Global Self-healing Concrete Market Forecast

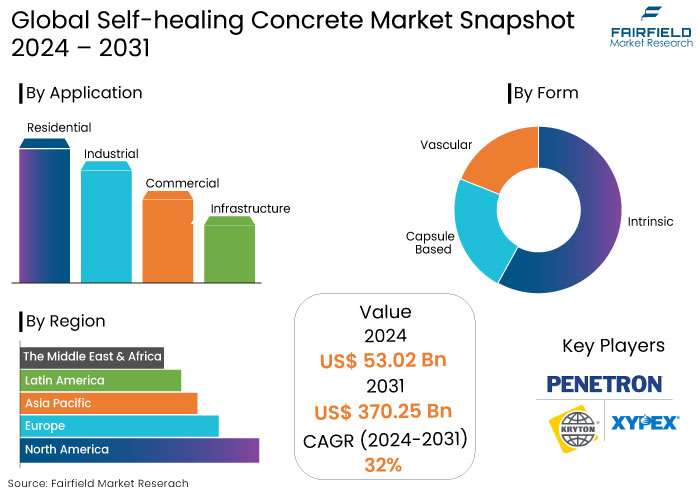

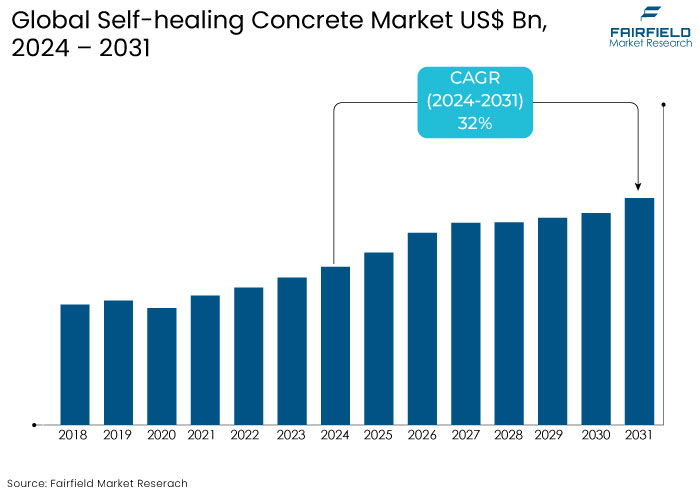

- The self-healing concrete market is projected to be valued at US$370.25 Bn by 2031, showing significant growth from the US$53.02 Bn valued in 2024.

- The market for self-healing concrete is expected to show a significant expansion rate with a healthy CAGR of 32% during the forecast period from 2024 to 2031.

Self-healing Concrete Market Insights

- The growing emphasis on sustainable building materials is driving the self-healing concrete market.

- The innovative self-healing material not only extends the lifespan of infrastructure but also significantly reduces maintenance offering potential cost savings.

- Global infrastructure development and renovation projects especially in transportation and urban areas create significant opportunities to adopt self-healing concrete.

- Innovations in autonomous healing systems such as microencapsulation and bacteria-based healing agents are improving the performance and appeal of self-healing concrete.

- The market faces high upfront costs than traditional concrete slowing adoption especially in cost-sensitive regions.

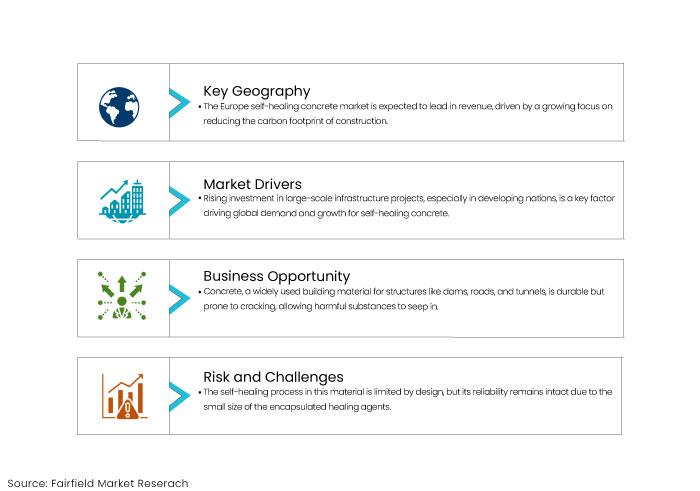

- Europe is leading the market driven by strict sustainability regulations and a strong focus on green building initiatives.

- Rapid urbanization and infrastructure growth in Asia Pacific offer significant market expansion opportunities in the coming years.

- Self-healing concrete is increasingly valued for its ability to improve the durability and resilience of critical structures particularly in disaster-prone regions.

A Look Back and a Look Forward - Comparative Analysis

The self-healing concrete market has shown significant growth driven by increasing demand for sustainable construction materials that reduce maintenance costs and extend the lifespan of structures. Pre-2023, the market experienced moderate growth largely fueled by advancements in material science and growing awareness of the benefits of self-healing technologies.

Early adoption was primarily in Europe and North America with rising government regulations around green building and infrastructure development. Post-2024, the market is expected to witness accelerated growth driven by rapid urbanization, infrastructure repair needs, and a rising focus on sustainability.

Innovations in self-healing mechanisms like autonomic self-healing and microencapsulation will enhance the product’s performance making it attractive for widespread adoption. Increased investments in research and development and government initiatives for smart infrastructure will push market growth particularly in Asia Pacific and the Middle East. Expansion into residential construction and cost-efficiency improvements will be key growth drivers in the coming years.

Key Growth Determinants

- Rising Private and Government Investments Remain a Primary Driver

Increasing investment in large-scale infrastructure projects is an important aspect driving up demand for self-healing concrete internationally. The fact that many developing nations are investing in and working together on infrastructure projects for long-term financial gain is a crucial element boosting the global self-healing concrete market growth.

The market is also projected to be driven primarily by increasing infrastructure investment and the aim to reduce overall structural maintenance costs. Self-healing concrete offers a range of benefits particularly in terms of reducing overall repair and maintenance costs. Research indicates that these advantages can lead to a significant 50% decrease underscoring the substantial cost savings potential.

Concrete is the cement manufacturing industry's final output accounting for 5% of all worldwide CO2 emissions. As a result, cement manufacturers anticipate that increasing investments in the creation of self-healing concrete will help them reduce their carbon footprint and costs related to ongoing cement manufacturing for maintenance and reinforcement.

- Environmentally Sustainable Construction Materials Favour Market Growth

Increased investment in large-scale infrastructure projects, and rising demand for long-lasting and sustainable infrastructure are predicted to contribute to the self-healing concrete market growth. Growing consumer desire for long-lasting and environment-friendly infrastructure is a key driver of industry expansion.

The development of micro cracks shortens the service life of concrete structures by allowing water, moisture, dust, and chloride ions to enter the structure. It causes the concrete to deteriorate and the steel reinforcement to corrode, necessitating frequent and expensive maintenance and repair work. There has been increased demand for environment-friendly building materials like self-healing concrete, which is anticipated to boost market growth significantly.

Key Growth Barriers

- Limited Self-healing Mechanism Could Limit Market Expansion

The self-healing process used by this material is constrained by design. Due to the minuscule size of the encapsulated healing ingredients, the material's overall dependability is not compromised.

The microscopic size of the capsule constrains the amount of healing chemicals in the concrete. Ultimately, this limits how much damage the healing agent can undo. Despite their high elasticity, high-elastic polymers occasionally cannot endure pressure.

Microcapsules are weak to external force and are akin to high-elastic polymers. The capacity of materials to store microcapsules is anticipated to be constrained as will the irreversible process of capsule rupture. It is anticipated that this product flaw will constrain self-healing concrete market expansion.

- Lack of Awareness and Expertise

One of the key restraints for the self-healing concrete market is the need for widespread awareness and expertise regarding the benefits and applications of self-healing concrete. Although this technology can significantly enhance the durability of structures, many architects, engineers, and contractors need to be aware of its full potential or have limited experience with its implementation.

Knowledge gap slows down adoption as decision-makers may prefer to rely on traditional materials they are more familiar with. Self-healing concrete's specialized installation and handling requirements add complexity to construction processes requiring skilled labour and proper training.

Without widespread education and standardization, the adoption rate may remain limited particularly in regions with less access to cutting-edge construction technologies.

Self-healing Concrete Market Trends and Opportunities

- Growth of the Construction Industry Creates Immense Opportunities

Concrete is a typical building and construction material. It is extensively used to construct dams, ports, storage tanks, roads, tunnels, subways, etc. Despite being robust and long-lasting, it is highly prone to cracking, which allows numerous unwelcome aggressive chemicals and other things to seep in.

The infrastructure deteriorates and loses durability due to these fissures and chemical accumulation. Such damages are treated with active therapy methods like self-healing techniques.

The self-healing process of self-healing concrete enables quick restoration of fissures. Due to the inadequacies of the current treatments, innovative and alternative therapeutic techniques including polymeric material encapsulation and self-healing are in high demand.

Adopting such cutting-edge technologies over the forecast period will drive self-healing concrete market expansion. Furthermore, one of the main driving forces in a developing economy like India is the expansion of construction operations for both public and private infrastructures.

Domestic manufacturing processes are supported by government programs like the Make in India campaign, which makes it simple to obtain the raw materials needed by the building sector. Due to the product's durability and versatility in infrastructure, the building industry would benefit significantly.

- Integration of Autonomous Self-Healing Technologies

A significant trend in the self-healing concrete market is the growing integration of autonomous self-healing technologies, which enhance the ability of concrete to repair itself without external intervention.

Traditional self-healing concrete typically relies on external stimuli or specific conditions such as the presence of water, to activate healing agents like bacteria or microcapsules. However, advancements in materials science are leading to the development of more advanced systems where healing processes occur autonomously in response to damage.

Such systems utilize cutting-edge materials, such as polymers that can reshape themselves or microcapsules that automatically release healing agents when cracks form. This trend is gaining momentum as it promises to improve the reliability and durability of concrete structures, reducing the need for manual inspections and repairs.

Autonomous self-healing concrete is particularly attractive for use in critical infrastructure such as bridges, tunnels, and marine structures, where access for maintenance is difficult or costly. This trend aligns with the broader movement toward smart materials in the construction industry, where automation and self-maintenance are becoming integral to sustainable building practices.

How Does Regulatory Scenario Shape the Industry?

The regulatory scenario plays a pivotal role in shaping the self-healing concrete market growth particularly as governments and international organizations increasingly prioritize sustainable infrastructure and environmental impact reduction.

Regulatory frameworks like the European Green Deal and national sustainability standards encourage the adoption of eco-friendly construction materials including self-healing concrete, which aligns with policies aimed at reducing carbon emissions and improving infrastructure longevity.

Building codes and green certification systems such as LEED and BREEAM are not just promoting the use of innovative materials, they are creating real incentives for self-healing concrete. By enhancing durability and reducing long-term maintenance, these systems are making self-healing concrete an attractive option.

The growing attention to infrastructure resilience in regulatory discussions is further driving the demand for materials that can repair themselves without external intervention.

While regulations are still evolving, favourable policies and government-funded research programs in Europe, North America, and Asia Pacific will likely to foster innovation. These will also accelerate commercialization, and drive the adoption of self-healing concrete across various sectors including transportation, housing, and commercial real estate.

Segments Covered in the Report

- Vascular Form Type Continues to Rule the Market

The vascular form type held the significant market share and it is anticipated that it will continue to rule the self-healing concrete market during the forecast period. This shape is utilized when a network of tubes containing concrete-healing agents are fed through the concrete structure from the interior to the exterior of the building walls.

Capsule-based self-healing concrete is anticipated to experience a noticeable increase throughout the projected period due to the convenience the method offers for widespread deployment. When poured into the cracks, these substances react with the air or another concrete matrix embedded in the cracks to form hardened substances that fill the openings in the walls and other construction components.

The market prefers bacteria-based self-healing capsules because they have long lifespans and can continue functioning for over 100 years. At the same time, chemical-based capsules are less joint in self-healing applications since they may lose their healing properties over time.

- Infrastructure Category Takes the Lead

The infrastructure category held the largest self-healing concrete market share. It is anticipated to continue to rule the market during the forecast period due to increased investment in significant infrastructure projects.

Some concrete structures used in infrastructure projects such as bridges, buildings, and tunnels built on or in the ground are invariably buried in the surrounding soil. This construction is subjected to various ground conditions including diverse soil types, saturation regimes, and chemical exposure, which can affect the concrete and reduce the building's strength.

A huge amount must be invested in machinery, equipment, and capital to repair and maintain such infrastructure. There is an increased demand for more environmentally friendly building materials.

Large international corporations can also take advantage of the chance to engage in long-term infrastructure projects in developing nations, which are anticipated to increase demand for building supplies, including concrete, steel bars, and other materials. These elements are expected to support the segment's revenue growth.

Regional Analysis

- Europe Self-healing Concrete Market Takes the Charge

Europe self-healing concrete market is anticipated to account for the largest revenue share due to the increased emphasis on lowering the carbon impact of construction activities.

According to the European Commission, cement manufacturing accounted for around 9.5% of all CO2 emissions worldwide. Additionally, businesses in the area have increased their research expenditures, which has resulted in the creation of better and more potent self-healing concrete. For instance,

- A group of research scientists from the Politecnico di Milano and the Polytechnic University of Valencia (UPV) created a new self-healing concrete material in October 2021. It is ultra-resistant, 30% more durable, and has a higher yield threshold than traditional high-performance concrete.

The mixture contains elements that alter the material's potential for self-mending including crystalline additives, alumina nanofibers, and cellulose nanocrystals. These elements are anticipated to significantly contribute to the market's revenue growth in Europe in the coming years.

Fairfield’s Competitive Landscape Analysis

The self-healing concrete market is nascent but rapidly growing with several key players driving innovation and competition. Prominent companies like Basilisk, CEMEX, LafargeHolcim, and Sika AG are leading the market through advancements in self-healing technologies such as bacteria-based healing agents, microencapsulation, and chemical additives.

Leading firms are focusing on research and development to improve the efficiency and cost-effectiveness of self-healing concrete solutions. Start-ups and academic institutions also contribute to the competitive landscape, pushing novel innovations forward.

Strategic partnerships, collaborations, and government-funded projects are becoming crucial for gaining market share. However, high production costs and limited awareness still challenge widespread adoption, providing opportunities for emerging players to differentiate through cost-efficient solutions and education initiatives.

Key Market Companies

- Basilisk

- PENETRON

- Kryton

- Xypex Chemical Corporation

- Sika AG

- BASF SE

- Hycrete, Inc.

- Cemex

- Oscrete

- GCP Applied Technologies

- RPM International

Recent Industry Developments

- December 2023 -

Basilisk launched Basilisk Healing Agent M, a microbial-based solution specifically designed for marine and coastal applications, targeting infrastructure such as piers, bridges, and offshore structures. The product responds to saltwater environments by sealing cracks, significantly improving the durability of concrete in harsh marine conditions.

- November 2023 -

Sika AG, a prominent name in specialty chemicals, launched its self-healing concrete technology under the SikaProof® brand, targeting underground and waterproofing applications.

An Expert’s Eye

- Increasing demand for sustainable, low-maintenance construction materials drives the market's growth, especially in infrastructure and smart cities.

- Experts emphasize the need for further R&D to reduce production costs and make it more commercially viable for widespread adoption.

- Self-healing concrete is crucial for reducing the carbon footprint in construction by extending the lifespan of structures and reducing the need for repairs and replacements.

- Increasing governmental support for green and resilient infrastructure projects is expected to be a key market driver, furthering the adoption of self-healing materials globally.

Global Self-healing Concrete Market is Segmented as-

By Form

- Intrinsic

- Capsule Based

- Vascular

By Application

- Residential

- Industrial

- Commercial

- Infrastructure

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

1. Executive Summary

1.1. Global Self-healing Concrete Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019-2023

3.1. Global Self-healing Concrete, Production Output, by Region, 2019 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East & Africa

4. Global Self-healing Concrete Market Outlook, 2019 - 2031

4.1. Global Self-healing Concrete Market Outlook, by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Intrinsic

4.1.1.2. Capsule Based

4.1.1.3. Vascular

4.2. Global Self-healing Concrete Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Residential

4.2.1.2. Industrial

4.2.1.3. Commercial

4.2.1.4. Infrastructure

4.3. Global Self-healing Concrete Market Outlook, by Region, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. North America

4.3.1.2. Europe

4.3.1.3. Asia Pacific

4.3.1.4. Latin America

4.3.1.5. Middle East & Africa

5. North America Self-healing Concrete Market Outlook, 2019 - 2031

5.1. North America Self-healing Concrete Market Outlook, by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Intrinsic

5.1.1.2. Capsule Based

5.1.1.3. Vascular

5.2. North America Self-healing Concrete Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Residential

5.2.1.2. Industrial

5.2.1.3. Commercial

5.2.1.4. Infrastructure

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. North America Self-healing Concrete Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. U.S. Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.3.1.2. U.S. Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.3.1.3. Canada Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.3.1.4. Canada Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Self-healing Concrete Market Outlook, 2019 - 2031

6.1. Europe Self-healing Concrete Market Outlook, by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Intrinsic

6.1.1.2. Capsule Based

6.1.1.3. Vascular

6.2. Europe Self-healing Concrete Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Residential

6.2.1.2. Industrial

6.2.1.3. Commercial

6.2.1.4. Infrastructure

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Europe Self-healing Concrete Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Germany Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.2. Germany Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.3. U.K. Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.4. U.K. Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.5. France Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.6. France Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.7. Italy Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.8. Italy Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.9. Turkey Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.10. Turkey Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.11. Russia Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.12. Russia Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.13. Rest of Europe Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.14. Rest of Europe Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Self-healing Concrete Market Outlook, 2019 - 2031

7.1. Asia Pacific Self-healing Concrete Market Outlook, by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Intrinsic

7.1.1.2. Capsule Based

7.1.1.3. Vascular

7.2. Asia Pacific Self-healing Concrete Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Residential

7.2.1.2. Industrial

7.2.1.3. Commercial

7.2.1.4. Infrastructure

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Asia Pacific Self-healing Concrete Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. China Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.2. China Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.3. Japan Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.4. Japan Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.5. South Korea Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.6. South Korea Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.7. India Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.8. India Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.9. Southeast Asia Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.10. Southeast Asia Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.11. Rest of Asia Pacific Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.12. Rest of Asia Pacific Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Self-healing Concrete Market Outlook, 2019 - 2031

8.1. Latin America Self-healing Concrete Market Outlook, by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Intrinsic

8.1.1.2. Capsule Based

8.1.1.3. Vascular

8.2. Latin America Self-healing Concrete Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.2.1.1. Residential

8.2.1.2. Industrial

8.2.1.3. Commercial

8.2.1.4. Infrastructure

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Latin America Self-healing Concrete Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Brazil Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.2. Brazil Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.3. Mexico Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.4. Mexico Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.5. Argentina Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.6. Argentina Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.7. Rest of Latin America Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.8. Rest of Latin America Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Self-healing Concrete Market Outlook, 2019 - 2031

9.1. Middle East & Africa Self-healing Concrete Market Outlook, by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Intrinsic

9.1.1.2. Capsule Based

9.1.1.3. Vascular

9.2. Middle East & Africa Self-healing Concrete Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Residential

9.2.1.2. Industrial

9.2.1.3. Commercial

9.2.1.4. Infrastructure

9.2.1.5. Others

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Middle East & Africa Self-healing Concrete Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. GCC Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.2. GCC Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.3. South Africa Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.4. South Africa Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.5. Egypt Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.6. Egypt Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.7. Nigeria Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.8. Nigeria Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.9. Rest of Middle East & Africa Self-healing Concrete Market by Form, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.10. Rest of Middle East & Africa Self-healing Concrete Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Application vs Application Heatmap

10.2. Manufacturer vs Application Heatmap

10.3. Company Market Share Analysis, 2022

10.4. Competitive Dashboard

10.5. Company Profiles

10.5.1. Basilisk

10.5.1.1. Company Overview

10.5.1.2. Product Portfolio

10.5.1.3. Financial Overview

10.5.1.4. Business Strategies and Development

10.5.2. PENETRON

10.5.2.1. Company Overview

10.5.2.2. Product Portfolio

10.5.2.3. Financial Overview

10.5.2.4. Business Strategies and Development

10.5.3. Kryton

10.5.3.1. Company Overview

10.5.3.2. Product Portfolio

10.5.3.3. Financial Overview

10.5.3.4. Business Strategies and Development

10.5.4. Xypex Chemical Corporation

10.5.4.1. Company Overview

10.5.4.2. Product Portfolio

10.5.4.3. Financial Overview

10.5.4.4. Business Strategies and Development

10.5.5. Sika AG

10.5.5.1. Company Overview

10.5.5.2. Product Portfolio

10.5.5.3. Financial Overview

10.5.5.4. Business Strategies and Development

10.5.6. BASF SE

10.5.6.1. Company Overview

10.5.6.2. Product Portfolio

10.5.6.3. Financial Overview

10.5.6.4. Business Strategies and Development

10.5.7. Hycrete, Inc.

10.5.7.1. Company Overview

10.5.7.2. Product Portfolio

10.5.7.3. Financial Overview

10.5.7.4. Business Strategies and Development

10.5.8. Cemex

10.5.8.1. Company Overview

10.5.8.2. Product Portfolio

10.5.8.3. Financial Overview

10.5.8.4. Business Strategies and Development

10.5.9. Oscrete

10.5.9.1. Company Overview

10.5.9.2. Product Portfolio

10.5.9.3. Financial Overview

10.5.9.4. Business Strategies and Development

10.5.10. GCP Applied Technologies

10.5.10.1. Company Overview

10.5.10.2. Product Portfolio

10.5.10.3. Financial Overview

10.5.10.4. Business Strategies and Development

10.5.11. RPM International

10.5.11.1. Company Overview

10.5.11.2. Product Portfolio

10.5.11.3. Financial Overview

10.5.11.4. Business Strategies and Development

10.5.12. Akzo Nobel N.V.

10.5.12.1. Company Overview

10.5.12.2. Product Portfolio

10.5.12.3. Financial Overview

10.5.12.4. Business Strategies and Development

10.5.13. Bouygues Construction

10.5.13.1. Company Overview

10.5.13.2. Product Portfolio

10.5.13.3. Financial Overview

10.5.13.4. Business Strategies and Development

10.5.14. Breedom Group plc

10.5.14.1. Company Overview

10.5.14.2. Product Portfolio

10.5.14.3. Financial Overview

10.5.14.4. Business Strategies and Development

10.5.15. Acciona

10.5.15.1. Company Overview

10.5.15.2. Product Portfolio

10.5.15.3. Financial Overview

10.5.15.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Form Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |