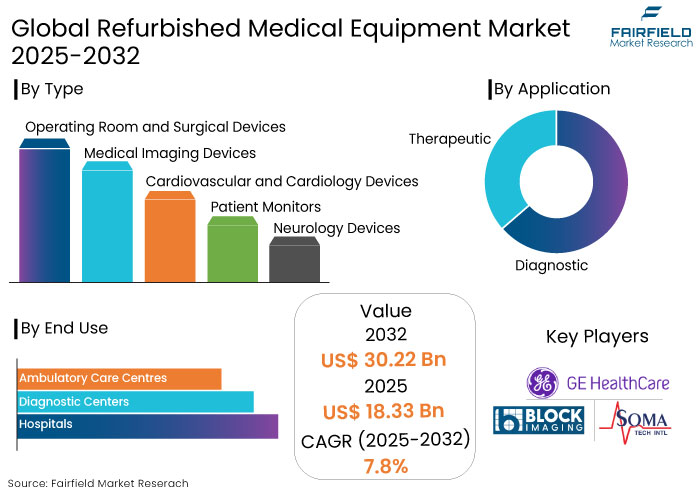

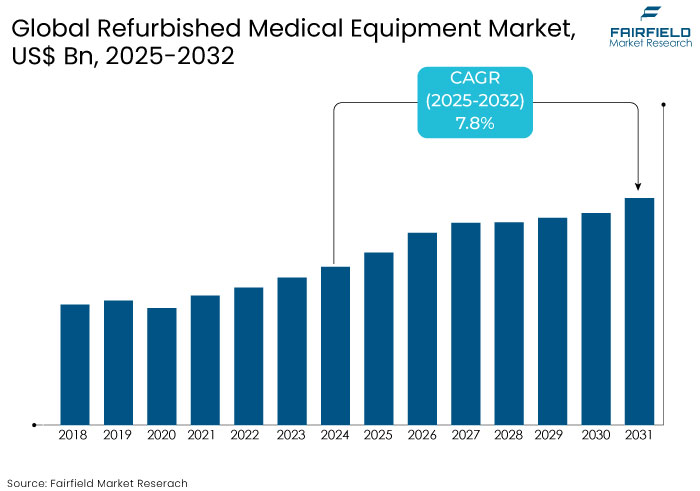

- The refurbished medical equipment market is projected to reach a size of US$30.22 Bn by 2032, showing significant growth from the US$18.33 Bn achieved in 2025.

- The market for refurbished medical equipment is expected to record a significant expansion rate, with an estimated CAGR of 7.8% from 2025 to 2032.

Refurbished Medical Equipment Market Insights

- Refurbished equipment offers significant cost savings, driving adoption among budget-conscious healthcare providers.

- North America dominates the market due to its advanced healthcare systems, robust regulatory frameworks, and high adoption rates.

- Increased emphasis on reducing electronic waste and promoting the circular economy accelerates refurbished medical equipment market.

- Technologies like AI and IoT are enhancing the quality and reliability of refurbished devices, boosting acceptance.

- Hospitals are the primary consumers of refurbished medical equipment due to high patient volumes and diverse equipment needs.

- Diagnostic centres increasingly use refurbished imaging systems to manage costs and expand services.

- Partnerships between governments and private companies in emerging regions are fuelling market expansion.

- Medical imaging devices with its cost advantage, lead the type segmentation of the market

A Look Back and a Look Forward - Comparative Analysis

The increasing need for cost-effective healthcare solutions fueled the refurbished medical equipment market during the period from 2019 to 2023. Hospitals and diagnostic centers, especially in emerging economies, embraced refurbished medical devices to manage budget constraints while meeting patient care needs.

North America and Europe dominated the market during this period, with their robust healthcare infrastructure and stringent regulatory frameworks ensuring quality assurance. The growing emphasis on sustainability was pivotal in encouraging healthcare providers to adopt refurbished equipment, reducing electronic waste.

Rising healthcare expenditure and advancements in refurbishing technology will likely enhance product quality and reliability, further driving adoption. Emerging economies in Asia-Pacific and Latin America are projected to become key growth areas due to expanding healthcare infrastructures and increasing demand for affordable medical devices. A growing focus on value-based care and sustainability initiatives will solidify the market’s trajectory over the forecast period.

Key Growth Determinants

- Increased Demand for High-end Imaging Equipment at Reduced Costs Fuels Demand

Chronic diseases such as cancer, vascular disorders, and neurological conditions necessitated the implementation of enhanced diagnostic imaging in clinics, hospitals, or medical centers. Advanced AI-integrated imaging, portable systems, and novel high-resolution modalities are enhancing the usability of diagnostic equipment and reducing operational costs for most healthcare organizations.

The refurbishment and reuse of instruments contribute to global sustainability objectives by minimizing electronic waste and its environmental impact over its lifecycle. The prevalence of chronic diseases and global initiatives for enhanced diagnostics in neurology and cardiology have generated tremendous demand.

A notable advantage of remanufactured equipment is that it provides extensive coverage without compromising quality. Refurbished systems enable facilities to adopt the latest technology without the high expenses of entirely new equipment.

- Focus on Sustainability and Circular Economy Boosts Market Growth

Sustainability and environmental legislation concerns are driving the healthcare sector to embrace environment-friendly methods. Refurbished medical equipment supports these objectives by prolonging the lifespan of medical devices, minimizing electronic waste, and preserving resources. Growing focus on sustainability and circular economy remains a key driver for refurbished medical equipment market growth.

Prominent manufacturers are advocating refurbishment as a component of their sustainability initiatives, targeting environmentally aware consumers. Numerous hospitals and clinics are increasingly driven by financial efficiency and their responsibility to minimize environmental impacts.

With the increasing global focus on sustainability, the refurbished medical equipment market is projected to expand considerably, capitalizing on its congruence with circular economy concepts.

Key Growth Barriers

- Perception of Used Medical Equipment Being Less Dependable is a Main Setback

Refurbished equipment often lacks the warranty and customer support typically associated with new equipment, leading to concerns regarding dependability and maintenance among consumers. Refurbished equipment has typically been previously utilized, prompting inquiries about their remaining lifespan and performance, particularly concerning components prone to wear.

Refurbished gadgets may include obsolete technology or lack compatibility with contemporary systems, raising further concerns regarding reliability in the rapidly advancing medical technology domain.

These concerns are typically resolved by high-quality refurbishment methods utilizing a licensed OEM source or reputable supplier, rendering refurbished medical equipment a dependable and cost-effective option for several healthcare facilities.

- Lack of Standardized Protocols Among Medical Equipment Manufacturers Hinders Market Growth

Several nations possess conflicting and inconsistent legislation concerning refurbished medical devices and are subject to stringent laws, but others may be entirely unregulated. Independent manufacturers and third-party sellers frequently employ varied procedures for the refurbishment, testing, and certification of reconditioned goods.

Due to the divergent processes involved, it would expose one to a deficiency in responsibility while attempting to establish a direct correlation between a reconditioned gadget and unreliability. In the absence of a standardized and measured refurbishing procedure, healthcare practitioners may voice apprehension regarding the safety and quality of refurbished equipment.

Implementing refurbishing standards, such as those aligned with ISO certification techniques, could enhance confidence and acceptance through globally recognized benchmarks. Consistent regulations would enhance adherence and safety in the repair and resale of medical equipment.

Refurbished Medical Equipment Market Trends and Opportunities

- Expanding Networks for Recycled Medical Equipment Bolsters Demand

Internet marketplaces have seen a steep rise, mostly focusing on refurbished medical equipment due to providers' escalating need for affordable, high-quality medical products. Such internet platforms facilitate global transactions, hence streamlining the entire process.

Platforms integrated with logistical networks can save costs and enhance accessibility while prolonging the lifespan of medical products. Call centers and integrated e-commerce platforms for payment gateways, user reviews, and artificial intelligence-driven recommendation services further facilitate healthcare practitioners in acquiring certified reconditioned equipment.

It diminishes electronic waste and lowers procurement expenses for healthcare providers, as refurbished products align with the principles of a circular economy. An online platform facilitates vendors in connecting with prospective buyers globally for transactions involving refurbished neurology, imaging, and surgical equipment.

- Integration of Advanced Refurbishment Technologies

The integration of cutting-edge refurbishment technologies is revolutionizing the refurbished medical equipment market. Modern refurbishment processes now employ advanced AI, IoT, and automation tools to diagnose, repair, and upgrade medical devices efficiently.

The technologies allow companies to evaluate the condition of used equipment more precisely, ensuring that repairs or replacements are done to meet or even exceed original performance specifications. IoT-enabled diagnostic tools can continuously monitor device components during refurbishment, predicting potential failures and ensuring higher reliability post-refurbishment.

Refurbished products now appeal to a broader range of buyers, including high-end hospitals and specialty clinics, which may have hesitated to adopt. By integrating these transformative technologies, the market is enhancing its credibility and expanding its reach into premium healthcare segments.

How Does Regulatory Scenario Shaping the Industry?

The regulatory scenario is pivotal in shaping the refurbished medical equipment market, ensuring product safety, reliability, and market growth. Regulatory frameworks vary across regions but share a common goal: to provide end-users with confidence about the quality and safety of refurbished devices.

In North America, agencies like the U.S. Food and Drug Administration (FDA) enforce strict guidelines for refurbishing processes, requiring compliance with Good Manufacturing Practices (GMP). It includes reconditioning, recalibration, and quality testing, ensuring refurbished equipment performs comparably to new devices. Such stringent standards have boosted trust among healthcare providers and driven adoption in the region.

In Europe, CE certification is mandatory, ensuring that refurbished equipment meets European safety, health, and environmental requirements. These regulations encourage sustainability by promoting the reuse of medical devices under well-defined standards.

Emerging markets in Asia Pacific and Latin America are adopting regulatory frameworks inspired by Western standards, further opening opportunities for global players. Compliance with these standards reassures buyers in these regions of the reliability of refurbished products.

Segments Covered in the Report

- Demand to Remain High for Medical Imaging Devices

Medical imaging devices own a substantial market share in the refurbished medical equipment market due to their cost advantage over new models. Healthcare providers are selecting refurbished equipment to economize on essential diagnostic applications such as X-ray, MRI, and CT scans.

Refurbished MRI machines cost approximately 30 to 50% less than new models, rendering them appropriate for budget-sensitive healthcare institutions. Modern refurbishing technologies, including high-end software and hardware upgrades, allow refurbished equipment to match industry performance standards.

Healthcare companies believe that refurbished equipment functions effectively for a long period of time if maintained properly. Refurbished equipment offered by GE Healthcare and Siemens Healthineers is recognized by consumers for its superior quality, upgraded features, and included warranties.

- High Sales come from Hospitals Sector with Growing Demand for Affordable and Reliable Medical Devices

Hospitals dominate the refurbished medical equipment market because of their broad demand for affordable, reliable, and advanced medical technology. It is further supported by financial constraints, service expansion needs, and the availability of high-quality refurbished equipment that meets regulatory standards.

Hospitals often need to manage large numbers of patients while adhering to budget constraints. Refurbished medical equipment offers a cost-effective alternative to new equipment purchases, allowing hospitals to equip their facilities with high-quality technology at relatively lower prices.

Hospitals require a variety of medical equipment, such as imaging systems, patient monitoring systems, and surgical instruments. Refurbished options are often prioritized to quickly and affordably address gaps in these critical areas, especially in regions with limited healthcare funding.

Regional Analysis

- North America Maintains Primacy in the Market

North America leads the refurbished medical equipment market, primarily driven by the United States. The region benefits from a high-end healthcare system with a high adoption rate of advanced medical technologies. Hospitals and diagnostic centres in North America frequently opt for refurbished equipment to balance their need for cutting-edge solutions with cost constraints.

Institutions are opting for refurbished medical equipment with rising healthcare costs to reduce expenses without compromising healthcare facilities. Many healthcare providers in the U.S. and Canada prioritize refurbished equipment as a practical alternative for upgrading their facilities.

Stringent regulations around refurbished medical devices give buyers confidence about the product's safety, quality, and quality. Regulatory frameworks by organizations like the U.S. FDA ensure refurbished equipment meets stringent standards, bolstering market trust.

- Europe Refurbished Medical Equipment Market to Stand out

Europe holds the second largest share of the refurbished medical equipment market, driven by significant adoption in countries like Germany, the UK, and France. Countries in Europe place a strong emphasis on environmental sustainability and the circular economy. The use of refurbished equipment aligns with these principles, reducing electronic waste and extending the lifecycle of medical devices.

Several countries in Europe face budgetary restrictions in their public healthcare systems. Refurbished equipment provides a cost-effective solution for hospitals and clinics to acquire advanced technologies while managing financial limitations.

Nations in Europe are increasingly adopting refurbished medical equipment as they expand their healthcare infrastructure. The affordability of these devices enables these countries to meet growing patient demands.

Fairfield’s Competitive Landscape Analysis

The refurbished medical equipment market is intensely competitive, comprising major entities such as GE Healthcare, Siemens Healthineers, Philips Healthcare, and Canon Medical Systems. The competition is increased by improvements in refurbishing methods that adhere to regulatory criteria such as FDA and CE certifications.

Key strategies encompass collaborations with hospitals, expanding service networks, and the provision of extended warranties. New market entrants concentrate on specialized segments and pricing strategies to acquire market share. Environmental initiatives and circular economy practices significantly influence competition among prominent enterprises.

Key Market Companies

- GE HealthCare

- Koninklijke Philips N.V.

- Siemens Healthcare Private Limited

- Block Imaging, Inc

- Soma Tech Intl.

- Avante Health Solutions

- Hilditch Group Ltd

- EVERX PVT. LTD

- Canon Medical Systems Corporation

- Radiology Oncology Systems

- Master Medical Equipment

- Future Health Concepts

Recent Industry Developments

- In August 2023, GE Healthcare introduced Vscan Air SL, a portable, wireless ultrasound imaging system intended for swift cardiac and vascular evaluations at the point of care, which facilitates expedited diagnosis and treatment decisions for physicians.

- In November 2023, Siemens Healthineers and CommonSpirit Health acquired Block Imaging to offer more sustainable solutions and address the growing need from US hospitals, health systems, and other care facilities for multi-vendor imaging components and services.

An Expert’s Eye

- The affordability of refurbished medical equipment is the key driver, making advanced technology accessible to cost-sensitive healthcare providers.

- Industry specialists emphasize the role of environmental concerns, as refurbished equipment reduces electronic waste, aligning with global sustainability goals.

- Refurbishing processes incorporating AI and IoT technologies significantly improve product quality, reliability, and acceptance among premium healthcare providers.

- The shift towards value-based care models prompts healthcare providers to adopt refurbished devices for better cost management without compromising quality.

Global Refurbished Medical Equipment Market is Segmented as-

By Type

- Operating Room and Surgical Devices

- Medical Imaging Devices

- Cardiovascular and Cardiology Devices

- Patient Monitors

- Neurology Devices

By Application

- Diagnostic

- Therapeutic

By End Use

- Hospitals

- Diagnostic Centers

- Ambulatory Care Centers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Refurbished Medical Equipment Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Economic Overview

2.6.1. World Economic Projections

2.7. PESTLE Analysis

3. Price Analysis, 2019 - 2032

3.1. Global Average Price Analysis by Type, 2019 - 2032

3.2. Prominent Factor Affecting Refurbished Medical Equipment Prices

3.3. Global Average Price Analysis by Region

4. Global Refurbished Medical Equipment Market Outlook, 2019 - 2032

4.1. Global Refurbished Medical Equipment Market Outlook, by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Operating Room and Surgical Devices

4.1.1.2. Medical Imaging Devices

4.1.1.3. Cardiovascular and Cardiology Devices

4.1.1.4. Patient Monitors

4.1.1.5. Neurology Devices

4.1.1.6. Others

4.2. Global Refurbished Medical Equipment Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Diagnostic

4.2.1.2. Therapeutic

4.3. Global Refurbished Medical Equipment Market Outlook, by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Diagnostic Centers

4.3.1.3. Ambulatory Care Centers

4.3.1.4. Other

4.4. Global Refurbished Medical Equipment Market Outlook, by Region, Value (US$ Mn) and Volume (Units), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Latin America

4.4.1.5. Middle East & Africa

5. North America Refurbished Medical Equipment Market Outlook, 2019 - 2032

5.1. North America Refurbished Medical Equipment Market Outlook, by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Operating Room and Surgical Devices

5.1.1.2. Medical Imaging Devices

5.1.1.3. Cardiovascular and Cardiology Devices

5.1.1.4. Patient Monitors

5.1.1.5. Neurology Devices

5.1.1.6. Others

5.2. North America Refurbished Medical Equipment Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Diagnostic

5.2.1.2. Therapeutic

5.3. North America Refurbished Medical Equipment Market Outlook, by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Diagnostic Centers

5.3.1.3. Ambulatory Care Centers

5.3.1.4. Other

5.3.2. Attractiveness Analysis

5.4. North America Refurbished Medical Equipment Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. U.S. Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

5.4.1.2. U.S. Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

5.4.1.3. U.S. Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

5.4.1.4. Canada Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

5.4.1.5. Canada Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

5.4.1.6. Canada Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

6. Europe Refurbished Medical Equipment Market Outlook, 2019 - 2032

6.1. Europe Refurbished Medical Equipment Market Outlook, by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Operating Room and Surgical Devices

6.1.1.2. Medical Imaging Devices

6.1.1.3. Cardiovascular and Cardiology Devices

6.1.1.4. Patient Monitors

6.1.1.5. Neurology Devices

6.1.1.6. Others

6.2. Europe Refurbished Medical Equipment Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Diagnostic

6.2.1.2. Therapeutic

6.3. Europe Refurbished Medical Equipment Market Outlook, by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Diagnostic Centers

6.3.1.3. Ambulatory Care Centers

6.3.1.4. Other

6.3.2. Attractiveness Analysis

6.4. Europe Refurbished Medical Equipment Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Germany Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.2. Germany Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.3. Germany Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.4. U.K. Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.5. U.K. Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.6. U.K. Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.7. France Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.8. France Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.9. France Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.10. Italy Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.11. Italy Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.12. Italy Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.13. Türkiye Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.14. Türkiye Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.15. Türkiye Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.16. Russia Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.17. Russia Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.18. Russia Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.19. Rest of Europe Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.20. Rest of Europe Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

6.4.1.21. Rest of Europe Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

7. Asia Pacific Refurbished Medical Equipment Market Outlook, 2019 - 2032

7.1. Asia Pacific Refurbished Medical Equipment Market Outlook, by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Operating Room and Surgical Devices

7.1.1.2. Medical Imaging Devices

7.1.1.3. Cardiovascular and Cardiology Devices

7.1.1.4. Patient Monitors

7.1.1.5. Neurology Devices

7.1.1.6. Others

7.2. Asia Pacific Refurbished Medical Equipment Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Diagnostic

7.2.1.2. Therapeutic

7.3. Asia Pacific Refurbished Medical Equipment Market Outlook, by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Diagnostic Centers

7.3.1.3. Ambulatory Care Centers

7.3.1.4. Other

7.3.2. Attractiveness Analysis

7.4. Asia Pacific Refurbished Medical Equipment Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. China Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.2. China Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.3. China Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.4. Japan Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.5. Japan Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.6. Japan Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.7. South Korea Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.8. South Korea Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.9. South Korea Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.10. India Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.11. India Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.12. India Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.13. Southeast Asia Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.14. Southeast Asia Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.15. Southeast Asia Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.16. Rest of Asia Pacific Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.17. Rest of Asia Pacific Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

7.4.1.18. Rest of Asia Pacific Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

8. Latin America Refurbished Medical Equipment Market Outlook, 2019 - 2032

8.1. Latin America Refurbished Medical Equipment Market Outlook, by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Operating Room and Surgical Devices

8.1.1.2. Medical Imaging Devices

8.1.1.3. Cardiovascular and Cardiology Devices

8.1.1.4. Patient Monitors

8.1.1.5. Neurology Devices

8.2. Latin America Refurbished Medical Equipment Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Diagnostic

8.2.1.2. Therapeutic

8.3. Latin America Refurbished Medical Equipment Market Outlook, by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Diagnostic Centers

8.3.1.3. Ambulatory Care Centers

8.3.1.4. Other

8.3.2. Attractiveness Analysis

8.4. Latin America Refurbished Medical Equipment Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Brazil Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.4.1.2. Brazil Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.4.1.3. Brazil Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.4.1.4. Mexico Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.4.1.5. Mexico Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.4.1.6. Mexico Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.4.1.7. Argentina Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.4.1.8. Argentina Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.4.1.9. Argentina Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.4.1.10. Rest of Latin America Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.4.1.11. Rest of Latin America Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

8.4.1.12. Rest of Latin America Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

9. Middle East & Africa Refurbished Medical Equipment Market Outlook, 2019 - 2032

9.1. Middle East & Africa Refurbished Medical Equipment Market Outlook, by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.1.1. Key Highlights

9.1.1.1. Operating Room and Surgical Devices

9.1.1.2. Medical Imaging Devices

9.1.1.3. Cardiovascular and Cardiology Devices

9.1.1.4. Patient Monitors

9.1.1.5. Neurology Devices

9.1.1.6. Others

9.2. Middle East & Africa Refurbished Medical Equipment Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.2.1. Key Highlights

9.2.1.1. Diagnostic

9.2.1.2. Therapeutic

9.3. Middle East & Africa Refurbished Medical Equipment Market Outlook, by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.3.1. Key Highlights

9.3.1.1. Hospitals

9.3.1.2. Diagnostic Centers

9.3.1.3. Ambulatory Care Centers

9.3.1.4. Other

9.3.2. Attractiveness Analysis

9.4. Middle East & Africa Refurbished Medical Equipment Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1. Key Highlights

9.4.1.1. GCC Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.2. GCC Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.3. GCC Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.4. South Africa Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.5. South Africa Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.6. South Africa Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.7. Egypt Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.8. Egypt Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.9. Egypt Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.10. Nigeria Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.11. Nigeria Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.12. Nigeria Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.13. Rest of Middle East & Africa Refurbished Medical Equipment Market by Type, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.14. Rest of Middle East & Africa Refurbished Medical Equipment Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2032

9.4.1.15. Rest of Middle East & Africa Refurbished Medical Equipment Market by End-use, Value (US$ Mn) and Volume (Units), 2019 - 2032

10. Competitive Landscape

10.1. By Type vs by Application Heatmap

10.2. Company Market Share Analysis, 2024

10.3. Competitive Dashboard

10.4. Company Profiles

10.4.1. GE HealthCare

10.4.1.1. Company Overview

10.4.1.2. Product Portfolio

10.4.1.3. Financial Overview

10.4.1.4. Business Strategies and Development

10.4.2. Koninklijke Philips N.V.

10.4.2.1. Company Overview

10.4.2.2. Product Portfolio

10.4.2.3. Financial Overview

10.4.2.4. Business Strategies and Development

10.4.3. Siemens Healthcare Private Limited

10.4.3.1. Company Overview

10.4.3.2. Product Portfolio

10.4.3.3. Financial Overview

10.4.3.4. Business Strategies and Development

10.4.4. Block Imaging, Inc

10.4.4.1. Company Overview

10.4.4.2. Product Portfolio

10.4.4.3. Financial Overview

10.4.4.4. Business Strategies and Development

10.4.5. Soma Tech Intl.

10.4.5.1. Company Overview

10.4.5.2. Product Portfolio

10.4.5.3. Financial Overview

10.4.5.4. Business Strategies and Development

10.4.6. Avante Health Solutions

10.4.6.1. Company Overview

10.4.6.2. Product Portfolio

10.4.6.3. Financial Overview

10.4.6.4. Business Strategies and Development

10.4.7. Hilditch Group Ltd

10.4.7.1. Company Overview

10.4.7.2. Product Portfolio

10.4.7.3. Financial Overview

10.4.7.4. Business Strategies and Development

10.4.8. EVERX PVT. LTD

10.4.8.1. Company Overview

10.4.8.2. Product Portfolio

10.4.8.3. Financial Overview

10.4.8.4. Business Strategies and Development

10.4.9. Canon Medical Systems Corporation

10.4.9.1. Company Overview

10.4.9.2. Product Portfolio

10.4.9.3. Financial Overview

10.4.9.4. Business Strategies and Development

10.4.10. Radiology Oncology Systems

10.4.10.1. Company Overview

10.4.10.2. Product Portfolio

10.4.10.3. Financial Overview

10.4.10.4. Business Strategies and Development

10.4.11. Master Medical Equipment

10.4.11.1. Company Overview

10.4.11.2. Product Portfolio

10.4.11.3. Financial Overview

10.4.11.4. Business Strategies and Development

10.4.12. Future Health Concepts

10.4.12.1. Company Overview

10.4.12.2. Product Portfolio

10.4.12.3. Financial Overview

10.4.12.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |