Global Rubber Processing Aids and Anti-Tack Agents Market Forecast

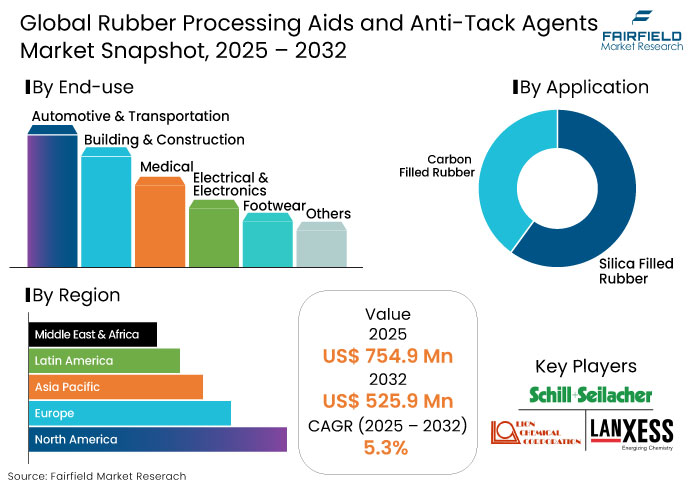

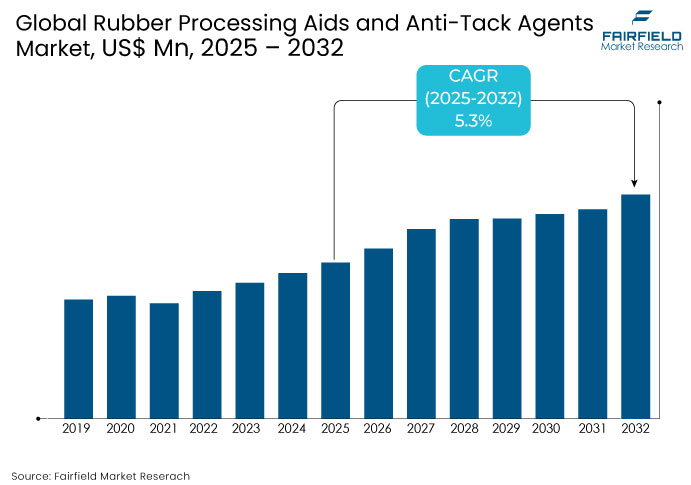

- The global rubber processing aids and anti-tack agents market size is expected to reach a size of US$ 754.9 Mn by 2032, showing significant growth from US$ 525.9 Mn attained in 2025.

- The market valuation for rubber processing aids and anti-tack agents is anticipated to expand at a CAGR of 5.3% from 2025 to 2032.

Rubber Processing Aids and Anti-Tack Agents Market Insights

- From automotive to construction, historical demand for rubber additives was reinforced by increased vehicle production and large-scale infrastructure investments, especially in North America and Asia.

- The market is set to grow steadily through the forecast period, fueled by rising car sales, construction activity, and demand from the medical and electronics sectors.

- Rising EV adoption (23% of passenger car sales in 2023) is boosting demand for high-performance rubber compounds that offer superior heat resistance and durability.

- Rapid healthcare growth in India, China, and the U.S. is increasing the need for precision-grade rubber components in diagnostics and wearable devices, driving demand for zinc stearates and silicone-based aids.

- With a 38.1% market share, calcium and zinc stearates remain the most used rubber processing aids due to their performance and compatibility with diverse rubber compounds.

- Applications such as gaskets, sealants, and waterproofing membranes in infrastructure and housing projects continue to be a major growth contributor, especially in the U.S. and India.

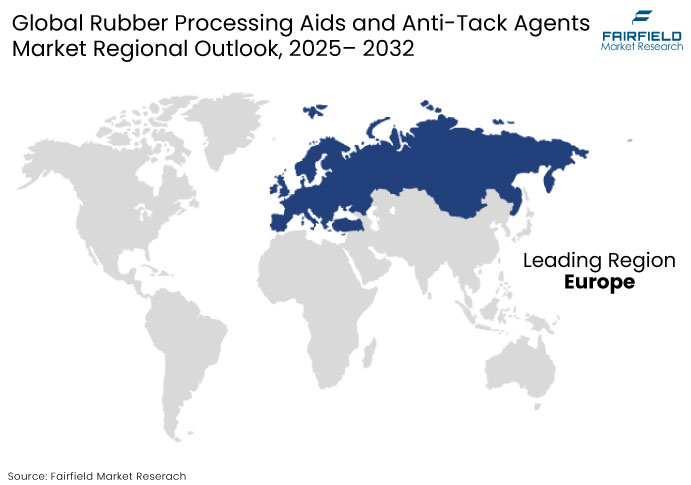

- Asia Pacific accounts for 8% of global market share due to strong EV supply chains, while Europe (26.1%) is driven by BEV adoption and demand for low-emission transportation materials.

- LANXESS has launched eco-friendly additive lines, responding to stricter environmental norms and shifting customer preferences toward green manufacturing practices.

A Look Back and a Look Forward - Comparative Analysis

- Moderate Growth Amid Industry Challenges

During the historical period, the rubber processing aids and antitack agents market saw steady growth, largely fueled by expansion in end-use industries. In 2023, the global automotive sector saw a resurgence with total sales nearing 72.8 million units, supporting demand for tire and under-the-hood rubber components. The construction sector, responsible for $2.2 trillion in U.S. spending alone, also contributed significantly to rubber product demand for insulation and sealing applications. the footwear and medical industries steadily consumed rubber-based materials, aided by post-pandemic recovery and stable consumer demand across regions.

- Surge in demand across end-use sectors to drive market expansion

With a projected CAGR of 5.3% through the forecast period, the rubber processing aids and antitack agents market is poised for accelerated growth. This will be driven by rising global car sales, which reached 74.6 million units in 2024, a 2.5% year-over-year increase, boosting tire and automotive rubber product demand. Simultaneously, the US$2.2 trillion U.S. construction sector and strong recovery in Asia Pacific civil projects are expected to propel demand for rubber insulation and sealants. The medical and electronics industries are also anticipated to play a vital role, especially with the increasing adoption of wearable and compact electronic devices requiring high-performance rubber components.

Key Growth Determinants

- Automotive Sector Expansion Accelerates Demand for Rubber Additives

The automotive industry continues to play a central role in driving demand for rubber processing aids and anti-tack agents. With global vehicle production rising, rubber materials have become critical to manufacturing durable and high-performance components such as tires, gaskets, and hoses. In India, the production of passenger vehicles and two-wheelers touched 2.36 million units in April 2024, reflecting the sector’s momentum.

China's October 2024 auto sales reached 3.05 million units, while the U.S. light vehicle sales stood at 14.5 million units in 2020. As automakers adopt advanced technologies to meet evolving performance and efficiency standards, the demand for specialized rubber solutions has intensified.

Anti-tack agents play an essential role in ensuring smooth production by preventing rubber compound sticking, while processing aids enhance material properties and manufacturing throughput. These agents are crucial for electric vehicles (EVs), which require rubber components that can withstand higher operational stresses and temperatures, especially as global EV production scales up sharply.

- Medical Sector Expansion Strengthens Need for Rubber Processing Materials

The rapid development of the global healthcare sector is significantly influencing the demand for rubber processing aids and anti-tack agents. These materials are essential for producing medical devices and components requiring biocompatibility and high durability.

India's healthcare market, valued at $372 billion in 2023, is growing due to policy pushes such as Ayushman Bharat and the development of new hospitals. Meanwhile, China's healthcare expenditure hit RMB 2.25 trillion in 2022, further amplifying the need for rubber-based medical supplies such as tubing, seals, and gloves.

Advanced rubber materials are crucial in maintaining the safety and reliability of medical equipment, especially as demand rises for diagnostic devices, wearable technologies, and telemedicine infrastructure.

In the U.S., healthcare spending reached $4.5 trillion in 2022, reflecting the scale at which rubber-based medical products are consumed. Zinc stearates and silicone polymers remain vital to achieving quality and consistency across medical-grade rubber applications, reinforcing the importance of these additives in modern healthcare ecosystems.

Key Growth Barriers

- Price volatility of raw materials challenges market stability

Fluctuations in the price of raw materials used in rubber processing aids and anti-tack agents are posing serious challenges to manufacturers. Key ingredients such as stearic acid, fatty acid esters, and zinc derivatives are heavily influenced by global supply chains and commodity pricing trends.

Disruptions due to geopolitical tensions or trade restrictions can directly affect procurement costs and production planning. Such volatility forces companies to adjust pricing strategies, which may impact profit margins and market competitiveness.

Reliance on petrochemical-based inputs exposes the market to oil price swings. Sustainability goals add pressure to transition toward bio-based alternatives, which are currently costlier and less commercially scalable. For small and medium enterprises, these pricing pressures can significantly hamper their ability to innovate or maintain consistent supply. Manufacturers must therefore explore long-term contracts or diversify their sourcing to mitigate these risks and ensure business continuity.

Market Opportunity

- Healthcare penetration in emerging economies creates growth opportunities

Emerging economies are witnessing significant growth in healthcare infrastructure, driven by rising public and private investments. India’s healthcare sector reached a value of US$ 372 billion in FY23, supported by expanding medical tourism and digital health initiatives. The medical devices market in India is projected to reach US$50 billion by 2031, while telemedicine is gaining traction with an expected value of US$5.4 billion by FY25. These developments are creating strong demand for testing, inspection, and certification (TIC) services to ensure regulatory compliance and product safety.

Globally, the demand for certified medical products and quality assurance solutions continues to rise as healthcare systems adapt to growing costs and technological advancements. In 2023, the global medical trend rate surged to 10.7%, with insurers in Asia Pacific and Africa expecting continued cost increases.

Countries in the European Union demonstrated robust pharmaceutical exports valued at US$ 730 billion and R&D investments of US$ 55 billion, reinforcing the need for compliant and innovative healthcare solutions. This environment presents growth opportunities for TIC providers focusing on healthcare expansion in both developing and developed regions.

Market Trend

- Electric vehicle surge reinforces demand for high-performance rubber compounds

The global transition to electric mobility is reshaping the rubber additives market, particularly in the tire and insulation component segments. EVs impose greater loads on tires due to their higher average weight 1,880 kg for BEVs and 1,958 kg for PHEVs driving the need for enhanced durability and heat resistance.

Europe’s regulatory targets for 100% CO₂ emission reduction by 2035 are accelerating EV adoption, which already accounted for 23% of new passenger cars in 2023. Rubber materials must now meet higher performance benchmarks, spurring demand for advanced processing aids.

China’s dominance in the EV space, with a 35% market share in 2023, and the rapid expansion of battery manufacturing globally are compelling tire and component manufacturers to innovate.

Anti-tack agents are increasingly used to maintain compound integrity during mass production, while processing aids support the thermal and mechanical stability required for EV applications. The rise of sustainable mobility is reshaping the technical requirements for rubber additives, pushing the market toward specialized, high-performance solutions.

Segments Covered in the Report

- Strong market position of stearates in the market

Stearates dominate the global rubber processing aids and anti-tack agents market by accounting for a 38.1% revenue share as of 2024. Their widespread use stems from their effectiveness in improving mold release and enhancing rubber flow during processing, especially in high-volume manufacturing sectors.

Calcium and zinc stearates remain particularly popular due to their multifunctional performance and compatibility with various rubber compounds, including natural rubber and SBR.

Rapid expansion in the automotive and construction industries has accelerated demand for Stearates, especially in Asia Pacific and North America.

The Asia Pacific region continues to register high consumption, largely driven by automotive manufacturing hubs in China and India. Furthermore, in North America, the U.S. construction sector saw a 2.9% year-on-year growth in spending in February 2025, reaching $2,195.8 billion contributing significantly to Stearate demand in rubber insulation and seal applications.

- Building and construction industry driving demand for rubber processing aids

The building and construction industry contributes to 22.4% of the global rubber processing aids and anti-tack agent’s market. Construction materials such as sealants, gaskets, and waterproof membranes use rubber compounds extensively, thereby driving demand for anti-tack agents and process aids that ensure product uniformity and handling efficiency during manufacturing. Applications in both residential and non-residential sectors remain key contributors.

The industry's expansion, particularly in emerging economies, supports this growth trajectory. In India, infrastructure-led development through the US$ 1.3 trillion Gati Shakti Master Plan and the National Infrastructure Pipeline has amplified rubber usage in construction accessories. The U.S. construction sector, which employed 8.2 million people in 2023, shows robust potential for further uptake of rubber additives, bolstered by annual residential housing demand of 1.6 million units and public infrastructure investments exceeding US$509 billion.

Regional Analysis

- Europe's rubber additives market is driven by the EV transition amid production declines and trade adjustments

Europe holds a 26.1% share in the global rubber additives market, supported by the growing penetration of battery-electric vehicles, which secured a 13.6% share of new car sales in 2024. Hybrid-electric cars followed with 30.9%, while diesel dropped to 11.9%. The van segment also showed resilience with 8.3% growth, led by Spain at 13.7%.

In contrast, EU car production fell by 6.2% to 11.4 million units, driven by sharp declines in Italy (-43.4%) and Belgium (-31.2%). Export values dropped 7.3%, led by a 25.5% fall in shipments to China. Electrically chargeable bus sales rose 26.8%, indicates a rising demand for rubber additives in EV-compatible components.

- Asia Pacific drives rubber additives demand through strong EV supply chains and export dynamics

Asia Pacific commands a 39.8% share of the global rubber additives market, primarily supported by China’s leadership in EV production and battery manufacturing. Despite a 12.2% fall in value, China remained the top source of EU car imports with a 17.2% share. Export volumes to the EU rose slightly by 0.5%, reflecting stable trade momentum.

The region benefits from Japan’s 6.4% export growth to the EU and Türkiye’s 13.8% rise in outbound trade, reinforcing demand for heat- and wear-resistant rubber additives. As EV component and tire applications expand, East Asia continues to supply a significant portion of the required high-performance rubber additives globally.

Competitive Landscape

The global rubber processing aids and anti-tack agents market is fairly fragmented, characterized by the presence of numerous small- to mid-sized players competing alongside a few established international companies. While several regional manufacturers cater to localized demand, they often lack the advanced technological capabilities to compete on a global scale.

The market is dominated by U.S. and European companies, primarily due to their technological superiority in the development and production of high-performance rubber processing aids. These companies maintain a competitive edge through continual investment in R&D, strategic partnerships, and product innovation tailored to advanced applications across automotive, industrial, and specialty rubber sectors.

Key Companies

- Lanxess AG

- Schill + Seilacher GmbH

- Lion Specialty Chemicals Co., Ltd

- Baerlocher GmbH

- Hallstar Company

- Peter Greven GmbH & Co. KG

- Performance Additives

- H.L. Blachford Ltd.

- Polymer Solutions Group

- Kettlitz-Chemie GmbH & Co. KG

- McLube

Recent Industry Developments

- In March 2024, LANXESS introduced a new range of sustainable rubber additives at the Tire Technology Expo in Hanover, Germany, highlighting its commitment to eco-sfriendly tire production. The launch included a sustainable variant of the antidegradant TMQ, certified under ISCC Plus, and Rhenocure DR/S, an advanced accelerator designed to enhance rubber compound engineering. These innovations aim to reduce environmental impact during both manufacturing and product lifecycle stages, reinforcing LANXESS’s position as a sustainability leader in the rubber additives market.

- In March 2024, Performance Additives announced, it had doubled its production capacity of rubber additives in Subang Jaya, Malaysia.

An Expert’s Eye

- Regulators continue to drive demand for eco-friendly process aids, and manufacturers respond by shifting to low-VOC, non-toxic alternatives.

- Automotive and industrial players push for faster cycle times and better dispersion, prompting formulators to refine process aids for higher performance.

- Rubber compounders demand more targeted antitack solutions as automation and compound complexity reshape production environments.

- Formulators now prioritize process aids that deliver efficiency and meet sustainability benchmarks, setting the pace for future innovation.

Global Rubber Processing Aids and Anti-Tack Agents Market is Segmented as-

By Product Type

- Fatty Acid Esters

- Polyethylene Glycol (PEG)

- Polypropylene Glycol (PPG)

- Others

- Fatty Acid Amide

- Monoethanolamine

- Diethanolamine

- Triethanolamine

- Others

- Stearates

- Soaps

- Silicone Polymers

- Others

By Application

- Silica Filled Rubber

- Tires & Tubes

- Molded Rubber Products

- Carbon Filled Rubber

- Tires & Tubes

- Molded Rubber Products

- Gaskets & Seals

- Wires & Cables

- Medical Gloves

By End Use

- Automotive & Transportation

- Building & Construction

- Medical

- Electrical & Electronics

- Footwear

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Rubber Processing Aids & Anti-tack Agents Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Rubber Processing Aids & Anti-tack Agents Market Outlook, 2019 - 2032

3.1. Global Rubber Processing Aids & Anti-tack Agents Market Outlook, by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Fatty Acid Esters

3.1.1.1.1. Polyethylene Glycol (PEG)

3.1.1.1.2. Polypropylene Glycol (PPG)

3.1.1.1.3. Others

3.1.1.2. Fatty Acid Amide

3.1.1.2.1. Monoethanolamine

3.1.1.2.2. Diethanolamine

3.1.1.2.3. Triethanolamine

3.1.1.2.4. Others

3.1.1.3. Stearates

3.1.1.4. Soaps

3.1.1.5. Silicone Polymers

3.1.1.6. Others

3.2. Global Rubber Processing Aids & Anti-tack Agents Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Silica Filled Rubber

3.2.1.1.1. Tires & Tubes

3.2.1.1.2. Molded Rubber Products

3.2.1.1.3. Misc.

3.2.1.2. Carbon Filled Rubber

3.2.1.2.1. Tires & Tubes

3.2.1.2.2. Molded Rubber Products

3.2.1.2.3. Gaskets & Seals

3.2.1.2.4. Wires & Cables

3.2.1.2.5. Medical Gloves

3.2.1.2.6. Misc.

3.3. Global Rubber Processing Aids & Anti-tack Agents Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Automotive & Transportation

3.3.1.2. Building & Construction

3.3.1.3. Medical

3.3.1.4. Electrical & Electronics

3.3.1.5. Footwear

3.3.1.6. Others

3.4. Global Rubber Processing Aids & Anti-tack Agents Market Outlook, by Region, Value (US$ Mn) and Volume (Tons), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Rubber Processing Aids & Anti-tack Agents Market Outlook, 2019 - 2032

4.1. North America Rubber Processing Aids & Anti-tack Agents Market Outlook, by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Fatty Acid Esters

4.1.1.1.1. Polyethylene Glycol (PEG)

4.1.1.1.2. Polypropylene Glycol (PPG)

4.1.1.1.3. Others

4.1.1.2. Fatty Acid Amide

4.1.1.2.1. Monoethanolamine

4.1.1.2.2. Diethanolamine

4.1.1.2.3. Triethanolamine

4.1.1.2.4. Others

4.1.1.3. Stearates

4.1.1.4. Soaps

4.1.1.5. Silicone Polymers

4.1.1.6. Others

4.2. North America Rubber Processing Aids & Anti-tack Agents Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Silica Filled Rubber

4.2.1.1.1. Tires & Tubes

4.2.1.1.2. Molded Rubber Products

4.2.1.1.3. Misc.

4.2.1.2. Carbon Filled Rubber

4.2.1.2.1. Tires & Tubes

4.2.1.2.2. Molded Rubber Products

4.2.1.2.3. Gaskets & Seals

4.2.1.2.4. Wires & Cables

4.2.1.2.5. Medical Gloves

4.2.1.2.6. Misc.

4.3. North America Rubber Processing Aids & Anti-tack Agents Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Automotive & Transportation

4.3.1.2. Building & Construction

4.3.1.3. Medical

4.3.1.4. Electrical & Electronics

4.3.1.5. Footwear

4.3.1.6. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Rubber Processing Aids & Anti-tack Agents Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.1.2. U.S. Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.1.3. U.S. Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.1.4. Canada Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.1.5. Canada Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.1.6. Canada Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Rubber Processing Aids & Anti-tack Agents Market Outlook, 2019 - 2032

5.1. Europe Rubber Processing Aids & Anti-tack Agents Market Outlook, by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Fatty Acid Esters

5.1.1.1.1. Polyethylene Glycol (PEG)

5.1.1.1.2. Polypropylene Glycol (PPG)

5.1.1.1.3. Others

5.1.1.2. Fatty Acid Amide

5.1.1.2.1. Monoethanolamine

5.1.1.2.2. Diethanolamine

5.1.1.2.3. Triethanolamine

5.1.1.2.4. Others

5.1.1.3. Stearates

5.1.1.4. Soaps

5.1.1.5. Silicone Polymers

5.1.1.6. Others

5.2. Europe Rubber Processing Aids & Anti-tack Agents Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Silica Filled Rubber

5.2.1.1.1. Tires & Tubes

5.2.1.1.2. Molded Rubber Products

5.2.1.1.3. Misc.

5.2.1.2. Carbon Filled Rubber

5.2.1.2.1. Tires & Tubes

5.2.1.2.2. Molded Rubber Products

5.2.1.2.3. Gaskets & Seals

5.2.1.2.4. Wires & Cables

5.2.1.2.5. Medical Gloves

5.2.1.2.6. Misc.

5.3. Europe Rubber Processing Aids & Anti-tack Agents Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Automotive & Transportation

5.3.1.2. Building & Construction

5.3.1.3. Medical

5.3.1.4. Electrical & Electronics

5.3.1.5. Footwear

5.3.1.6. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Rubber Processing Aids & Anti-tack Agents Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.2. Germany Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.3. Germany Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.4. U.K. Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.5. U.K. Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.6. U.K. Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.7. France Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.8. France Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.9. France Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.10. Italy Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.11. Italy Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.12. Italy Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.13. Spain Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.14. Spain Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.15. Spain Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.16. Russia Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.17. Russia Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.18. Russia Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.19. Rest of Europe Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.20. Rest of Europe Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.21. Rest of Europe Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Rubber Processing Aids & Anti-tack Agents Market Outlook, 2019 - 2032

6.1. Asia Pacific Rubber Processing Aids & Anti-tack Agents Market Outlook, by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Fatty Acid Esters

6.1.1.1.1. Polyethylene Glycol (PEG)

6.1.1.1.2. Polypropylene Glycol (PPG)

6.1.1.1.3. Others

6.1.1.2. Fatty Acid Amide

6.1.1.2.1. Monoethanolamine

6.1.1.2.2. Diethanolamine

6.1.1.2.3. Triethanolamine

6.1.1.2.4. Others

6.1.1.3. Stearates

6.1.1.4. Soaps

6.1.1.5. Silicone Polymers

6.1.1.6. Others

6.2. Asia Pacific Rubber Processing Aids & Anti-tack Agents Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Silica Filled Rubber

6.2.1.1.1. Tires & Tubes

6.2.1.1.2. Molded Rubber Products

6.2.1.1.3. Misc.

6.2.1.2. Carbon Filled Rubber

6.2.1.2.1. Tires & Tubes

6.2.1.2.2. Molded Rubber Products

6.2.1.2.3. Gaskets & Seals

6.2.1.2.4. Wires & Cables

6.2.1.2.5. Medical Gloves

6.2.1.2.6. Misc.

6.3. Asia Pacific Rubber Processing Aids & Anti-tack Agents Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Automotive & Transportation

6.3.1.2. Building & Construction

6.3.1.3. Medical

6.3.1.4. Electrical & Electronics

6.3.1.5. Footwear

6.3.1.6. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Rubber Processing Aids & Anti-tack Agents Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. China Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.2. China Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.3. China Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.4. Japan Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.5. Japan Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.6. Japan Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.7. South Korea Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.8. South Korea Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.9. South Korea Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.10. India Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.11. India Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.12. India Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.13. Southeast Asia Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.14. Southeast Asia Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.15. Southeast Asia Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.16. Rest of Asia Pacific Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.17. Rest of Asia Pacific Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.18. Rest of Asia Pacific Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Rubber Processing Aids & Anti-tack Agents Market Outlook, 2019 - 2032

7.1. Latin America Rubber Processing Aids & Anti-tack Agents Market Outlook, by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Fatty Acid Esters

7.1.1.1.1. Polyethylene Glycol (PEG)

7.1.1.1.2. Polypropylene Glycol (PPG)

7.1.1.1.3. Others

7.1.1.2. Fatty Acid Amide

7.1.1.2.1. Monoethanolamine

7.1.1.2.2. Diethanolamine

7.1.1.2.3. Triethanolamine

7.1.1.2.4. Others

7.1.1.3. Stearates

7.1.1.4. Soaps

7.1.1.5. Silicone Polymers

7.1.1.6. Others

7.2. Latin America Rubber Processing Aids & Anti-tack Agents Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Silica Filled Rubber

7.2.1.1.1. Tires & Tubes

7.2.1.1.2. Molded Rubber Products

7.2.1.1.3. Misc.

7.2.1.2. Carbon Filled Rubber

7.2.1.2.1. Tires & Tubes

7.2.1.2.2. Molded Rubber Products

7.2.1.2.3. Gaskets & Seals

7.2.1.2.4. Wires & Cables

7.2.1.2.5. Medical Gloves

7.2.1.2.6. Misc.

7.3. Latin America Rubber Processing Aids & Anti-tack Agents Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Automotive & Transportation

7.3.1.2. Building & Construction

7.3.1.3. Medical

7.3.1.4. Electrical & Electronics

7.3.1.5. Footwear

7.3.1.6. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Rubber Processing Aids & Anti-tack Agents Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.2. Brazil Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.3. Brazil Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.4. Mexico Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.5. Mexico Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.6. Mexico Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.7. Rest of Latin America Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.8. Rest of Latin America Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.9. Rest of Latin America Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Rubber Processing Aids & Anti-tack Agents Market Outlook, 2019 - 2032

8.1. Middle East & Africa Rubber Processing Aids & Anti-tack Agents Market Outlook, by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Fatty Acid Esters

8.1.1.1.1. Polyethylene Glycol (PEG)

8.1.1.1.2. Polypropylene Glycol (PPG)

8.1.1.1.3. Others

8.1.1.2. Fatty Acid Amide

8.1.1.2.1. Monoethanolamine

8.1.1.2.2. Diethanolamine

8.1.1.2.3. Triethanolamine

8.1.1.2.4. Others

8.1.1.3. Stearates

8.1.1.4. Soaps

8.1.1.5. Silicone Polymers

8.1.1.6. Others

8.2. Middle East & Africa Rubber Processing Aids & Anti-tack Agents Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Silica Filled Rubber

8.2.1.1.1. Tires & Tubes

8.2.1.1.2. Molded Rubber Products

8.2.1.1.3. Misc.

8.2.1.2. Carbon Filled Rubber

8.2.1.2.1. Tires & Tubes

8.2.1.2.2. Molded Rubber Products

8.2.1.2.3. Gaskets & Seals

8.2.1.2.4. Wires & Cables

8.2.1.2.5. Medical Gloves

8.2.1.2.6. Misc.

8.3. Middle East & Africa Rubber Processing Aids & Anti-tack Agents Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Automotive & Transportation

8.3.1.2. Building & Construction

8.3.1.3. Medical

8.3.1.4. Electrical & Electronics

8.3.1.5. Footwear

8.3.1.6. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Rubber Processing Aids & Anti-tack Agents Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.2. GCC Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.3. GCC Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.4. South Africa Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.5. South Africa Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.6. South Africa Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.7. Rest of Middle East & Africa Rubber Processing Aids & Anti-tack Agents Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.8. Rest of Middle East & Africa Rubber Processing Aids & Anti-tack Agents Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.9. Rest of Middle East & Africa Rubber Processing Aids & Anti-tack Agents Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Product Type vs by Application Heat map

9.2. Manufacturer vs by Application Heat map

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Lanxess AG

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Schill + Seilacher GmbH

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Lion Specialty Chemicals Co., Ltd

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Baerlocher GmbH

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Hallstar Company

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Peter Greven GmbH & Co. KG

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Performance Additives

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. H.L. Blachford Ltd.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Polymer Solutions Group

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Kettlitz-Chemie GmbH & Co. KG

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. McLube

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Application Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |