Global Semiconductor Intellectual Property (IP) Market Forecast

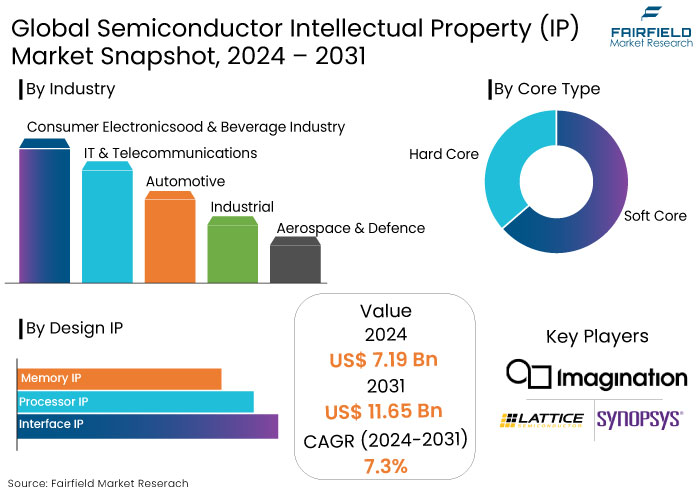

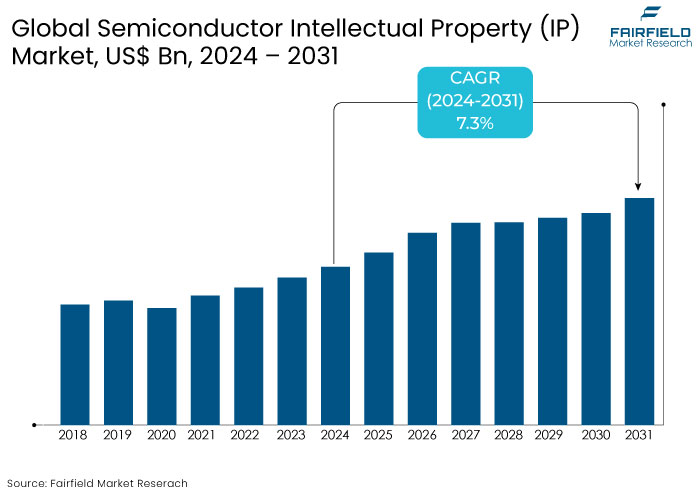

- The semiconductor intellectual property (IP) market is projected to reach a size of US$11.65 Bn by 2031, showing significant growth from the US$7.19 Bn obtained in 2024.

- The market for semiconductor intellectual property (IP) is expected to record a CAGR of 7.3% from 2024 to 2031.

Semiconductor Intellectual Property (IP) Market Insights

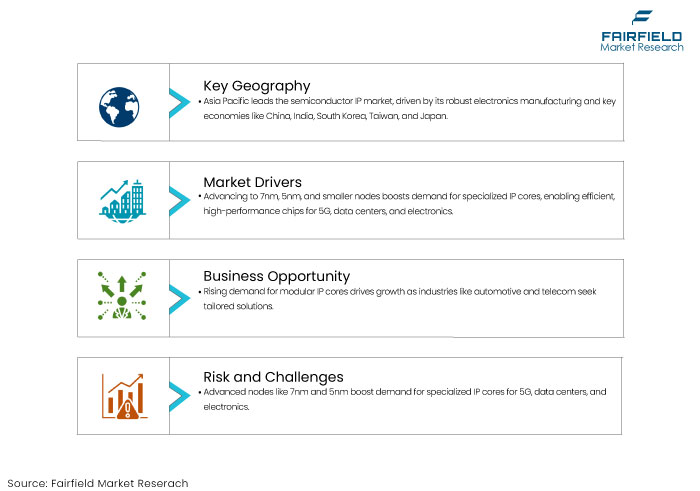

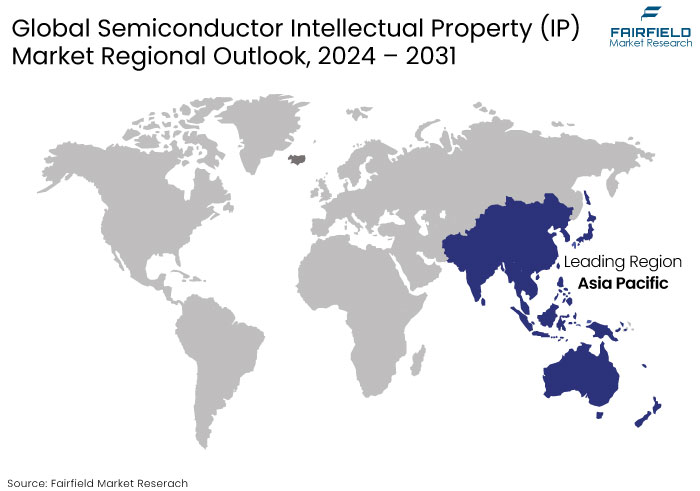

- Asia Pacific dominates semiconductor intellectual property (IP) market, attributed to its strong electronics manufacturing base.

- Hard IP cores are widely preferred for reliability and performance in high-speed applications.

- Increasing demand for application-specific designs has boosted the adoption of modular and customizable IP solutions across industries.

- Processor IPs dominate the design IP segmentation of the market, holding the largest market share.

- The expansion of 5G networks is a key driver, requiring advanced semiconductor IPs for connectivity and processing capabilities.

- Open-source platforms like RISC-V are disrupting the market, offering cost-effective and modular alternatives to traditional proprietary IPs.

- Growth in AI, quantum computing, and edge technologies will create new opportunities for advanced IP solutions.

- Primary applications include automotive, telecommunications, data centers, and edge computing.

A Look Back and a Look Forward - Comparative Analysis

The semiconductor intellectual property (IP) market experienced robust growth during the period from 2019 to 2023. Market growth during this period fueled by the surge in demand for consumer electronics, the proliferation of IoT devices, and advancements in wireless technologies such as 5G.

Key trends included increasing adoption of hard IP cores in SoC designs and growing interest in AI and machine learning applications. Global disruptions like the pandemic temporarily strained supply chains, but the demand for semiconductors in remote work devices and healthcare solutions accelerated the market expansion further.

The market is projected to grow accelerated over the forecast period due to increasing investments in advanced technologies like autonomous vehicles, quantum computing, and edge computing.

Government initiatives like the U.S. CHIPS Act and similar policies in Asia and Europe are expected to address supply chain vulnerabilities and foster domestic production. The market will likely shift toward soft IP cores, driven by demand for flexible and reusable designs. Emerging regions, including Latin America and Africa, may contribute to market expansion as tech adoption rises in these areas.

Key Growth Determinants

- Transition to Advanced Semiconductor Nodes Remains a Crucial Market Driving Factor

The continuous evolution of semiconductor fabrication processes, particularly the transition to advanced nodes such as 7nm, 5nm, and beyond, has driven the need for highly specialized IP cores. Advanced nodes allow for small, energy-efficient, and higher-performing chips, essential for 5G networks, data centres, and consumer electronics applications.

Designing at advanced scales is highly complex, and semiconductor IPs provide pre-verified solutions that significantly reduce time-to-market and development costs. As the industry pushes toward even smaller nodes, the reliance on semiconductor IPs for innovation and scalability becomes even more pronounced.

- Proliferation of IoT and Connected Devices

The rapid expansion of the Internet of Things (IoT) has been a transformative force in the semiconductor intellectual property (IP) market, creating a surge in demand for specialized and efficient IP cores. IoT devices, from smart home appliances and wearable technology to industrial automation systems and healthcare devices, require compact, low-power semiconductors capable of seamless communication.

Semiconductor intellectual property is vital in meeting these requirements, particularly through reusable, pre-verified soft IP cores. One of the key characteristics of IoT applications is their diverse functionality, which demands customizability in hardware design. Semiconductor IPs provide the building blocks for processors, connectivity modules, and sensors that can be tailored to specific IoT needs.

The exponential growth of connected devices, projected to exceed tens of billions globally, has also driven demand for robust communication protocols, such as Wi-Fi, Bluetooth, Zigbee, and LoRa. Semiconductor IP enables these protocols to be integrated directly into chip designs, facilitating seamless connectivity.

The rise of edge computing, which processes data closer to IoT devices, has increased the demand for semiconductor IPs capable of handling real-time analytics and AI-driven tasks.

Key Growth Barriers

- High Costs and Complexity of IP Development

One significant restraint in the semiconductor intellectual property (IP) market is the high cost and complexity of developing advanced IP cores. Designing semiconductor IPs for cutting-edge nodes such as 5nm and 3nm requires specialized tools, highly skilled engineers, and extensive validation processes to ensure compatibility and performance. These requirements lead to increased expenses for both development and licensing, making it difficult for small companies and start-ups to compete.

The verification and testing of IP cores for various fabrication processes add further layers of complexity and cost. It limits the accessibility of market, as only larger companies with substantial resources can afford to participate in advanced IP development. As the demand for more sophisticated functionalities grows, these challenges may slow the pace of innovation and adoption, particularly for smaller players in the industry.

- Intellectual Property Infringement and Licensing Issues

Intellectual property infringement and licensing disputes pose significant challenges to the semiconductor intellectual property (IP) market. As the industry relies significantly on the sharing and licensing IP cores, the risk of unauthorized use and patent violations increases.

IP theft or improper licensing can lead to costly legal battles, eroding trust between companies and discouraging innovation. Enforcing licensing agreements becomes particularly challenging for companies operating in regions with weak IP protection laws, further complicating market dynamics.

Disagreements over royalty rates and licensing terms can delay product development and commercialization, impacting the overall market growth. As the reliance on IP sharing continues to grow, these legal and regulatory hurdles present a substantial restraint for the semiconductor IP industry.

Semiconductor Intellectual Property (IP) Market Trends and Opportunities

- Shift Toward Customizable and Modular IP Solutions

One prominent trend in the semiconductor intellectual property (IP) market is the increasing demand for customizable and modular IP solutions. As automotive, healthcare, and telecommunications industries adopt more complex and diverse applications, the need for IP cores tailored to specific requirements has grown.

Unlike generic IPs, customizable cores allow developers to optimize performance, power consumption, and size for niche applications. Automotive applications often require IPs optimized for real-time processing and safety-critical operations, while healthcare devices demand ultra-low-power IPs for wearable and implantable solutions.

Modular IP solutions support this trend by enabling designers to integrate only the necessary components, reducing design complexity and costs. The rise of RISC-V, an open-source instruction set architecture (ISA), exemplifies this movement, as it offers developers a highly modular and adaptable platform. As customization and modularity become integral to competitive differentiation, this trend will shape the future growth of the market.

- Growth in Edge Computing and AI Applications

Edge computing and artificial intelligence (AI) applications present a significant growth opportunity for the semiconductor intellectual property (IP) market. Edge devices, which process data locally rather than relying on centralized cloud servers, require specialized semiconductor IPs that deliver high performance while maintaining low power consumption. It creates opportunities for IP developers to provide solutions optimized for tasks like real-time analytics, image recognition, and natural language processing at the edge.

AI, in particular, drives demand for specialized IPs such as neural network processors and AI accelerators. These components are critical for powering autonomous vehicles, robotics, smart cities, and other AI-driven technologies. Integrating AI capabilities into consumer electronics and industrial systems opens a vast market for IP cores tailored to machine learning and deep learning algorithms.

As the adoption of edge computing and AI technologies grows, the demand for sophisticated, efficient, and scalable semiconductor IP solutions is expected to increase. Companies innovate by providing pre-verified, AI-optimized IPs stand to capture a substantial share of this expanding market.

How Does Regulatory Scenario Shape the Industry?

The regulatory scenario shapes the semiconductor intellectual property (IP) market. Governments and international bodies are increasingly focusing on policies to safeguard intellectual property rights, ensure compliance with global trade norms, and promote the growth of domestic semiconductor industries.

Regulations to protect IP against infringement and unauthorized use are becoming strict, particularly in regions like North America and Europe, where the legal frameworks for IP enforcement are well-established. These measures enhance trust among stakeholders and encourage investment in IP development.

Initiatives such as the U.S. CHIPS and Science Act aim to strengthen domestic semiconductor supply chains by providing financial incentives and creating a favourable environment for IP creators. Countries in Asia Pacific, such as China and India, are introducing policies to boost local semiconductor innovation while protecting IP rights to attract global investment.

Segment Covered in the Report

- Processor IPs Dominate with Increasing Demand for Advanced Consumer Electronics

Processor IPs play a pivotal role in semiconductor intellectual property (IP) market, driven by the growing demand for advanced consumer electronics and the need for efficient, high-performance processing solutions. Processor IPs are essential in developing various consumer electronics, including smartphones, tablets, and laptops.

The increasing demand for these smart and IoT devices has significantly contributed to the growth of the processor IP segment. The segment is further expected to exhibit at a CAGR of 8.3% during the forecast period, maintaining its dominance in the market.

The widespread adoption of processor IPs is driven by their ability to provide pre-designed and verified processor cores, enabling designers to integrate processing functionality into system-on-chips (SoCs) efficiently and cost-effectively. It is particularly crucial in the fast-evolving consumer electronics market, where rapid time-to-market and adaptability to new technologies like artificial intelligence (AI) and 5G are essential.

- Hard Core Type Segment Maintains Primacy with Growing Demand for Processors in Consumer Electronics

The dominant position of the hard core segment in the semiconductor intellectual property (IP) market is attributed to the increasing demand for processors in consumer electronics. These electronics include laptops and computers, requiring efficient data transfer and robust performance.

Hard cores, or hard IPs, are pre-designed and pre-verified blocks of logic or functionality with fixed physical layouts tailored for specific manufacturing processes. These cores offer predictable performance metrics, including speed, power consumption, and area, making them highly reliable for integrating complex system-on-chip (SoC) designs.

The preference for hard cores stems from their ability to deliver consistent and optimized performance, essential in applications where timing, power efficiency, and space constraints are critical. By utilizing hard IPs, manufacturers can achieve fast time-to-market and reduce the risks associated with design variability, as these cores have been thoroughly tested and validated for specific fabrication processes.

Regional Analysis

- Asia Pacific Semiconductor Intellectual Property (IP) Market Emerges Lucrative

Asia Pacific dominates the semiconductor intellectual property (IP) market, holding the largest market share, primarily due to its vast electronics manufacturing industry. The region is home to several key economies like India, China, South Korea, Taiwan, and Japan, which play pivotal roles in driving the demand and production of semiconductor technologies.

Leading semiconductor companies like TSMC (Taiwan), Samsung (South Korea), and SMIC (China) are headquartered in Asia Pacific. These companies are significantly involved in advanced semiconductor design and manufacturing, contributing to adopting IP cores in various applications, from processors to memory solutions.

The region is at the forefront of technological developments in 5G, artificial intelligence, and IoT (Internet of Things). Such advancements require sophisticated semiconductor IP to enable high-performance computing, efficient data processing, and enhanced connectivity.

Asia Pacific has one of the world's most extensive consumer bases for electronic devices with a large and growing middle-class population. The demand for feature-rich and high-performing electronics increases the necessity for advanced semiconductor IP solutions.

- U.S. Remains a Key Contributor to Drive North America Market

The region's prominence is attributed to the strong presence of leading tech companies and semiconductor designers. The U.S. is home to global players that drive significant innovation through research and development investments. Supportive government policies have also encouraged the development of indigenous semiconductor technologies.

The increasing demand for connected devices and advancements in wireless technology have propelled the adoption of semiconductor IPs in various applications, including telecommunications and data centers.

North America, particularly the United States, is at the forefront of cutting-edge technologies such as artificial intelligence (AI), autonomous vehicles, cloud computing, and advanced telecommunications. Such high-end technologies rely significantly on semiconductor IP for functionality, performance, and integration. The region remains a global leader in semiconductor design and intellectual property, strongly emphasizing high-performance and specialized IPs for emerging technologies.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the semiconductor intellectual property (IP) market is characterized by the presence of key global players such as ARM Holdings, Synopsys, Cadence Design Systems, and Imagination Technologies. These companies dominate the market through robust portfolios of hard and soft IP cores, catering to diverse applications, including consumer electronics, automotive, and IoT.

The competitive market is driven by continuous innovation in advanced IP solutions for AI, 5G, and edge computing. Small players and start-ups focus on niche areas like RISC-V architecture, offering modular and cost-effective solutions.

Strategic collaborations, mergers, and acquisitions are common as companies aim to expand portfolios and geographical presence. Rapid technological advancements and increasing demand for customized IP solutions shape the landscape.

Key Market Companies

- Arm Limited

- Synopsys, Inc.

- Cadence Design Systems, Inc.

- Imagination Technologies

- CEVA, Inc.

- Lattice Semiconductor

- Rambus

- eMemory Technology Inc.

- Silicon Storage Technology, Inc.

- VeriSilicon

- Achronix Semiconductor Corporation

- ALPHAWAVE SEMI

- Analog Bits

- ARTERIS, INC

- Frontgrade Gaisler

- Dolphin Design

- Dream Chip Technologies GmbH

- Eureka Technology, Inc.

Recent Industry Developments

- In March 2023, Rambus announced the availability of IP cores, including Arm CryptoCell and CryptoIsland Root of Trust cores, as components of its security IP portfolio, allowing clients to utilize a broad array of security IP solutions customized for their specific architecture.

- In September 2023, VeriSilicon stated that Inuitive, a prominent vision-on-chip processing firm, has integrated its dual-channel Image Signal Processing (ISP) IP, characterized by low latency and low power consumption, into its mass-produced NU4100 vision AI processor.

An Expert’s Eye

- Semiconductor IP is a cornerstone for innovations in AI, 5G, IoT, and autonomous vehicles, enabling faster, more efficient, and cost-effective chip development.

- The growing preference for customizable and modular IP solutions to meet application-specific requirements in sectors like automotive and healthcare drives the semiconductor intellectual property (IP) market forward.

- IP law specialists noted that intellectual property infringement and inconsistent regulatory enforcement across regions remain significant concerns.

- The rise of open-source platforms like RISC-V is seen as a disruptive trend, promoting flexibility and reducing licensing costs for developers.

Global Semiconductor Intellectual Property (IP) Market is Segmented as-

By Design IP

- Interface IP

- Processor IP

- Memory IP

By Core Type

- Soft Core

- Hard Core

By Revenue Source

- Royalty

- Licensing

By Industry

- Consumer Electronics

- IT & Telecommunications

- Automotive

- Industrial

- Aerospace & Defence

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

- Be

1. Executive Summary

1.1. Global Semiconductor Intellectual Property (IP) Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Semiconductor Intellectual Property (IP) Market Outlook, 2019 - 2031

3.1. Global Semiconductor Intellectual Property (IP) Market Outlook, by Design IP, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Application Specific Integrated Circuit (ASIC) IP

3.1.1.2. Interface IP

3.1.1.3. Graphics IP (GPU IP)

3.1.1.4. Memory IP

3.1.1.5. Processor IP

3.1.1.6. Verification IP

3.2. Global Semiconductor Intellectual Property (IP) Market Outlook, by IP Source, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Licensing

3.2.1.2. Royalty

3.3. Global Semiconductor Intellectual Property (IP) Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Semiconductor Intellectual Property (IP) Market Outlook, 2019 - 2031

4.1. North America Semiconductor Intellectual Property (IP) Market Outlook, by Design IP, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Application Specific Integrated Circuit (ASIC) IP

4.1.1.2. Interface IP

4.1.1.3. Graphics IP (GPU IP)

4.1.1.4. Memory IP

4.1.1.5. Processor IP

4.1.1.6. Verification IP

4.2. North America Semiconductor Intellectual Property (IP) Market Outlook, by IP Source, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Licensing

4.2.1.2. Royalty

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Semiconductor Intellectual Property (IP) Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. U.S. Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

4.3.1.2. U.S. Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

4.3.1.3. Canada Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

4.3.1.4. Canada Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Semiconductor Intellectual Property (IP) Market Outlook, 2019 - 2031

5.1. Europe Semiconductor Intellectual Property (IP) Market Outlook, by Design IP, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Application Specific Integrated Circuit (ASIC) IP

5.1.1.2. Interface IP

5.1.1.3. Graphics IP (GPU IP)

5.1.1.4. Memory IP

5.1.1.5. Processor IP

5.1.1.6. Verification IP

5.2. Europe Semiconductor Intellectual Property (IP) Market Outlook, by IP Source, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Licensing

5.2.1.2. Royalty

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Semiconductor Intellectual Property (IP) Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Germany Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

5.3.1.2. Germany Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

5.3.1.3. U.K. Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

5.3.1.4. U.K. Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

5.3.1.5. France Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

5.3.1.6. France Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

5.3.1.7. Italy Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

5.3.1.8. Italy Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

5.3.1.9. Turkey Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

5.3.1.10. Turkey Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

5.3.1.11. Russia Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

5.3.1.12. Russia Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

5.3.1.13. Rest of Europe Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

5.3.1.14. Rest of Europe Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Semiconductor Intellectual Property (IP) Market Outlook, 2019 - 2031

6.1. Asia Pacific Semiconductor Intellectual Property (IP) Market Outlook, by Design IP, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Application Specific Integrated Circuit (ASIC) IP

6.1.1.2. Interface IP

6.1.1.3. Graphics IP (GPU IP)

6.1.1.4. Memory IP

6.1.1.5. Processor IP

6.1.1.6. Verification IP

6.2. Asia Pacific Semiconductor Intellectual Property (IP) Market Outlook, by IP Source, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Licensing

6.2.1.2. Royalty

6.2.2. Others BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Semiconductor Intellectual Property (IP) Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. China Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

6.3.1.2. China Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

6.3.1.3. Japan Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

6.3.1.4. Japan Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

6.3.1.5. South Korea Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

6.3.1.6. South Korea Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

6.3.1.7. India Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

6.3.1.8. India Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

6.3.1.9. Southeast Asia Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

6.3.1.10. Southeast Asia Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

6.3.1.11. Rest of Asia Pacific Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

6.3.1.12. Rest of Asia Pacific Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Semiconductor Intellectual Property (IP) Market Outlook, 2019 - 2031

7.1. Latin America Semiconductor Intellectual Property (IP) Market Outlook, by Design IP, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Application Specific Integrated Circuit (ASIC) IP

7.1.1.2. Interface IP

7.1.1.3. Graphics IP (GPU IP)

7.1.1.4. Memory IP

7.1.1.5. Processor IP

7.1.1.6. Verification IP

7.2. Latin America Semiconductor Intellectual Property (IP) Market Outlook, by IP Source, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Licensing

7.2.1.2. Royalty

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Semiconductor Intellectual Property (IP) Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Brazil Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

7.3.1.2. Brazil Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

7.3.1.3. Mexico Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

7.3.1.4. Mexico Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

7.3.1.5. Argentina Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

7.3.1.6. Argentina Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

7.3.1.7. Rest of Latin America Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

7.3.1.8. Rest of Latin America Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Semiconductor Intellectual Property (IP) Market Outlook, 2019 - 2031

8.1. Middle East & Africa Semiconductor Intellectual Property (IP) Market Outlook, by Design IP, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Application Specific Integrated Circuit (ASIC) IP

8.1.1.2. Interface IP

8.1.1.3. Graphics IP (GPU IP)

8.1.1.4. Memory IP

8.1.1.5. Processor IP

8.1.1.6. Verification IP

8.2. Middle East & Africa Semiconductor Intellectual Property (IP) Market Outlook, by IP Source, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Licensing

8.2.1.2. Royalty

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Semiconductor Intellectual Property (IP) Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. GCC Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

8.3.1.2. GCC Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

8.3.1.3. South Africa Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

8.3.1.4. South Africa Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

8.3.1.5. Egypt Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

8.3.1.6. Egypt Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

8.3.1.7. Nigeria Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

8.3.1.8. Nigeria Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

8.3.1.9. Rest of Middle East & Africa Semiconductor Intellectual Property (IP) Market by Design IP, Value (US$ Bn), 2019 - 2031

8.3.1.10. Rest of Middle East & Africa Semiconductor Intellectual Property (IP) Market by IP Source, Value (US$ Bn), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2023

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. Imagination Technologies

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. Rambus Inc

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. Arm Ltd

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Cadence Design Systems

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. Ceva Inc

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Takumi Corporation

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. Nvidia Corporation

9.3.7.1. Company Overview

9.3.7.2. Product Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. Qualcomm

9.3.8.1. Company Overview

9.3.8.2. Product Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. TES Electronic Solutions GmbH

9.3.9.1. Company Overview

9.3.9.2. Product Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. VeriSilicon/Vivante

9.3.10.1. Company Overview

9.3.10.2. Product Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. Digital Media Professionals

9.3.11.1. Company Overview

9.3.11.2. Product Portfolio

9.3.11.3. Financial Overview

9.3.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Design IP Coverage |

|

|

Core Type Coverage |

|

|

Revenue Source Coverage |

|

|

Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |