Global Rupture Disc Market Forecast

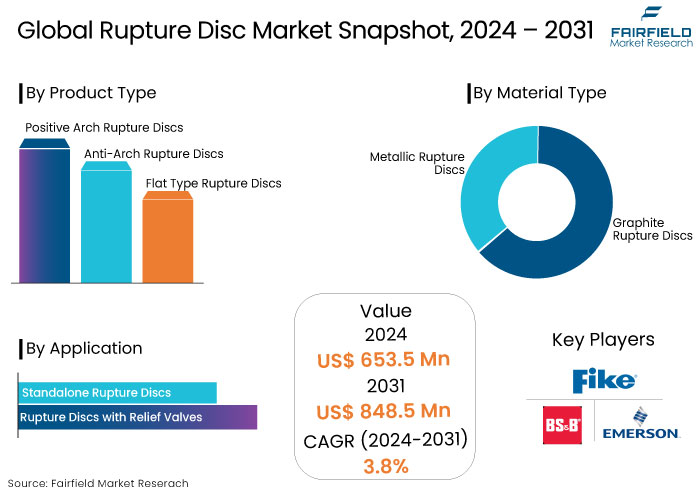

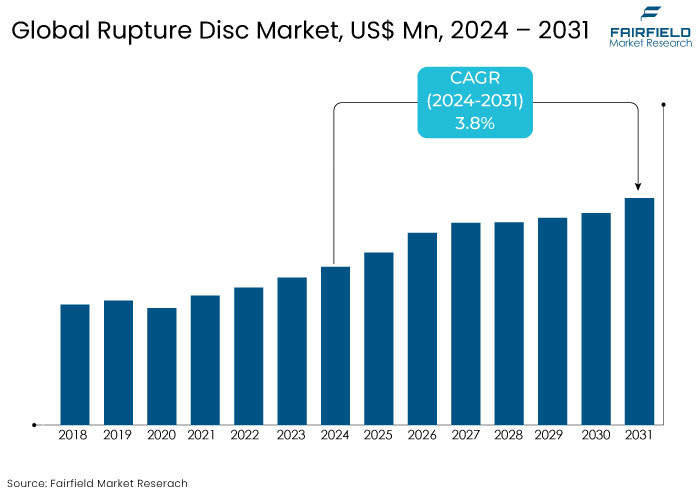

- The rupture disc market is projected to be worth US$653.5 Mn in 2024 and is projected to reach a value of US$848.5 Mn by 2031.

- Sales are estimated to rise at a CAGR of 3.8% over the forecast period between 2024 and 2031.

Rupture Disc Market Insights

- Stringent industry regulations across sectors like oil & gas, chemicals, and pharmaceuticals are boosting demand for rupture discs for enhanced safety.

- IoT-enabled rupture discs with real-time monitoring are gaining traction, allowing predictive maintenance and operational efficiency.

- Industries handling aggressive chemicals prioritize durable materials like graphite and stainless steel for longer-lasting rupture discs, which drive the market forward.

- Metallic rupture discs dominate the market, holding the majority share due to their versatility and performance under high pressure.

- Rapid industrialization and evolving safety standards in Asia-Pacific are expected to make it one of the fastest-growing rupture disc markets.

- The renewable energy sector, primarily hydrogen and biofuel, is adopting rupture discs for safe pressure regulation in high-stress applications.

- New products with replaceable components are emerging to reduce operational downtime, especially in continuous production industries.

- Anti-arch and flat-type discs are gaining popularity in specialized applications like low-pressure systems and controlled environments.

A Look Back and a Look Forward - Comparative Analysis

The rupture disc market saw steady growth from 2019 to 2023, driven by increasing demand across industries such as oil & gas, chemicals, pharmaceuticals, and food processing. These sectors required enhanced pressure relief systems to maintain safety and regulatory compliance, especially in high-pressure environments.

The rising focus on worker safety and equipment protection also fueled market demand, as rupture discs provide reliable, immediate pressure relief without the risk of mechanical failure. Technological advancements led to developing rupture discs with long lifespans and higher accuracy, enhancing market growth.

The rupture disc market is expected to expand further due to advancements in manufacturing technologies and the integration of IoT-enabled systems. These smart rupture discs can offer real-time pressure monitoring and predictive maintenance alerts, which enhance safety and operational efficiency in industrial applications.

The push for green energy solutions is likely to drive demand for rupture discs in renewable energy sectors, such as hydrogen fuel and biofuel production, where high-pressure systems are common.

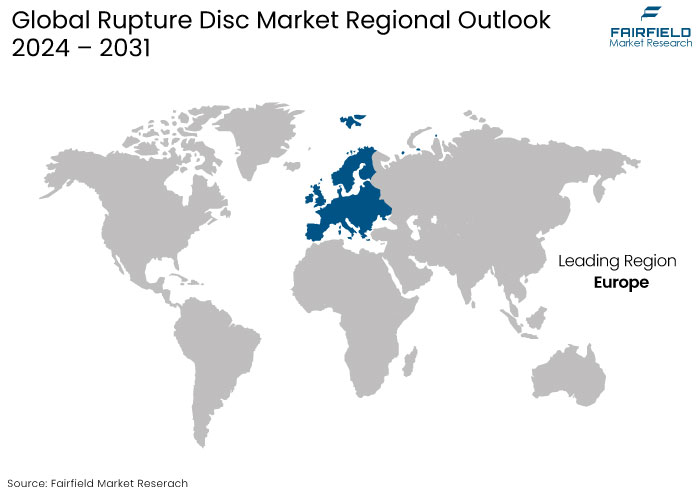

Emerging markets in Asia Pacific are anticipated to show strong growth due to rapid industrialization, while strict regulatory standards on environmental safety and hazard prevention in North America and Europe will support the market's upward trajectory.

Key Growth Determinants

- Increased Demand from the Oil and Gas Sector

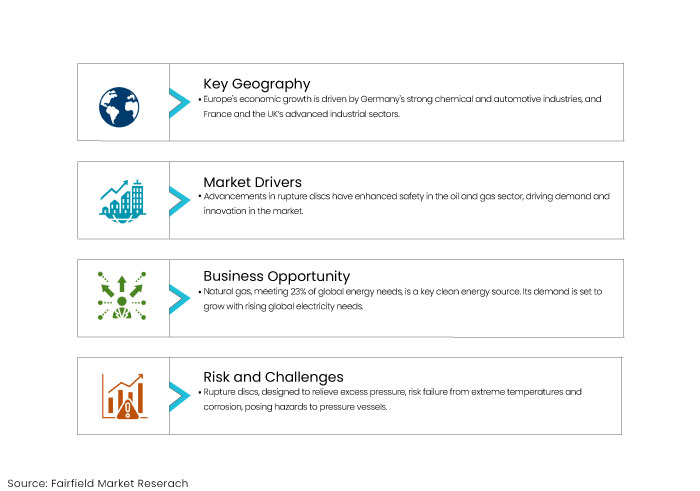

Technological advancements in pressure control have evolved significantly since the early days of the oil and gas sector, which relied on rudimentary rupture discs. An enhanced version of these safety devices has been developed to ensure a secure operating pressure regime.

The safety level has risen due to various advancements, leading many design and plant personnel to pay attention to using the facility's essential safety equipment. The rupture disc market is propelled by continuous advancements in rupture devices and their applications within the oil and gas sector.

- Water and Wastewater Infrastructure Aging Drives Demand for Rupture Discs

The deterioration of public infrastructure is a significant issue for numerous countries. In older building infrastructure, pressure-reducing valves require replacement as they have concluded their life cycles. Replacing these valves is crucial to prevent degradation, extend the operating lifespan of industrial infrastructure, and maintain optimal levels of safety and functionality.

In recent years, public awareness of the necessity for improved sanitation and hygiene has intensified, which has resulted in a greater need for advanced safety measures, prolonged service life, and enhanced water supply and sanitation infrastructure in numerous countries globally.

In response to the increasing demand, governments have redirected their efforts towards substantial investments in advanced technology and infrastructures to ensure citizens have access to clean water and improved sanitary facilities.

New investments encompass several initiatives, including the construction of sewage treatment facilities, the implementation of advanced rainwater collecting systems, the establishment of efficient drainage networks, and the provision of sustainable wastewater treatment solutions. These measures are essential for providing access to safe drinking water and mitigating environmental damage from inappropriate garbage disposal.

Key Growth Barriers

- Absence of Oversight and Regulatory Frameworks Remains a Crucial Barrier

Rupture discs, consisting of an external metal shell and an internal membrane, are vulnerable to severe temperatures and corrosion, resulting in undesired occurrences. The principal function of a rupture disc is to serve as a relief device when the confined fluid or chemical attains a predetermined pressure. The disc ceases to fulfill its designated function upon rupture, presenting possible hazards to pressure vessels and other infrastructure.

In essential operations, including fluid control applications, hygiene and cleanliness protocols, safety systems, sewage treatment facilities, rainwater harvesting systems, drainage networks, wastewater treatment solutions, power generation sectors, natural gas, electricity, mining endeavors, and diverse industries such as food processing, pharmaceuticals, brewing, synthetic materials, rubber, pulp and paper, public infrastructure, aerospace, aviation, railway, trucking, and shipping, the integration of a monitoring and control system is imperative.

The device can swiftly detect a blown disc and alert the process system operator, allowing for timely intervention and successful process management. The significance of such a system is especially pronounced in businesses that encounter harsh conditions, such as high temperatures, corrosive fluids, or toxic chemicals.

- Limited Reusability and System Downtime

Another significant restraint is the limited reusability of rupture discs, as they function as single-use devices, unlike some other pressure relief options that can be reset and reused. When a rupture disc activates, it typically requires immediate replacement, leading to unexpected downtime and disruption in production processes.

For industries reliant on continuous operations, such as petrochemicals, oil and gas, and pharmaceuticals, this limitation can significantly impact productivity and profitability.

Additionally, the process of replacing a rupture disc can be complex, sometimes necessitating skilled labour or specialized tools, particularly in high-temperature or high-pressure environments. Consequently, industries that cannot afford frequent shutdowns might consider alternative relief systems, posing a restraint to the market expansion of rupture discs.

Rupture Disc Market Trends and Opportunities

- Increasing Demand from the Power Generation Spurs the Market Demand

Natural gas is widely utilized for electricity generation due to its clean combustion properties. The utilization of natural gas as an energy source is gaining significance in contemporary society.

Natural gas accounts for 23% of the global energy requirements, positioning it as one of the predominant energy sources worldwide. This percentage is anticipated to rise as nations globally acknowledge its numerous benefits. By 2040, the IEA anticipates that electricity demand will grow at an annual rate of 2.1%, double the rate of primary energy demand.

Energy demand is anticipated to expand owing to heightened household earnings, transportation and home heating electrification, and a growing necessity for air conditioning and digitally connected devices. An enhanced infrastructure for facilitating these activities is expected to stimulate the market for rupture discs indirectly.

- Growing Mining Initiatives to Generate Opportunities for Rupture Discs

Rupture discs have become a safety measure in the mining industry to protect miners. A rupture disc is engineered to offer a reliable pressure release mechanism for pipelines, vessels, and equipment, which is particularly advantageous in regions where mining operations include hazardous substances.

The demand for equipment and safety relief devices in fluid control applications for mining operations is expected to increase due to the necessity of various types of equipment, including valves, pumps, and additional components when executing such projects.

Safety relief mechanisms are employed to avert the probable occurrence of mishaps at such places. Consequently, manufacturers have addressed this demand by augmenting output and including new products in their catalogues to meet customer needs.

The predicted increase of mining operations in countries such as Australia, Brazil, China, India, Russia, and South Africa is expected to influence the global rupture disc market positively.

How Does Regulatory Scenario Shape this Industry?

The regulatory environment plays a crucial role in shaping the rupture disc market, as stringent safety standards across industries drive demand for high-quality, and reliable pressure relief solutions.

Regulatory bodies such as the American Society of Mechanical Engineers (ASME), the Occupational Safety and Health Administration (OSHA), and the European Pressure Equipment Directive (PED) set strict guidelines for equipment used in high-pressure environments to prevent hazardous incidents. Such regulations mandate that industries, including oil and gas, pharmaceuticals, chemicals, and food processing, adopt certified rupture discs that meet specific safety and performance standards.

As regulatory requirements evolve, particularly concerning environmental and workplace safety, there is an increased emphasis on ensuring that equipment can withstand higher pressure thresholds without risking failure. This trend encourages the adoption of advanced rupture disc technologies with longer lifespans, higher precision, and greater resilience to extreme conditions.

The rise of environmental regulations is expected to increase the use of rupture discs in eco-conscious industries like hydrogen fuel and biofuels, where reliable pressure management is critical. The regulatory landscape positively influences the rupture disc market by driving consistent demand for high-quality and compliant pressure relief solutions.

Segments Covered in the Report

- Metallic Rupture Discs Gain Traction

In the global rupture disc market, metallic rupture discs hold a dominant position over graphite rupture discs, primarily due to their versatility, durability, and widespread application across industries. Metallic rupture discs are generally preferred in applications where higher pressures and extreme temperature resistance are required, such as in oil and gas, petrochemicals, and pharmaceuticals.

These discs are typically made from materials like stainless steel, Hastelloy, or Inconel, which provide high durability and precision. As a result, metallic rupture discs account for around 65% of the market share, reflecting their broad adoption and suitability for high-stress environments.

- Positive Arch Rupture Discs Take the Lead

Positive arch rupture discs are the dominant product type, primarily due to their high reliability and versatility in various industrial applications, including oil and gas, chemical processing, and pharmaceuticals.

Positive arch rupture discs are designed to open quickly at a specified pressure, efficiently venting excess pressure and protecting equipment. Their arched structure provides enhanced durability and better control over burst pressure, making them suitable for high-pressure applications.

Consequently, positive arch rupture discs hold a market share of approximately 55%, reflecting their wide adoption in sectors that demand high-performance pressure relief.

Regional Analysis

- Europe Influences the Rupture Disc Market with Robust End Market

Europe region has experienced significant economic growth recently, with certain countries continually exhibiting robust end markets. Germany has a flourishing chemical and automotive sector, while France and the UK possess one of the most developed industrial sectors globally, supplying vital resources for regional growth.

France and the UK have pioneered innovation and technological advancements, creating new products and services for home and global markets. Other profitable end users, such as the food and beverage sector, have demonstrated substantial demand for rupture discs and are expected to maintain this demand.

Germany is among the leading markets in the European region for rupture discs, attributed to the significant presence of numerous small and medium-sized manufacturers and their after-sales services. Germany is projected to represent approximately 5% of the global market share, while the UK is expected to experience a steady compound annual growth rate (CAGR) over the forecast period.

- GCC Nations to Experience Significant Demand for Rupture Discs

The utilization of rupture discs has significantly surged in GCC nations recently. Due to an increase in oil and gas revenue, along with a construction and investment surge fueled by decades of petroleum revenue reserves, the region has some of the fastest-growing economies globally.

Saudi Arabia, the United Arab Emirates, Kuwait, and Qatar, the principal GCC states, are the foremost producers of oil and gas; thus, sales in this sector are expected to see a robust value CAGR during the forecast period.

Rupture disc manufacturers in the Middle East and Africa are anticipated to witness significant expansion owing to their extensive utilization in the mining, power generation, and oil and gas sectors.

Fairfield’s Competitive Landscape Analysis

The rupture disc market is anticipated to be quite fragmented, with a limited number of participants. Market participants are strategically concentrating on the creation of innovative, high-performance products and customized solutions to broaden their client bases and enhance their market shares.

To enhance market penetration, several unorganized enterprises are focusing on creating personalized and cost-effective products. Key industry stakeholders are strategically enhancing their market position through collaborations and partnerships with suppliers and distributors.

Leading organizations focus on substantial research and development investment to deliver cost-effective solutions. Parker, Hannifin Corp, Emerson Electric Co, Halma Plc, Mersen Group, and V-TEX Corp are prominent global brands and major manufacturers seeking to establish market positions while safeguarding their unique identities.

Key Market Companies

- Emerson Electric Co

- BS&B Safety Systems, L.L.C

- Fike Corporation

- Parker Hannifin Corp

- Halma Plc

- Graco Inc.

- V-TEX Corp.

- Continental Disc Corporation LLC

- Mersen Group

- WOLFF GROUP

- BASCO

- REMBE

- Shanghai Huali Safety Devices Co., Ltd

- Dalian Duta Technology Safety System Co Ltd

Recent Industry Developments

- June 2023 -

BS&B launched a smart rupture disc solution integrating IoT capabilities for real-time pressure monitoring. The system includes a sensor-enabled rupture disc that allows operators to monitor disc performance remotely, which is particularly beneficial in high-risk industries such as oil and gas.

- April 2024 -

ZOOK launched a reusable rupture disc system featuring replaceable components that allow for quick changes without requiring a full disc replacement. It aims to reduce downtime and maintenance costs, particularly in manufacturing facilities and other high-use environments.

An Expert’s Eye

- Industries like oil & gas, chemicals, and pharmaceuticals are driving rupture disc demand due to strict safety and regulatory requirements for pressure management.

- Integrating IoT and digital monitoring transforms rupture discs from passive safety devices to smart components, enabling real-time monitoring and predictive maintenance.

- Advanced materials, such as stainless steel and graphite, are in demand to enhance durability and withstand harsh environments, especially in chemical processing and heavy industrial applications.

- Rapid industrialization in the Asia-Pacific region is expected to fuel growth as regulatory standards for workplace and environmental safety increase in developing economies.

Global Rupture Disc Market is Segmented as-

By Material Type

- Graphite Rupture Discs

- Metallic Rupture Discs

By Product Type

- Positive Arch Rupture Discs

- Anti-Arch Rupture Discs

- Flat Type Rupture Discs

By Application

- Standalone Rupture Discs

- Rupture Discs with Relief Valves

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Rupture Disc Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentation

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Rupture Disc Market Outlook, 2019 - 2031

3.1. Global Rupture Disc Market Outlook, by Material Type, Value (US$ Mn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Graphite Rupture Discs

3.1.1.2. Metallic Rupture Discs

3.2. Global Rupture Disc Market Outlook, by Product Type, Value (US$ Mn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Positive Arch Rupture Discs

3.2.1.2. Anti-Arch Rupture Discs

3.2.1.3. Flat Type Rupture Discs

3.3. Global Rupture Disc Market Outlook, by Application, Value (US$ Mn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Standalone Rupture Discs

3.3.1.2. Rupture Discs with Relief Valves

3.4. Global Rupture Disc Market Outlook, by Region, Value (US$ Mn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Rupture Disc Market Outlook, 2019 - 2031

4.1. North America Rupture Disc Market Outlook, by Material Type, Value (US$ Mn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Graphite Rupture Disc

4.1.1.2. Metallic Rupture Disc

4.2. North America Rupture Disc Market Outlook, by Product Type, Value (US$ Mn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Positive Arch Rupture Discs

4.2.1.2. Anti-Arch Rupture Discs

4.2.1.3. Flat Type Rupture Discs

4.3. North America Rupture Disc Market Outlook, by Application, Value (US$ Mn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Standalone Rupture Discs

4.3.1.2. Rupture Discs with Relief Valves

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Rupture Disc Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

4.4.1.2. U.S. Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

4.4.1.3. U.S. Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

4.4.1.4. Canada Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

4.4.1.5. Canada Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

4.4.1.6. Canada Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Rupture Disc Market Outlook, 2019 - 2031

5.1. Europe Rupture Disc Market Outlook, by Material Type, Value (US$ Mn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Graphite Rupture Disc

5.1.1.2. Metallic Rupture Disc

5.2. Europe Rupture Disc Market Outlook, by Product Type, Value (US$ Mn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Positive Arch Rupture Discs

5.2.1.2. Anti-Arch Rupture Discs

5.2.1.3. Flat Type Rupture Discs

5.3. Europe Rupture Disc Market Outlook, by Application, Value (US$ Mn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Standalone Rupture Discs

5.3.1.2. Rupture Discs with Relief Valves

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Rupture Disc Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

5.4.1.2. Germany Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

5.4.1.3. Germany Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

5.4.1.4. U.K. Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

5.4.1.5. U.K. Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

5.4.1.6. U.K. Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

5.4.1.7. France Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

5.4.1.8. France Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

5.4.1.9. France Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

5.4.1.10. Italy Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

5.4.1.11. Italy Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

5.4.1.12. Italy Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

5.4.1.13. Turkey Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

5.4.1.14. Turkey Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

5.4.1.15. Turkey Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

5.4.1.16. Russia Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

5.4.1.17. Russia Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

5.4.1.18. Russia Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

5.4.1.19. Rest of Europe Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

5.4.1.20. Rest of Europe Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

5.4.1.21. Rest of Europe Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Rupture Disc Market Outlook, 2019 - 2031

6.1. Asia Pacific Rupture Disc Market Outlook, by Material Type, Value (US$ Mn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Graphite Rupture Disc

6.1.1.2. Metallic Rupture Disc

6.2. Asia Pacific Rupture Disc Market Outlook, by Product Type, Value (US$ Mn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Positive Arch Rupture Discs

6.2.1.2. Anti-Arch Rupture Discs

6.2.1.3. Flat Type Rupture Discs

6.3. Asia Pacific Rupture Disc Market Outlook, by Application, Value (US$ Mn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Standalone Rupture Discs

6.3.1.2. Rupture Discs with Relief Valves

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Rupture Disc Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

6.4.1.2. China Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

6.4.1.3. China Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

6.4.1.4. Japan Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

6.4.1.5. Japan Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

6.4.1.6. Japan Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

6.4.1.7. South Korea Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

6.4.1.8. South Korea Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

6.4.1.9. South Korea Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

6.4.1.10. India Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

6.4.1.11. India Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

6.4.1.12. India Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

6.4.1.13. Southeast Asia Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

6.4.1.14. Southeast Asia Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

6.4.1.15. Southeast Asia Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Rupture Disc Market Outlook, 2019 - 2031

7.1. Latin America Rupture Disc Market Outlook, by Material Type, Value (US$ Mn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Graphite Rupture Disc

7.1.1.2. Metallic Rupture Disc

7.2. Latin America Rupture Disc Market Outlook, by Product Type, Value (US$ Mn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Positive Arch Rupture Discs

7.2.1.2. Anti-Arch Rupture Discs

7.2.1.3. Flat Type Rupture Discs

7.3. Latin America Rupture Disc Market Outlook, by Application, Value (US$ Mn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Standalone Rupture Discs

7.3.1.2. Rupture Discs with Relief Valves

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Rupture Disc Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

7.4.1.2. Brazil Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

7.4.1.3. Brazil Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

7.4.1.4. Mexico Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

7.4.1.5. Mexico Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

7.4.1.6. Mexico Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

7.4.1.7. Argentina Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

7.4.1.8. Argentina Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

7.4.1.9. Argentina Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

7.4.1.10. Rest of Latin America Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

7.4.1.11. Rest of Latin America Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

7.4.1.12. Rest of Latin America Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Rupture Disc Market Outlook, 2019 - 2031

8.1. Middle East & Africa Rupture Disc Market Outlook, by Material Type, Value (US$ Mn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Graphite Rupture Disc

8.1.1.2. Metallic Rupture Disc

8.2. Middle East & Africa Rupture Disc Market Outlook, by Product Type, Value (US$ Mn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Positive Arch Rupture Discs

8.2.1.2. Anti-Arch Rupture Discs

8.2.1.3. Flat Type Rupture Discs

8.3. Middle East & Africa Rupture Disc Market Outlook, by Application, Value (US$ Mn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Standalone Rupture Discs

8.3.1.2. Rupture Discs with Relief Valves

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Rupture Disc Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

8.4.1.2. GCC Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

8.4.1.3. GCC Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

8.4.1.4. South Africa Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

8.4.1.5. South Africa Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

8.4.1.6. South Africa Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

8.4.1.7. Egypt Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

8.4.1.8. Egypt Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

8.4.1.9. Egypt Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

8.4.1.10. Nigeria Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

8.4.1.11. Nigeria Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

8.4.1.12. Nigeria Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Rupture Disc Market by Material Type, Value (US$ Mn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Rupture Disc Market by Product Type, Value (US$ Mn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Rupture Disc Market by Application, Value (US$ Mn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2024

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. Emerson Electric Co

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. BS&B Safety Systems, L.L.C

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. Fike Corporation

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Parker Hannifin Corp

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. Halma Plc

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Graco Inc.

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. V-TEX Corp.

9.3.7.1. Company Overview

9.3.7.2. Product Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. Continental Disc Corporation LLC

9.3.8.1. Company Overview

9.3.8.2. Product Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. Mersen Group

9.3.9.1. Company Overview

9.3.9.2. Product Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. WOLFF GROUP

9.3.10.1. Company Overview

9.3.10.2. Product Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. BASCO

9.3.11.1. Company Overview

9.3.11.2. Product Portfolio

9.3.11.3. Financial Overview

9.3.11.4. Business Strategies and Development

9.3.12. REMBE

9.3.12.1. Company Overview

9.3.12.2. Product Portfolio

9.3.12.3. Financial Overview

9.3.12.4. Business Strategies and Development

9.3.13. Shanghai Huali Safety Devices Co., Ltd

9.3.13.1. Company Overview

9.3.13.2. Product Portfolio

9.3.13.3. Financial Overview

9.3.13.4. Business Strategies and Development

9.3.14. Dalian Duta Technology Safety System Co Ltd

9.3.14.1. Company Overview

9.3.14.2. Product Portfolio

9.3.14.3. Financial Overview

9.3.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Material Type Coverage |

|

|

Product Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |