Global Sesame Oil Market Forecast

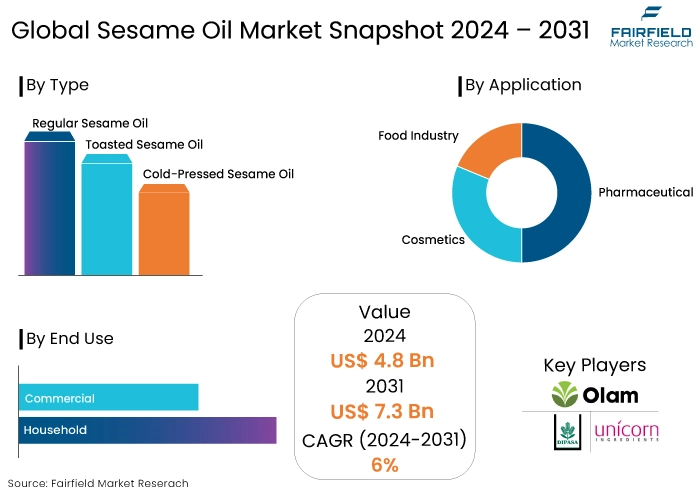

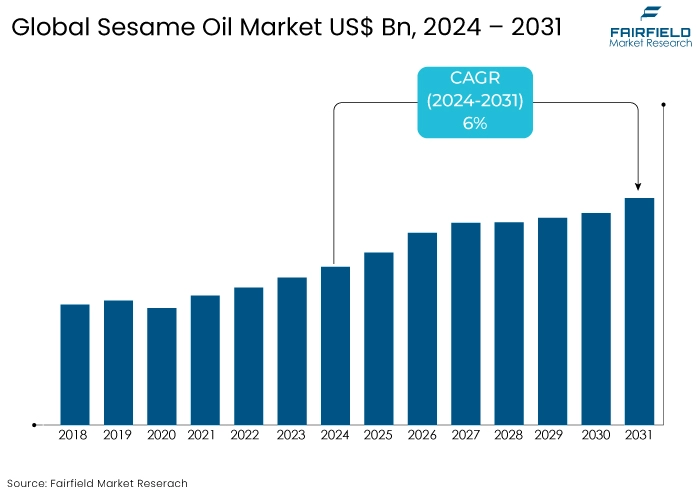

- The sesame oil market is projected to reach a size of US$7.3 Bn by 2031 showing significant growth from US$4.8 Bn achieved in 2024.

- The market for sesame oil is expected to show a significant expansion rate with an estimated CAGR of 6% from 2024 to 2031.

Sesame Oil Market Insights

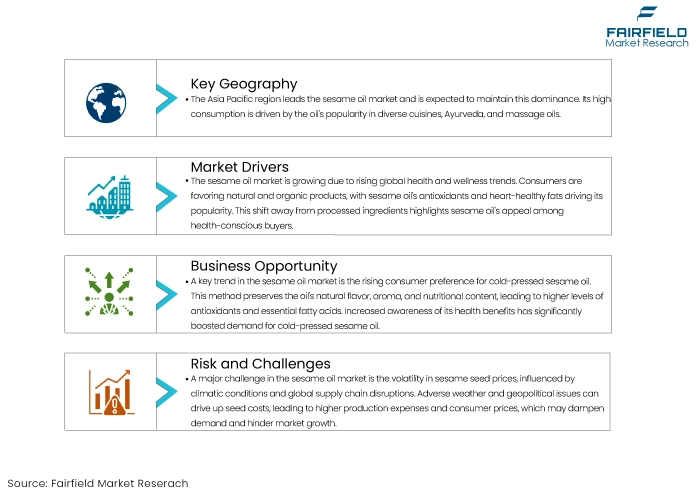

- Rising health consciousness and demand for natural products is a crucial market driving element for the sesame oil market.

- Increasing applications of sesame oils in the cosmetic and pharmaceutical industries caters to the market’s growth.

- Increasing consumer preference for natural, cold-pressed, and organic sesame oil creates huge demand for sesame oil market.

- Growing popularity in culinary uses and globalization of cuisines is a key factor for the market’s growth.

- The increased adoption of cold-pressed sesame oil is a growing trend in the market.

- Expansion of sesame oil into emerging markets is aiding the market’s growth over the forecast period.

- Asia Pacific accounts for sesame oil market share.

- Food industry finds the key application into the global sesame oil market.

A Look Back and a Look Forward - Comparative Analysis

The sesame oil market has shown steady growth mainly driven by the increasing consumer awareness of its health benefits and expanding applications in both culinary and non-culinary sectors. This understanding of consumer behaviour is crucial for navigating the market's future.

The market benefitted from rising demand in the food and beverage industry, particularly in Asia Pacific and the Middle East, where sesame oil is a staple. The increasing trend of using natural and organic products also contributed to the market's expansion with consumers seeking healthy alternatives to traditional cooking oils. The cosmetics and pharmaceutical industries saw increased usage of sesame oil due to its antioxidant and anti-inflammatory properties, further propelling market growth.

The sesame oil market is poised for a promising future post 2024. The trend toward plant-based diets and natural ingredients is expected to sustain demand especially in North America and Europe opening up new opportunities for growth.

Innovations in extraction processes and developing new product varieties, such as cold-pressed and organic sesame oils, are likely to drive market growth. Furthermore, expanding awareness of the oil's health benefits and its versatile applications across various industries, including skincare and aromatherapy are expected to fuel market expansion. However, challenges like fluctuating raw material prices and competition from other edible oils may impact growth.

Key Growth Determinants

- Rising Health Consciousness and Demand for Natural Products

One of the primary growth drivers of the sesame oil market is the increasing global trend toward health and wellness. Consumers are increasingly seeking reassurance in their health choices, leading to a surge in demand for natural and organic products, including sesame oil. This increasing trend is a strong indicator of the market's potential for growth.

Sesame oil is rich in antioxidants, such as sesamol and sesamin, and contains a high concentration of unsaturated fatty acids known to promote heart health. The health benefits and the growing awareness of the negative impacts of processed and artificial ingredients have positioned sesame oil as a preferred choice among health-conscious consumers.

The shift toward healthy dietary practices are expected to continue driving the demand for sesame oil, particularly in regions like North America and Europe, where the organic and natural food markets are rapidly expanding.

- Expanding Applications in the Cosmetic and Pharmaceutical Industries

The cosmetic and pharmaceutical industries have increasingly adopted sesame oil due to its beneficial properties such as moisturizing, anti-inflammatory, and antioxidant effects. Sesame oil is used as a carrier in lotions, creams, and massage oils in skincare. It is valued for penetrating deep into the skin, providing nourishment and hydration.

The pharmaceutical industry also utilizes sesame oil in various formulations, particularly in traditional medicine systems like Ayurveda, where it is used for its healing properties. As the demand for natural and organic skincare products grows, the use of sesame oil in these industries is expected to expand further, contributing significantly to market growth.

- Increasing Popularity in Culinary Uses and Globalization of Cuisines

Sesame oil's versatility in the culinary world is another significant growth driver. Traditionally used in Asian and Middle Eastern cuisines, sesame oil is now gaining recognition worldwide as a versatile cooking oil. Its unique nutty flavour and high smoke point make it suitable for a variety of cooking methods, inspiring chefs and home cooks to experiment with frying, sautéing, and dressing.

As globalization continues to influence food trends, more people are experimenting with international cuisines leading to increased use of sesame oil in Western kitchens. The rise of plant-based diets and the demand for healthy cooking oils have also contributed to the growing adoption of sesame oil in the culinary sector. This trend is expected to persist further driving the market's growth in the coming years.

Key Growth Barriers

- Fluctuating Raw Material Prices

One significant constraint affecting the sesame oil market is the fluctuation in raw material prices, particularly the cost of sesame seeds. Sesame seed production is highly dependent on climatic conditions, and any adverse weather events can lead to reduced yields, driving up prices.

The global supply chain for sesame seeds is susceptible to disruptions such as trade restrictions or geopolitical tensions, which can further exacerbate price volatility. The unpredictability of raw material costs poses challenges for manufacturer who may need help maintaining consistent product pricing. As a result, higher production costs can increase consumer prices, potentially dampening demand and hindering market growth.

- Competition from Other Edible Oils

Another restraint for the sesame oil market is the intense competition from other edible oils, such as olive, coconut, and sunflower. Sesame oils are often more widely available and marketed as healthier alternatives, which can overshadow sesame oil's benefits.

Some oils are priced more competitively, making them more appealing to price-sensitive consumers. The extensive use of olive oil in Mediterranean diets and the growing popularity of coconut oil for its perceived health benefits have particularly challenged sesame oil's market share.

The fierce competition makes it difficult for sesame oil to establish a dominant position in the global market, especially in regions where other oils have a more substantial presence.

Sesame Oil Market Trends and Opportunities

- Increasing Adoption of Cold-Pressed Sesame Oil

A notable trend in the sesame oil market is the growing consumer preference for cold-pressed sesame oil. Cold-pressing is a method of oil extraction that involves minimal heat, preserving the natural flavor, aroma, and nutritional content of the oil.

The process results in pure and flavourful oil that retains higher levels of antioxidants, vitamins, and essential fatty acids compared to oil extracted using traditional methods. As consumers become more aware of the health benefits associated with cold-pressed oils particularly their enhanced nutritional profile, the demand for cold-pressed sesame oil has seen a significant rise.

The trend is especially prominent among health-conscious consumers willing to pay a premium for high-quality and natural products. The broad clean-label movement supports the shift toward cold-pressed oils, where consumers seek transparency in product sourcing and manufacturing processes.

The increasing popularity of artisanal and gourmet food products has driven the demand for cold-pressed sesame oil often marketed as a specialty product with superior taste and health benefits. As this trend continues, it is likely to drive innovation in the sesame oil market, with producers focusing on expanding their cold-pressed product lines to meet growing consumer demand.

- Expansion into Emerging Markets

The sesame oil market presents significant growth opportunities through expansion into emerging markets, particularly in regions like Latin America, Africa, and Southeast Asia.

As consumers in the global markets become more exposed to international food trends, there is a rising interest even excitement in trying new ingredients and cooking methods including the use of sesame oil.

The growing health and wellness awareness drives demand for natural and healthy cooking oils. With its health benefits and versatility in cooking, sesame oil is well-positioned to tap into this trend.

The expanding retail infrastructure including the proliferation of supermarkets and online grocery platforms makes it easy for consumers in emerging markets to access products like sesame oil. sesame oil producers can focus on strategic marketing and education efforts to introduce sesame oil to new consumers in these regions to capitalize on this opportunity.

Highlighting the oil's health benefits, diverse culinary applications, and cultural significance in traditional cuisines can help build a strong consumer base. Partnerships with local distributors and retailers can further facilitate market entry and growth in these emerging markets, significantly boosting the global sesame oil market.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario plays a pivotal role in shaping the sesame oil market particularly as governments and regulatory bodies implement stringent standards for food safety, quality, and labelling.

It is important to note that these changes are also driven by consumer demand. In many regions, regulations now require clear labelling of product origin, processing methods (such as cold-pressed or refined), and any potential allergens, such as sesame seeds.

Regulations have led to great transparency in the market with consumers becoming informed about the products they purchase, and their demand for high-quality and authentic sesame oil is a significant force in the market.

The growing focus on organic and non-GMO certifications has influenced the market as consumers increasingly seek products that meet these standards. Regulatory frameworks in regions like the European Union and North America have also imposed limits on pesticide residues and contaminants in food products.

The regulatory pressures ensure that only high-quality sesame oil products reach the market, enhancing consumer trust and potentially leading to high market penetration particularly in health-conscious and environmentally aware segments.

Fairfield’s Ranking Board

Segments Covered in the Report

- Regular Sesame Oil Retains Dominance in the Sesame Oil Market

Regular sesame oil is produced by extracting oil from uncooked, crushed sesame seeds, while toasted sesame oil is created from sesame seeds that have been toasted. The primary distinction between plain and toasted sesame oil is their flavour profiles. The procedure of toasting enhances the flavour of the sesame oil.

When spices are toasted, their flavours enhance. However, toasted sesame oil is typically employed to improve the taste of a dish rather than being utilized as cooking oil. When cooking with plain sesame oil, adding spices allows us to create the desired taste.

Toasted sesame oil already possesses a developed flavour so reheating it will result in a burnt and slightly bitter taste. Cold-pressed oils are commonly utilized in conjunction with coconut oil. Cold-pressed sesame oil is obtained by pressing and crushing sesame seeds without toasting or roasting.

- Seasame Oil Finds the Most Favored Application in the Food Industry

Sesame oil has numerous advantages and applications in the food sector, thanks to its benefits, including enhanced bone health, protection against anaemia, improved eye health, and nourishment for hair.

The sesame oil market is being propelled by the anticipated substantial expansion of the food and beverage industry globally in the forecast period. It is frequently employed for sautéing meats and vegetables, as well as for incorporating sauces and marinades.

Sesame oil is utilized in several non-culinary domains, such as its incorporation as an ingredient in soap, cosmetics, lubricants, and pharmaceuticals.

Regional Analysis

- Asia Pacific Sesame Oil Market Exhibits High Market Share

Asia Pacific region experiences high market share in the sesame oil market and is projected to maintain its dominance throughout the forecast period. Due to its growing popularity in various cuisines, Ayurveda, and the production of various massage oils, the region is experiencing a significant increase in the consumption of sesame oil.

Sesame oil is among the most ancient edible oils globally. The region is being propelled by these elements, which are contributing to the sesame oil market growth.

- Growing Consciousness about Sesame Oil’s Health Benefits in the Region Propel North America Market

North America is projected to experience the high growth rate throughout the projection period. Sesame oil has a diverse range of uses in the food and beverages industry and offers several health advantages.

The growing consciousness among the region's population regarding sesame oil's health advantages is anticipated to propel North America sesame oil market. The sesame oil industry in the region is projected to experience expansion as a result of the increasing demand for Chinese, Indian, and Korean cuisines in Western nations.

The sesame oil market in the region is anticipated to experience expansion due to favourable government measures supporting sesame seed growers and the rising global exports of sesame seeds to produce sesame oil.

Fairfield’s Competitive Landscape Analysis

The sesame oil market is characterized by a mix of global and regional players leading to moderate competition. Key players like Kadoya Sesame Mills Inc., Wilmar International, and Archer Daniels Midland Company dominate due to their established brand presence, extensive distribution networks, and diversified product portfolios.

The companies leverage economies of scale and invest in product innovation particularly in organic and cold-pressed segments to maintain a competitive edge. Regional players especially in Asia Pacific compete by offering traditional and locally sourced products that appeal to culturally specific tastes.

The market is also seeing the entry of new, smaller brands focusing on niche segments like gourmet and artisanal oils, intensifying competition and driving the need for differentiation through quality and branding.

Key Market Companies

- Olam International

- Dipasa Europe B.V.

- Unicorn Ingredients Limited

- Virdhara International

- Tradin Organic Agriculture B.V.

- Samruddhi Organic Farm (India) Private Limited

- Orienco

- Shiloh Farms

- Akay Agro Allied

- ORGANIC INDIA

- MANISHANKAR OILS PRIVATE LIMITED

- TAMPICO

Recent Industry Developments

- February 2024

Kadoya, a leading player in the sesame oil market, has expanded its product line to include premium and organic sesame oils to align with the growing consumer demand for healthier, high-quality oils.

- December 2023

Wilmar International has been actively pursuing acquisitions to strengthen its presence in the global edible oils market, including sesame oil.

An Expert’s Eye

- Opportunity for market players to introduce premium product lines catering to health-conscious consumers.

- Increasing consumer preference for natural, cold-pressed, and organic sesame oil creates huge demand for sesame oil market.

- Vulnerability of sesame seed production to climatic conditions and geopolitical factors creates uncertainty in pricing and supply stability poses a risk to market growth.

- Competitive pressure from alternative oils like olive, coconut, and sunflower oils, there is a need for differentiation through product quality and unique health benefits.

Global Sesame Oil Market is Segmented as-

By Type

- Regular Sesame Oil

- Toasted Sesame Oil

- Cold-Pressed Sesame Oil

By End Use

- Household

- Commercial

By Application

- Pharmaceutical

- Cosmetics

- Food Industry

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

1. Executive Summary

1.1. Global Sesame Oil Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019 - 2023

3.1. Global Sesame Oil Market Production Output, by Region, Value (US$ Bn) and Volume (Tons), 2019 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East and Africa

4. Price Analysis, 2019 - 2023

4.1. Global Average Price Analysis, by Nature, US$ Per Unit, 2019 - 2023

4.2. Prominent Factor Affecting Sesame Oil Prices

4.3. Global Average Price Analysis, by Region, US$ Per Unit

5. Global Sesame Oil Market Outlook, 2019 - 2031

5.1. Global Sesame Oil Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Organic

5.1.1.2. Conventional

5.2. Global Sesame Oil Market Outlook, by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. White Sesame Seeds

5.2.1.2. Black Sesame Seeds

5.2.1.3. Brown Sesame Seeds

5.3. Global Sesame Oil Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Cold Pressed Oil

5.3.1.2. Refined Oil

5.4. Global Sesame Oil Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Food Processing

5.4.1.1.1. Bakery

5.4.1.1.2. Sauces and Dressings

5.4.1.1.3. Snacks & Meals

5.4.1.1.4. Others

5.4.1.2. Foodservice/HoReCa

5.4.1.3. Pharmaceuticals/Nutraceuticals

5.4.1.4. Cosmetics & Personal Care

5.4.1.5. Household/Retail

5.5. Global Sesame Oil Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. North America

5.5.1.2. Europe

5.5.1.3. Asia Pacific

5.5.1.4. Latin America

5.5.1.5. Middle East & Africa

6. North America Sesame Oil Market Outlook, 2019 - 2031

6.1. Global Sesame Oil Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Organic

6.1.1.2. Conventional

6.2. North America Sesame Oil Market Outlook, by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. White Sesame Seeds

6.2.1.2. Black Sesame Seeds

6.2.1.3. Brown Sesame Seeds

6.3. North America Sesame Oil Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Cold Pressed Oil

6.3.1.2. Refined Oil

6.4. North America Sesame Oil Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Food Processing

6.4.1.1.1. Bakery

6.4.1.1.2. Sauces and Dressings

6.4.1.1.3. Snacks & Meals

6.4.1.1.4. Others

6.4.1.2. Foodservice/HoReCa

6.4.1.3. Pharmaceuticals/Nutraceuticals

6.4.1.4. Cosmetics & Personal Care

6.4.1.5. Household/Retail

6.5. North America Sesame Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. U.S. Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.5.1.2. U.S. Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.5.1.3. U.S. Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.5.1.4. U.S. Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.5.1.5. Canada Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.5.1.6. Canada Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.5.1.7. Canada Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.5.1.8. Canada Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Sesame Oil Market Outlook, 2019 - 2031

7.1. Europe Sesame Oil Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Organic

7.1.1.2. Conventional

7.2. Europe Sesame Oil Market Outlook, by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. White Sesame Seeds

7.2.1.2. Black Sesame Seeds

7.2.1.3. Brown Sesame Seeds

7.3. Europe Sesame Oil Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Cold Pressed Oil

7.3.1.2. Refined Oil

7.4. Europe Sesame Oil Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Food Processing

7.4.1.1.1. Bakery

7.4.1.1.2. Sauces and Dressings

7.4.1.1.3. Snacks & Meals

7.4.1.1.4. Others

7.4.1.2. Foodservice/HoReCa

7.4.1.3. Pharmaceuticals/Nutraceuticals

7.4.1.4. Cosmetics & Personal Care

7.4.1.5. Household/Retail

7.5. Europe Sesame Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Germany Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.2. Germany Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.3. Germany Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.4. Germany Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.5. U.K. Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.6. U.K. Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.7. U.K. Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.8. U.K. Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.9. France Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.10. France Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.11. France Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.12. France Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.13. Italy Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.14. Italy Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.15. Italy Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.16. Italy Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.17. Turkey Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.18. Turkey Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.19. Turkey Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.20. Turkey Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.21. Russia Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.22. Russia Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.23. Russia Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.24. Russia Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.25. Rest of Europe Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.26. Rest of Europe Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.27. Rest of Europe Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.1.28. Rest of Europe Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Sesame Oil Market Outlook, 2019 - 2031

8.1. Asia Pacific Sesame Oil Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Organic

8.1.1.2. Conventional

8.2. Asia Pacific Sesame Oil Market Outlook, by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. White Sesame Seeds

8.2.1.2. Black Sesame Seeds

8.2.1.3. Brown Sesame Seeds

8.3. Asia Pacific Sesame Oil Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Cold Pressed Oil

8.3.1.2. Refined Oil

8.4. Asia Pacific Sesame Oil Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Food Processing

8.4.1.1.1. Bakery

8.4.1.1.2. Sauces and Dressings

8.4.1.1.3. Snacks & Meals

8.4.1.1.4. Others

8.4.1.2. Foodservice/HoReCa

8.4.1.3. Pharmaceuticals/Nutraceuticals

8.4.1.4. Cosmetics & Personal Care

8.4.1.5. Household/Retail

8.5. Asia Pacific Sesame Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. China Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.2. China Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.3. China Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.4. China Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.5. Japan Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.6. Japan Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.7. Japan Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.8. Japan Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.9. South Korea Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.10. South Korea Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.11. South Korea Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.12. South Korea Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.13. India Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.14. India Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.15. India Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.16. India Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.17. Southeast Asia Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.18. Southeast Asia Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.19. Southeast Asia Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.20. Southeast Asia Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.21. Rest of Asia Pacific Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.22. Rest of Asia Pacific Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.23. Rest of Asia Pacific Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.1.24. Rest of Asia Pacific Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Sesame Oil Market Outlook, 2019 - 2031

9.1. Latin America Sesame Oil Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Organic

9.1.1.2. Conventional

9.2. Latin America Sesame Oil Market Outlook, by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. White Sesame Seeds

9.2.1.2. Black Sesame Seeds

9.2.1.3. Brown Sesame Seeds

9.3. Latin America Sesame Oil Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Cold Pressed Oil

9.3.1.2. Refined Oil

9.4. Latin America Sesame Oil Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. Food Processing

9.4.1.1.1. Bakery

9.4.1.1.2. Sauces and Dressings

9.4.1.1.3. Snacks & Meals

9.4.1.1.4. Others

9.4.1.2. Foodservice/HoReCa

9.4.1.3. Pharmaceuticals/Nutraceuticals

9.4.1.4. Cosmetics & Personal Care

9.4.1.5. Household/Retail

9.5. Latin America Sesame Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1. Key Highlights

9.5.1.1. Brazil Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.2. Brazil Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.3. Brazil Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.4. Brazil Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.5. Mexico Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.6. Mexico Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.7. Mexico Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.8. Mexico Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.9. Argentina Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.10. Argentina Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.11. Argentina Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.12. Argentina Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.13. Rest of Latin America Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.14. Rest of Latin America Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.15. Rest of Latin America Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.1.16. Rest of Latin America Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.5.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Sesame Oil Market Outlook, 2019 - 2031

10.1. Middle East & Africa Sesame Oil Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Organic

10.1.1.2. Conventional

10.2. Middle East & Africa Sesame Oil Market Outlook, by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. White Sesame Seeds

10.2.1.2. Black Sesame Seeds

10.2.1.3. Brown Sesame Seeds

10.3. Middle East & Africa Sesame Oil Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. Cold Pressed Oil

10.3.1.2. Refined Oil

10.4. Middle East & Africa Sesame Oil Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.4.1. Key Highlights

10.4.1.1. Food Processing

10.4.1.1.1. Bakery

10.4.1.1.2. Sauces and Dressings

10.4.1.1.3. Snacks & Meals

10.4.1.1.4. Others

10.4.1.2. Foodservice/HoReCa

10.4.1.3. Pharmaceuticals/Nutraceuticals

10.4.1.4. Cosmetics & Personal Care

10.4.1.5. Household/Retail

10.5. Middle East & Africa Sesame Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1. Key Highlights

10.5.1.1. GCC Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.2. GCC Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.3. GCC Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.4. GCC Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.5. South Africa Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.6. South Africa Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.7. South Africa Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.8. South Africa Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.9. Egypt Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.10. Egypt Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.11. Egypt Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.12. Egypt Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.13. Nigeria Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.14. Nigeria Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.15. Nigeria Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.16. Nigeria Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.17. Rest of Middle East & Africa Sesame Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.18. Rest of Middle East & Africa Sesame Oil Market by Source, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.19. Rest of Middle East & Africa Sesame Oil Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.1.20. Rest of Middle East & Africa Sesame Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.5.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Nature vs Source Heatmap

11.2. Company Market Share Analysis, 2023

11.3. Competitive Dashboard

11.4. Company Profiles

11.4.1. Archer Daniels Midland Company

11.4.1.1. Company Overview

11.4.1.2. Product Portfolio

11.4.1.3. Financial Overview

11.4.1.4. Business Strategies and Development

11.4.2. Chee Seng Oil Factory Pte Ltd.

11.4.2.1. Company Overview

11.4.2.2. Product Portfolio

11.4.2.3. Financial Overview

11.4.2.4. Business Strategies and Development

11.4.3. ConnOils LLC

11.4.3.1. Company Overview

11.4.3.2. Product Portfolio

11.4.3.3. Financial Overview

11.4.3.4. Business Strategies and Development

11.4.4. Dipasa Group

11.4.4.1. Company Overview

11.4.4.2. Product Portfolio

11.4.4.3. Financial Overview

11.4.4.4. Business Strategies and Development

11.4.5. Ernesto Ventós S.A.

11.4.5.1. Company Overview

11.4.5.2. Product Portfolio

11.4.5.3. Financial Overview

11.4.5.4. Business Strategies and Development

11.4.6. Fytel Edible Oils Ltd.

11.4.6.1. Company Overview

11.4.6.2. Product Portfolio

11.4.6.3. Financial Overview

11.4.6.4. Business Strategies and Development

11.4.7. Gustav Heess

11.4.7.1. Company Overview

11.4.7.2. Product Portfolio

11.4.7.3. Financial Overview

11.4.7.4. Business Strategies and Development

11.4.8. Haitoglou Bros S.A.

11.4.8.1. Company Overview

11.4.8.2. Product Portfolio

11.4.8.3. Financial Overview

11.4.8.4. Business Strategies and Development

11.4.9. Iwai Sesame Oil Co., Ltd.

11.4.9.1. Company Overview

11.4.9.2. Product Portfolio

11.4.9.3. Financial Overview

11.4.9.4. Business Strategies and Development

11.4.10. Kadoya Sesame Mills Inc.

11.4.10.1. Company Overview

11.4.10.2. Product Portfolio

11.4.10.3. Financial Overview

11.4.10.4. Business Strategies and Development

11.4.11. La Tourangelle, Inc.

11.4.11.1. Company Overview

11.4.11.2. Product Portfolio

11.4.11.3. Financial Overview

11.4.11.4. Business Strategies and Development

11.4.12. Midtrans International

11.4.12.1. Company Overview

11.4.12.2. Product Portfolio

11.4.12.3. Financial Overview

11.4.12.4. Business Strategies and Development

11.4.13. Now Foods

11.4.13.1. Company Overview

11.4.13.2. Product Portfolio

11.4.13.3. Financial Overview

11.4.13.4. Business Strategies and Development

11.4.14. Oh Aik Guan Food Industrial Pte Ltd.

11.4.14.1. Company Overview

11.4.14.2. Product Portfolio

11.4.14.3. Financial Overview

11.4.14.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

End Use Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |