Global Remote Patient Monitoring Device Market Forecast

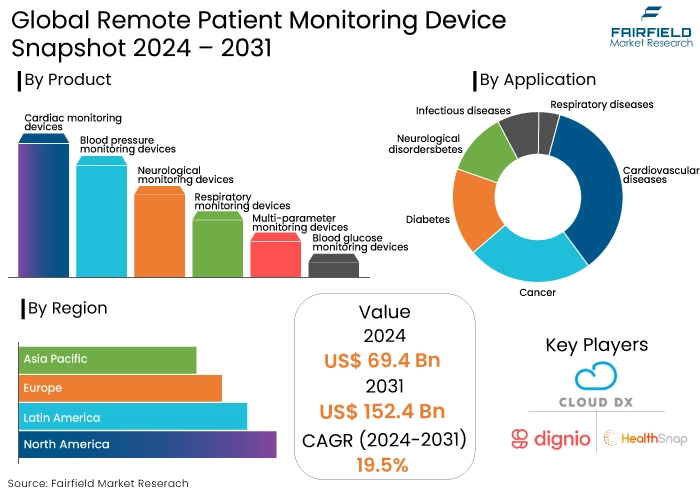

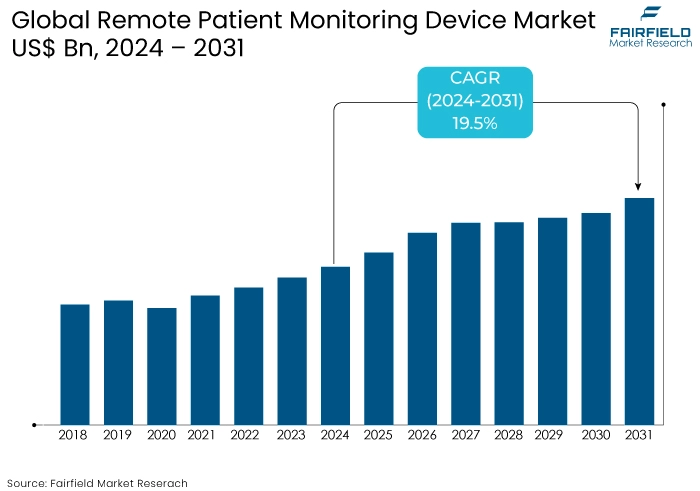

- The global remote patient monitoring device market is projected to reach US$152.4 Bn by 2031, showing significant growth from the US$69.4 Bn achieved in 2024.

- The market for remote patient monitoring device is expected to exhibit a remarkable rate of expansion, with an estimated CAGR of 19.5% during the period from 2024 to 2031.

Remote Patient Monitoring Device Market Insights

- Remote patient monitoring devices enable healthcare providers to monitor patients remotely, reducing the need for frequent hospital visits.

- Innovations in IoT technology, AI, and mobile health applications enhance the functionality and accessibility of RPM devices.

- The cardiac monitoring devices segment is predicted to surpass US$9.1 billion by 2031.

- The rising proportion of elderly individuals requiring ongoing medical care is a critical factor fueling the growth of the RPM device market revenue.

- FDA's emergency use authorization for RPM devices during health crises has accelerated their deployment.

- Rapid urbanization and increased disposable income in regions like Asia-Pacific, Latin America, and parts of Africa present opportunities for growth.

- Raising concerns about patient privacy and the integrity of health information fuels the industry's growth.

- Stakeholders must prioritize compliance with regulations like HIPAA and ensure robust data protection measures.

A Look Back and a Look Forward - Comparative Analysis

The increasing prevalence of chronic diseases and the aging population are primary contributors to industry growth. The market is estimated to rise from US$69.4 Bn in 2024 to US$152.4 Bn by 2031, reflecting a healthy CAGR of 19.5% during the forecast period from 2024 to 2031.

As per the remote patient monitoring device market analysis, the adoption of IoT technologies in healthcare is revolutionizing patient monitoring, enabling real-time data collection and analysis through connected devices.

Strategic partnerships among healthcare providers and technology firms are enhancing service delivery and patient outcomes, as seen in recent collaborations aimed at improving remote care. These key market trends collectively position the market for sustained growth in the coming years.

Key Growth Determinants

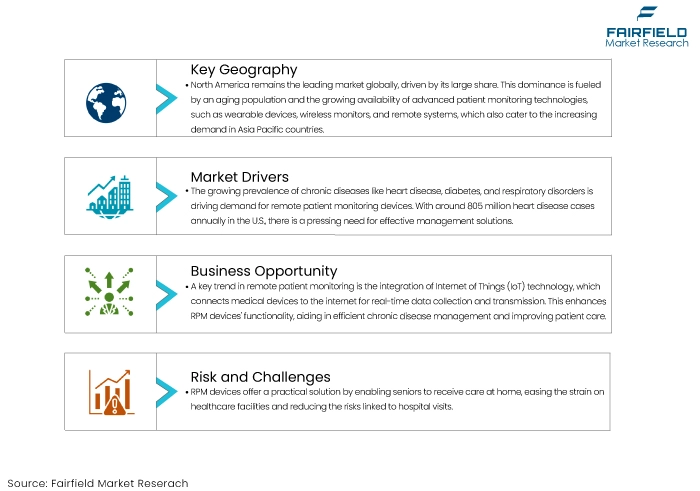

- Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases is a significant driver of growth in remote patient monitoring device market demand. Conditions such as heart disease, diabetes, and respiratory disorders are becoming increasingly common, necessitating continuous monitoring to manage these health issues effectively. Around 805 million people suffer from heart disease annually in the United States, highlighting the urgent need for effective management solutions.

RPM devices enable healthcare providers to monitor patients remotely, allowing for timely interventions and reducing the need for frequent hospital visits. It is particularly beneficial for patients with chronic conditions as it enhances their quality of life and promotes better health outcomes.

- Technological Advancements Accelerate the Sales

Technological advancements are revolutionizing the remote patient monitoring device market sales, making it a key growth driver. Innovations in Internet of Things (IoT) technology, artificial intelligence (AI), and mobile health (mHealth) applications are enhancing the functionality and accessibility of RPM devices.

Technologies enable real-time data collection and analysis, allowing healthcare providers to monitor patients' health metrics remotely and respond promptly to any concerning changes. The integration of AI in RPM devices enhances predictive analytics, enabling more personalized healthcare solutions tailored to individual patient needs.

- Aging Population Remains a Key Driving Factor

The aging population is another critical factor fueling the growth of the remote patient monitoring device market revenue. As life expectancy increases, the proportion of elderly individuals requiring ongoing medical care is rising.

The demographic shift is particularly pronounced in developed countries, where the elderly population is expected to grow significantly in the coming years. Old adults often suffer from multiple chronic conditions necessitating regular monitoring and management to maintain their health and independence.

RPM devices provide a practical solution by allowing seniors to receive care in the comfort of their homes reducing the burden on healthcare facilities and minimizing the risks associated with hospital visits.

Key Growth Barriers

- Data Security Concerns

One primary constraint affecting the remote patient monitoring device market value is the growing concern over data security. As RPM devices collect and transmit sensitive health information, they become potential targets for cyberattacks and data breaches.

The healthcare sector has seen a significant increase in cyber threats, with hackers exploiting vulnerabilities in connected devices to access personal health data. This situation raises serious concerns about patient privacy and the integrity of health information.

Regulatory bodies such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States impose strict guidelines on data protection, which can complicate the deployment of RPM technologies.

- Lack of Supportive Reimbursement Coverage

Another significant restraint impacting remote patient monitoring device market share is the lack of supportive reimbursement coverage.

Many healthcare systems and insurance providers have yet to establish comprehensive reimbursement policies for RPM services, which can deter healthcare providers from adopting these technologies.

The variability in reimbursement policies across different regions can create further complications, making it challenging for manufacturers and providers to navigate the landscape.

Remote Patient Monitoring Device Market Trends and Opportunities

- Integration of IoT in Healthcare

One of the remote patient monitoring device market trends is the integration of Internet of Things (IoT) technology in healthcare.

IoT enables the seamless connection of medical devices to the internet, allowing for real-time data collection and transmission. This capability enhances the functionality of RPM devices, making it easier for healthcare providers to monitor patients remotely.

The increasing adoption of IoT in healthcare is driven by the need for more efficient and effective patient management solutions, particularly for chronic disease management.

- Expansion into Emerging Markets

The remote patient monitoring device market opportunities present an avenue for growth through expansion into emerging markets.

Regions such as Asia-Pacific, Latin America, and parts of Africa are experiencing rapid urbanization and an increase in disposable income, leading to a growing demand for advanced healthcare solutions. As these regions face rising healthcare challenges, including a high prevalence of chronic diseases, the need for effective remote monitoring solutions becomes critical. This expansion offers substantial revenue potential and contributes to improving healthcare access and outcomes in underserved populations.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape plays a crucial role in shaping the remote patient monitoring device market growth. In recent years, regulatory bodies have increasingly recognized the importance of RPM technologies, leading to the establishment of frameworks that facilitate their adoption.

The FDA's emergency use authorization for certain RPM devices during health crises has accelerated their deployment, allowing for quicker access to innovative solutions that enhance patient care.

Favorable regulatory scenarios in regions like Europe have contributed to the market's growth. The presence of developed healthcare infrastructures and supportive regulations encourages the adoption of RPM devices; as healthcare providers seek to integrate these technologies into their practices. However, regulatory variations across different regions can pose challenges, potentially hindering the market expansion.

Concerns regarding data security and privacy are also significant, as they can undermine consumer confidence in RPM systems. To address these challenges, stakeholders must prioritize compliance with regulations such as HIPAA and ensure robust data protection measures are in place. This focus on regulatory adherence not only fosters trust among users but also paves the way for sustained growth in the RPM market, as healthcare systems increasingly embrace remote monitoring solutions to improve patient outcomes.

Fairfield’s Ranking Board

Segment Covered in the Report

- Special Monitors Gain Traction

As per the remote patient monitoring device market analysis, the special monitors segment has emerged as the dominant category. This segment encompasses a variety of advanced monitoring devices tailored for specific health conditions, such as cardiac arrhythmias, diabetes, and respiratory issues.

The increasing prevalence of chronic diseases has driven demand for specialized monitoring solutions that provide real-time data and facilitate timely interventions.

Cardiac monitors are particularly significant; as cardiovascular diseases remain a leading cause of mortality worldwide. The cardiac devices segment of the market is predicted to surpass US$ 9.1 billion by 2031.

Advancements in technology, such as the integration of IoT and AI, have enhanced the capabilities of these devices, making them more appealing to both healthcare providers and patients.

- Cardiovascular Diseases Treatment Leads Market with US$3.1 Bn Revenue

Within the application category of the remote patient monitoring device market update, the cardiovascular diseases treatment segment stands out as the dominant force. The segment accounted for US$3.1 Bn in 2023. This segment has garnered significant attention due to the alarming rise in cardiovascular conditions, which are among the leading causes of death globally.

The increasing number of patients requiring regular monitoring for conditions such as hypertension, heart failure, and arrhythmias has fueled the demand for RPM devices tailored to cardiovascular care.

The growing emphasis on preventive healthcare and patient engagement has led to a great focus on managing cardiovascular health through remote monitoring solutions.

Regional Analysis

- North America Emerges Lucrative Exhibiting High Market Share

North America continues to dominate the market, holding the largest share globally. This regional market is largely driven by an aging population and the increasing availability of advanced patient monitoring technologies. These technologies include wearable devices, wireless monitors, and remote systems, which address the rising demand in Asia Pacific countries.

Asia Pacific is expected to demonstrate the high CAGR rate during the forecast period. This region is becoming a hub for medical tourism, attracting patients seeking high-quality healthcare services. These services include cutting-edge surgical techniques and advanced patient monitoring solutions. The market in the region is set for substantial growth, fueled by a mix of demographic, economic, and technological factors.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the remote patient monitoring device market is characterized by intense rivalry among key players, driven by rapid technological advancements and the increasing demand for innovative healthcare solutions.

Leading companies, including Abbott Laboratories, AMD Global Telemedicine, and BIOTRONIK are actively engaged in product development and strategic partnerships to enhance their market presence.

The key players are focusing on expanding their product portfolios by incorporating advanced features such as IoT connectivity and AI-driven analytics, which improve patient monitoring and data management capabilities. The RPM market is evolving significantly with innovation and strategic collaborations being key factors for success in this highly competitive environment.

Key Market Companies

- Abbott Laboratories

- Medtronic

- Philips Healthcare

- Cardiomo

- HealthSnap

- Dignio

- Cloud DX

- Clear Arch Health

- Eko Health

- AiCure

- CureSelect

- Life Care Solutions

Recent Industry Developments

- August 2024 -

BayCare has partnered with chronic disease management company Cadence to implement a remote patient monitoring and responsive virtual care program to combine BayCare Medical Group's expert clinical team with Cadence's robust technology platform. It is to provide proactive and preventive health care to seniors with chronic conditions in Florida's Tampa Bay and West Central regions.

- August 2024 –

Carematix developed a Cellular Weight Scale, that scale tracks and shares patient weight measurements with healthcare professionals in real time to help monitor weight fluctuations in patients with chronic conditions. These chronic conditions include heart disease, diabetes, and obesity. Healthcare professionals assist in developing personalized care plans for such diseases.

An Expert’s Eye

- Advancements in technology, such as IoT and AI integration have enhanced the capabilities of RPM devices.

- Favorable regulatory scenarios in regions like Europe have contributed to the market's growth.

- Challenges include regulatory variations across different regions and concerns regarding data security and privacy.

- Regulatory bodies recognize the importance of RPM technologies leading to frameworks for their adoption.

Global Remote Patient Monitoring Device Market is Segmented as-

By Product

- Cardiac monitoring devices

- Blood pressure monitoring devices

- Neurological monitoring devices

- Respiratory monitoring devices

- Multi-parameter monitoring devices

- Blood glucose monitoring devices

- Fetal and neonatal monitoring devices

- Sleep monitoring devices

- Other monitoring devices

By Application

- Cardiovascular diseases

- Cancer

- Diabetes

- Neurological disorders

- Infectious diseases

- Respiratory diseases

- Other applications

By Region

- North America

- Latin America

- Europe

- Asia Pacific

1. Executive Summary

1.1. Global Remote Patient Monitoring Device Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. PESTLE Analysis

3. Global Remote Patient Monitoring Device Market Outlook, 2019 - 2031

3.1. Global Remote Patient Monitoring Device Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Cardiac Monitors

3.1.1.1.1. ECG Monitoring

3.1.1.1.2. Fetal Heart Rate Monitor

3.1.1.1.3. Blood Pressure Monitors

3.1.1.2. Respiratory Monitors

3.1.1.2.1. Respiratory Rate Monitor

3.1.1.2.2. Spirometers

3.1.1.2.3. Sleep Apnea Monitor

3.1.1.3. Haematological Monitors

3.1.1.3.1. Blood Glucose Monitor

3.1.1.3.2. Prothrombin Time Monitor

3.2. Global Remote Patient Monitoring Device Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Cardiac Arrhythmia

3.2.1.2. Diabetes

3.2.1.3. Ischemic Diseases

3.2.1.4. Hypertension

3.2.1.5. Sleep Apnea

3.2.1.6. Chronic Respiratory Diseases

3.2.1.7. Hyperlipidemia

3.3. Global Remote Patient Monitoring Device Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Hospital

3.3.1.2. Homecare Settings

3.3.1.3. Long-term Care Centers

3.3.1.4. Others

3.4. Global Remote Patient Monitoring Device Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Remote Patient Monitoring Device Market Outlook, 2019 - 2031

4.1. North America Remote Patient Monitoring Device Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Cardiac Monitors

4.1.1.1.1. ECG Monitoring

4.1.1.1.2. Fetal Heart Rate Monitor

4.1.1.1.3. Blood Pressure Monitors

4.1.1.2. Respiratory Monitors

4.1.1.2.1. Respiratory Rate Monitor

4.1.1.2.2. Spirometers

4.1.1.2.3. Sleep Apnea Monitor

4.1.1.3. Haematological Monitors

4.1.1.3.1. Blood Glucose Monitor

4.1.1.3.2. Prothrombin Time Monitor

4.2. North America Remote Patient Monitoring Device Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Cardiac Arrhythmia

4.2.1.2. Diabetes

4.2.1.3. Ischemic Diseases

4.2.1.4. Hypertension

4.2.1.5. Sleep Apnea

4.2.1.6. Chronic Respiratory Diseases

4.2.1.7. Hyperlipidemia

4.3. North America Remote Patient Monitoring Device Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Hospital

4.3.1.2. Homecare Settings

4.3.1.3. Long-term Care Centers

4.3.1.4. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Remote Patient Monitoring Device Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

4.4.1.2. U.S. Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

4.4.1.3. U.S. Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

4.4.1.4. Canada Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

4.4.1.5. Canada Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

4.4.1.6. Canada Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Remote Patient Monitoring Device Market Outlook, 2019 - 2031

5.1. Europe Remote Patient Monitoring Device Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Cardiac Monitors

5.1.1.1.1. ECG Monitoring

5.1.1.1.2. Fetal Heart Rate Monitor

5.1.1.1.3. Blood Pressure Monitors

5.1.1.2. Respiratory Monitors

5.1.1.2.1. Respiratory Rate Monitor

5.1.1.2.2. Spirometers

5.1.1.2.3. Sleep Apnea Monitor

5.1.1.3. Haematological Monitors

5.1.1.3.1. Blood Glucose Monitor

5.1.1.3.2. Prothrombin Time Monitor

5.2. Europe Remote Patient Monitoring Device Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Cardiac Arrhythmia

5.2.1.2. Diabetes

5.2.1.3. Ischemic Diseases

5.2.1.4. Hypertension

5.2.1.5. Sleep Apnea

5.2.1.6. Chronic Respiratory Diseases

5.2.1.7. Hyperlipidemia

5.3. Europe Remote Patient Monitoring Device Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospital

5.3.1.2. Homecare Settings

5.3.1.3. Long-term Care Centers

5.3.1.4. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Remote Patient Monitoring Device Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.2. Germany Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.3. Germany Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.4. U.K. Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.5. U.K. Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.6. U.K. Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.7. France Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.8. France Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.9. France Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.10. Italy Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.11. Italy Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.12. Italy Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.13. Turkey Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.14. Turkey Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.15. Turkey Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.16. Russia Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.17. Russia Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.18. Russia Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.19. Rest of Europe Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.20. Rest of Europe Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.21. Rest of Europe Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Remote Patient Monitoring Device Market Outlook, 2019 - 2031

6.1. Asia Pacific Remote Patient Monitoring Device Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Cardiac Monitors

6.1.1.1.1. ECG Monitoring

6.1.1.1.2. Fetal Heart Rate Monitor

6.1.1.1.3. Blood Pressure Monitors

6.1.1.2. Respiratory Monitors

6.1.1.2.1. Respiratory Rate Monitor

6.1.1.2.2. Spirometers

6.1.1.2.3. Sleep Apnea Monitor

6.1.1.3. Haematological Monitors

6.1.1.3.1. Blood Glucose Monitor

6.1.1.3.2. Prothrombin Time Monitor

6.2. Asia Pacific Remote Patient Monitoring Device Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Cardiac Arrhythmia

6.2.1.2. Diabetes

6.2.1.3. Ischemic Diseases

6.2.1.4. Hypertension

6.2.1.5. Sleep Apnea

6.2.1.6. Chronic Respiratory Diseases

6.2.1.7. Hyperlipidemia

6.3. Asia Pacific Remote Patient Monitoring Device Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospital

6.3.1.2. Homecare Settings

6.3.1.3. Long-term Care Centers

6.3.1.4. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Remote Patient Monitoring Device Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.2. China Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.3. China Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.4. Japan Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.5. Japan Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.6. Japan Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.7. South Korea Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.8. South Korea Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.9. South Korea Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.10. India Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.11. India Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.12. India Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.13. Southeast Asia Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.14. Southeast Asia Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.15. Southeast Asia Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Remote Patient Monitoring Device Market Outlook, 2019 - 2031

7.1. Latin America Remote Patient Monitoring Device Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Cardiac Monitors

7.1.1.1.1. ECG Monitoring

7.1.1.1.2. Fetal Heart Rate Monitor

7.1.1.1.3. Blood Pressure Monitors

7.1.1.2. Respiratory Monitors

7.1.1.2.1. Respiratory Rate Monitor

7.1.1.2.2. Spirometers

7.1.1.2.3. Sleep Apnea Monitor

7.1.1.3. Haematological Monitors

7.1.1.3.1. Blood Glucose Monitor

7.1.1.3.2. Prothrombin Time Monitor

7.2. Latin America Remote Patient Monitoring Device Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Cardiac Arrhythmia

7.2.1.2. Diabetes

7.2.1.3. Ischemic Diseases

7.2.1.4. Hypertension

7.2.1.5. Sleep Apnea

7.2.1.6. Chronic Respiratory Diseases

7.2.1.7. Hyperlipidemia

7.3. Latin America Remote Patient Monitoring Device Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospital

7.3.1.2. Homecare Settings

7.3.1.3. Long-term Care Centers

7.3.1.4. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Remote Patient Monitoring Device Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

7.4.1.2. Brazil Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.3. Brazil Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.4. Mexico Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

7.4.1.5. Mexico Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.6. Mexico Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.7. Argentina Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

7.4.1.8. Argentina Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.9. Argentina Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.10. Rest of Latin America Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

7.4.1.11. Rest of Latin America Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.12. Rest of Latin America Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Remote Patient Monitoring Device Market Outlook, 2019 - 2031

8.1. Middle East & Africa Remote Patient Monitoring Device Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Cardiac Monitors

8.1.1.1.1. ECG Monitoring

8.1.1.1.2. Fetal Heart Rate Monitor

8.1.1.1.3. Blood Pressure Monitors

8.1.1.2. Respiratory Monitors

8.1.1.2.1. Respiratory Rate Monitor

8.1.1.2.2. Spirometers

8.1.1.2.3. Sleep Apnea Monitor

8.1.1.3. Haematological Monitors

8.1.1.3.1. Blood Glucose Monitor

8.1.1.3.2. Prothrombin Time Monitor

8.2. Middle East & Africa Remote Patient Monitoring Device Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Cardiac Arrhythmia

8.2.1.2. Diabetes

8.2.1.3. Ischemic Diseases

8.2.1.4. Hypertension

8.2.1.5. Sleep Apnea

8.2.1.6. Chronic Respiratory Diseases

8.2.1.7. Hyperlipidemia

8.3. Middle East & Africa Remote Patient Monitoring Device Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospital

8.3.1.2. Homecare Settings

8.3.1.3. Long-term Care Centers

8.3.1.4. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Remote Patient Monitoring Device Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.2. GCC Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.3. GCC Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.4. South Africa Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.5. South Africa Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.6. South Africa Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.7. Egypt Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.8. Egypt Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.9. Egypt Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.10. Nigeria Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.11. Nigeria Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.12. Nigeria Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Remote Patient Monitoring Device Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Remote Patient Monitoring Device Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Remote Patient Monitoring Device Market by End User, Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Indication Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Boston Scientific Corporation

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Koninklijke Philips N.V.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Abbott Laboratories

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Nihon Kohden Corporation

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. F. Hoffmann-La Roche Ltd.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. LifeWatch AG

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Medtronic

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. St. Jude Medical

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Others

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |