Global Self-driving Cars Market Forecast

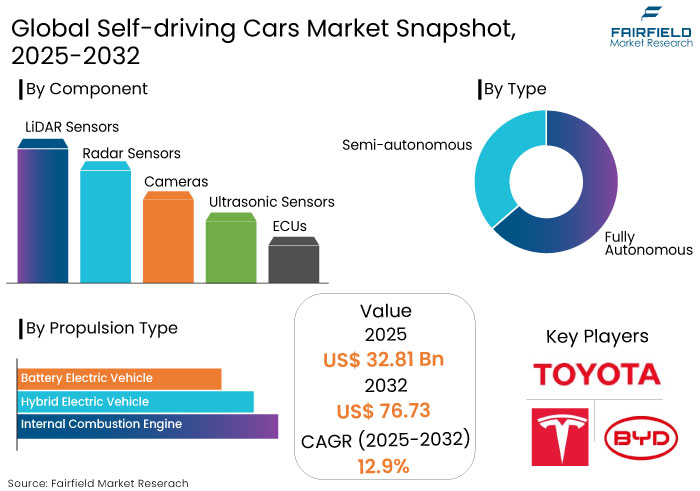

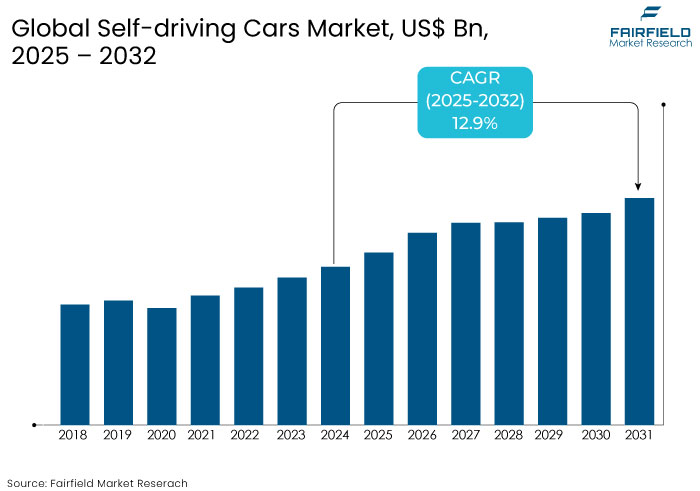

- The self-driving cars market is projected to reach a size of US$ 76.73 Bn by 2032, showing significant growth from the US$ 32.81 Bn achieved in 2025.

- The market for self-driving cars is set to show a steady expansion rate, with a CAGR of 12.9% from 2025 to 2032.

Self-driving Cars Market Insights

- Advancements in AI-driven computing and ultra-fast 5G networks are set to accelerate the capabilities and reliability of self-driving technology.

- Most autonomous vehicles are being developed as Electric Vehicles (EVs), pushing sustainability and emissions reduction in urban areas.

- Autonomous vehicles could reduce traffic accidents by up to 90%, potentially saving US$ 190 Bn in annual costs.

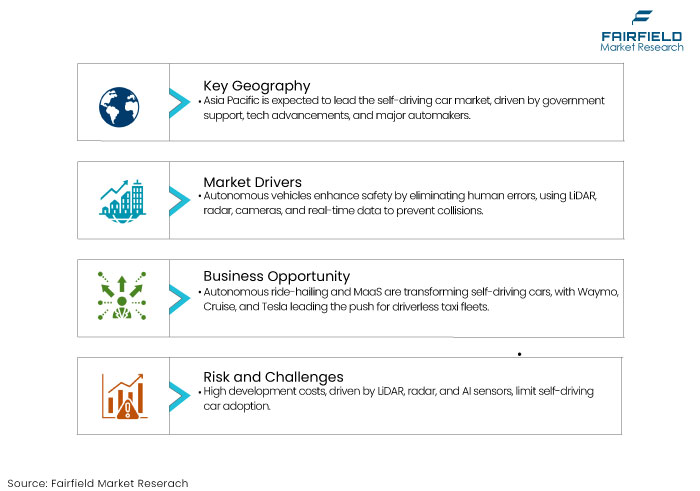

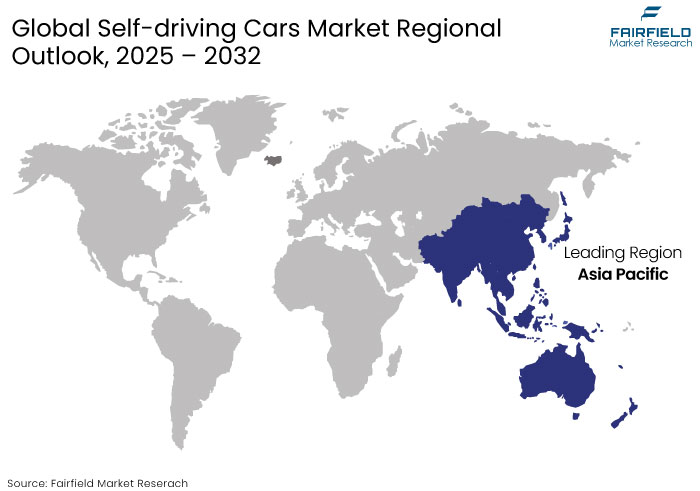

- Presence of leading automotive manufacturers caters Asia Pacific as the leading region with 36% of the market share in 2025.

- The versatility and cost-effectiveness of cameras make it the leading component segment, with 25% of the total share in 2025.

- Semi-autonomous type of cars dominates due to regulatory support for safety features.

- High cost of LIDR, AI systems, and 5G infrastructure slows self-driving cars' affordability and mass adoption.

- Companies like Waymo, Tesla, and Cruise are investing billions in autonomous driving technology, with Waymo raising over US$ 11 Bn in funding.

Key Growth Determinants

- High Demand for Safe and Efficient Transportation Systems

Safety is one of the biggest selling points of autonomous vehicles, as these eliminate human errors that contribute to most road accidents. Self-driving technology incorporates LiDAR, radar, cameras, and real-time data analytics to ensure a safer driving experience. Such systems can anticipate and prevent collisions, making autonomous vehicles a promising solution for reducing traffic-related fatalities.

Self-driving cars offer improved efficiency by optimizing traffic flow and reducing congestion. Ride-hailing services, logistics companies, and urban planners increasingly invest in autonomous fleets to enhance mobility while reducing environmental impact.

Vehicle automation can improve fuel efficiency by optimizing driving patterns, leading to an estimated 8% to 13% increase in congested traffic speeds. Governments worldwide are implementing regulations and incentives to support the adoption of self-driving technology, further fueling the self-driving cars market growth.

- Surging Investments and Strategic Partnerships in the Automotive Industry

The self-driving car industry is witnessing an influx of investments from technology giants and automakers, accelerating research and development. Companies like Google’s Waymo, Apple, Uber, and key automakers such as Ford, General Motors, and Toyota are investing billions into autonomous driving technology.

Strategic partnerships between software companies, semiconductor manufacturers, and automotive brands are driving innovation at a rapid pace. Collaborations with AI chipmakers like NVIDIA and Qualcomm enable the integration of high-performance computing solutions into self-driving systems.

Government initiatives, including funding programs and policy support, encourage investment in autonomous vehicle infrastructure. Expansion of autonomous ride-sharing services, delivery fleets, and commercial trucking solutions is also fueling market growth. By 2030, it is estimated that up to 10% of global new car sales could be Level 3 vehicles, which allow drivers to take their eyes off the road and hands off the wheel under certain conditions.

Key Growth Barriers

- High Development Costs and Limited Infrastructure to Impede Market Growth

One of the key restraints for the self-driving cars market is the high cost of development and deployment of autonomous cars. Building autonomous vehicles requires innovative technologies such as LiDAR, radar, AI-powered sensors, and real-time computing, significantly increasing production expenses.

A single LiDAR sensor can cost thousands of dollars, making mass adoption of autonomous vehicles costly. Setting up the necessary smart infrastructure, including vehicle-to-infrastructure (V2I) communication systems, 5G networks, and AI-driven traffic management, demands massive investments from governments and private sectors.

Self-driving Cars Market Trends and Opportunities

- Emergence of Autonomous Ride-hailing and Mobility-as-a-Service

One of the biggest game-changers in the self-driving cars market is the rise of autonomous ride-hailing and Mobility-as-a-Service (MaaS). Companies like Waymo, Cruise, and Tesla are racing to deploy self-driving taxi fleets that eliminate the need for human drivers, making ride-hailing services more affordable and widely accessible.

MaaS solutions, where users subscribe to autonomous vehicle services instead of owning a car, could reshape the auto industry by moving away from traditional car ownership. As technology improves and regulations catch up, self-driving taxis and shared autonomous fleets will disrupt traditional transportation models and create a multi-billion-dollar market. The mobility-as-a-service sector is anticipated to rise from US$ 412 Bn in 2025 to US$ 1,698 Bn by 2032, exhibiting a CAGR of 19.4%.

- Increasing Adoption of Self-driving Trucks Worldwide

The trucking industry faces a significant driver shortage, with current estimates indicating a deficit of around 50,000 qualified drivers. This shortage is projected to double by 2030. Autonomous trucks offer a solution by handling long-haul routes, thereby mitigating the impact of driver shortages.

Autonomous trucking also presents environmental advantages. Research indicates that self-driving trucks can increase energy efficiency by up to 32% compared to traditional trucking methods, contributing to reduced greenhouse gas emissions. This factor is estimated to propel demand and augment the global self-driving cars market.

Segments Covered in the Report

- Semi-autonomous Cars Dominate Due to Regulatory Support for Safety Features

Semi-autonomous vehicles, classified under Levels 1 to 3 of automation, integrate Advanced Driver Assistance Systems (ADAS) such as adaptive cruise control, lane-keeping assistance, and automated parking. Such features enhance driving safety and convenience, making these increasingly popular among consumers in the self-driving cars market.

The substantial market share of the semi-autonomous type of cars is attributed to the various benefits these vehicles offer, including improved safety and partial automation, which appeal to a broad range of consumers. Governments worldwide are encouraging the integration of technologies like emergency braking systems and collision avoidance, which are key components of semi-autonomous cars.

- Versatility and Cost-effectiveness of Cameras Make it the Leading Component

Camera systems are currently the leading component segment in the self-driving cars market. These play a pivotal role in enabling vehicles to interpret their surroundings by capturing high-resolution images. The images are then processed to identify objects, read traffic signs, and monitor lane markings.

The integration of cameras is essential for functions such as adaptive cruise control, lane-keeping assistance, and pedestrian detection, all of which are critical for semi-autonomous and fully autonomous driving. Dominance of camera systems is attributed to their versatility and cost-effectiveness compared to other sensor types like LiDAR. Cameras provide detailed visual information, which, combined with novel image processing algorithms, allows for a comprehensive understanding of the driving environment.

Regional Analysis

- Favorable Government Norms to Propel Opportunities in Asia Pacific

Asia Pacific is estimated to remain the predominant market for self-driving cars over the projected period. It is set to be propelled by government efforts, technical progress, and the presence of leading automotive manufacturers.

Countries like China and South Korea are leading the region's expansion. As of August 2024, China has granted 16,000 test licenses for driverless vehicles and has designated almost 20,000 miles of public roads for autonomous vehicle testing. The nation's ambitious objective to guarantee that 70% of new vehicles possess Level 2 or Level 3 autonomy by 2025 illustrates its dedication to deploying autonomous vehicles.

The swift proliferation of robotaxi services by firms like Baidu Co., Ltd., and WeRide in several cities in China has fostered a strong ecosystem for self-driving technology. South Korea intends to sell at least one Level 4 vehicle by 2027.

- Europe to See Steady Growth Amid Investments in Autonomous Technology

Europe is emerging as a leading player in the self-driving cars market, driven by strong government policies, investments in autonomous technology, and a well-developed automotive industry. Europe is home to global automotive giants such as Volkswagen (Audi), BMW, Mercedes-Benz, Volvo, and Renault, all investing in self-driving technology.

Volkswagen Group has partnered with Argo AI for autonomous driving solutions, while Mercedes-Benz became the first automaker to receive regulatory approval for Level 3 autonomous driving (Drive Pilot).

Volvo has collaborated with Luminar and NVIDIA to enhance AI and LiDAR-based autonomous vehicle systems. Cities in Europe are testing autonomous public transport solutions, including self-driving shuttles and robotaxis. France, the Netherlands, and Spain have launched multiple pilot programs for self-driving electric taxis and shared mobility services.

The U.K. is investing in AV infrastructure and aims to have self-driving cars on roads by 2025, supported by a US$ 100 Mn funding initiative. The European Union (EU) and national governments are actively working on regulations for autonomous vehicles, ensuring safety and legal clarity for deployment.

Fairfield’s Competitive Landscape Analysis

The self-driving cars market is witnessing intense competition, with key players driving innovation through AI, LiDAR, and advanced sensor technologies. Leading OEMs and automotive manufacturers are integrating autonomous driving capabilities into their vehicles, while tech giants like Google (Waymo) and Apple invest heavily in autonomous mobility solutions.

Partnerships and acquisitions remain crucial as companies collaborate to enhance ADAS (Advanced Driver Assistance Systems) and full automation. The regulatory landscape and safety concerns shape market strategies, influencing research and development investments and deployment timelines. The industry is poised for rapid transformation, with robotaxi services and autonomous freight transport expected to be major growth drivers.

Key Market Companies

- Toyota Motor Corporation

- Tesla

- BYD Co., Ltd.

- Volkswagen Group

- Ford Motor Company

- Hyundai Motor Group

- General Motors

- Honda Motor Co., Ltd.

- Stellantis NV

- Mercedes-Benz Group AG

- BMW Group

- Renault Group

- Geely Auto

- Great Wall Motor

Recent Industry Developments

- In October 2024, Tesla launched the Cybercab, a fully automated robotaxi priced at less than US$ 30,000, constructed without a steering wheel or pedals.

- In October 2024, Toyota Motor Corporation signed a partnership deal with Suzuki Motor Corporation to build a battery electric car. The new model is exclusively developed as a Battery Electric Vehicle (BEV).

- In June 2024, Cruise LLC, a subsidiary of General Motors, announced the resumption of manual driving in Phoenix, Houston, and Dallas, with monitored operations continuing in Phoenix and Dallas.

Global Self-driving Cars Market is Segmented as-

By Type

- Fully Autonomous

- Semi-autonomous

By Component

- LiDAR Sensors

- Radar Sensors

- Cameras

- Ultrasonic Sensors

- ECUs (Electronic Control Units)

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicles

By Propulsion Type

- Internal Combustion Engine (ICE)

- Hybrid Electric Vehicle (HEV)

- Battery Electric Vehicle (BEV)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Self-driving Cars Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Self-driving Cars Market Outlook, 2019 - 2032

3.1. Global Self-driving Cars Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Fully Autonomous

3.1.1.2. Semi-autonomous

3.2. Global Self-driving Cars Market Outlook, by Component, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. LiDAR Sensors

3.2.1.2. Radar Sensors

3.2.1.3. Cameras

3.2.1.4. Ultrasonic Sensors

3.2.1.5. ECUs (Electronic Control Units)

3.2.1.6. Misc.

3.3. Global Self-driving Cars Market Outlook, by Vehicle Type, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Passenger Vehicle

3.3.1.2. Commercial Vehicles

3.4. Global Self-driving Cars Market Outlook, by Propulsion Type, Value (US$ Bn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Internal Combustion Engine (ICE)

3.4.1.2. Hybrid Electric Vehicle (HEV)

3.4.1.3. Battery Electric Vehicle (BEV)

3.5. Global Self-driving Cars Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Self-driving Cars Market Outlook, 2019 - 2032

4.1. North America Self-driving Cars Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Fully Autonomous

4.1.1.2. Semi-Autonomous

4.2. North America Self-driving Cars Market Outlook, by Component, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. LiDAR Sensors

4.2.1.2. Radar Sensors

4.2.1.3. Cameras

4.2.1.4. Ultrasonic Sensors

4.2.1.5. ECUs (Electronic Control Units)

4.2.1.6. Misc.

4.3. North America Self-driving Cars Market Outlook, by Vehicle Type, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Passenger Vehicle

4.3.1.2. Commercial Vehicles

4.4. North America Self-driving Cars Market Outlook, by Propulsion Type, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Internal Combustion Engine (ICE)

4.4.1.2. Hybrid Electric Vehicle (HEV)

4.4.1.3. Battery Electric Vehicle (BEV)

4.5. North America Self-driving Cars Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. U.S. Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

4.5.1.2. U.S. Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

4.5.1.3. U.S. Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

4.5.1.4. U.S. Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

4.5.1.5. Canada Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

4.5.1.6. Canada Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

4.5.1.7. Canada Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

4.5.1.8. Canada Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Self-driving Cars Market Outlook, 2019 - 2032

5.1. Europe Self-driving Cars Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Fully Autonomous

5.1.1.2. Semi-Autonomous

5.2. Europe Self-driving Cars Market Outlook, by Component, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. LiDAR Sensors

5.2.1.2. Radar Sensors

5.2.1.3. Cameras

5.2.1.4. Ultrasonic Sensors

5.2.1.5. ECUs (Electronic Control Units)

5.2.1.6. Misc.

5.3. Europe Self-driving Cars Market Outlook, by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Passenger Vehicle

5.3.1.2. Commercial Vehicles

5.4. Europe Self-driving Cars Market Outlook, by Propulsion Type, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Internal Combustion Engine (ICE)

5.4.1.2. Hybrid Electric Vehicle (HEV)

5.4.1.3. Battery Electric Vehicle (BEV)

5.5. Europe Self-driving Cars Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Germany Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

5.5.1.2. Germany Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

5.5.1.3. Germany Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.4. Germany Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

5.5.1.5. U.K. Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

5.5.1.6. U.K. Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

5.5.1.7. U.K. Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.8. U.K. Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

5.5.1.9. France Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

5.5.1.10. France Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

5.5.1.11. France Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.12. France Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

5.5.1.13. Italy Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

5.5.1.14. Italy Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

5.5.1.15. Italy Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.16. Italy Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

5.5.1.17. Türkiye Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

5.5.1.18. Türkiye Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

5.5.1.19. Türkiye Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.20. Türkiye Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

5.5.1.21. Russia Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

5.5.1.22. Russia Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

5.5.1.23. Russia Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.24. Russia Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

5.5.1.25. Rest of Europe Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

5.5.1.26. Rest of Europe Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

5.5.1.27. Rest of Europe Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

5.5.1.28. Rest of Europe Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Self-driving Cars Market Outlook, 2019 - 2032

6.1. Asia Pacific Self-driving Cars Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Fully Autonomous

6.1.1.2. Semi-Autonomous

6.2. Asia Pacific Self-driving Cars Market Outlook, by Component, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. LiDAR Sensors

6.2.1.2. Radar Sensors

6.2.1.3. Cameras

6.2.1.4. Ultrasonic Sensors

6.2.1.5. ECUs (Electronic Control Units)

6.2.1.6. Misc.

6.3. Asia Pacific Self-driving Cars Market Outlook, by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Passenger Vehicle

6.3.1.2. Commercial Vehicles

6.4. Asia Pacific Self-driving Cars Market Outlook, by Propulsion Type, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Internal Combustion Engine (ICE)

6.4.1.2. Hybrid Electric Vehicle (HEV)

6.4.1.3. Battery Electric Vehicle (BEV)

6.5. Asia Pacific Self-driving Cars Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. China Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

6.5.1.2. China Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

6.5.1.3. China Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.5.1.4. China Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

6.5.1.5. Japan Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

6.5.1.6. Japan Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

6.5.1.7. Japan Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.5.1.8. Japan Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

6.5.1.9. South Korea Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

6.5.1.10. South Korea Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

6.5.1.11. South Korea Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.5.1.12. South Korea Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

6.5.1.13. India Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

6.5.1.14. India Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

6.5.1.15. India Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.5.1.16. India Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

6.5.1.17. Southeast Asia Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

6.5.1.18. Southeast Asia Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

6.5.1.19. Southeast Asia Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.5.1.20. Southeast Asia Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

6.5.1.21. Rest of Asia Pacific Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

6.5.1.22. Rest of Asia Pacific Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

6.5.1.23. Rest of Asia Pacific Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

6.5.1.24. Rest of Asia Pacific Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Self-driving Cars Market Outlook, 2019 - 2032

7.1. Latin America Self-driving Cars Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Fully Autonomous

7.1.1.2. Semi-Autonomous

7.2. Latin America Self-driving Cars Market Outlook, by Component, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. LiDAR Sensors

7.2.1.2. Radar Sensors

7.2.1.3. Cameras

7.2.1.4. Ultrasonic Sensors

7.2.1.5. ECUs (Electronic Control Units)

7.2.1.6. Misc.

7.3. Latin America Self-driving Cars Market Outlook, by Vehicle Type, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Passenger Vehicle

7.3.1.2. Commercial Vehicles

7.4. Latin America Self-driving Cars Market Outlook, by Propulsion Type, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Internal Combustion Engine (ICE)

7.4.1.2. Hybrid Electric Vehicle (HEV)

7.4.1.3. Battery Electric Vehicle (BEV)

7.5. Latin America Self-driving Cars Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Brazil Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

7.5.1.2. Brazil Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

7.5.1.3. Brazil Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

7.5.1.4. Brazil Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

7.5.1.5. Mexico Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

7.5.1.6. Mexico Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

7.5.1.7. Mexico Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

7.5.1.8. Mexico Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

7.5.1.9. Argentina Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

7.5.1.10. Argentina Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

7.5.1.11. Argentina Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

7.5.1.12. Argentina Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

7.5.1.13. Rest of Latin America Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

7.5.1.14. Rest of Latin America Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

7.5.1.15. Rest of Latin America Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

7.5.1.16. Rest of Latin America Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Self-driving Cars Market Outlook, 2019 - 2032

8.1. Middle East & Africa Self-driving Cars Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Fully Autonomous

8.1.1.2. Semi-Autonomous

8.2. Middle East & Africa Self-driving Cars Market Outlook, by Component, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. LiDAR Sensors

8.2.1.2. Radar Sensors

8.2.1.3. Cameras

8.2.1.4. Ultrasonic Sensors

8.2.1.5. ECUs (Electronic Control Units)

8.2.1.6. Misc.

8.3. Middle East & Africa Self-driving Cars Market Outlook, by Vehicle Type, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Passenger Vehicle

8.3.1.2. Commercial Vehicles

8.4. Middle East & Africa Self-driving Cars Market Outlook, by Propulsion Type, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Internal Combustion Engine (ICE)

8.4.1.2. Hybrid Electric Vehicle (HEV)

8.4.1.3. Battery Electric Vehicle (BEV)

8.5. Middle East & Africa Self-driving Cars Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. GCC Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

8.5.1.2. GCC Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

8.5.1.3. GCC Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

8.5.1.4. GCC Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

8.5.1.5. South Africa Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

8.5.1.6. South Africa Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

8.5.1.7. South Africa Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

8.5.1.8. South Africa Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

8.5.1.9. Egypt Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

8.5.1.10. Egypt Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

8.5.1.11. Egypt Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

8.5.1.12. Egypt Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

8.5.1.13. Nigeria Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

8.5.1.14. Nigeria Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

8.5.1.15. Nigeria Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

8.5.1.16. Nigeria Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

8.5.1.17. Rest of Middle East & Africa Self-driving Cars Market by Type, Value (US$ Bn), 2019 - 2032

8.5.1.18. Rest of Middle East & Africa Self-driving Cars Market by Component, Value (US$ Bn), 2019 - 2032

8.5.1.19. Rest of Middle East & Africa Self-driving Cars Market by Vehicle Type, Value (US$ Bn), 2019 - 2032

8.5.1.20. Rest of Middle East & Africa Self-driving Cars Market by Propulsion Type, Value (US$ Bn), 2019 - 2032

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. by Vehicle Type vs by Component Heat map

9.2. Manufacturer vs by Component Heat map

9.3. Company Market Share Analysis, 2025

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Toyota Motor Corporation

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Tesla

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. BYD Co., Ltd.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Volkswagen Group

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Ford Motor Company

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Hyundai Motor Group

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. General Motors

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Honda Motor Co., Ltd.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Stellantis NV

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Mercedes-Benz Group AG

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. BMW Group

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Renault Group

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Geely Auto

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Great Wall Motor

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Component Coverage |

|

|

Vehicle Type Coverage |

|

|

Propulsion Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |