Global Saliva-based Screening Market Forecast

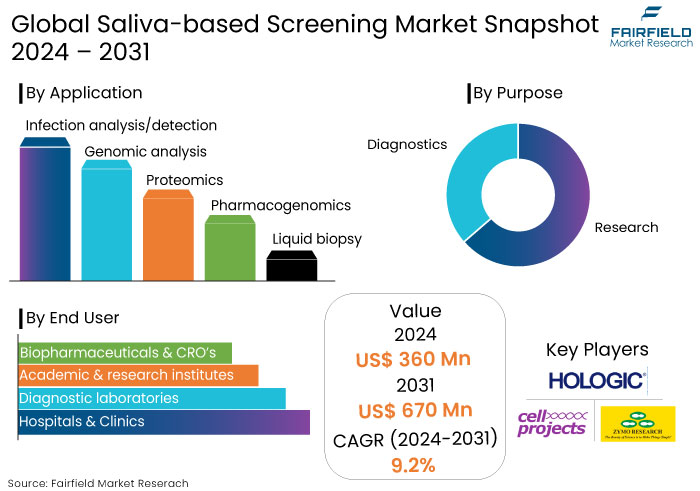

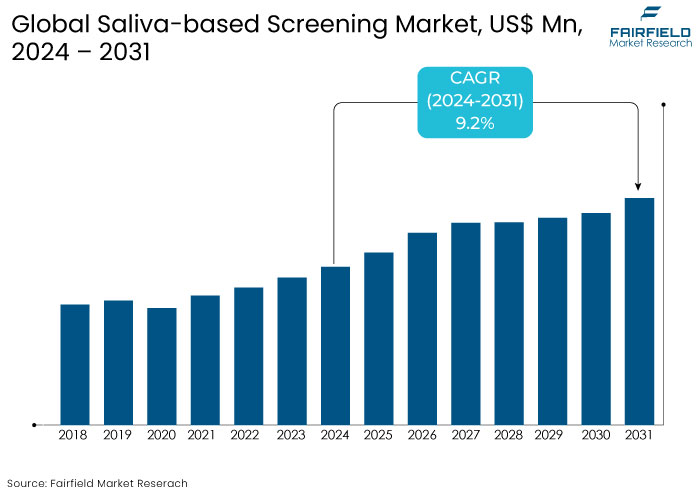

- The saliva-based screening market is projected to reach a size of US$670 Mn by 2031, showing significant growth from the US$360 Mn achieved in 2024.

- The market for saliva-based screening is expected to show a significant expansion rate, with an estimated CAGR of 9.2% from 2024 to 2031.

Saliva-based Screening Market Insights

- Saliva diagnostics are gaining popularity due to their painless, simple, and stress-free sample collection method, enhancing patient compliance.

- Integration of AI and molecular diagnostic technologies, such as PCR, has improved test accuracy and expanded applications.

- Infection analysis/detection leads the market, supported by its role in addressing global healthcare challenges.

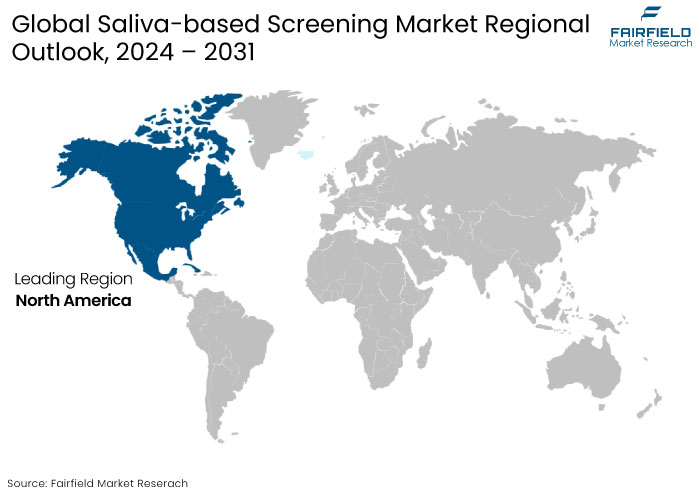

- North America dominates the market due to advanced healthcare infrastructure, with Europe following closely as a hub for innovation.

- Saliva-based tests are cost-efficient, making them suitable for large-scale screening in resource-limited regions.

- The pandemic significantly accelerated the adoption of saliva-based diagnostic tools, particularly for mass infection detection.

A Look Back and a Look Forward - Comparative Analysis

The saliva-based screening market experienced steady growth during the period from 2019 to 2023 driven by increasing awareness of non-invasive diagnostic methods and their advantages over traditional techniques.

The market expanded significantly due to the COVID-19 pandemic, accelerating the adoption of saliva-based diagnostic tests for viral detection. Advancements in biomarkers for diabetes, cancer, and infectious diseases further contributed to market development.

Cost-effectiveness, ease of sample collection, and patient compliance made saliva-based screening a preferred alternative for diagnostic labs and research applications. However, adoption was slower in resource-limited settings due to the need for advanced technologies.

The market is projected to expand at a CAGR of fueled by technological advancements in point-of-care (POC) testing and increased integration of artificial intelligence (AI) in diagnostics. Saliva-based diagnostics are expanding into broad applications, such as early cancer detection, hormonal monitoring, and drug testing.

Supportive government initiatives and investments in healthcare infrastructure, particularly in emerging economies, are further accelerating growth. The increasing prevalence of chronic diseases and the rising demand for personalized healthcare solutions ensure sustained market expansion. These factors collectively position saliva-based screening as a transformative force in the global diagnostics industry.

Key Growth Determinants

- Rising Prevalence of Chronic Diseases to Bolster Market

The increasing prevalence of chronic diseases, such as diabetes, cancer, and cardiovascular disorders, is a key driver for the saliva-based screening market. These conditions require regular monitoring and early detection to improve patient outcomes and reduce healthcare costs.

Saliva-based diagnostics offer a non-invasive and cost-effective alternative for detecting biomarkers associated with these diseases. Saliva tests can detect glucose levels for diabetes management or identify specific genetic markers for cancer risk.

The convenience of saliva-based screening encourages patient compliance, particularly for populations requiring frequent testing, such as the elderly or those in remote areas. As the burden of chronic diseases continues to grow globally, the demand for efficient and patient-friendly diagnostic solutions like saliva-based screening will increase.

- Growing Demand for Non-Invasive Diagnostic Methods

The global shift towards non-invasive diagnostic techniques is a major growth driver for the saliva-based screening market. Unlike traditional methods such as blood draws or biopsies, saliva collection is painless, simple, and stress-free, making it ideal for a wide range of patients, including children and those with needle phobia.

Saliva-based screening reduces the risk of infection transmission, making it highly relevant in the post-pandemic era. With increasing awareness of patient-centric care and the advantages of non-invasive diagnostics, saliva-based screening is poised to become a preferred choice in healthcare settings worldwide.

Key Growth Barriers

- Limited Biomarker Availability and Test Accuracy Remains Key Barrier

One of the significant restraints for the saliva-based screening market is the limited availability of reliable biomarkers and challenges in test accuracy. While saliva offers a non-invasive and accessible medium, the concentration of many biomarkers in saliva is often lower than in blood, making detection more complex.

The said limitation impacts the sensitivity and specificity of saliva-based tests, particularly for diseases requiring early diagnosis or those with subtle biomarker signatures, such as early-stage cancers.

Environmental factors, such as diet, hydration, and oral hygiene, can influence saliva composition and lead to variability in test results. These factors make it challenging to standardize saliva-based diagnostic protocols across diverse populations, limiting their widespread adoption. Despite advancements in molecular technologies, overcoming these hurdles remains crucial to fully unlocking the potential of saliva-based diagnostics.

- High Initial Development Costs and Regulatory Challenges

The saliva-based screening market faces significant restraints from high initial development costs and complex regulatory hurdles. Developing saliva-based diagnostic tools requires substantial investment in research to identify and validate biomarkers, and integrate advanced technologies like polymerase chain reaction (PCR) and point-of-care devices. These processes can be time-consuming and costly, particularly for small or emerging players.

Regulatory agencies such as the FDA and EMA impose stringent requirements for demonstrating diagnostic tests' safety, efficacy, and reliability. Meeting these standards involves extensive clinical trials and documentation, increasing time-to-market and costs for developers.

For start-ups and companies without robust financial backing, these challenges can hinder market entry and innovation, slowing the overall saliva-based screening industry growth. Addressing regulatory and cost barriers is critical for fostering broad adoption and technological advancements.

Saliva-based Screening Market Trends and Opportunities

- Integration of AI and Machine Learning in Saliva-Based Diagnostics

Integrating artificial intelligence (AI) and machine learning (ML) in diagnostics is a notable trend shaping the saliva-based screening market. AI and ML revolutionize how saliva-based diagnostic tools analyze complex data sets, enabling rapid and highly accurate results. These technologies excel at identifying patterns in biomarker profiles, even in low concentrations, enhancing the sensitivity and specificity of tests.

AI algorithms can detect minute variations in saliva samples indicative of early-stage diseases like cancer or neurodegenerative disorders. AI-powered platforms are being used to predict patient outcomes and recommend personalized treatment plans based on saliva-based screening. .

The rise of wearable health devices with integrated saliva diagnostic features further exemplifies this trend. These advancements improve diagnostic capabilities and streamline workflows for clinicians, making saliva-based screening a roust and reliable option for real-time health monitoring.

- Expansion into Preventive and Personalized Healthcare

The growing emphasis on preventive and personalized healthcare presents a significant opportunity for the saliva-based screening market. Saliva diagnostics offer a non-invasive, cost-effective, and patient-friendly method for early disease detection and regular health monitoring, aligning with the global shift towards proactive healthcare.

Saliva-based tests are increasingly used for detecting genetic predispositions to diseases, enabling individuals to take preventive measures long before symptoms arise. Similarly, hormonal monitoring through saliva can guide personalized treatments for conditions such as infertility, stress-related disorders, and endocrine imbalances.

Emerging markets also provide untapped opportunities, as saliva diagnostics can improve healthcare access in regions with limited infrastructure. Companies investing in affordable, portable diagnostic tools can cater to underserved populations while addressing global health challenges.

Collaboration with telemedicine platforms and wearable technology developers can expand the reach of saliva-based diagnostics, making them integral to future healthcare solutions focused on prevention and personalization.

How Does Regulatory Scenario Shape the Industry?

The regulatory environment plays a pivotal role in shaping the saliva-based screening market. Regulatory agencies such as the FDA (U.S.), EMA (Europe), and local healthcare authorities in emerging economies enforce strict guidelines to ensure saliva-based diagnostic tools' safety, accuracy, and reliability. These regulations are essential for building trust among healthcare providers and patients and driving market credibility.

Saliva-based diagnostic tools must undergo rigorous validation processes in developed markets including clinical trials to demonstrate their efficacy compared to traditional methods like blood tests. The FDA's emergency use authorization (EUA) during the COVID-19 pandemic accelerated the adoption of saliva-based testing for viral detection. This regulatory flexibility showcased the potential of saliva diagnostics in meeting urgent healthcare needs.

Stringent requirements and lengthy approval processes pose challenges for new entrants and innovative start-ups, particularly in emerging regions. Efforts to harmonize global standards for diagnostic tools are ongoing, aiming to streamline approvals and foster market expansion.

Regulatory support for advanced technologies such as AI-powered diagnostic platforms and portable saliva-based devices fosters innovation. Governments and agencies are also incentivizing research into biomarker discovery and saliva-based testing applications, further accelerating growth in this sector while ensuring public health safety.

Segments Covered in the Report

- Saliva-Based Detection Kits to Stand Out with a 60% of Market Share

Saliva-Based detection kits are designed to identify specific biomarkers in saliva, facilitating the diagnosis of various conditions, including infectious diseases, genetic disorders, and hormonal imbalances.

The surge in demand for non-invasive, rapid, and user-friendly diagnostic tools has propelled the adoption of these kits. Their prominence was notably amplified during the COVID-19 pandemic, where they served as efficient alternatives to nasopharyngeal swabs for virus detection.

Companies like Nalagenetics and Nusantics received regulatory approval to introduce PCR test kits for detecting COVID-19 in saliva samples, highlighting the growing acceptance and utilization of saliva-based detection methods. The advantages of saliva-based detection kits include ease of sample collection, reduced discomfort compared to blood draws, and the potential for at-home testing, which enhance patient compliance and broadens accessibility.

As technological advancements continue to improve the sensitivity and specificity of these kits, their application scope is expanding beyond infectious diseases to areas like oncology and metabolic disorders.

- Infection analysis/detection stands out as the dominant application

The infection analysis/detection segment has gained prominence due to the increasing demand for non-invasive, rapid, and reliable diagnostic methods for infectious diseases. Saliva-based tests for infection detection have become essential tools in diagnosing various infectious diseases, including viral, bacterial, and fungal infections.

The non-invasive nature of saliva collection offers a patient-friendly alternative to traditional blood tests, enhancing patient compliance and facilitating mass screening efforts. During the COVID-19 pandemic, saliva-based diagnostics played a crucial role in large-scale testing due to their ease of use and reduced risk of transmission during sample collection.

The said application segment has been further supported by advancements in molecular diagnostic technologies, such as PCR and rapid antigen tests, improving the sensitivity and specificity of saliva-based infection detection. The growing prevalence of infectious diseases globally and the need for efficient diagnostic tools continue to drive the dominance of this application in the saliva-based screening market.

While specific percentage market share figures for infection analysis/detection within the saliva-based screening market are not readily available, this application is recognized as a leading segment due to its widespread adoption and critical role in public health diagnostics.

The ongoing development of saliva-based assays for a broader range of pathogens is expected to solidify further its position as the dominant application in the market.

Regional Analysis

- North America Takes the Lead with Advanced Healthcare Infrastructure

North America is the dominant region in the saliva-based screening market, driven by its advanced healthcare infrastructure, high adoption rates for innovative diagnostic technologies, and significant investments in research and development.

North America is home to leading diagnostic companies and research institutions, making it a hub for technological advancements in saliva-based screening. Key players like OraSure Technologies and Thermo Fisher Scientific are actively developing cutting-edge saliva diagnostic kits for infection detection, genomics, and oncology applications.

The region's focus on patient-centric healthcare has encouraged the adoption of non-invasive diagnostic methods. Saliva-based tests are particularly popular for their ease of use, cost-effectiveness, and potential for at-home testing.

North America's leadership in the saliva-based screening market is anchored by its robust healthcare ecosystem, commitment to innovation, and early adoption of advanced diagnostic tools. The region's market dominance is expected to continue, driven by increasing healthcare expenditure and a focus on preventive diagnostics.

- Europe to be Second Largest Market with Supportive Regulatory Framework

Europe is the second-largest market for saliva-based screening, driven by its focus on innovation, preventive healthcare, and a supportive regulatory framework. The region has shown significant growth potential due to its increasing adoption of non-invasive diagnostics and the rising prevalence of chronic diseases.

Countries in Europe including Germany, the United Kingdom, France, and Italy, are at the forefront of adopting saliva-based diagnostic technologies. These nations invest significantly in research and development, advancing saliva-based testing for infection detection, genomics, and oncology applications.

The integration of saliva diagnostics into preventive healthcare systems and their use in early disease detection is gaining momentum, particularly in chronic and hereditary diseases.

Europe's regulatory landscape, governed by the European Medicines Agency (EMA) and local regulatory bodies, encourages innovation in diagnostics.

The introduction of the European Union's In-Vitro Diagnostic Regulation (IVDR) emphasizes safety, accuracy, and performance, fostering confidence in saliva-based diagnostic tools. Governments across Europe are providing funding and incentives for research in non-invasive diagnostics, boosting the market for saliva-based screening solutions.

Fairfield’s Competitive Landscape Analysis

The saliva-based screening market is highly competitive, driven by innovation and the increasing demand for non-invasive diagnostic solutions. Key players include OraSure Technologies, Salimetrics LLC, Thermo Fisher Scientific, NEOGEN Corporation, and Quest Diagnostics, each focusing on developing advanced diagnostic kits and technologies.

Emerging players are introducing cost-effective, portable solutions targeting underserved markets. Technological advancements, regulatory approvals, and a growing emphasis on personalized and preventive healthcare shape the competitive landscape.

Key Market Companies

- Thermo Fisher Scientific

- Hologic

- Qiagen

- Zymo Research Corporation

- DNA Genotek Inc.

- Invitek Molecular GmbH

- Salimetrics, LLC.

- BioChain Institute Inc.

- Mawi DNA Technologies LLC

- Cell Projects Ltd.

- Kyodo International, Inc.

- Spectrum Solutions

- NEOGEN Corporation

- Xiamen Zeesan Biotech Co., Ltd.

- Sedia Biosciences Corporation

- Biosynex SA

- Chembio Diagnostics, Inc.

- Creative Diagnostics

- OraSure Technologies

Recent Industry Developments

- In December 2023, Molbio Diagnostics, based in Goa, partnered with a Finnish company to commercialize PROMILLESS, a saliva-based test kit designed to measure body alcohol content.

- In June 2023, The United Kingdom saw the launch of Salilistic, the world's first saliva-based pregnancy test. This test eliminates the need for urine samples, marking a significant advancement in home pregnancy testing by offering a more convenient and non-invasive option for users.

An Expert’s Eye

- Saliva-based screening is a game-changer for diagnostics, offering a painless, simple, and stress-free alternative to traditional methods like blood tests.

- The pandemic accelerated the adoption of saliva-based tests, proving their reliability and scalability for mass diagnostics, especially in infection detection.

- Saliva diagnostics are gaining traction in genomics, oncology, hormonal monitoring, and personalized healthcare, showcasing their versatility.

- Innovations in molecular diagnostics, such as PCR and AI-driven analysis, improve test sensitivity and specificity, making saliva tests reliable.

Global Saliva-based Screening Market is Segmented as-

By Product

- Saliva Collection Devices

- Saliva Nucleic Acid Purification Kits

- Saliva Base Detection Kits

By Purpose

- Research

- Diagnostics

By Application

- Infection analysis/detection

- Genomic analysis

- Proteomics

- Pharmacogenomics

- Liquid biopsy

By End User

- Hospitals & Clinics

- Diagnostic laboratories

- Academic & research institutes

- Biopharmaceuticals & CRO’s

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Saliva-based Screening Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Saliva-based Screening Market Outlook, 2019 - 2031

3.1. Global Saliva-based Screening Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Saliva collection kits/devices

3.1.1.2. Saliva nucleic acid purification kits

3.1.1.3. Saliva base detection kits

3.1.1.3.1. PCR based

3.1.1.3.2. Rapid kits

3.2. Global Saliva-based Screening Market Outlook, by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Research use only

3.2.1.2. Diagnostics

3.3. Global Saliva-based Screening Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Infection analysis/detection

3.3.1.2. Genomic analysis

3.3.1.3. Proteomics

3.3.1.4. Pharmacogenomics

3.3.1.5. Liquid biopsy

3.4. Global Saliva-based Screening Market Outlook, by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. Hospitals & Clinics

3.4.1.2. Diagnostic laboratories

3.4.1.3. Academic & research institutes

3.4.1.4. Biopharmaceuticals & CRO’s

3.5. Global Saliva-based Screening Market Outlook, by Region, Value (US$ Mn) and Volume (Units), 2019 - 2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Saliva-based Screening Market Outlook, 2019 - 2031

4.1. North America Saliva-based Screening Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Saliva collection kits/devices

4.1.1.2. Saliva nucleic acid purification kits

4.1.1.3. Saliva base detection kits

4.1.1.3.1. PCR based

4.1.1.3.2. Rapid kits

4.2. North America Saliva-based Screening Market Outlook, by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Research use only

4.2.1.2. Diagnostics

4.3. North America Saliva-based Screening Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Infection analysis/detection

4.3.1.2. Genomic analysis

4.3.1.3. Proteomics

4.3.1.4. Pharmacogenomics

4.3.1.5. Liquid biopsy

4.4. North America Saliva-based Screening Market Outlook, by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Hospitals & Clinics

4.4.1.2. Diagnostic laboratories

4.4.1.3. Academic & research institutes

4.4.1.4. Biopharmaceuticals & CRO’s

4.5. North America Saliva-based Screening Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. U.S. Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.5.1.2. U.S. Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.5.1.3. U.S. Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.5.1.4. U.S. Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.5.1.5. Canada Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.5.1.6. Canada Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.5.1.7. Canada Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.5.1.8. Canada Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Saliva-based Screening Market Outlook, 2019 - 2031

5.1. Europe Saliva-based Screening Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Saliva collection kits/devices

5.1.1.2. Saliva nucleic acid purification kits

5.1.1.3. Saliva base detection kits

5.1.1.3.1. PCR based

5.1.1.3.2. Rapid kits

5.2. Europe Saliva-based Screening Market Outlook, by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Research use only

5.2.1.2. Diagnostics

5.3. Europe Saliva-based Screening Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Infection analysis/detection

5.3.1.2. Genomic analysis

5.3.1.3. Proteomics

5.3.1.4. Pharmacogenomics

5.3.1.5. Liquid biopsy

5.4. Europe Saliva-based Screening Market Outlook, by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Hospitals & Clinics

5.4.1.2. Diagnostic laboratories

5.4.1.3. Academic & research institutes

5.4.1.4. Biopharmaceuticals & CRO’s

5.5. Europe Saliva-based Screening Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. Germany Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.2. Germany Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.3. Germany Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.4. Germany Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.5. U.K. Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.6. U.K. Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.7. U.K. Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.8. U.K. Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.9. France Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.10. France Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.11. France Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.12. France Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.13. Italy Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.14. Italy Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.15. Italy Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.16. Italy Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.17. Turkey Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.18. Turkey Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.19. Turkey Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.20. Turkey Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.21. Russia Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.22. Russia Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.23. Russia Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.24. Russia Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.25. Rest of Europe Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.26. Rest of Europe Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.27. Rest of Europe Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.1.28. Rest of Europe Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Saliva-based Screening Market Outlook, 2019 - 2031

6.1. Asia Pacific Saliva-based Screening Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Saliva collection kits/devices

6.1.1.2. Saliva nucleic acid purification kits

6.1.1.3. Saliva base detection kits

6.1.1.3.1. PCR based

6.1.1.3.2. Rapid kits

6.2. Asia Pacific Saliva-based Screening Market Outlook, by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Research use only

6.2.1.2. Diagnostics

6.3. Asia Pacific Saliva-based Screening Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Infection analysis/detection

6.3.1.2. Genomic analysis

6.3.1.3. Proteomics

6.3.1.4. Pharmacogenomics

6.3.1.5. Liquid biopsy

6.4. Asia Pacific Saliva-based Screening Market Outlook, by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Hospitals & Clinics

6.4.1.2. Diagnostic laboratories

6.4.1.3. Academic & research institutes

6.4.1.4. Biopharmaceuticals & CRO’s

6.5. Asia Pacific Saliva-based Screening Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. China Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.2. China Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.3. China Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.4. China Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.5. Japan Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.6. Japan Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.7. Japan Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.8. Japan Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.9. South Korea Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.10. South Korea Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.11. South Korea Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.12. South Korea Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.13. India Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.14. India Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.15. India Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.16. India Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.17. Southeast Asia Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.18. Southeast Asia Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.19. Southeast Asia Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.20. Southeast Asia Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.21. Rest of Asia Pacific Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.22. Rest of Asia Pacific Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.23. Rest of Asia Pacific Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.1.24. Rest of Asia Pacific Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Saliva-based Screening Market Outlook, 2019 - 2031

7.1. Latin America Saliva-based Screening Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Saliva collection kits/devices

7.1.1.2. Saliva nucleic acid purification kits

7.1.1.3. Saliva base detection kits

7.1.1.3.1. PCR based

7.1.1.3.2. Rapid kits

7.2. Latin America Saliva-based Screening Market Outlook, by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Research use only

7.2.1.2. Diagnostics

7.3. Latin America Saliva-based Screening Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Infection analysis/detection

7.3.1.2. Genomic analysis

7.3.1.3. Proteomics

7.3.1.4. Pharmacogenomics

7.3.1.5. Liquid biopsy

7.4. Latin America Saliva-based Screening Market Outlook, by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Hospitals & Clinics

7.4.1.2. Diagnostic laboratories

7.4.1.3. Academic & research institutes

7.4.1.4. Biopharmaceuticals & CRO’s

7.5. Latin America Saliva-based Screening Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Brazil Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.2. Brazil Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.3. Brazil Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.4. Brazil Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.5. Mexico Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.6. Mexico Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.7. Mexico Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.8. Mexico Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.9. Argentina Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.10. Argentina Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.11. Argentina Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.12. Argentina Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.13. Rest of Latin America Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.14. Rest of Latin America Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.15. Rest of Latin America Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.1.16. Rest of Latin America Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Saliva-based Screening Market Outlook, 2019 - 2031

8.1. Middle East & Africa Saliva-based Screening Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Saliva collection kits/devices

8.1.1.2. Saliva nucleic acid purification kits

8.1.1.3. Saliva base detection kits

8.1.1.3.1. PCR based

8.1.1.3.2. Rapid kits

8.2. Middle East & Africa Saliva-based Screening Market Outlook, by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Research use only

8.2.1.2. Diagnostics

8.3. Middle East & Africa Saliva-based Screening Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Infection analysis/detection

8.3.1.2. Genomic analysis

8.3.1.3. Proteomics

8.3.1.4. Pharmacogenomics

8.3.1.5. Liquid biopsy

8.4. Middle East & Africa Saliva-based Screening Market Outlook, by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Hospitals & Clinics

8.4.1.2. Diagnostic laboratories

8.4.1.3. Academic & research institutes

8.4.1.4. Biopharmaceuticals & CRO’s

8.5. Middle East & Africa Saliva-based Screening Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. GCC Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.2. GCC Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.3. GCC Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.4. GCC Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.5. South Africa Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.6. South Africa Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.7. South Africa Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.8. South Africa Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.9. Egypt Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.10. Egypt Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.11. Egypt Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.12. Egypt Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.13. Nigeria Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.14. Nigeria Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.15. Nigeria Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.16. Nigeria Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.17. Rest of Middle East & Africa Saliva-based Screening Market by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.18. Rest of Middle East & Africa Saliva-based Screening Market by Purpose, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.19. Rest of Middle East & Africa Saliva-based Screening Market by Application, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.1.20. Rest of Middle East & Africa Saliva-based Screening Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. by Application vs by Purpose Heatmap

9.2. Manufacturer vs by Purpose Heatmap

9.3. Company Market Share Analysis, 2023

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Thermo Fisher Scientific

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Hologic

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Qiagen

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Zymo Research Corporation

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. DNA Genotek Inc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Invitek Molecular GmbH

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Salimetrics, LLC.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. BioChain Institute Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Mawi DNA Technologies LLC

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Cell Projects Ltd.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Kyodo International, Inc.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Spectrum Solutions

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. NEOGEN Corporation

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Xiamen Zeesan Biotech Co., Ltd.

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Sedia Biosciences Corporation

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. Biosynex SA

9.5.16.1. Company Overview

9.5.16.2. Product Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Business Strategies and Development

9.5.17. Chembio Diagnostics, Inc.

9.5.17.1. Company Overview

9.5.17.2. Product Portfolio

9.5.17.3. Financial Overview

9.5.17.4. Business Strategies and Development

9.5.18. Creative Diagnostics

9.5.18.1. Company Overview

9.5.18.2. Product Portfolio

9.5.18.3. Financial Overview

9.5.18.4. Business Strategies and Development

9.5.19. OraSure Technologies

9.5.19.1. Company Overview

9.5.19.2. Product Portfolio

9.5.19.3. Financial Overview

9.5.19.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Purpose Coverage |

|

|

Application Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |