Global Semiconductor Testing Services Market Forecast

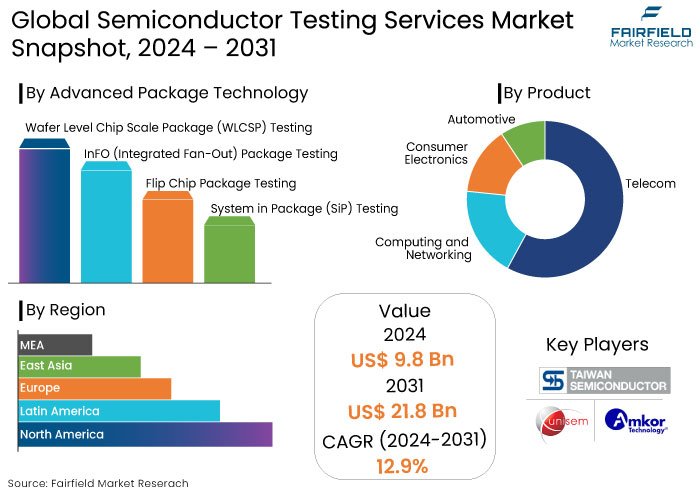

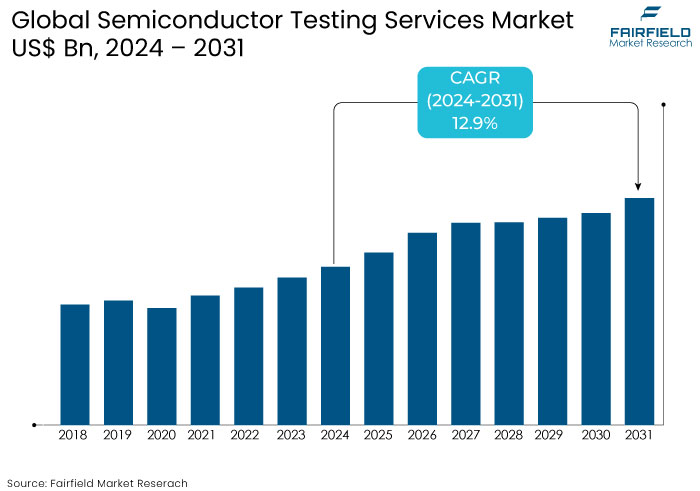

- The semiconductor testing services market is poised to reach a size of US$21.8 Bn by 2031, showing significant growth from the US$9.8 Bn obtained in 2024.

- The market is anticipated to exhibit a significant expansion rate, with an estimated CAGR of 12.9% from 2024 to 2031

Semiconductor Testing Services Market Insights

- The surge in demand for consumer electronics, automotive applications, and IoT devices contributes to the semiconductor testing services market, necessitating rigorous quality assurance processes.

- Outsourcing has emerged as a significant trend in the market, as companies increasingly turn to specialized firms for testing services, reducing operational costs.

- Innovations in semiconductor technologies, including smaller geometries and 5G integration, drive the need for advanced testing services to ensure quality and reliability.

- The market growth in North America and the Asia Pacific is attributed to significant investments in semiconductor manufacturing and testing infrastructure.

- North America dominates the global market with the presence of leading competitors in the region.

- Consumer electronics emerges as the major application segment over the forecast period.

A Look Back and a Look Forward - Comparative Analysis

The semiconductor testing services market has experienced significant growth leading up to 2023, driven by advancements in semiconductor technology and the increasing complexity of integrated circuits. From 2019 to 2023, the market recorded a steady CAGR rate as companies prioritized quality assurance in response to rising consumer demand for electronic devices, automotive applications, and IoT solutions.

The transition to small manufacturing nodes will fuel the market growth during the forecast period with growing demand for 5G technology, and the increasing reliance on outsourced testing services.

As semiconductor companies focus on core manufacturing processes, they will likely partner with specialized testing service providers to enhance efficiency and reduce costs. Asia Pacific region, in particular, is expected to play a crucial role in this growth, supported by substantial investments in semiconductor manufacturing and testing infrastructure.

Key Growth Determinants

- Increasing Demand for Advanced Semiconductor Devices

The growing complexity and functionality of semiconductor devices are major drivers of the semiconductor testing services market. As technology advances, integrated circuits (ICs) are becoming more intricate, necessitating sophisticated testing methodologies to ensure reliability and performance, which is particularly true for applications in consumer electronics, automotive systems, and IoT devices, where performance is critical.

The transition to smaller manufacturing nodes, such as 5nm and 3nm technologies, has further intensified the need for comprehensive testing services to identify potential defects and ensure that products meet stringent quality standards. According to various market reports, the semiconductor industry is projected to invest heavily in R&D and testing capabilities, fostering growth in testing services as companies seek to maintain a competitive edge in a rapidly evolving landscape.

- Rise of Outsourcing Testing Services

Outsourcing semiconductor testing services has been a key driving factor and an evolving trend, significantly contributing to semiconductor testing services market growth. Many semiconductor manufacturers increasingly rely on specialized testing service providers to manage the complexities of testing, allowing them to concentrate on core production processes. This shift is driven by the need for flexibility and cost-efficiency in an industry characterized by rapid technological changes.

By partnering with experienced testing service companies, semiconductor firms can leverage advanced testing technologies and expertise without investing heavily in their infrastructure. It reduces operational costs and enhances the quality and reliability of semiconductor products, which is critical in applications where safety and performance are paramount.

Reports indicate that this outsourcing model is expected to gain traction, further propelling the market in the coming years.

Key Growth Barriers

- Complexity of Semiconductor Devices

The increasing complexity of semiconductor devices presents a significant challenge for semiconductor testing services market. As technology advances, semiconductor chips become more intricate, integrating multiple functions within smaller physical spaces. Such complexity complicates the testing process, requiring advanced testing methodologies and equipment.

Traditional testing services may need help to keep pace with these developments, leading to longer testing cycles and higher costs. Furthermore, the need for specialized expertise to perform these tests can limit the number of service providers capable of meeting industry standards. As a result, semiconductor manufacturers may need more time to market for new products, potentially stalling growth in the semiconductor testing services market.

Companies must invest heavily in research and development to enhance testing technologies, which may strain resources and impact overall profitability.

- Supply Chain Disruptions Pose a Significant Restraint

Supply chain disruptions pose a significant restraint for the semiconductor testing services market growth. The semiconductor industry relies mainly on a global supply chain for raw materials, components, and specialized equipment.

Disruptions caused by geopolitical tensions, natural disasters, or pandemics can lead to shortages of critical components required for testing. Such disruptions delay testing processes and increase operational costs due to the need for alternative sourcing solutions or expedited shipping.

The semiconductor industry's cyclical nature can lead to periods of oversupply followed by shortages, creating volatility in demand for testing services. As companies strive to maintain efficiency and cost-effectiveness, any interruption in the supply chain can significantly impact their ability to deliver timely and comprehensive testing services, hindering market growth.

Semiconductor Testing Services Market Trends and Opportunities

- Rise of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies in semiconductor testing presents a significant opportunity for transformation. Such technologies can enhance the accuracy and efficiency of testing processes by analysing large datasets generated during testing.

AI algorithms can identify patterns and anomalies that human testers might overlook, leading to more reliable results. Additionally, ML can optimize testing parameters in real time, allowing for adaptive testing processes that improve overall performance.

As AI and ML continue to advance, their application in semiconductor testing can lead to reduced time-to-market for new products, improved yield rates, and lower testing costs. These factors encourage testing service providers to invest in AI-driven solutions, positioning themselves as leaders in a rapidly evolving market.

- Increased Focus on Quality and Reliability

The demand for high-quality and reliable testing services is growing as semiconductor devices are increasingly integrated into critical applications such as automotive, healthcare, and industrial automation. Regulatory standards and customer expectations drive semiconductor manufacturers to prioritize product quality assurance.

Testing services offering advanced quality and reliability testing solutions, including environmental testing, failure analysis, and long-term reliability assessments, will find significant opportunities in the semiconductor testing services market.

The focus on quality helps manufacturers mitigate risks associated with product failures and enhances their reputation and competitiveness in the market. By developing comprehensive testing solutions emphasizing quality and reliability, testing service providers can differentiate themselves and capture a larger market share.

How Does Regulatory Scenario Shape the Industry?

The regulatory scenario significantly shapes the semiconductor testing services market by imposing stringent standards and guidelines that manufacturers must adhere to for product safety, reliability, and performance.

Regulatory bodies across different regions, such as the U.S. Federal Communications Commission (FCC) and the European Union’s CE marking, enforce compliance requirements for semiconductor devices used in critical applications, including telecommunications, and healthcare. Such regulations necessitate thorough testing to ensure that semiconductors meet performance criteria and do not pose safety risks. Consequently, semiconductor testing services must align their methodologies with these regulations, driving the demand for specialized testing solutions that can meet various compliance standards.

As the semiconductor industry faces growing scrutiny regarding environmental impact, regulations surrounding sustainability and eco-friendliness are also emerging. Testing services must incorporate assessments related to material usage, energy efficiency, and recyclability to comply with these regulations.

The evolving regulatory landscape compels semiconductor testing service providers to invest in advanced testing technologies and training, ensuring they can provide comprehensive compliance testing while enhancing their credibility and marketability. Ultimately, stringent regulatory requirements drive innovation and expansion in the semiconductor testing services market.

Segments Covered in the Report

- Wafer Level Chip Scale Package (WLCSP) Remains a Dominant Advanced Packaging Technology

WLCSP offers several advantages that make it a preferred choice for manufacturers, particularly in miniaturization and cost-efficiency. WLCSP allows for a very compact package size, making it ideal for applications where space is a constraint, such as mobile devices and wearables.

Since WLCSP is packaged at the wafer level, it eliminates the need for additional packaging steps, significantly reducing the overall footprint of the semiconductor device.

The direct connection of the die to the printed circuit board (PCB) without an interposer results in shorter electrical paths, which leads to improved signal integrity and performance, making WLCSP suitable for high-speed applications. Additionally, the technology has inherent thermal advantages, aiding in better heat dissipation.

- Consumer Electronics Find the Best Application in Semiconductor Testing Services

The consumer electronics market experiences massive production volumes, particularly for smartphones, tablets, wearables, and home appliances. This scale creates a significant demand for semiconductor testing services to ensure that millions of devices meet quality standards.

Continuous technological advancements (e.g., new features, improved user interfaces, and enhanced performance) necessitate rigorous testing to validate new semiconductor designs. Companies need to test and roll out new products to stay competitive quickly.

Consumers expect high-quality, reliable products. Any defects in semiconductor components can lead to product failures, negatively impacting brand reputation. Therefore, comprehensive testing is critical to ensuring that devices function as intended.

The integration of technologies like artificial intelligence (AI), the Internet of Things (IoT), and augmented reality (AR) into consumer electronics increases the complexity of semiconductor components. Advanced testing services are needed to verify that these integrated systems work seamlessly.

Regional Analysis

- North America Set to Lead the Market

North America is the dominant region semiconductor testing services market, driven primarily by the presence of key technological companies and a robust semiconductor ecosystem. The United States is home to many leading semiconductor manufacturers, design firms, and research institutions, fostering innovation and development in semiconductor technologies.

The demand for semiconductor testing services is further propelled by the rapid growth of advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and 5G telecommunications. These technologies require highly reliable and efficient semiconductor components, necessitating rigorous testing to ensure performance and compliance with industry standards.

North America's significant investment in research and development and advanced manufacturing capabilities allows for developing cutting-edge testing methodologies and equipment. As industries continue to innovate and demand high quality and reliable electronic devices, North America market is expected to maintain its leadership position in the coming years.

Fairfield’s Competitive Landscape Analysis

The semiconductor testing services market is highly competitive, with key players focusing on innovation, quality assurance, and advanced testing technologies to maintain their market position.

Leading companies such as Advantest Corporation, ASE Group, Amkor Technology, and STATS ChipPAC play pivotal roles, leveraging extensive expertise and strong client relationships with leading semiconductor manufacturers. Small and regional players also contribute by offering specialized services or cost-effective solutions in targeted markets.

The demand for complex testing shapes the competitive landscape due to technological advancements, such as 5G, AI, IoT, and automotive electronics. To differentiate themselves, companies invest in automation, machine learning, and efficient testing systems to enhance throughput and precision, aiming to meet stringent quality standards and reduce time-to-market for clients.

Key Market Companies

- JCET Group Co., Ltd.

- Taiwan Semiconductor Manufacturing Company Limited

- Unisem

- ASE Group

- Amkor Technology

- Siliconware Precision Industries Co., Ltd.

- Powertech Technology Inc.

- Bluetest Testservice GmbH

- Micross

- Integra Technologies

- Presto Engineering

- UL Solutions

- EAG Laboratories

- Criteria Labs

- ATS Engineering

Recent Industry Developments

- In January 2024, Intel and TSMC expanded operations to include advanced packaging facilities in Japan. TSMC, in partnership with Sony and Toyota, invested in two new Japanese facilities, aiming to enhance its chip-on-wafer-on-substrate (CoWoS) technology, which is crucial for high-demand AI applications

- In October 2023, Samsung Electronics ramped up production at its semiconductor facilities to meet increased demand from the AI sector. However, Samsung and other chipmakers, including SK Hynix, implemented strategic production cuts to address market overstock and rebalance inventory in response to fluctuating demand.

An Expert’s Eye

- The increasing complexity of semiconductor chips will drive demand for specialized, high-precision testing solutions.

- Expansion in key regions like Japan and North America, coupled with strategic partnerships among leading players like TSMC and Intel, positions the semiconductor testing services market at high level.

- With electric vehicles and autonomous driving technologies progressing, experts emphasize the importance of robust testing protocols for automotive-grade chips.

- High standards for durability and safety in extreme conditions make the automotive sector a lucrative area for testing services.

Global Semiconductor Testing Services Market is Segmented as-

By Advanced Package Technology

- Wafer Level Chip Scale Package (WLCSP) Testing

- InFO (Integrated Fan-Out) Package Testing

- Flip Chip Package Testing

- System in Package (SiP) Testing

By Application

- Telecom

- Computing and Networking

- Consumer Electronics

- Automotive

By Region

- North America

- Latin America

- Europe

- East Asia

- The Middle East and Africa

1. Executive Summary

1.1. Global Semiconductor Testing Services Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Semiconductor Testing Services Market Outlook, 2019 - 2031

3.1. Global Semiconductor Testing Services Market Outlook, by Service, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Assembly & Packaging Services

3.1.1.2. Copper Wire & Gold Wire Bonding

3.1.1.3. Flip Chip

3.1.1.4. Wafer Level Packaging

3.1.1.5. TSV

3.1.1.6. Others

3.1.1.7. Testing Services

3.2. Global Semiconductor Testing Services Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Communication

3.2.1.2. Computing & Networking

3.2.1.3. Consumer Electronics

3.2.1.4. Industrial

3.2.1.5. Automotive Electronics

3.3. Global Semiconductor Testing Services Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Semiconductor Testing Services Market Outlook, 2019 - 2031

4.1. North America Semiconductor Testing Services Market Outlook, by Service, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Assembly & Packaging Services

4.1.1.2. Copper Wire & Gold Wire Bonding

4.1.1.3. Flip Chip

4.1.1.4. Wafer Level Packaging

4.1.1.5. TSV

4.1.1.6. Others

4.1.1.7. Testing Services

4.2. North America Semiconductor Testing Services Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Communication

4.2.1.2. Computing & Networking

4.2.1.3. Consumer Electronics

4.2.1.4. Industrial

4.2.1.5. Automotive Electronics

4.3. North America Semiconductor Testing Services Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. U.S. Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

4.3.1.2. U.S. Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

4.3.1.3. Canada Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

4.3.1.4. Canada Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Semiconductor Testing Services Market Outlook, 2019 - 2031

5.1. Europe Semiconductor Testing Services Market Outlook, by Service, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Assembly & Packaging Services

5.1.1.2. Copper Wire & Gold Wire Bonding

5.1.1.3. Flip Chip

5.1.1.4. Wafer Level Packaging

5.1.1.5. TSV

5.1.1.6. Others

5.1.1.7. Testing Services

5.2. Europe Semiconductor Testing Services Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Communication

5.2.1.2. Computing & Networking

5.2.1.3. Consumer Electronics

5.2.1.4. Industrial

5.2.1.5. Automotive Electronics

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Semiconductor Testing Services Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Germany Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

5.3.1.2. Germany Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

5.3.1.3. U.K. Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

5.3.1.4. U.K. Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

5.3.1.5. France Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

5.3.1.6. France Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

5.3.1.7. Italy Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

5.3.1.8. Italy Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

5.3.1.9. Turkey Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

5.3.1.10. Turkey Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

5.3.1.11. Russia Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

5.3.1.12. Russia Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

5.3.1.13. Rest of Europe Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

5.3.1.14. Rest of Europe Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Semiconductor Testing Services Market Outlook, 2019 - 2031

6.1. Asia Pacific Semiconductor Testing Services Market Outlook, by Service, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Assembly & Packaging Services

6.1.1.2. Copper Wire & Gold Wire Bonding

6.1.1.3. Flip Chip

6.1.1.4. Wafer Level Packaging

6.1.1.5. TSV

6.1.1.6. Others

6.1.1.7. Testing Services

6.2. Asia Pacific Semiconductor Testing Services Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Communication

6.2.1.2. Computing & Networking

6.2.1.3. Consumer Electronics

6.2.1.4. Industrial

6.2.1.5. Automotive Electronics

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Semiconductor Testing Services Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. China Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

6.3.1.2. China Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

6.3.1.3. Japan Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

6.3.1.4. Japan Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

6.3.1.5. South Korea Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

6.3.1.6. South Korea Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

6.3.1.7. India Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

6.3.1.8. India Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

6.3.1.9. Southeast Asia Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

6.3.1.10. Southeast Asia Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

6.3.1.11. Rest of Asia Pacific Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

6.3.1.12. Rest of Asia Pacific Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Semiconductor Testing Services Market Outlook, 2019 - 2031

7.1. Latin America Semiconductor Testing Services Market Outlook, by Service, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Assembly & Packaging Services

7.1.1.2. Copper Wire & Gold Wire Bonding

7.1.1.3. Flip Chip

7.1.1.4. Wafer Level Packaging

7.1.1.5. TSV

7.1.1.6. Others

7.1.1.7. Testing Services

7.2. Latin America Semiconductor Testing Services Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Communication

7.2.1.2. Computing & Networking

7.2.1.3. Consumer Electronics

7.2.1.4. Industrial

7.2.1.5. Automotive Electronics

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Semiconductor Testing Services Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Brazil Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

7.3.1.2. Brazil Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

7.3.1.3. Mexico Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

7.3.1.4. Mexico Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

7.3.1.5. Argentina Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

7.3.1.6. Argentina Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

7.3.1.7. Rest of Latin America Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

7.3.1.8. Rest of Latin America Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Semiconductor Testing Services Market Outlook, 2019 - 2031

8.1. Middle East & Africa Semiconductor Testing Services Market Outlook, by Service, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Assembly & Packaging Services

8.1.1.2. Copper Wire & Gold Wire Bonding

8.1.1.3. Flip Chip

8.1.1.4. Wafer Level Packaging

8.1.1.5. TSV

8.1.1.6. Others

8.1.1.7. Testing Services

8.2. Middle East & Africa Semiconductor Testing Services Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Communication

8.2.1.2. Computing & Networking

8.2.1.3. Consumer Electronics

8.2.1.4. Industrial

8.2.1.5. Automotive Electronics

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Semiconductor Testing Services Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. GCC Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

8.3.1.2. GCC Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

8.3.1.3. South Africa Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

8.3.1.4. South Africa Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

8.3.1.5. Egypt Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

8.3.1.6. Egypt Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

8.3.1.7. Nigeria Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

8.3.1.8. Nigeria Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

8.3.1.9. Rest of Middle East & Africa Semiconductor Testing Services Market by Service, Value (US$ Bn), 2019 - 2031

8.3.1.10. Rest of Middle East & Africa Semiconductor Testing Services Market by Application, Value (US$ Bn), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Application Heatmap

9.2. Company Market Share Analysis, 2023

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. ASE Group, Inc

9.4.1.1. Company Overview

9.4.1.2. Service Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Amkor Technology, Inc.

9.4.2.1. Company Overview

9.4.2.2. Service Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Siliconware Precision Industries Co., Ltd.

9.4.3.1. Company Overview

9.4.3.2. Service Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Powertech Technology, Inc.

9.4.4.1. Company Overview

9.4.4.2. Service Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. United Test and Assembly Center Ltd.

9.4.5.1. Company Overview

9.4.5.2. Service Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. JCET Group Co Ltd

9.4.6.1. Company Overview

9.4.6.2. Service Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Chips Technologies, Inc.

9.4.7.1. Company Overview

9.4.7.2. Service Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Chipbond Technology Corporation.

9.4.8.1. Company Overview

9.4.8.2. Service Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. King Yuan Electronics Co Ltd

9.4.9.1. Company Overview

9.4.9.2. Service Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Unisem

9.4.10.1. Company Overview

9.4.10.2. Service Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Advanced Package Technology Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |