Global RTD Alcoholic Beverages Market Forecast

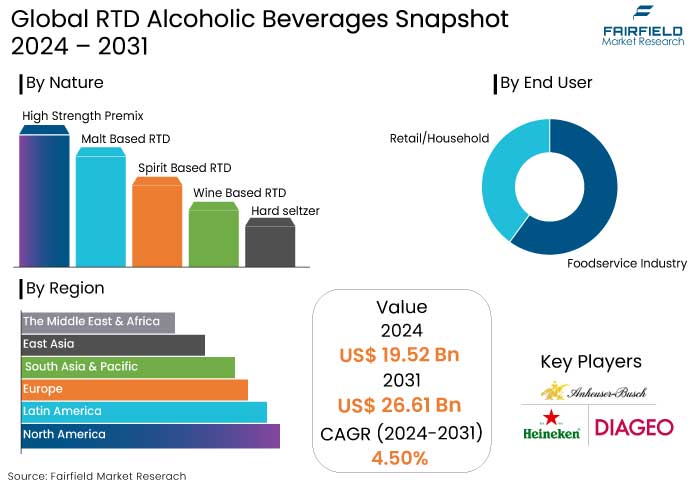

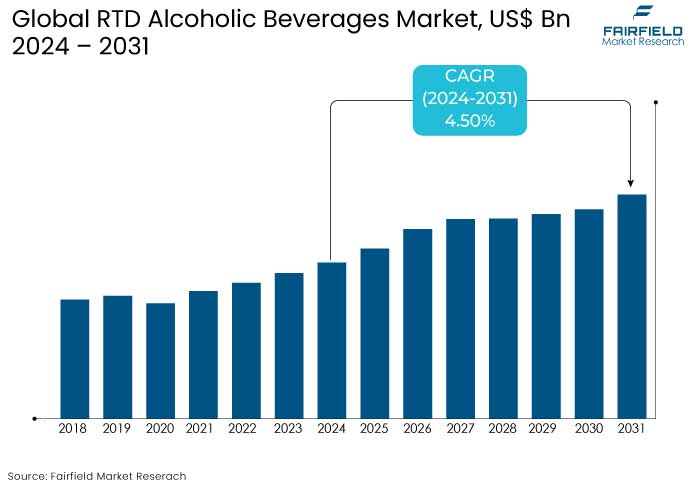

- The global RTD alcoholic beverages market is projected to reach a size of US$26.61 Bn by 2031, showing significant growth from the US$19.52 Bn achieved in 2024.

- The market revenue is expected to exhibit a remarkable rate of expansion, with an estimated CAGR of 4.50% during the period from 2024 to 2031.

RTD Alcoholic Beverages Market Insights

- The demand for diverse flavors and innovative combinations has led to a surge in product offerings catering to a wide range of tastes.

- The U.K. is anticipated to attain about 13.1% of the value share in Europe RTD alcoholic beverages sector.

- The rise of e-commerce platforms allows brands to reach a broader audience without the constraints of traditional retail channels.

- The growing health consciousness among consumers can lead to skepticism about alcoholic products.

- The regulatory landscape significantly influences RTD alcoholic beverage sales.

- The increasing trend toward health consciousness is shaping the market growths.

- The complex and often stringent regulatory environment dictates laws regarding the production distribution, and marketing of alcoholic drinks.

A Look Back and a Look Forward - Comparative Analysis

The Ready-to-Drink (RTD) alcoholic beverages market has experienced significant growth, particularly pre-2023, driven by changing consumer preferences toward convenience and innovative flavors. The RTD alcoholic beverages market growth was characterized by a surge in demand for ready-to-eat products, appealing to young demographics seeking portable and diverse drinking options.

Market trend further fueled by the rise of social media, which promoted unique and visually appealing RTD products enhancing their popularity among millennials and Gen Z consumers. Post-2024, the market is projected to expand at a CAGR of 4.50% from 2024 to 2031.

Market growth is expected to be supported by several RTD alcoholic beverages market trends and factors including the increasing acceptance of RTD beverages in various social settings, and the ongoing innovation in flavors and packaging.

The rise of e-commerce platforms has made these products accessible further driving sales. The market is poised for continued expansion with evolving consumer preferences and innovative marketing strategies playing crucial roles in shaping its future.

Key Growth Determinants

- Changing Consumer Preferences

As per the RTD alcoholic beverages market overview, one of the primary drivers for this industry is the shifting preferences of consumers toward convenience and variety. Today's consumers, particularly millennials and Gen Z prioritize convenience in their busy lifestyles, making RTD beverages a simple and easy choice. These products offer ease of consumption without the need for mixing or preparation, allowing for a quick and enjoyable drinking experience.

The convenience of RTD beverages is a key factor in their appeal, offering a straightforward solution for those on the go. Additionally, the demand for diverse flavors and innovative combinations has led to a surge in product offerings, catering to a wide range of tastes. As consumers continue to seek out new and exciting options, the RTD market is further driving its growth.

- E-commerce Expansion

The rise of e-commerce is another significant driver for the RTD alcoholic beverages market expansion. With the increasing prevalence of online shopping, consumers now have greater access to a broader variety of RTD products than ever before.

The convenience of purchasing alcoholic beverages online and home delivery options has transformed how consumers buy these products, especially during the COVID-19 pandemic. E-commerce platforms allow established brands and new entrants to reach a broader audience without the constraints of traditional retail channels.

Online retailers often feature detailed product descriptions, customer reviews, and promotional deals, further enhancing the shopping experience. This trend facilitates market expansion and encourages brands to innovate and differentiate themselves.

- Health-Conscious Consumer Trends

The increasing trend toward health consciousness among consumers is significantly shaping the RTD alcoholic beverages market growth demonstrating the market's responsiveness to consumer needs. As more individuals become aware of their dietary choices, there is a growing demand for healthier options, including low-calorie, low-sugar, and lower-alcohol beverages. This shift has prompted brands to reformulate their products to include organic ingredients, natural sweeteners, and enhanced nutritional profiles, catering to health-oriented consumers.

The rise of wellness culture has led many individuals to seek healthy alternatives to traditional alcoholic drinks. This focus on health and wellness not only enhances brand loyalty but also attracts new consumers who might have previously avoided alcoholic beverages.

Key Growth Barriers

- Regulatory Challenges

One of the significant growth restraints for the RTD alcoholic beverages market is the complex and often stringent regulatory environment. This environment, which varies from country to country and region to region dictates laws regarding the production, distribution, and marketing of alcoholic drinks. These laws can create barriers for companies looking to enter new markets, with specific challenges such as labeling requirements, advertising restrictions, and age verification processes.

Any changes in legislation such as increased taxes on alcoholic beverages or strict advertising rules further complicate the landscape making it challenging for brands to maintain profitability and market share.

- Health Concerns and Consumer Skepticism

Another restraint impacting the RTD alcoholic beverages market revenue is the growing health consciousness among consumers, which can lead to skepticism about alcoholic products. However, companies in this industry should be more active. As more individuals prioritize wellness and healthy lifestyles, there is increasing scrutiny of the ingredients and nutritional content of alcoholic beverages.

Market trend can result in consumers avoiding RTD products perceived as unhealthy or overly processed particularly those high in sugar or artificial additives. Additionally, negative perceptions surrounding alcohol consumption such as its association with health risks and social issues can deter potential customers from purchasing RTD beverages.

RTD Alcoholic Beverages Market Trends and Opportunities

- Premiumization of RTD Beverages

One of the RTD alcoholic beverages market trends is the premiumization of products. Consumers increasingly seek high-quality, artisanal options with unique flavors and superior ingredients. This shift toward premium products are driven by a desire for more sophisticated drinking experiences, particularly among young demographics willing to pay more for perceived quality and authenticity.

Brands are responding by developing RTD beverages that feature craft spirits, natural ingredients, and innovative flavor combinations often highlighting their sourcing and production processes. This trend enhances the consumer experience and allows brands to differentiate themselves in a crowded market. As premium RTD options gain traction, they attract a more discerning consumer base that values quality over quantity, increasing sales and brand loyalty.

- Expansion into Emerging Markets

The RTD alcoholic beverages market opportunities look promising for growth through expansion into emerging markets. As disposable incomes rise and urbanization increases in Asia Pacific, Latin America, and parts of Africa, a growing consumer base is eager for convenient and innovative drinking options.

Markets are witnessing a shift in drinking culture with young consumers increasingly embracing RTD products as part of their social experiences. Companies can capitalize on this opportunity by tailoring their offerings to local tastes and preferences and introducing flavors and formulations that resonate with regional consumers. Strategic partnerships with local distributors and retailers can enhance market penetration and brand visibility.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape significantly influences RTD alcoholic beverages market demand, impacting production, distribution, and marketing strategies. Recent discussions around reforming alcoholic beverage control laws highlight the need for regulations to adapt to the evolving marketplace, particularly as consumer preferences shift towards RTDs.

In many regions, regulations are becoming stricter regarding labeling, advertising, and selling alcoholic beverages. For instance, the introduction of mandatory pregnancy warning labels on alcoholic products aims to promote responsible consumption and protect public health. Such regulations can affect how companies market their RTD products potentially limiting promotional strategies that appeal to young consumers.

As per the RTD alcoholic beverages market analysis, the regulatory environment can also dictate the types of ingredients used in RTD beverages influencing product innovation. As companies strive to meet health-conscious consumer demands, regulations surrounding sugar content and alcohol levels may shape product formulations.

Segments Covered in the Report

- Hard Seltzer Poised to Lead the Market as Lighter Alcohol

As per the RTD alcoholic beverages market forecast, hard seltzer, also known as spiked seltzer, is a refreshing highball drink made from carbonated water, alcohol, and fruit flavorings. As a light and simple premixed beverage, it is becoming a popular alternative to traditional beer and cider, due to its natural ingredients. This category is particularly thriving in North America, driven by consumer demand for lighter alcoholic options. It is projected to grow at rates of 9% in Europe and 11% in East Asia, significantly contributing to the increasing popularity of RTD alcoholic beverages globally.

- Retail/ Household to Boost Demand for Alcoholic Beverages

Retail/household is one of the fastest-growing sectors worldwide significantly impacting the demand for alcoholic beverages. With over 1 billion tourists crossing borders annually, key sales channels include airports, airlines, and border shops. These venues present lucrative opportunities for RTD alcoholic beverages market manufacturers. To capitalize on this trend, ready-to-drink (RTD) beverage producers should concentrate on enhancing sales in the travel retail market by offering premium products. As travel continues to rise, this sector is poised for substantial growth, making it an essential focus for the alcoholic beverages industry.

Regional Analysis

- North America Market Maintains Primacy in the Market

The U.S. is a leading player in the RTD alcoholic beverages market boasting the high number of consumers particularly in the premium segment. Recently, there has been a notable shift towards low-alcohol options like beer, cider, and ready-to-drink (RTD) beverages. RTD consumption has surged in the past three years due to its convenience and appealing flavors.

Hard seltzers, a new category has gained immense popularity emerging as alternatives to traditional beer and cider.

- U.K. to Drive Growth in the Market with a 13.1% Share

The U.K. stands as a leading producer and consumer of the RTD alcoholic beverages market in Europe. Recently, the shift toward low-alcohol options has significantly boosted the ready-to-drink (RTD) market. Consumers are increasingly seeking unique and convenient alcoholic beverages, resulting in higher RTD consumption.

Domestic producers are focusing on creating and promoting these products reinforcing the U.K.'s strong position in the market. The U.K. is expected to account for around 13.1% of the share in Europe RTD alcoholic beverages sector highlighting its prominence and growth potential in this category.

Fairfield’s Competitive Landscape Analysis

The RTD alcoholic beverages market is characterized by intense competition with established players and new entrants innovating to capture consumer interest. One notable example is Brown-Forman, which launched its Jack Daniel's RTD cocktails in Mexico in November 2022. This product line includes classic cocktails like Jack and Cola, appealing to consumers seeking convenience without sacrificing quality.

As the market evolves, companies focus on unique flavor profiles and premium ingredients to differentiate their products driving innovation and variety in the RTD segment.

Key Market Companies

- Mark Anthony Brands International

- Diageo

- Anheuser-Busch InBev

- Heineken

- Constellation Brands

- Brown-Forman

- Pernod Ricard

- Molson Coors Beverage Company

- Suntory Holdings

- Sazerac Company

- Bacardi Limited

- Coca-Cola Company

Recent Industry Developments

- July 2024

Cheers Group, a Goa-based company, has launched Ready-to-Drink (RTD) cocktails made with an indigenous cashew spirit, a Goan's favorite tipple. The specially-infused varieties of cocktail ingredients provide a smooth, fruity, and tangy drink that complements the intense and fruity flavor of Cashew Feni. The growth of RTD cocktails is driven by consumer taste preferences, a desire for high-quality, portable cocktails, flavor innovation, and a shift away from the age-old spirits category.

- March 2024

Brown-Forman is set to launch its new ready-to-drink (RTD) beverage, Jack Daniel's & Ginger Ale, across the U.S. this month. This refreshing drink combines Jack Daniel's American whiskey with premium ginger ale, boasting alcohol by volume (ABV) of 7%. The suggested retail price is $3.49 for a 35.5cl can, with four packs available for $12.99. This product aims to cater to the growing demand for convenient and flavorful RTD options, appealing to whiskey enthusiasts and casual drinkers looking for a ready-made cocktail experience.

An Expert’s Eye

- The RTD alcoholic beverages market opportunities look promising for growth through expansion into emerging markets.

- Negative perceptions surrounding alcohol consumption can deter potential customers from purchasing RTD beverages.

- Consumers are increasingly seeking high-quality, artisanal RTD beverages with unique flavors and superior ingredients.

- Stricter regulations regarding labeling, advertising, and selling alcoholic beverages can affect the sales of RTD products.

- Brands are developing RTD beverages featuring craft spirits, natural ingredients, and innovative flavors.

Global RTD Alcoholic Beverages Market is Segmented as-

By Nature

- High Strength Premix

- Malt Based RTD

- Spirit Based RTD

- Wine Based RTD

- Hard seltzer

- Other Alcoholic RTDs

By End Use

- Retail/Household

- Foodservice Industry

By Region

- North America

- Latin America

- Europe

- South Asia & Pacific

- East Asia

- The Middle East & Africa

1. Executive Summary

1.1. Global RTD Alcoholic Beverages Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume and Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact Of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. Pestle Analysis

3. Production Output and Trade Statistics, 2019 - 2023

3.1. Global RTD Alcoholic Beverages Market Production Output, by Region, Value (US$ Mn) and Volume (Liters),2019 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East and Africa

4. Price Analysis, 2019 - 2023

4.1. Global Average Price Analysis, by Nature, US$ Per Unit, 2019 - 2023

4.2. Prominent Factor Affecting RTD Alcoholic Beverages Prices

4.3. Global Average Price Analysis, by Region, US$ Per Unit, 2019 - 2023

5. Global RTD Alcoholic Beverages Market Outlook, 2019 - 2031

5.1. Global RTD Alcoholic Beverages Market Outlook, by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. High Strength Premix

5.1.1.2. Malt Based RTD

5.1.1.3. Spirit Based RTD

5.1.1.4. Wine Based RTD

5.1.1.5. Hard seltzer

5.1.1.6. Other Alcoholic RTDs

5.2. Global RTD Alcoholic Beverages Market Outlook, by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Retail/Household

5.2.1.2. Foodservice Industry

5.3. Global RTD Alcoholic Beverages Market Outlook, by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Citrus

5.3.1.2. Berries

5.3.1.3. Tropical

5.3.1.4. Mixed Fruits

5.3.1.5. Spices

5.3.1.6. Others

5.4. Global RTD Alcoholic Beverages Market Outlook, by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. On Trade

5.4.1.1.1. Bar, Pubs, And Clubs

5.4.1.1.2. Fine Dining Restaurants

5.4.1.1.3. Other On-Trade Channels

5.4.1.2. Off Trade

5.4.1.2.1. Mass Merchandisers

5.4.1.2.2. Specialty Stores

5.4.1.2.3. Online Retails

5.4.1.2.4. Other Off-trade Channels

5.5. Global RTD Alcoholic Beverages Market Outlook, by Region, Value (US$ Mn) and Volume (Liters), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. North America

5.5.1.2. Europe

5.5.1.3. Asia Pacific

5.5.1.4. Latin America

5.5.1.5. Middle East & Africa

6. North America RTD Alcoholic Beverages Market Outlook, 2019 - 2031

6.1. North America RTD Alcoholic Beverages Market Outlook, by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. High Strength Premix

6.1.1.2. Malt Based RTD

6.1.1.3. Spirit Based RTD

6.1.1.4. Wine Based RTD

6.1.1.5. Hard seltzer

6.1.1.6. Other Alcoholic RTDs

6.2. North America RTD Alcoholic Beverages Market Outlook, by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Retail/Household

6.2.1.2. Foodservice Industry

6.3. North America RTD Alcoholic Beverages Market Outlook, by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Citrus

6.3.1.2. Berries

6.3.1.3. Tropical

6.3.1.4. Mixed Fruits

6.3.1.5. Spices

6.3.1.6. Others

6.4. North America RTD Alcoholic Beverages Market Outlook, by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. On Trade

6.4.1.1.1. Bar, Pubs, And Clubs

6.4.1.1.2. Fine Dining Restaurants

6.4.1.1.3. Other On-Trade Channels

6.4.1.2. Off Trade

6.4.1.2.1. Mass Merchandisers

6.4.1.2.2. Specialty Stores

6.4.1.2.3. Online Retails

6.4.1.2.4. Other Off-trade Channels

6.5. North America RTD Alcoholic Beverages Market Outlook, by Country, Value (US$ Mn) and Volume (Liters), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. U.S. RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

6.5.1.2. U.S. RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

6.5.1.3. U.S. RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

6.5.1.4. U.S. RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

6.5.1.5. Canada RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

6.5.1.6. Canada RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

6.5.1.7. Canada RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

6.5.1.8. Canada RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Europe RTD Alcoholic Beverages Market Outlook, 2019 - 2031

7.1. Europe RTD Alcoholic Beverages Market Outlook, by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. High Strength Premix

7.1.1.2. Malt Based RTD

7.1.1.3. Spirit Based RTD

7.1.1.4. Wine Based RTD

7.1.1.5. Hard seltzer

7.1.1.6. Other Alcoholic RTDs

7.2. Europe RTD Alcoholic Beverages Market Outlook, by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Retail/Household

7.2.1.2. Foodservice Industry

7.3. Europe RTD Alcoholic Beverages Market Outlook, by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Citrus

7.3.1.2. Berries

7.3.1.3. Tropical

7.3.1.4. Mixed Fruits

7.3.1.5. Spices

7.3.1.6. Others

7.4. Europe RTD Alcoholic Beverages Market Outlook, by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. On Trade

7.4.1.1.1. Bar, Pubs, And Clubs

7.4.1.1.2. Fine Dining Restaurants

7.4.1.1.3. Other On-Trade Channels

7.4.1.2. Off Trade

7.4.1.2.1. Mass Merchandisers

7.4.1.2.2. Specialty Stores

7.4.1.2.3. Online Retails

7.4.1.2.4. Other Off-trade Channels

7.5. Europe RTD Alcoholic Beverages Market Outlook, by Country, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Germany RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.2. Germany RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.3. Germany RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.4. Germany RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.5. U.K. RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.6. U.K. RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.7. U.K. RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.8. U.K. RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.9. France RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.10. France RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.11. France RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.12. France RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.13. Italy RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.14. Italy RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.15. Italy RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.16. Italy RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.17. Turkey RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.18. Turkey RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.19. Turkey RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.20. Turkey RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.21. Russia RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.22. Russia RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.23. Russia RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.24. Russia RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.25. Rest Of Europe RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.26. Rest Of Europe RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.27. Rest Of Europe RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.1.28. Rest of Europe RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific RTD Alcoholic Beverages Market Outlook, 2019 - 2031

8.1. Asia Pacific RTD Alcoholic Beverages Market Outlook, by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. High Strength Premix

8.1.1.2. Malt Based RTD

8.1.1.3. Spirit Based RTD

8.1.1.4. Wine Based RTD

8.1.1.5. Hard seltzer

8.1.1.6. Other Alcoholic RTDs

8.2. Asia Pacific RTD Alcoholic Beverages Market Outlook, by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Retail/Household

8.2.1.2. Foodservice Industry

8.3. Asia Pacific RTD Alcoholic Beverages Market Outlook, by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Citrus

8.3.1.2. Berries

8.3.1.3. Tropical

8.3.1.4. Mixed Fruits

8.3.1.5. Spices

8.3.1.6. Others

8.4. Asia Pacific RTD Alcoholic Beverages Market Outlook, by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. On Trade

8.4.1.1.1. Bar, Pubs, And Clubs

8.4.1.1.2. Fine Dining Restaurants

8.4.1.1.3. Other On-Trade Channels

8.4.1.2. Off Trade

8.4.1.2.1. Mass Merchandisers

8.4.1.2.2. Specialty Stores

8.4.1.2.3. Online Retails

8.4.1.2.4. Other Off-trade Channels

8.5. Asia Pacific RTD Alcoholic Beverages Market Outlook, by Country, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. China RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.2. China RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.3. China RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.4. China RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.5. Japan RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.6. Japan RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.7. Japan RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.8. Japan RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.9. South Korea RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.10. South Korea RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.11. South Korea RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.12. South Korea RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.13. India RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.14. India RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.15. India RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.16. India RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.17. Southeast Asia RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.18. Southeast Asia RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.19. Southeast Asia RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.20. Southeast Asia RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.21. Rest Of Asia Pacific RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.22. Rest Of Asia Pacific RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.23. Rest Of Asia Pacific RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.1.24. Rest of Asia RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America RTD Alcoholic Beverages Market Outlook, 2019 - 2031

9.1. Latin America RTD Alcoholic Beverages Market Outlook, by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. High Strength Premix

9.1.1.2. Malt Based RTD

9.1.1.3. Spirit Based RTD

9.1.1.4. Wine Based RTD

9.1.1.5. Hard seltzer

9.1.1.6. Other Alcoholic RTDs

9.2. Latin America RTD Alcoholic Beverages Market Outlook, by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Retail/Household

9.2.1.2. Foodservice Industry

9.3. Latin America RTD Alcoholic Beverages Market Outlook, by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Citrus

9.3.1.2. Berries

9.3.1.3. Tropical

9.3.1.4. Mixed Fruits

9.3.1.5. Spices

9.3.1.6. Others

9.4. Latin America RTD Alcoholic Beverages Market Outlook, by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. On Trade

9.4.1.1.1. Bar, Pubs, And Clubs

9.4.1.1.2. Fine Dining Restaurants

9.4.1.1.3. Other On-Trade Channels

9.4.1.2. Off Trade

9.4.1.2.1. Mass Merchandisers

9.4.1.2.2. Specialty Stores

9.4.1.2.3. Online Retails

9.4.1.2.4. Other Off-trade Channels

9.5. Latin America RTD Alcoholic Beverages Market Outlook, by Country, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1. Key Highlights

9.5.1.1. Brazil RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.2. Brazil RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.3. Brazil RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.4. Brazil RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.5. Mexico RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.6. Mexico RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.7. Mexico RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.8. Mexico RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.9. Argentina RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.10. Argentina RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.11. Argentina RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.12. Argentina RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.13. Rest Of Latin America RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.14. Rest Of Latin America RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.15. Rest Of Latin America RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.1.16. Rest of Latin America RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

9.5.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa RTD Alcoholic Beverages Market Outlook, 2019 - 2031

10.1. Middle East & Africa RTD Alcoholic Beverages Market Outlook, by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. High Strength Premix

10.1.1.2. Malt Based RTD

10.1.1.3. Spirit Based RTD

10.1.1.4. Wine Based RTD

10.1.1.5. Hard seltzer

10.1.1.6. Other Alcoholic RTDs

10.2. Middle East & Africa RTD Alcoholic Beverages Market Outlook, by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Retail/Household

10.2.1.2. Foodservice Industry

10.3. Middle East & Africa RTD Alcoholic Beverages Market Outlook, by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. Citrus

10.3.1.2. Berries

10.3.1.3. Tropical

10.3.1.4. Mixed Fruits

10.3.1.5. Spices

10.3.1.6. Others

10.4. Middle East & Africa RTD Alcoholic Beverages Market Outlook, by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.4.1. Key Highlights

10.4.1.1. On Trade

10.4.1.1.1. Bar, Pubs, And Clubs

10.4.1.1.2. Fine Dining Restaurants

10.4.1.1.3. Other On-Trade Channels

10.4.1.2. Off Trade

10.4.1.2.1. Mass Merchandisers

10.4.1.2.2. Specialty Stores

10.4.1.2.3. Online Retails

10.4.1.2.4. Other Off-trade Channels

10.5. Middle East & Africa RTD Alcoholic Beverages Market Outlook, by Country, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1. Key Highlights

10.5.1.1. GCC RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.2. GCC RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.3. GCC RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.4. GCC RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.5. South Africa RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.6. South Africa RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.7. South Africa RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.8. South Africa RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.9. Egypt RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.10. Egypt RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.11. Egypt RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.12. Egypt RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.13. Nigeria RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.14. Nigeria RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.15. Nigeria RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.16. Nigeria RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.17. Rest Of Middle East & Africa RTD Alcoholic Beverages Market by Nature, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.18. Rest Of Middle East & Africa RTD Alcoholic Beverages Market by End Use, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.19. Rest Of Middle East & Africa RTD Alcoholic Beverages Market by Flavor, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.1.20. Rest of Middle East & Africa RTD Alcoholic Beverages Market by Distribution Channel, Value (US$ Mn) and Volume (Liters), 2019 - 2031

10.5.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Flavor Vs End Use Heat Map

11.2. Manufacturer Vs by End Use Heatmap

11.3. Company Market Share Analysis, 2023

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Anheuser-Busch InBev

11.5.1.1. Company Overview

11.5.1.2. Nature Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Diageo PLC

11.5.2.1. Company Overview

11.5.2.2. Nature Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Bacardi Limited

11.5.3.1. Company Overview

11.5.3.2. Nature Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Halewood Wines & Spirits

11.5.4.1. Company Overview

11.5.4.2. Nature Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Mark Anthony Group of Companies

11.5.5.1. Company Overview

11.5.5.2. Nature Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Inspyration Siam Co., Ltd.

11.5.6.1. Company Overview

11.5.6.2. Nature Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Brown-Forman

11.5.7.1. Company Overview

11.5.7.2. Nature Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Manchester Drinks

11.5.8.1. Company Overview

11.5.8.2. Nature Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Molson Coors Beverage Company

11.5.9.1. Company Overview

11.5.9.2. Nature Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. The BosLiters Beer Company

11.5.10.1. Company Overview

11.5.10.2. Nature Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Davide Campari-Milano N.V.

11.5.11.1. Company Overview

11.5.11.2. Nature Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. Asahi Group Holdings, Ltd.

11.5.12.1. Company Overview

11.5.12.2. Nature Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. Carlsberg Breweries A/S

11.5.13.1. Company Overview

11.5.13.2. Nature Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. SHS Group

11.5.14.1. Company Overview

11.5.14.2. Nature Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

11.5.15. Pernod Ricard SA

11.5.15.1. Company Overview

11.5.15.2. Nature Portfolio

11.5.15.3. Financial Overview

11.5.15.4. Business Strategies and Development

11.5.16. Global Brands Ltd.

11.5.16.1. Company Overview

11.5.16.2. Nature Portfolio

11.5.16.3. Financial Overview

11.5.16.4. Business Strategies and Development

11.5.17. Radico Khaitan Limited

11.5.17.1. Company Overview

11.5.17.2. Nature Portfolio

11.5.17.3. Financial Overview

11.5.17.4. Business Strategies and Development

11.5.18. La Martiniquaise

11.5.18.1. Company Overview

11.5.18.2. Nature Portfolio

11.5.18.3. Financial Overview

11.5.18.4. Business Strategies and Development

11.5.19. Suntory Holdings Limited

11.5.19.1. Company Overview

11.5.19.2. Nature Portfolio

11.5.19.3. Financial Overview

11.5.19.4. Business Strategies and Development

11.5.20. Constellation Brands Inc.

11.5.20.1. Company Overview

11.5.20.2. Nature Portfolio

11.5.20.3. Financial Overview

11.5.20.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms And Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Nature Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |