Global Sports and Athletic Socks Market Forecast

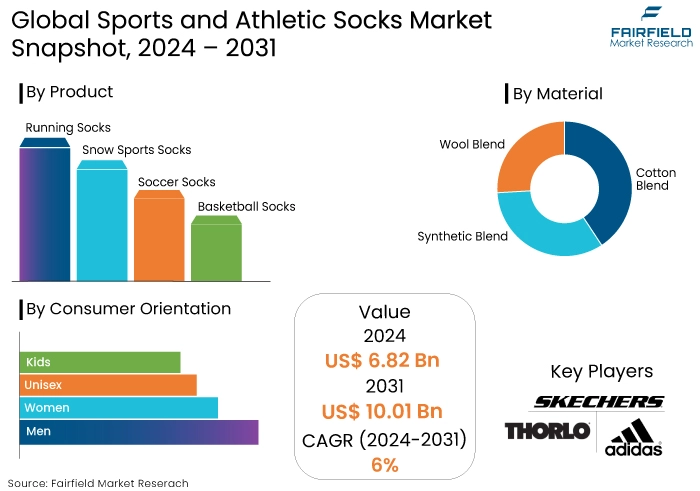

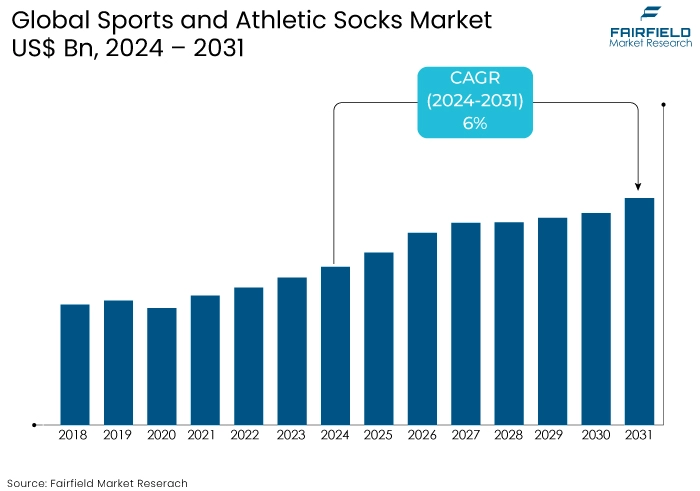

- The sports and athletic socks market is projected to reach a size of US$10.01 Bn by 2031, showing significant growth from the US$6.82 Bn achieved in 2024

- The market for sports and athletic socks is expected to experience a CAGR of 6% from 2024 to 2031

Sports and Athletic Socks Market Insights

- The market is experiencing steady growth driven by increasing sports participation and fitness awareness.

- Advances in fabric technology such as moisture-wicking and compression features are key elements for market expansion.

- Consumer preference for eco-friendly materials is pushing brands to adopt sustainable practices.

- Personalized and custom-designed socks are gaining popularity catering to individual preferences.

- Online sales are boosting market reach with brands increasingly focusing on direct-to-consumer channels.

- Leading players like Nike, Adidas, and Under Armour lead the market leveraging strong brand loyalty.

- Growth opportunities are expanding in developing regions due to rising disposable incomes.

- Socks designed for specific sports or health benefits like injury prevention are in high demand.

A Look Back and a Look Forward - Comparative Analysis

Before 2023, the sports and athletic socks market experienced steady growth driven by increasing health awareness and the rise in fitness activities. The demand for high-performance socks that offer features such as moisture-wicking, cushioning, and support led to innovations in materials and design.

The market growth fueled by the expanding sports and fitness industry where athletes and fitness enthusiasts sought specialized socks to enhance performance and comfort. The growing popularity of sports and casual athletic wear among consumers contributed to the market expansion.

Leading brands focused on product differentiation and technological advancements to cater to diverse consumer needs. Post-2024, the market is expected to witness accelerated growth. Key drivers include ongoing surge in fitness and wellness trends that are likely to sustain high demand for performance-oriented athletic wear.

The rise of e-commerce and direct-to-consumer sales channels is expected to boost market accessibility and growth. The increasing emphasis on eco-friendly and sustainable products is also likely to influence market dynamics with consumers favouring environmentally conscious brands.

As consumer preferences evolve and the sportswear market continues to expand, the market will experience robust growth and diversification.

Key Growth Determinants

- Rising Health and Fitness Trends

The growing focus on health and fitness is a major driver for the sports and athletic socks market. As more individuals prioritize physical well-being and engage in regular exercise, the demand for specialized athletic gear including socks has surged.

Sports and athletic socks are designed to enhance performance by providing features such as moisture-wicking, cushioning, and arch support. These features are essential for athletes and fitness enthusiasts who require high-performance wear to improve comfort and prevent injuries.

The popularity of activities such as running, cycling, and gym workouts contributes to the increased need for advanced athletic socks. Moreover, the rise of fitness culture driven by social media influencers and health-conscious communities has heightened consumer awareness and demand for premium athletic wear. This trend is expected to continue driving market growth as many people adopt healthy lifestyles and seek products that support their fitness goals.

- Technological Innovations in Sock Materials

Technological advancements in sock materials and design significantly boost the sports and athletic socks market. Innovations such as moisture-wicking fabrics, anti-microbial treatments, and compression technology have transformed athletic socks into high-performance gear.

Moisture-wicking materials help keep feet dry and comfortable during intense activities, while anti-microbial treatments prevent odours and infections. Compression technology enhances blood circulation, reducing fatigue and improving athletic performance. These advancements cater to the specific needs of athletes and active individuals, offering enhanced comfort and functionality.

As technology evolves, manufacturers integrate new materials and design features to meet consumer demands for superior performance. The continuous innovation in sock technology attracts new customers and encourages existing users to upgrade their gear, driving growth in the market.

- Growth of E-Commerce and Direct-to-Consumer Channels

The expansion of e-commerce and direct-to-consumer sales channels is a significant driver for the sports and athletic socks market. Online shopping platforms provide consumers with a convenient way to explore a wide range of athletic socks, compare products, and make purchases from the comfort of their homes.

E-commerce allows brands to reach a global audience and offer personalized shopping experiences such as tailored recommendations and easy returns. Direct-to-consumer channels enable brands to establish close connection with their customers, gather valuable feedback, and offer exclusive products.

The growth of digital marketing and social media has further amplified the reach of online sales as brands engage with consumers through targeted advertising and influencer partnerships. Also, the shift towards online and direct sales is expected to drive market growth by increasing accessibility, enhancing consumer engagement, and expanding market reach for sports and athletic socks.

Key Growth Determinants

- High Competition and Market Saturation

The sports and athletic socks market faces significant competition and saturation, which can restrain growth. With numerous brands and products available, distinguishing oneself in a crowded market is challenging.

Established brands and new entrants alike compete on price, quality, and innovation, which can lead to price wars and reduced profit margins. Market saturation also makes it difficult for new companies to gain a foothold and for existing players to achieve substantial market share.

The abundance of choices can overwhelm consumers making it hard for any single brand to stand out. This intense competition pressures companies to continually innovate and invest in marketing to maintain relevance, which can strain resources and impact profitability.

As the market becomes increasingly saturated, managing brand differentiation and maintaining competitive advantage become critical challenges for growth.

- Rising Costs of Raw Materials

Increasing costs of raw materials pose a significant restraint for the sports and athletic socks market. The prices of materials such as cotton, synthetic fibres, and advanced-performance fabrics can fluctuate due to supply chain disruptions, trade policies, and changes in production costs.

Increased raw material costs lead to high production expenses, which can result in elevated retail prices for consumers. High costs can affect consumer purchasing behaviour potentially reducing demand for premium or high-performance socks.

Manufacturers may face pressure to absorb or pass these costs on to consumers, impacting profitability and competitive positioning. As companies strive to balance cost control with product quality and innovation, managing raw material costs becomes critical in sustaining market growth and profitability.

Sports and Athletic Socks Market Trends and Opportunities

- Increased Focus on Sustainability

A significant trend in the sports and athletic socks market is the growing emphasis on sustainability. As environmental awareness rises among consumers, there is a heightened demand for eco-friendly and ethically produced products.

Manufacturers respond by incorporating sustainable materials such as recycled fibers, organic cotton, and biodegradable materials into their sock designs. Brands also focus on reducing carbon footprint through energy-efficient production processes and sustainable packaging solutions. This trend is driven by consumer preferences for products that align with their values, regulatory pressures, and corporate social responsibility initiatives.

Companies that successfully integrate sustainability into their product offerings meet the growing demand for environmentally conscious goods, enhance their brand image, and appeal to broad audience. As sustainability becomes increasingly important, it is expected to shape product development, marketing strategies, and consumer purchasing decisions in the market.

- Customization and Personalization

The growing demand for customization and personalization is an emerging opportunity in the sports and athletic socks market. Consumers are increasingly seeking products that reflect their preferences and styles, leading to a rise in custom-designed athletic socks. This trend is driven by the desire for unique and personalized sports gear that enhances performance and personal expression.

Advances in technology, such as digital printing and 3D knitting, enable manufacturers to offer bespoke designs, colours, and features tailored to individual needs. Customization options may include personalized text, logos, or specific design elements that cater to niche markets or team-specific requirements.

This market opportunity allows brands to differentiate themselves in a competitive market, attract loyal customers, and command high price points for bespoke products. As the trend toward personalization continues, companies that embrace this opportunity and offer innovative customization options can capitalize on growing consumer demand and enhance their market presence.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario is significantly shaping the sports and athletic socks market by influencing product standards, safety, and sustainability practices. Textile safety and quality regulations ensure that socks meet specific performance and safety criteria, such as the absence of harmful chemicals and adherence to material durability standards.

Compliance with these regulations is crucial for market acceptance and consumer trust. Moreover, increasing environmental regulations are pushing manufacturers to adopt sustainable practices.

Governments and international bodies are imposing strict guidelines on using eco-friendly materials and waste management. This trend is driving brands to integrate recycled fibres, reduce carbon footprints, and use biodegradable packaging.

Regulations around labour practices and ethical production are prompting companies to ensure fair labour conditions throughout their supply chains. This regulatory pressure enhances transparency and fosters corporate social responsibility.

Segments Covered in the Report

- Men’s Socks to Influence the Sports and Athletic Socks Market

Men's socks category leads the market accumulating around 63% of revenue. Men exhibit a great affinity for dressy socks than women. The demand for women's socks is projected to increase at a substantial CAGR rate during the period from 2024 to 2031.

The World Federation of the Sporting Goods Industry (WFSGI) asserts that more female participation in sports will enhance the sportswear sector. Female participation in various sports is increasing, and they are more inclined than males to perceive sports as vital for sustaining their health and well-being.

- Cotton Blend Socks to Top the Position

Based on material type, cotton blend socks prevail in the sports and athletic socks market owing to their extensive popularity, which is derived from intrinsic attributes such as breathability, comfort, and moisture absorption. Cotton's natural fibres facilitate enhanced air circulation, mitigating the likelihood of foot perspiration and irritation.

London Sock Company, a UK-based firm launched its collection of back-to-work socks in October 2023. These are meticulously hand-finished from a premium stretch-cotton blend cloth to enhance durability.

Cotton blended socks, wool socks are also favoured for their superior insulation capabilities, ensuring warmth in frigid conditions while efficiently managing moisture to preserve dryness. The inherent flexibility of wool fibres ensures a secure fit, delivering both comfort and support.

Regional Analysis

- North America Emerging as a Significant Market

North America is expected to dominate the market for sports and athletic socks over the forecast period. The United States held a significant share of around 18% in the regional sports and athletic socks market. The country's need for athletic and sports socks that provide superior comfort and protection is expected to increase due to the increased number of injuries from sports and other recreational activities.

Consumers in America today increasingly worry about their safety when engaging in recreational and other sporting activities. Therefore, regional sales of sports and athletic socks are anticipated to increase as more people become aware of the health hazards linked to such sports and recreational activities.

Fairfield’s Competitive Landscape Analysis

The sports and athletic socks market is highly competitive with leading players like Nike, Adidas, Puma, Under Armour, and Asics dominating the landscape. Key brands lead through innovation, extensive product portfolios, and strong brand loyalty. They invest significantly in research and development to create high-performance socks with features like moisture-wicking, compression, and enhanced durability.

Small and emerging brands focus on niche markets, offering specialized or sustainable products to differentiate themselves. The market is also seeing increased competition from private labels and direct-to-consumer brands that offer quality products at competitive prices.

The competitive dynamics are shaped by continuous innovation, branding, and the ability to meet evolving consumer preferences, particularly regarding sustainability and performance.

Key Market Companies

- Nike, Inc.

- Adidas AG

- VF Corporation

- PUMA SE

- Jockey International Inc.

- Drymax Technologies Inc.

- Hanesbrands Inc.

- Under Armour, Inc.

- Skechers U.S.A., Inc.

- ASICS Corporation

- Wolverine World Wide, Inc.

- THORLO, Inc.

- New Balance Athletics, Inc.

Recent Industry Developments

- January 2024 -

Puma S.E. announced the inauguration of their newest store in Dubai, situated in the prominent City Walk site in the UAE. The store will be the company's fourth establishment in the UAE, set to open in 2024 and showcase some of the brand's most popular products.

- December 2023 -

Under Armour, Inc. inaugurated its inaugural outlet store in the O2 multipurpose indoor stadium in London, UK. The 3,949-square-foot store, conceived within the brand's new Factory House retail concept, features a range of sportswear, footwear, and accessories.

An Expert’s Eye

- Continuous innovation in materials and design is crucial for staying competitive in the sports and athletic socks market.

- Offering personalized and custom-designed socks is a growing trend, providing brands with a competitive edge and appealing to niche markets.

- The ongoing focus on health and fitness is expected to sustain market demand, particularly for performance-oriented socks with advanced features.

- Educating consumers on the benefits of high-performance socks is vital, as informed customers are more likely to invest in premium products.

Global Sports and Athletic Socks Market is Segmented as-

By Product

- Running Socks

- Snow Sports Socks

- Soccer Socks

- Basketball Socks

By Consumer Orientation

- Men

- Women

- Unisex

- Kids

By Material Type

- Cotton Blend

- Synthetic Blend

- Wool Blend

By Sales Channel

- Online

- Offline

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

1. Executive Summary

1.1. Global Sports and Athletic Socks Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Sports and Athletic Socks Market Outlook, 2019 - 2031

3.1. Global Sports and Athletic Socks Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Running Socks

3.1.1.2. Snow Sports Socks

3.1.1.3. Soccer Socks

3.1.1.4. Basketball Socks

3.1.1.5. Cycling Socks

3.1.1.6. Fitness Socks

3.1.1.7. Casual Sports Socks

3.1.1.8. Golf Socks

3.1.1.9. Hockey Socks

3.2. Global Sports and Athletic Socks Market Outlook, by Consumer Orientation, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Men

3.2.1.2. Women

3.2.1.3. Unisex

3.2.1.4. Kids

3.3. Global Sports and Athletic Socks Market Outlook, by Material Type, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Cotton Blend

3.3.1.2. Synthetic Blend

3.3.1.3. Wool Blend

3.4. Global Sports and Athletic Socks Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. Online

3.4.1.1.1. Direct to Customer Sales

3.4.1.1.2. Third Party Sales

3.4.1.2. Offline

3.4.1.2.1. Franchised Stores

3.4.1.2.2. Independent Stores

3.4.1.2.3. Mono-Brand Stores

3.4.1.2.4. Specialty Stores

3.4.1.2.5. Hypermarket/ Supermarket

3.4.1.2.6. Convenience Stores

3.4.1.2.7. Departmental Stores

3.4.1.2.8. Other Sales Channel

3.5. Global Sports and Athletic Socks Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Sports and Athletic Socks Market Outlook, 2019 - 2031

4.1. North America Sports and Athletic Socks Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Running Socks

4.1.1.2. Snow Sports Socks

4.1.1.3. Soccer Socks

4.1.1.4. Basketball Socks

4.1.1.5. Cycling Socks

4.1.1.6. Fitness Socks

4.1.1.7. Casual Sports Socks

4.1.1.8. Golf Socks

4.1.1.9. Hockey Socks

4.2. North America Sports and Athletic Socks Market Outlook, by Consumer Orientation, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Men

4.2.1.2. Women

4.2.1.3. Unisex

4.2.1.4. Kids

4.3. North America Sports and Athletic Socks Market Outlook, by Material Type, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Cotton Blend

4.3.1.2. Synthetic Blend

4.3.1.3. Wool Blend

4.4. North America Sports and Athletic Socks Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Online

4.4.1.1.1. Direct to Customer Sales

4.4.1.1.2. Third Party Sales

4.4.1.2. Offline

4.4.1.2.1. Franchised Stores

4.4.1.2.2. Independent Stores

4.4.1.2.3. Mono-Brand Stores

4.4.1.2.4. Specialty Stores

4.4.1.2.5. Hypermarket/ Supermarket

4.4.1.2.6. Convenience Stores

4.4.1.2.7. Departmental Stores

4.4.1.2.8. Other Sales Channel

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Sports and Athletic Socks Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. U.S. Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

4.5.1.2. U.S. Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

4.5.1.3. U.S. Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

4.5.1.4. U.S. Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

4.5.1.5. Canada Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

4.5.1.6. Canada Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

4.5.1.7. Canada Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

4.5.1.8. Canada Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Sports and Athletic Socks Market Outlook, 2019 - 2031

5.1. Europe Sports and Athletic Socks Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Running Socks

5.1.1.2. Snow Sports Socks

5.1.1.3. Soccer Socks

5.1.1.4. Basketball Socks

5.1.1.5. Cycling Socks

5.1.1.6. Fitness Socks

5.1.1.7. Casual Sports Socks

5.1.1.8. Golf Socks

5.1.1.9. Hockey Socks

5.2. Europe Sports and Athletic Socks Market Outlook, by Consumer Orientation, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Men

5.2.1.2. Women

5.2.1.3. Unisex

5.2.1.4. Kids

5.3. Europe Sports and Athletic Socks Market Outlook, by Material Type, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Cotton Blend

5.3.1.2. Synthetic Blend

5.3.1.3. Wool Blend

5.4. Europe Sports and Athletic Socks Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Online

5.4.1.1.1. Direct to Customer Sales

5.4.1.1.2. Third Party Sales

5.4.1.2. Offline

5.4.1.2.1. Franchised Stores

5.4.1.2.2. Independent Stores

5.4.1.2.3. Mono-Brand Stores

5.4.1.2.4. Specialty Stores

5.4.1.2.5. Hypermarket/ Supermarket

5.4.1.2.6. Convenience Stores

5.4.1.2.7. Departmental Stores

5.4.1.2.8. Other Sales Channel

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Sports and Athletic Socks Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. Germany Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.2. Germany Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

5.5.1.3. Germany Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

5.5.1.4. Germany Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.5.1.5. U.K. Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.6. U.K. Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

5.5.1.7. U.K. Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

5.5.1.8. U.K. Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.5.1.9. France Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.10. France Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

5.5.1.11. France Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

5.5.1.12. France Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.5.1.13. Italy Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.14. Italy Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

5.5.1.15. Italy Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

5.5.1.16. Italy Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.5.1.17. Turkey Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.18. Turkey Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

5.5.1.19. Turkey Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

5.5.1.20. Turkey Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.5.1.21. Russia Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.22. Russia Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

5.5.1.23. Russia Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

5.5.1.24. Russia Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.5.1.25. Rest of Europe Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

5.5.1.26. Rest of Europe Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

5.5.1.27. Rest of Europe Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

5.5.1.28. Rest of Europe Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Sports and Athletic Socks Market Outlook, 2019 - 2031

6.1. Asia Pacific Sports and Athletic Socks Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Running Socks

6.1.1.2. Snow Sports Socks

6.1.1.3. Soccer Socks

6.1.1.4. Basketball Socks

6.1.1.5. Cycling Socks

6.1.1.6. Fitness Socks

6.1.1.7. Casual Sports Socks

6.1.1.8. Golf Socks

6.1.1.9. Hockey Socks

6.2. Asia Pacific Sports and Athletic Socks Market Outlook, by Consumer Orientation, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Men

6.2.1.2. Women

6.2.1.3. Unisex

6.2.1.4. Kids

6.3. Asia Pacific Sports and Athletic Socks Market Outlook, by Material Type, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Cotton Blend

6.3.1.2. Synthetic Blend

6.3.1.3. Wool Blend

6.4. Asia Pacific Sports and Athletic Socks Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Online

6.4.1.1.1. Direct to Customer Sales

6.4.1.1.2. Third Party Sales

6.4.1.2. Offline

6.4.1.2.1. Franchised Stores

6.4.1.2.2. Independent Stores

6.4.1.2.3. Mono-Brand Stores

6.4.1.2.4. Specialty Stores

6.4.1.2.5. Hypermarket/ Supermarket

6.4.1.2.6. Convenience Stores

6.4.1.2.7. Departmental Stores

6.4.1.2.8. Other Sales Channel

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Sports and Athletic Socks Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. China Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

6.5.1.2. China Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

6.5.1.3. China Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

6.5.1.4. China Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.5.1.5. Japan Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

6.5.1.6. Japan Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

6.5.1.7. Japan Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

6.5.1.8. Japan Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.5.1.9. South Korea Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

6.5.1.10. South Korea Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

6.5.1.11. South Korea Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

6.5.1.12. South Korea Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.5.1.13. India Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

6.5.1.14. India Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

6.5.1.15. India Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

6.5.1.16. India Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.5.1.17. Southeast Asia Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

6.5.1.18. Southeast Asia Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

6.5.1.19. Southeast Asia Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

6.5.1.20. Southeast Asia Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.5.1.21. Rest of Asia Pacific Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

6.5.1.22. Rest of Asia Pacific Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

6.5.1.23. Rest of Asia Pacific Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

6.5.1.24. Rest of Asia Pacific Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Sports and Athletic Socks Market Outlook, 2019 - 2031

7.1. Latin America Sports and Athletic Socks Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Running Socks

7.1.1.2. Snow Sports Socks

7.1.1.3. Soccer Socks

7.1.1.4. Basketball Socks

7.1.1.5. Cycling Socks

7.1.1.6. Fitness Socks

7.1.1.7. Casual Sports Socks

7.1.1.8. Golf Socks

7.1.1.9. Hockey Socks

7.2. Latin America Sports and Athletic Socks Market Outlook, by Consumer Orientation, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Men

7.2.1.2. Women

7.2.1.3. Unisex

7.2.1.4. Kids

7.3. Latin America Sports and Athletic Socks Market Outlook, by Material Type, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Cotton Blend

7.3.1.2. Synthetic Blend

7.3.1.3. Wool Blend

7.4. Latin America Sports and Athletic Socks Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Online

7.4.1.1.1. Direct to Customer Sales

7.4.1.1.2. Third Party Sales

7.4.1.2. Offline

7.4.1.2.1. Franchised Stores

7.4.1.2.2. Independent Stores

7.4.1.2.3. Mono-Brand Stores

7.4.1.2.4. Specialty Stores

7.4.1.2.5. Hypermarket/ Supermarket

7.4.1.2.6. Convenience Stores

7.4.1.2.7. Departmental Stores

7.4.1.2.8. Other Sales Channel

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Sports and Athletic Socks Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Brazil Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

7.5.1.2. Brazil Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

7.5.1.3. Brazil Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

7.5.1.4. Brazil Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

7.5.1.5. Mexico Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

7.5.1.6. Mexico Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

7.5.1.7. Mexico Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

7.5.1.8. Mexico Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

7.5.1.9. Argentina Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

7.5.1.10. Argentina Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

7.5.1.11. Argentina Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

7.5.1.12. Argentina Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

7.5.1.13. Rest of Latin America Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

7.5.1.14. Rest of Latin America Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

7.5.1.15. Rest of Latin America Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

7.5.1.16. Rest of Latin America Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Sports and Athletic Socks Market Outlook, 2019 - 2031

8.1. Middle East & Africa Sports and Athletic Socks Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Running Socks

8.1.1.2. Snow Sports Socks

8.1.1.3. Soccer Socks

8.1.1.4. Basketball Socks

8.1.1.5. Cycling Socks

8.1.1.6. Fitness Socks

8.1.1.7. Casual Sports Socks

8.1.1.8. Golf Socks

8.1.1.9. Hockey Socks

8.2. Middle East & Africa Sports and Athletic Socks Market Outlook, by Consumer Orientation, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Men

8.2.1.2. Women

8.2.1.3. Unisex

8.2.1.4. Kids

8.3. Middle East & Africa Sports and Athletic Socks Market Outlook, by Material Type, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Cotton Blend

8.3.1.2. Synthetic Blend

8.3.1.3. Wool Blend

8.4. Middle East & Africa Sports and Athletic Socks Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Online

8.4.1.1.1. Direct to Customer Sales

8.4.1.1.2. Third Party Sales

8.4.1.2. Offline

8.4.1.2.1. Franchised Stores

8.4.1.2.2. Independent Stores

8.4.1.2.3. Mono-Brand Stores

8.4.1.2.4. Specialty Stores

8.4.1.2.5. Hypermarket/ Supermarket

8.4.1.2.6. Convenience Stores

8.4.1.2.7. Departmental Stores

8.4.1.2.8. Other Sales Channel

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Sports and Athletic Socks Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. GCC Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

8.5.1.2. GCC Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

8.5.1.3. GCC Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

8.5.1.4. GCC Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.5.1.5. South Africa Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

8.5.1.6. South Africa Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

8.5.1.7. South Africa Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

8.5.1.8. South Africa Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.5.1.9. Egypt Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

8.5.1.10. Egypt Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

8.5.1.11. Egypt Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

8.5.1.12. Egypt Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.5.1.13. Nigeria Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

8.5.1.14. Nigeria Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

8.5.1.15. Nigeria Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

8.5.1.16. Nigeria Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.5.1.17. Rest of Middle East & Africa Sports and Athletic Socks Market by Product, Value (US$ Bn), 2019 - 2031

8.5.1.18. Rest of Middle East & Africa Sports and Athletic Socks Market by Consumer Orientation, Value (US$ Bn), 2019 - 2031

8.5.1.19. Rest of Middle East & Africa Sports and Athletic Socks Market by Material Type, Value (US$ Bn), 2019 - 2031

8.5.1.20. Rest of Middle East & Africa Sports and Athletic Socks Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Material Type vs by Consumer Orientation Heat map

9.2. Manufacturer vs by Consumer Orientation Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Nike, Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Adidas AG

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. VF Corporation

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. PUMA SE

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Jockey International Inc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Drymax Technologies Inc

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Hanesbrands Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Under Armour, Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Skechers U.S.A, Inc.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. ASICS Corporation

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Wolverine Worldwide, Inc.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. THORLO, Inc.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. New Balance Athletics, Inc.

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Consumer Orientation Coverage |

|

|

Material Type Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |