Global Smart Agriculture Market Forecast

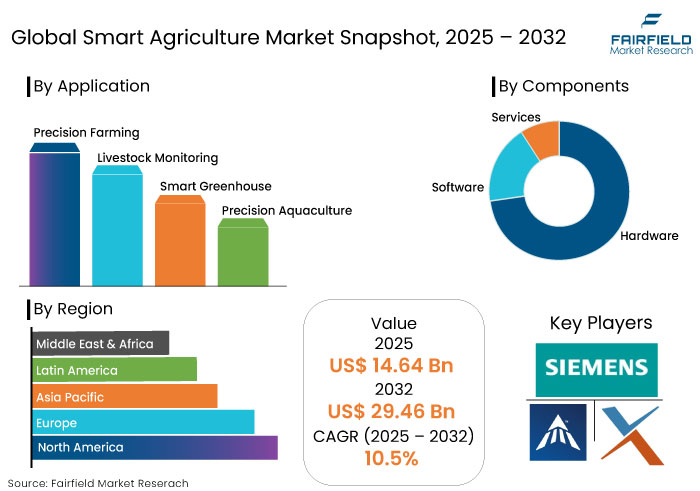

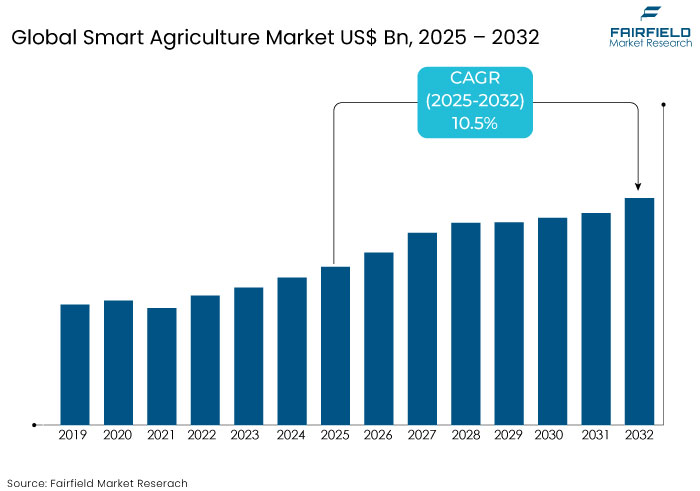

- The smart agriculture market is projected to reach US$ 29.46 Bn by 2032 from US$ 14.64 Bn anticipated in 2025.

- The smart agriculture market is set to witness a CAGR of 10.5% from 2025 to 2032.

Smart Agriculture Market Insights

- Hardware leads the components category with 52% of share in 2025, driven by use of IoT sensors, drones, and automated machinery.

- AI-driven predictive analytics and IoT-based precision farming are transforming crop monitoring, irrigation, and yield optimization.

- Smart irrigation solutions gain impetus amid rising demand for IoT-powered water conservation

- Adoption of robotic harvesters, self-driving tractors, and AI-powered drones is enhancing efficiency and reducing labor costs.

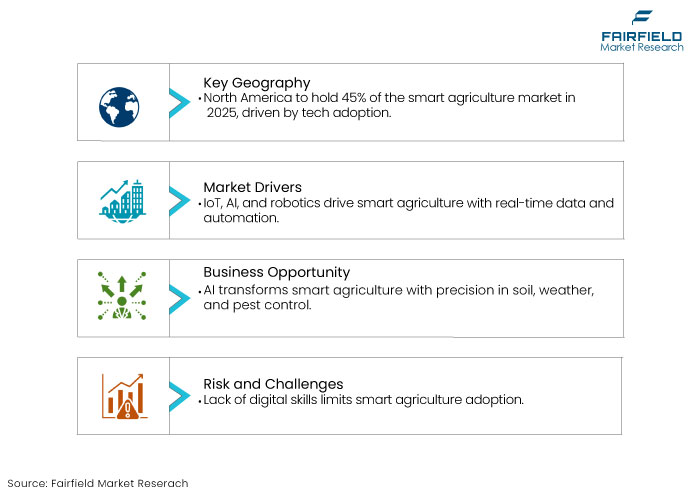

- North America is set to dominate globally, accumulating around 45% of the total share in 2025.

- Farmers are increasingly adopting climate-smart solutions, boosting the market's growth.

- Smart agriculture is set to be important for increasing productivity and minimizing resource wastage.

- Rising environmental concerns like greenhouse gas emissions are anticipated to propel demand for smart agriculture systems.

Key Growth Determinants

- Integration of Automation Tools into Smart Agriculture

Rapid integration of the Internet of Things (IoT), Artificial Intelligence (AI), robotics, and Machine Learning (ML) in agriculture is one of the key drivers of the smart agriculture market. IoT plays a key role in precision farming by using smart sensors and automation tools to collect real-time data on soil moisture, temperature, humidity, and crop health.

Soil sensors help determine the optimal irrigation schedule, ensuring water conservation and reducing unnecessary waste. AI-powered drones and robotics are widely used to monitor crop growth, detect pest infestations, and automate tasks such as planting, spraying fertilizers, and harvesting.

- Rising Global Food Demand

With the world’s population projected to reach 9.7 billion by 2050, global food production must increase by at least 60% to meet rising consumption demands. This urgent need for increased food production while maintaining sustainability has fueled the smart agriculture market.

One of the key challenges in traditional farming is inefficient resource utilization, leading to excessive use of water, fertilizers, and pesticides. Precision farming solutions enable farmers to accurately monitor soil health and nutrient levels, ensuring optimal input application. Increasing frequency of climate-related disruptions, such as droughts, floods, and unpredictable weather patterns has further highlighted the need for climate-smart agricultural practices.

Key Growth Barriers

- Lack of Technical Expertise and Digital Literacy

Successful implementation of smart agriculture technologies requires a certain level of technical knowledge and digital literacy, something that several traditional farmers lack. As smart farming tools rely on big data analytics, cloud computing, AI-driven decision-making, and IoT connectivity, several farmers struggle to understand and operate these systems efficiently.

The knowledge gap could discourage them from adopting precision farming techniques, ultimately affecting the growth of the smart agriculture market. Rural areas often lack proper training and technical support, making it even more difficult for farmers to integrate these solutions into their daily operations.

Smart Agriculture Market Trends and Opportunities

- Adoption of AI-driven Tools for Real-time Monitoring

Integrating AI into precision agriculture is rapidly transforming the smart agriculture market. Farmers are now leveraging AI-driven tools to analyze soil health, predict weather patterns, detect pests, and optimize irrigation schedules with unprecedented accuracy.

AI-powered solutions allow farmers to make data-driven decisions, improving productivity while minimizing resource wastage. One of the most significant developments in this market is using AI in predictive analytics. By analyzing historical data and real-time satellite imagery, AI can forecast crop yields, monitor plant health, and detect diseases before they spread, ensuring better crop management.

- High Demand for IoT-based Smart Irrigation Systems

With climate change causing erratic weather patterns and water scarcity, demand for IoT-based smart irrigation systems presents a massive growth opportunity for the smart agriculture market. Traditional irrigation methods often lead to overwatering or underwatering, resulting in crop damage, lower yields, and resource wastage. IoT-powered smart irrigation systems solve this challenge using real-time soil moisture data and weather forecasts to optimize water usage.

Smart systems rely on IoT sensors placed in the soil to continuously monitor moisture levels, temperature, and humidity. When the soil moisture level drops below the optimal range, the smart irrigation system automatically triggers watering to maintain ideal conditions.

Segment Covered in the Report

- Hardware Gains Traction Amid Need for Accurate Information

By components, the hardware segment is anticipated to lead the global smart agriculture market. Hardware forms the backbone of smart farming, providing the essential tools and devices that enable modern agricultural practices. The need for accurate, real-time information drives the reliance on hardware in smart agriculture.

Farmers depend on these tools to gather critical data on soil conditions, crop health, and environmental factors. This data collection is fundamental for implementing precision agriculture techniques that optimize resource use and maximize yields.

- Precision Farming to Lead with Innovations like GPS Systems

In terms of application, precision farming segment will likely hold 42% share in 2025. Precision farming employs innovative technologies such as GPS guidance systems, IoT-enabled sensors, and data analytics to manage crops at a micro level. This approach allows farmers to monitor soil conditions, track crop health, and optimize resource use, leading to increased yields and reduced environmental impact.

Adoption of precision farming is driven by the need for sustainable agricultural practices and high demand for food production to meet the needs of a rising global population. Implementing these technologies can help farmers make informed decisions that enhance productivity and promote environmental stewardship. Precision farming is at the forefront of modern agricultural solutions, offering a pathway to more efficient and productive farming practices.

Regional Analysis

- North America Sees Adoption of Unique Drone Technology

North America dominates the smart agriculture market and is set to account for 45% of share in 2025 due to its novel technological capabilities and strong focus on sustainable farming. The region's early adoption of cutting-edge technologies such as precision farming, IoT-enabled devices, and AI-driven solutions has revolutionized traditional agricultural practices.

The U.S. leads the regional market, supported by favorable government initiatives like subsidies for smart equipment and funding for agricultural research. Large-scale farms in the U.S. have widely embraced GPS-enabled tractors, sensor-based irrigation systems, and drone technology to optimize yields and reduce resource wastage.

- Asia Pacific to Witness Rising Demand for IoT-based Tools

Asia Pacific smart agriculture market is experiencing the fastest growth globally, driven by the region's booming agriculture sector and increasing food demand. Countries like China, India, and Japan are adopting unique farming technologies to address limited arable land, water scarcity, and climate change.

Government initiatives promoting precision farming and smart equipment subsidies have accelerated adoption. In India, for example, affordable IoT-based tools and drones are gaining popularity among small and mid-sized farms. China's push toward modernizing its agricultural sector through AI-driven crop monitoring systems highlights the region's focus on innovation.

Fairfield’s Competitive Landscape Analysis

The smart agriculture market is highly competitive, with leading players focusing on innovation, strategic partnerships, and acquisitions to strengthen their global presence. Key companies such as Deere & Company, Trimble Inc., and AGCO Corporation are driving developments in precision farming, IoT-enabled solutions, and farm automation technologies.

Emerging players also contribute with specialized products like smart irrigation systems and crop monitoring tools. Regional players, particularly in Asia Pacific and Europe, are gaining traction by addressing local agricultural needs. The dynamic competitive landscape highlights a strong push toward modernizing traditional farming practices globally.

Key Market Companies

- Siemens

- Ag Leader Technology

- AgJunction, Inc.

- AGCO Corporation

- Libelium

- Deere & Company

- Bayer AG

- Raven Industries

- DeLaval

- Trimble

- AKVA Group

Recent Industry Developments

- In March 2024, Deere & Company, Kinze Manufacturing, and Ag Leader Technology signed a partnership deal that facilitates the integration of each company's equipment and technology solutions into the agricultural operation of its customers.

- In April 2024, AGCO Corporation introduced PTx, a new brand that represents its precision agriculture portfolio.

Global Smart Agriculture Market is Segmented as-

By Components

- Hardware

- Sensing Devices

- Automation & Control Systems

- RFID Tags & Readers

- Software

- Services

- System Integration & Consulting

- Maintenance & Support

- Assisted Professional Services

By Application

- Precision Farming

- Livestock Monitoring

- Smart Greenhouse

- Precision Aquaculture

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Smart Agriculture Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Landscape

2.6. COVID-19 Impact Analysis

2.6.1. Supply

2.6.2. Demand

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Price Trend Analysis

3.1. Key Highlights

3.2. Prominent Factors Affecting Smart Agriculture Prices

3.3. Global Average Price Analysis

4. Global Smart Agriculture Market Outlook, 2019 - 2032

4.1. Global Smart Agriculture Market Outlook, by Components, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Hardware

4.1.1.1.1. Sensing Devices

4.1.1.1.2. Automation & Control Systems

4.1.1.1.3. RFID Tags & Readers

4.1.1.1.4. Misc.

4.1.1.2. Software

4.1.1.3. Services

4.1.1.3.1. System Integration & Consulting

4.1.1.3.2. Maintenance & Support

4.1.1.3.3. Assisted Professional Services

4.1.1.3.4. Misc.

4.2. Global Smart Agriculture Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Precision Farming

4.2.1.2. Livestock Monitoring

4.2.1.3. Smart Greenhouse

4.2.1.4. Precision Aquaculture

4.2.1.5. Misc.

4.3. Global Smart Agriculture Market Outlook, by Region, Value (US$ Bn) & Volume (KT), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. North America

4.3.1.2. Europe

4.3.1.3. Asia Pacific

4.3.1.4. Latin America

4.3.1.5. Middle East & Africa

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. North America Smart Agriculture Market Outlook, 2019 - 2032

5.1. North America Smart Agriculture Market Outlook, by Components, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Hardware

5.1.1.1.1. Sensing Devices

5.1.1.1.2. Automation & Control Systems

5.1.1.1.3. RFID Tags & Readers

5.1.1.1.4. Misc.

5.1.1.2. Software

5.1.1.3. Services

5.1.1.3.1. System Integration & Consulting

5.1.1.3.2. Maintenance & Support

5.1.1.3.3. Assisted Professional Services

5.1.1.3.4. Misc.

5.2. North America Smart Agriculture Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Precision Farming

5.2.1.2. Livestock Monitoring

5.2.1.3. Smart Greenhouse

5.2.1.4. Precision Aquaculture

5.2.1.5. Misc.

5.3. North America Smart Agriculture Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. U.S. Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

5.3.1.2. U.S. Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.3. Canada Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

5.3.1.4. Canada Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Smart Agriculture Market Outlook, 2019 - 2032

6.1. Europe Smart Agriculture Market Outlook, by Components, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Hardware

6.1.1.1.1. Sensing Devices

6.1.1.1.2. Automation & Control Systems

6.1.1.1.3. RFID Tags & Readers

6.1.1.1.4. Misc.

6.1.1.2. Software

6.1.1.3. Services

6.1.1.3.1. System Integration & Consulting

6.1.1.3.2. Maintenance & Support

6.1.1.3.3. Assisted Professional Services

6.1.1.3.4. Misc.

6.2. Europe Smart Agriculture Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Precision Farming

6.2.1.2. Livestock Monitoring

6.2.1.3. Smart Greenhouse

6.2.1.4. Precision Aquaculture

6.2.1.5. Misc.

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Europe Smart Agriculture Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Germany Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

6.3.1.2. Germany Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.3. U.K. Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

6.3.1.4. U.K. Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.5. France Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

6.3.1.6. France Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.7. Italy Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

6.3.1.8. Italy Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.9. Turkey Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

6.3.1.10. Turkey Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.11. Russia Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

6.3.1.12. Russia Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.13. Rest of Europe Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

6.3.1.14. Rest of Europe Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Smart Agriculture Market Outlook, 2019 - 2032

7.1. Asia Pacific Smart Agriculture Market Outlook, by Components, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Hardware

7.1.1.1.1. Sensing Devices

7.1.1.1.2. Automation & Control Systems

7.1.1.1.3. RFID Tags & Readers

7.1.1.1.4. Misc.

7.1.1.2. Software

7.1.1.3. Services

7.1.1.3.1. System Integration & Consulting

7.1.1.3.2. Maintenance & Support

7.1.1.3.3. Assisted Professional Services

7.1.1.3.4. Misc.

7.2. Asia Pacific Smart Agriculture Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Precision Farming

7.2.1.2. Livestock Monitoring

7.2.1.3. Smart Greenhouse

7.2.1.4. Precision Aquaculture

7.2.1.5. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Asia Pacific Smart Agriculture Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. China Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

7.3.1.2. China Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

7.3.1.3. Japan Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

7.3.1.4. Japan Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

7.3.1.5. South Korea Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

7.3.1.6. South Korea Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

7.3.1.7. India Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

7.3.1.8. India Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

7.3.1.9. Southeast Asia Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

7.3.1.10. Southeast Asia Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

7.3.1.11. Rest of Asia Pacific Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

7.3.1.12. Rest of Asia Pacific Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Smart Agriculture Market Outlook, 2019 - 2032

8.1. Latin America Smart Agriculture Market Outlook, by Components, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Hardware

8.1.1.1.1. Sensing Devices

8.1.1.1.2. Automation & Control Systems

8.1.1.1.3. RFID Tags & Readers

8.1.1.1.4. Misc.

8.1.1.2. Software

8.1.1.3. Services

8.1.1.3.1. System Integration & Consulting

8.1.1.3.2. Maintenance & Support

8.1.1.3.3. Assisted Professional Services

8.1.1.3.4. Misc.

8.2. Latin America Smart Agriculture Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Precision Farming

8.2.1.2. Livestock Monitoring

8.2.1.3. Smart Greenhouse

8.2.1.4. Precision Aquaculture

8.2.1.5. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Latin America Smart Agriculture Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Brazil Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

8.3.1.2. Brazil Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

8.3.1.3. Mexico Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

8.3.1.4. Mexico Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

8.3.1.5. Argentina Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

8.3.1.6. Argentina Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

8.3.1.7. Rest of Latin America Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

8.3.1.8. Rest of Latin America Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Smart Agriculture Market Outlook, 2019 - 2032

9.1. Middle East & Africa Smart Agriculture Market Outlook, by Components, Value (US$ Bn), 2019 - 2032

9.1.1. Key Highlights

9.1.1.1. Hardware

9.1.1.1.1. Sensing Devices

9.1.1.1.2. Automation & Control Systems

9.1.1.1.3. RFID Tags & Readers

9.1.1.1.4. Misc.

9.1.1.2. Software

9.1.1.3. Services

9.1.1.3.1. System Integration & Consulting

9.1.1.3.2. Maintenance & Support

9.1.1.3.3. Assisted Professional Services

9.1.1.3.4. Misc.

9.2. Middle East & Africa Smart Agriculture Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

9.2.1. Key Highlights

9.2.1.1. Precision Farming

9.2.1.2. Livestock Monitoring

9.2.1.3. Smart Greenhouse

9.2.1.4. Precision Aquaculture

9.2.1.5. Misc.

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Middle East & Africa Smart Agriculture Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

9.3.1. Key Highlights

9.3.1.1. GCC Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

9.3.1.2. GCC Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

9.3.1.3. South Africa Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

9.3.1.4. South Africa Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

9.3.1.5. Egypt Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

9.3.1.6. Egypt Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

9.3.1.7. Nigeria Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

9.3.1.8. Nigeria Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

9.3.1.9. Rest of Middle East & Africa Smart Agriculture Market by Components, Value (US$ Bn), 2019 - 2032

9.3.1.10. Rest of Middle East & Africa Smart Agriculture Market by Application, Value (US$ Bn), 2019 - 2032

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Company Market Share Analysis, 2024

10.2. Competitive Dashboard

10.3. Company Profiles

10.3.1. Siemens

10.3.1.1. Company Overview

10.3.1.2. Solution Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. Ag Leader Technology

10.3.2.1. Company Overview

10.3.2.2. Solution Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. AgJunction, Inc.

10.3.3.1. Company Overview

10.3.3.2. Solution Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. AGCO Corporation

10.3.4.1. Company Overview

10.3.4.2. Solution Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. Deere & Company

10.3.5.1. Company Overview

10.3.5.2. Solution Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Bayer AG

10.3.6.1. Company Overview

10.3.6.2. Solution Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. Raven Industries

10.3.7.1. Company Overview

10.3.7.2. Solution Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. DeLaval

10.3.8.1. Company Overview

10.3.8.2. Solution Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. Trimble

10.3.9.1. Company Overview

10.3.9.2. Solution Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. AKVA Group

10.3.10.1. Company Overview

10.3.10.2. Solution Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Components Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |