Global Sports Equipment Market Forecast

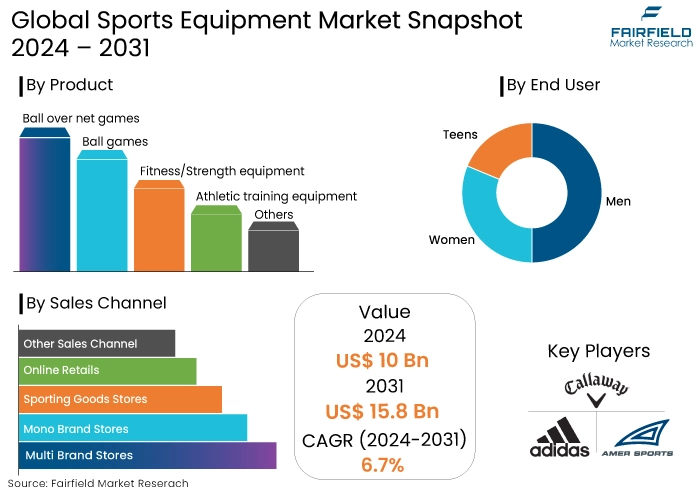

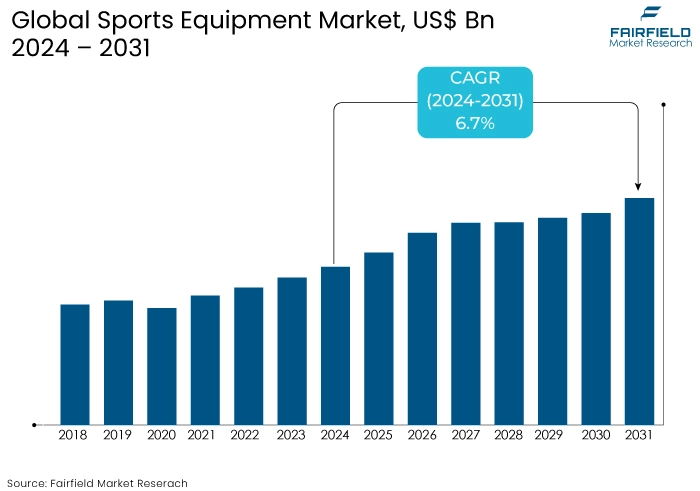

- The global sports equipment market is projected to reach a value of US$15.8 Bn by 2031, showing significant growth from the US$10 Bn achieved in 2024.

- The market value is expected to reach a notable rate of expansion, with an estimated CAGR of 6.7% during the forecast period from 2024 to 2031.

Sports Equipment Market Insights

- Rising health awareness in young generation is a key driver for sports equipment demand.

- Urban areas show increased interest in fitness due to sedentary lifestyles.

- Specialty & sports shops segment leads the sports equipment market with 45.3% share.

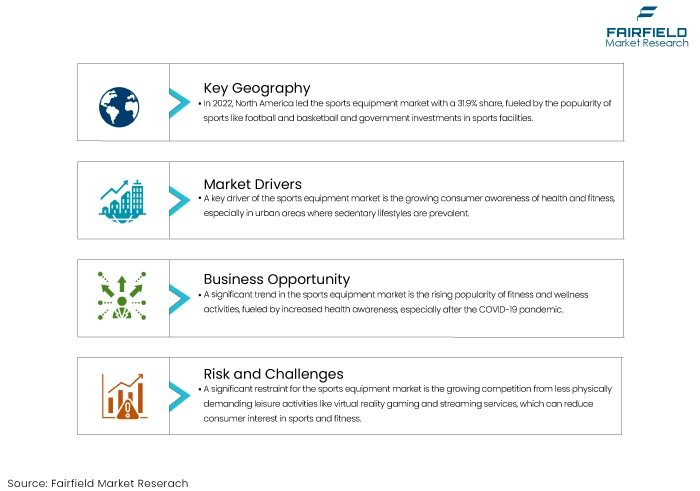

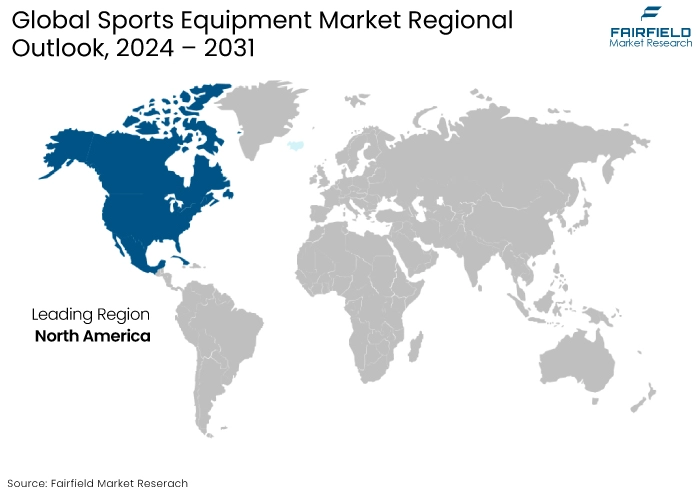

- North America held 31.9% market share in 2022 driven by sports popularity in the region.

- Social media and influencer marketing boost fitness culture, sport equipment accessories, and other equipment sales.

- Asia Pacific market is estimated to record a 7.4% CAGR through 2031 with growth in fitness equipment sales.

- Women’s participation in sports expands market demand for tailored equipment to meet their unique needs.

- Based on product type, ball games dominated the market with a 34.3% revenue share in 2022.

- The fitness/strength equipment exhibits rapid growth due to lifestyle changes.

- The online retail segment is projected to expand at a 7.4% CAGR through 2030.

A Look Back and a Look Forward - Comparative Analysis

The sports equipment market experienced notable growth trends in pre-2023 and is projected to continue expanding post-2024. Market growth reflects a recovery and resilience in the industry driven by increased consumer interest in fitness and sports activities.

Several key trends and factors are fueling the market growth. There is a growing emphasis on health and fitness, leading to increased participation in sports and recreational activities. Advancements in material technologies and product designs are also attracting consumers, enhancing performance and user experience.

As per Fairfield's sports equipment market report, the rise of online shopping has made sports equipment accessible allowing consumers to purchase a wider range of products conveniently. A huge number of consumers are also purchasing used sports equipment. This growing adoption of e-commerce and sports equipment resale options are shaping the growth of the industry.

Increasing awareness of environmental issues is pushing brands to adopt sustainable practices that appeal to eco-conscious consumers. These factors collectively contribute to a dynamic and evolving sports equipment products, setting the stage for sustained growth in the coming years.

Key Growth Determinants

- Increasing Health Awareness

One of the primary growth drivers for sports equipment market is the increasing awareness of health and fitness among consumers. As lifestyle-related health issues such as obesity and cardiovascular diseases become more prevalent, individuals are seeking ways to improve their physical well-being. This trend is particularly evident in urban areas where sedentary lifestyles are common.

The rise of fitness culture fueled by social media and influencer marketing has led to a surge in demand for various sports and fitness equipment. As more people exercise regularly, the need for quality sports equipment rises and so the rise in sports equipment stores driving market growth.

- Inclusion of Women in Sports

The rise of women participating in sports is a significant growth driver for the market. Over the past few years, there has been a notable increase in female participation across various sports disciplines supported by initiatives from sports federations and organizations aimed at promoting gender equality in athletics. This shift is not only changing the dynamics of sports but also expanding the market for sports equipment tailored specifically for women.

As more women engage in sports, there is a growing demand for equipment that meets their specific needs, from apparel to specialized gear. This trend signifies a cultural shift that is reshaping the sports landscape and creating new avenues for growth in the market.

- Technological Advancements

Technological advancements are another crucial driver and contribute significantly toward sports equipment market expansion. Innovations in materials and design have led to the development of high-performance equipment that enhances athletic performance and safety.

The integration of technology into sports equipment such as smart wearables and connected devices has created new opportunities for engagement and performance tracking. Brands that leverage technology to offer innovative solutions are likely to gain a competitive edge in the market.

People also seek various sports equipment accessories such as sports equipment organizers and sports equipment storage options that are expected to drive sports equipment sector growth.

Key Growth Barriers

- Competition from Alternative Leisure Activities

One significant restraint for sports equipment market is the competition from alternative leisure activities. As consumer preferences evolve, many individuals are gravitating toward activities that require less physical exertion, such as virtual reality gaming, streaming services, and other forms of entertainment. This shift in leisure activities can detract from the time and resources consumers might otherwise allocate to sports and fitness.

The rise of digital entertainment options has made it easy for people to engage in sedentary activities, which can lead to a decline in participation in traditional sports. As a result, the demand for sports equipment may stagnate or decline.

- Economic Factors and Disposable Income

Another critical restraint affecting the sports equipment market revenue is economic fluctuations and disposable income levels. During periods of economic downturn or uncertainty, consumers often prioritize essential expenditures over discretionary spending, which includes sports equipment. This can lead to reduced sales and slower market growth, particularly for high-end or specialized equipment that may not be deemed necessary.

Variations in disposable income across different regions can create disparities in market performance. As economic conditions fluctuate, the market must remain adaptable to sustain growth and meet consumer needs effectively.

Sports Equipment Market Trends and Opportunities

Growing Popularity of Fitness and Wellness

A significant trend shaping the value of sports equipment market is the growing popularity of fitness and wellness. As more individuals prioritize their health, there has been a marked increase in participation in fitness activities, including gym workouts, yoga, and outdoor sports. This trend is driven by a heightened awareness of the importance of physical health, particularly in the wake of the COVID-19 pandemic, which underscored the need to maintain a healthy lifestyle.

Fitness influencers and social media platforms have played a crucial role in promoting various fitness regimes, encouraging people to invest in sports equipment that enhances their workout experience. This includes everything from home gym equipment like weights and resistance bands to specialized gear and sports equipment storage ideas for activities such as running, cycling, yoga, and organizing. As a result, manufacturers are responding by innovating and diversifying their product offerings to cater to this expanding market.

Expansion into Emerging Markets

Some exciting sports equipment market opportunities lie in the expansion into emerging markets. Countries in regions such as Asia-Pacific, Latin America, and parts of Africa are experiencing rapid economic growth, leading to increased disposable incomes and a burgeoning middle class. Additionally, the increasing availability of e-commerce platforms allows for easy access to sports equipment further driving sales.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape significantly influences the sports equipment market by establishing standards for safety, quality, and environmental impact. Governments and international bodies are increasingly implementing regulations that ensure products meet specific safety criteria, which is crucial for consumer protection.

Regulations regarding the materials used in sports equipment such as restrictions on harmful substances are becoming stringent. This not only affects manufacturers but also encourages innovation as companies strive to comply with these standards while maintaining product performance.

Various governments support initiatives promoting sports participation, especially among youth and women. These initiatives often come with funding and resources aimed at enhancing sports infrastructure and accessibility, which in turn drives demand for sports equipment.

Fairfield’s Ranking Board

Segments Covered in the Report

- Ball Games Rule the Market with 3% Share and Growing Fitness Trends

The ball games segment held a dominant 34.3% revenue share in the sports equipment market in 2022 driven by global interest in cricket, basketball, and football with a projected CAGR of over 6.4%.

The fitness and strength equipment segment is projected to experience the highest growth rate due to urban lifestyle changes, increasing health concerns, and rising disposable incomes. This shift is fueling a greater consumer focus on sports and fitness, highlighting the evolving landscape of the market.

- Female Rules the Market with Increasing Participation

The rise in women's participation in sports is set to boost the global sports industry. The World Bank reported an increase in the female population from US$ 3.8 Bn in 2020 to US$3.9 Bn in 2022. This surge is driven by health awareness and is expected to enhance the global tennis equipment market.

More women are competing in national and international tournaments alongside a growing female viewership of sports events further propelling the demand for the sports equipment market. This trend signifies a positive shift toward gender equality in sports participation and viewership.

- Online Sales Channel Set to Gain the Notable Share

Effective sales channel and marketing strategies can significantly impact product success. As consumer purchasing patterns evolve, online retailers are increasingly offering innovative sports equipment at discounted rates with this segment projected to expand at a CAGR of 12.5%.

Segment growth is driven by increased internet penetration, targeted marketing, and a rise in smartphone usage. As consumer spending and e-commerce expand, online retail is poised to further enhance its presence in the market during the forecast period.

Regional Analysis

- North America Accounted for Notable Market Share

In 2022, North America held a commanding 31.9% share of the sports equipment market, driven by the rising popularity of sports like football and basketball. Governments in the region are investing in new arenas and improved facilities to enhance the sporting experience for citizens. This commitment is expected to foster a positive outlook for market growth throughout the forecast period, further solidifying North America's position as a leader in the sports equipment industry.

- Asia Pacific Sports Equipment Market Set for Notable Growth

Asia Pacific sports equipment market is projected to achieve the highest CAGR of 7.4% during the forecast period. In 2021, sales of fitness equipment surged due to COVID-19, while India saw significant growth in outdoor equipment driven by rising sports popularity and new leagues.

Australia also experienced increased demand due to a heightened focus on sports. Additionally, growing disposable incomes and consumer spending in emerging markets like India, China, and the Middle East are expected to boost demand for sporting goods supported by improved infrastructure and a variety of athletic events.

Fairfield’s Competitive Landscape Analysis

The sports equipment market features both international and domestic players focusing on innovation, new product launches, and strategic distribution expansions. Collaborations with celebrities are also enhancing customer reach.

In July 2024, Fitness World, India's leading fitness brand, recently unveiled its K-6 Strength Series, a state-of-the-art fitness equipment set to redefine the industry. The innovative K-6 series features a biomechanically designed steel frame, stylish steel designer shroud, elegant black color, and comfortable beige seat upholstery.

Strategic moves highlight the industry's focus on diversifying offerings and expanding market presence to capitalize on growing consumer interest in fitness and sports activities.

Key Market Companies

- Adidas AG

- Amer Sports

- Callaway Golf Co.

- Sumitomo Rubber Industries Limited

- Nike, Inc.

- Puma SE

- Mizuno Corporation

- Sports Direct International PLC

- Yonex Co., Ltd

- Under Armour

Recent Industry Developments

- July 2024

Reliance Retail is set to launch a sports format rivaling French Competitor Decathlon to capitalize on the post-COVID-19 athleisure market boom. Founded in 1976, Decathlon is known for delivering high-quality, affordable, and durable products.

The company entered the Indian market in 2009 and has over 100 stores across India. Reliance is also mulling to expand its business in the $150 billion diagnostic healthcare sector. The company is said to lease 8,000-10,000 sq ft of space across malls and high streets in top cities for the new venture. The name of the new brand has yet to be disclosed. The company is looking for a player with a nationwide presence to scale its business.

An Expert’s Eye

- Technological advances in sports accessories lead to high-performance sports gear and smart devices.

- Alternative leisure activities like gaming pose competition and are a hindrance to sports equipment.

- Economic factors and disposable income impact spending on sports equipment in several regions.

- Fitness and wellness trends increase demand for gym and outdoor sports gear.

- Rising disposable income in emerging markets boosts sports equipment demand.

- Improved infrastructure in several areas in developing regions supports market growth.

Global Sports Equipment Market is Segmented as-

By Product

- Ball over net games

- Ball games

- Fitness/Strength equipment

- Athletic training equipment

- Others

By End User

- Men

- Women

- Teens

By Sales Channel

- Multi Brand Stores

- Mono Brand Stores

- Franchise Store

- Company Owned Stores

- Sporting Goods Stores

- Online Retails

- Direct Store

- Indirect Store

- Other Sales Channel

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia

- Oceania

- The Middle East & Africa

1. Executive Summary

1.1. Global Sports Equipment Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Sports Equipment Market Outlook, 2019 - 2031

3.1. Global Sports Equipment Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Up to 18 micron

3.1.1.2. 18 to 50 micron

3.1.1.3. 50 to 80 micron

3.1.1.4. Above 80 micron

3.2. Global Sports Equipment Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Bags & Pouches

3.2.1.2. Wraps

3.2.1.3. Lamination

3.2.1.4. Labels

3.2.1.5. Others

3.3. Global Sports Equipment Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Food & Beverages

3.3.1.2. Floral

3.3.1.3. Textile

3.3.1.4. Healthcare

3.3.1.5. Others

3.4. Global Sports Equipment Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Sports Equipment Market Outlook, 2019 - 2031

4.1. North America Sports Equipment Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Up to 18 micron

4.1.1.2. 18 to 50 micron

4.1.1.3. 50 to 80 micron

4.1.1.4. Above 80 micron

4.2. North America Sports Equipment Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Bags & Pouches

4.2.1.2. Wraps

4.2.1.3. Lamination

4.2.1.4. Labels

4.2.1.5. Others

4.3. North America Sports Equipment Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Food & Beverages

4.3.1.2. Floral

4.3.1.3. Textile

4.3.1.4. Healthcare

4.3.1.5. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Sports Equipment Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

4.4.1.2. U.S. Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

4.4.1.3. U.S. Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

4.4.1.4. Canada Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

4.4.1.5. Canada Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

4.4.1.6. Canada Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Sports Equipment Market Outlook, 2019 - 2031

5.1. Europe Sports Equipment Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Up to 18 micron

5.1.1.2. 18 to 50 micron

5.1.1.3. 50 to 80 micron

5.1.1.4. Above 80 micron

5.2. Europe Sports Equipment Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Bags & Pouches

5.2.1.2. Wraps

5.2.1.3. Lamination

5.2.1.4. Labels

5.2.1.5. Others

5.3. Europe Sports Equipment Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Food & Beverages

5.3.1.2. Floral

5.3.1.3. Textile

5.3.1.4. Healthcare

5.3.1.5. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Sports Equipment Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.2. Germany Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.3. Germany Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.4.1.4. U.K. Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.5. U.K. Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.6. U.K. Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.4.1.7. France Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.8. France Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.9. France Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.4.1.10. Italy Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.11. Italy Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.12. Italy Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.4.1.13. Turkey Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.14. Turkey Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.15. Turkey Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.4.1.16. Russia Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.17. Russia Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.18. Russia Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.4.1.19. Rest of Europe Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

5.4.1.20. Rest of Europe Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.21. Rest of Europe Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Cassava Starch Market Outlook, 2019 - 2031

6.1. Asia Pacific Cassava Starch Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Up to 18 micron

6.1.1.2. 18 to 50 micron

6.1.1.3. 50 to 80 micron

6.1.1.4. Above 80 micron

6.2. Asia Pacific Sports Equipment Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Bags & Pouches

6.2.1.2. Wraps

6.2.1.3. Lamination

6.2.1.4. Labels

6.2.1.5. Others

6.3. Asia Pacific Sports Equipment Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Food & Beverages

6.3.1.2. Floral

6.3.1.3. Textile

6.3.1.4. Healthcare

6.3.1.5. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Sports Equipment Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.2. China Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.3. China Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.4.1.4. Japan Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.5. Japan Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.6. Japan Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.4.1.7. South Korea Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.8. South Korea Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.9. South Korea Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.4.1.10. India Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.11. India Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.12. India Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.4.1.13. Southeast Asia Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.14. Southeast Asia Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.15. Southeast Asia Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Sports Equipment Market Outlook, 2019 - 2031

7.1. Latin America Sports Equipment Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Up to 18 micron

7.1.1.2. 18 to 50 micron

7.1.1.3. 50 to 80 micron

7.1.1.4. Above 80 micron

7.2. Latin America Sports Equipment Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Bags & Pouches

7.2.1.2. Wraps

7.2.1.3. Lamination

7.2.1.4. Labels

7.2.1.5. Others

7.3. Latin America Sports Equipment Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Food & Beverages

7.3.1.2. Floral

7.3.1.3. Textile

7.3.1.4. Healthcare

7.3.1.5. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Sports Equipment Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

7.4.1.2. Brazil Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.3. Brazil Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

7.4.1.4. Mexico Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

7.4.1.5. Mexico Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.6. Mexico Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

7.4.1.7. Argentina Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

7.4.1.8. Argentina Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.9. Argentina Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

7.4.1.10. Rest of Latin America Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

7.4.1.11. Rest of Latin America Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.12. Rest of Latin America Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Sports Equipment Market Outlook, 2019 - 2031

8.1. Middle East & Africa Sports Equipment Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Up to 18 micron

8.1.1.2. 18 to 50 micron

8.1.1.3. 50 to 80 micron

8.1.1.4. Above 80 micron

8.2. Middle East & Africa Sports Equipment Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Bags & Pouches

8.2.1.2. Wraps

8.2.1.3. Lamination

8.2.1.4. Labels

8.2.1.5. Others

8.3. Middle East & Africa Sports Equipment Market Outlook, by Sales Channel, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Food & Beverages

8.3.1.2. Floral

8.3.1.3. Textile

8.3.1.4. Healthcare

8.3.1.5. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Sports Equipment Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.2. GCC Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.3. GCC Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.4.1.4. South Africa Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.5. South Africa Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.6. South Africa Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.4.1.7. Egypt Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.8. Egypt Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.9. Egypt Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.4.1.10. Nigeria Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.11. Nigeria Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.12. Nigeria Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Sports Equipment Market by Product Type, Value (US$ Bn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Sports Equipment Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Sports Equipment Market by Sales Channel, Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Sales Channel vs by End User Heat map

9.2. Manufacturer vs by End User Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Amer Sports.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Adidas AG

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Callaway Golf Company.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. PUMA SE.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Cabela's incorporated.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. GLOBERIDE, Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. MIZUNO Corporation.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Nike Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Jarden Corporation.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. YONEX Co, Ltd.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

End User Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |