Global Stroke Rehabilitation Market Forecast

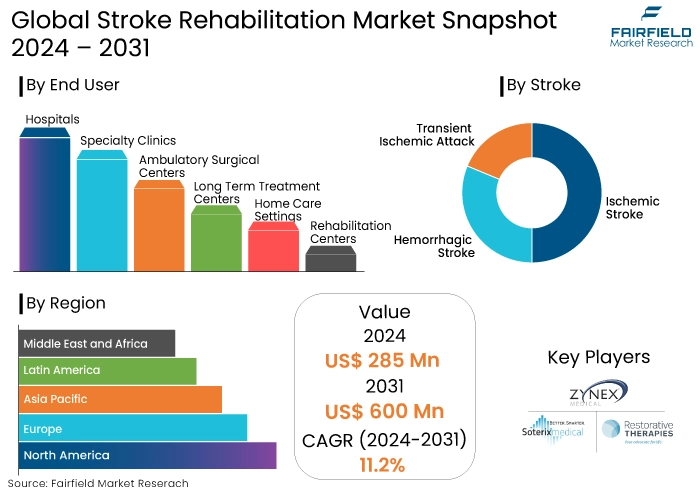

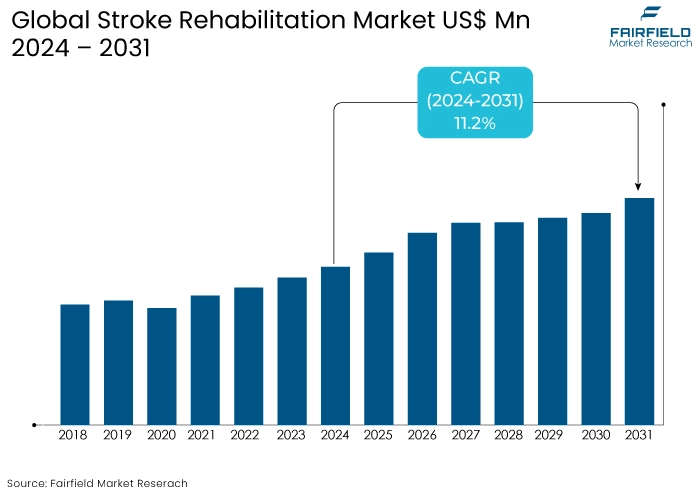

- The global stroke rehabilitation market is projected to reach value of US$600 Mn by 2031, showing significant growth from the US$285 Mn achieved in 2024.

- The market revenue is projected to exhibit a remarkable CAGR of 11.2% during the forecast period from 2024 to 2031.

Stroke Rehabilitation Market Insights

- The shift toward patient-centric models in healthcare is increasing the emphasis on home-based rehabilitation.

- Ischemic stroke patients make up 87.3% of those in stroke recovery facilities.

- Home-based rehabilitation offers convenience, reduced travel costs, and enhanced comfort for stroke patients.

- Hospitals are the leading choice for stroke rehabilitation medications and devices and expected to reach a valuation of US$5,859.9 Mn in 2024.

- Inconsistent reimbursement policies can deter investment in new technologies.

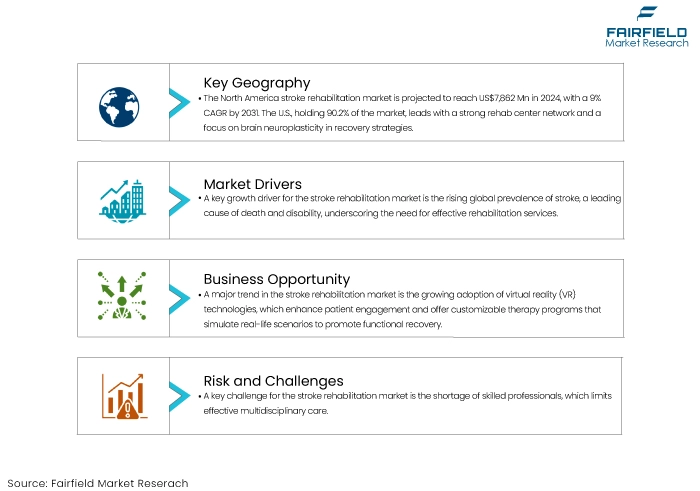

- North America is projected to experience US$7,862 Mn in 2024 driven by evidence-based techniques that leverage the brain's adaptability.

- The shortage of skilled professionals in the field can lead to inadequate rehabilitation services resulting in slow recovery times and poor outcomes.

- Increasing prevalence of stroke remain a key driver for stroke rehabilitation market.

- East Asia stroke rehabilitation industry is projected to reach US$ 2,985 Mn in 2024.

A Look Back and a Look Forward - Comparative Analysis

The stroke rehabilitation market has shown prominent growth, particularly from 2024 to 2031, where it is projected to expand at a CAGR of 11.2%. This growth trajectory reflects a strong demand for rehabilitation services and products aimed at improving the quality of life for stroke survivors.

Prior to 2023, the market was already experiencing noteworthy growth driven by an increasing prevalence of strokes and advancements in rehabilitation technologies. The introduction of innovative products such as Medtronic's NeuroRecovery System has further fueled this demand.

Post-2024, the market is expected to benefit from a surge in rehabilitation centers that provide specialized care. Several market trends are fueling this growth and the increasing number of stroke cases globally is a primary driver. Similarly, innovations in rehabilitation technologies including robotic and electrical stimulators are enhancing recovery outcomes consequently fueling the industry growth.

There has also been a notable shift toward home-based rehabilitation, which is becoming increasingly popular among patients. Enhanced awareness of stroke management and increased investments in healthcare infrastructure are also pivotal. These trends and factors collectively indicate a promising future for the market, with a strong emphasis on improving patient outcomes through advanced therapeutic solutions.

Key Growth Determinants

- Increasing Prevalence of Stroke

One of the primary growth drivers for the stroke rehabilitation market is the increasing prevalence of stroke globally. According to the World Health Organization (WHO), stroke is one of the leading causes of death and disability worldwide, with millions of new cases reported annually. This alarming statistic highlights the urgent need for effective rehabilitation services to aid recovery and improve the quality of life for stroke survivors.

As the aging population increases, particularly in developed countries, the incidence of stroke is expected to rise further escalating the demand for rehabilitation solutions. Additionally, lifestyle factors such as obesity, sedentary behavior, and hypertension contribute to the growing number of stroke cases.

As awareness of stroke recovery options expands, the demand for comprehensive rehabilitation services will continue to grow, positioning the market for sustained expansion.

- Technological Advancements in Rehabilitation

Technological advancements are revolutionizing the stroke rehabilitation market expansion, serving as a significant growth driver. Innovations in rehabilitation technologies such as robotic-assisted devices, virtual reality (VR) systems, and mobile health applications are enhancing the effectiveness of rehabilitation therapies.

The integration of artificial intelligence (AI) in rehabilitation strategies further enables real-time monitoring and adjustments to therapy optimizing recovery outcomes. Moreover, tele-rehabilitation solutions have gained traction especially post-pandemic allowing patients to access therapy remotely thus expanding the reach of rehabilitation services. As healthcare providers increasingly adopt these advanced technologies, the market will experience accelerated growth.

- Growing Demand for Home-Based Rehabilitation

The growing demand for home-based rehabilitation is another pivotal driver of the stroke rehabilitation market. As healthcare systems shift toward patient-centric models, there is an increasing emphasis on providing rehabilitation services in the comfort of patients' homes.

Home-based rehabilitation offers several advantages, including greater convenience, reduced travel costs, and enhanced comfort for patients recovering from stroke. Additionally, caregivers play a crucial role in home-based rehabilitation, and increasing educational resources and support for them enhance the effectiveness of home therapies. As the population ages and more individuals prefer to recuperate at home, the demand for home-based rehabilitation solutions will continue to expand.

Key Growth Barriers

- Lack of Skilled Professionals

A significant restraint for the growth of the stroke rehabilitation market is the shortage of skilled professionals in the field. Effective stroke rehabilitation requires a multidisciplinary approach involving various specialists, including physical therapists, occupational therapists, speech-language pathologists, and neurologists.

The complexity of stroke recovery necessitates a team of trained professionals who can provide comprehensive care tailored to individual patient needs. However, many regions face a critical shortage of these skilled practitioners, which can lead to inadequate rehabilitation services. As a result, patients may experience slower recovery times and poorer outcomes, which can deter healthcare providers from investing in rehabilitation services.

- High Costs of Rehabilitation Services

Another significant restraint impacting the stroke rehabilitation market revenue is the high cost of rehabilitation services. Advanced rehabilitation technologies, such as robotic devices and virtual reality systems, while effective, often come with substantial price tags that can be prohibitive for many healthcare facilities and patients.

Ongoing therapy sessions, specialized equipment, and the need for skilled professionals contribute to the overall expense of stroke rehabilitation. This financial burden can lead to reduced access to necessary rehabilitation programs ultimately affecting patient outcomes and recovery rates.

Stroke Rehabilitation Market Trends and Opportunities

- Rise of Virtual Reality in Rehabilitation

One of the most significant trends shaping the stroke rehabilitation market is the increasing adoption of virtual reality (VR) technologies. VR offers innovative and engaging rehabilitation solutions that can enhance patient motivation and participation during therapy sessions.

By immersing patients in interactive environments, VR can simulate real-life scenarios that promote functional recovery such as walking in a park or navigating through a grocery store. Additionally, the flexibility of VR systems enables therapists to customize rehabilitation programs to meet individual patient needs, making therapy more effective.

- Expansion of Tele-Rehabilitation Services

The expansion of telerehabilitation services offers several stroke rehabilitation market opportunities. The COVID-19 pandemic accelerated the adoption of telehealth solutions, demonstrating their effectiveness in delivering rehabilitation services remotely.

Tele-rehabilitation allows stroke survivors to receive therapy from the comfort of their homes, reducing barriers such as travel difficulties and time constraints. As technology advances, integrating telerehabilitation with wearable devices and mobile health applications can provide real-time feedback and personalized interventions further improving patient outcomes.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape plays a crucial role in shaping the stroke rehabilitation market growth influencing both the development and adoption of innovative therapies and technologies. Regulatory bodies such as the FDA in the United States and the EMA in Europe establish guidelines that ensure the safety and efficacy of rehabilitation devices and treatments. These regulations can either facilitate or hinder market growth, depending on their stringency and the speed of approval processes.

One significant challenge is the variability in rehabilitation practices and the lack of standardized outcome measures, which can complicate the regulatory approval of new devices and therapies. This inconsistency may lead to delays in bringing innovative solutions to market, as companies must navigate complex regulatory requirements to demonstrate the effectiveness of their products.

Fairfield’s Ranking Board

Segments Covered in the Report

- Surge in Ischemic Stroke Recovery Boosts the Market Share

As per the stroke rehabilitation market update, ischemic stroke patients make up 87.3% of those in stroke recovery facilities, seeking specialized cognitive rehabilitation for executive function, memory, and attention.

Over the next decade, the share of these patients is projected to expand at a CAGR of 9.7%, contributing an estimated revenue of US$19,021.7 Mn in 2024. In contrast, hemorrhagic and transient ischemic stroke patients are expected to represent only 9.7% and 5.1% of the market share, respectively, in the same year.

- Hospitals Lead the Market Through Increasing Awareness

Hospitals remain the leading choice for stroke rehabilitation medications and devices expected to reach a valuation of US$5,859.9 Mn in 2024 capturing a notable global market share annually. Increasing stroke cases and awareness about stroke and their diagnosis, people intend to visit hospitals for treatment for fast recovery and good outcomes.

Rehabilitation centers offering tailored inpatient recovery programs are projected to grow even faster. These centers benefit from improved access to evidence-based interventions and technological advancements through collaborations with research organizations enhancing the effectiveness of stroke rehabilitation strategies.

Regional Analysis

- North America's Booming Stroke Rehabilitation Market

North America stroke rehabilitation market is projected to value at US$7,862 Mn in 2024, driven by evidence-based techniques that leverage the brain's adaptability. This demand is expected to capture a CAGR of 9% by 2031.

The United States with a robust network of rehab centers will account for 90.2% of the regional market. Focusing on brain and neuroplasticity in recovery research, the U.S. market shows notable influence on rehabilitation strategies embraced by regional industry players.

- East Asia Poised to Lead the Market Through 2031

East Asia stroke rehabilitation market is projected to reach US$2,985 Mn in 2024, driven by rising stroke prevalence and increased patient awareness. China leads the market, contributing nearly 41% of regional revenue, with government initiatives boosting outpatient services and accessibility.

China's market is anticipated to expand at a CAGR of 12.4%, reaching US$ 3,719 million by 2031. Japan and South Korea are also expanding with increased awareness and health care infrastructures.

Fairfield’s Competitive Landscape Analysis

Leading players in the stroke rehabilitation market include Penumbra, Inc., Saebo Inc., DJO Global, and BIONIK Inc., among others. These companies lead in technology-enabled rehabilitation by developing robotic therapy devices and advanced wearables.

Small rehabilitation clinics also provide tailored stroke rehab practices for survivors. In August 2021, MicroTransponder launched the Vivistim Paired VNS system as a novel alternative to traditional medication for ischemic stroke recovery enhancing the company's position in the healthcare sector.

Key Market Companies

- Penumbra, Inc. (REAL System)

- Saebo Inc

- Shanghai Siyi Intelligent Technology Co., Ltd.

- DJO Global

- Shenzhen XFT Medical

- Soterix Medical Inc.

- Restorative Therapies

- Zynex Medical, Inc

- Myolyn

- ACP - Accelerated Care Plus.

Recent Industry Developments

- August 2024, AmLife International is celebrating its 10th anniversary with the launch of its rehabilitation and regenerative center, AmHope. To mark this anniversary, the company is investing RM 1.4 million to establish AmHope, a rehabilitation and regenerative center designed to help seniors overcome the challenges of stroke and other physical health issues.

AmHope offers pioneering technology in the form of High Potential Hydrogen Therapy and Electric Potential Therapy, which can accelerate healing for various conditions, including chronic wounds and injuries. The center also has a shuttle service for transportation and plans to roll out a mobile truck to serve local communities.

- March 2024, The Centers for Medicare & Medicaid Services (CMS) has established a new Healthcare Common Procedure Coding System (HCPCS) Level II code for the IpsiHand™ Upper Extremity Rehabilitation System by Neurolutions, Inc. This marks the first time a brain-computer interface (BCI) controlled therapy has been recognized with an HCPCS code, setting a new benchmark for thought-activated controlled devices.

An Expert’s Eye

- Advanced rehabilitation technologies can be prohibitive for many healthcare facilities and patients.

- Enhanced awareness of stroke management and increased investments in healthcare infrastructure are the key factors for stroke rehabilitation market growth.

- Variability in rehabilitation practices and lack of standardized outcome measures can complicate the regulatory approval of new devices and therapies.

- The global prevalence of stroke is a primary growth driver, highlighting the need for effective rehabilitation services.

- The complexity of stroke recovery necessitates a multidisciplinary approach involving various specialists.

Global Stroke Rehabilitation Market is Segmented as-

By Product

- Electrical Stimulators

- Table Top

- Wearable

- Robotic Stimulators

- Wireless Stimulators

- Non-Invasive Stimulators

- Cognitive Stimulators

- Others

By Stroke

- Ischemic Stroke

- Hemorrhagic Stroke

- Transient Ischemic Attack

By End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Long Term Treatment Centers

- Home Care Settings

- Rehabilitation Centers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

1. Executive Summary

1.1. Global Stroke Rehabilitation Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Stroke Rehabilitation Market Outlook, 2019 - 2031

3.1. Global Stroke Rehabilitation Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Electrical Stimulators

3.1.1.1.1. Table Top

3.1.1.1.2. Wearable

3.1.1.2. Robotic Stimulators

3.1.1.3. Wireless Stimulators

3.1.1.4. Non-Invasive Stimulators

3.1.1.5. Cognitive Stimulators

3.1.1.6. Others

3.2. Global Stroke Rehabilitation Market Outlook, by Stroke Type, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Ischemic Stroke

3.2.1.2. Hemorrhagic Stroke

3.2.1.3. Transient Ischemic Attack

3.3. Global Stroke Rehabilitation Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Specialty Clinics

3.3.1.3. Ambulatory Surgical Centers

3.3.1.4. Long Term Treatment Centers

3.3.1.5. Home Care Settings

3.3.1.6. Rehabilitation Centers

3.4. Global Stroke Rehabilitation Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Stroke Rehabilitation Market Outlook, 2019 - 2031

4.1. North America Stroke Rehabilitation Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Electrical Stimulators

4.1.1.1.1. Table Top

4.1.1.1.2. Wearable

4.1.1.2. Robotic Stimulators

4.1.1.3. Wireless Stimulators

4.1.1.4. Non-Invasive Stimulators

4.1.1.5. Cognitive Stimulators

4.1.1.6. Others

4.2. North America Stroke Rehabilitation Market Outlook, by Stroke Type, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Ischemic Stroke

4.2.1.2. Hemorrhagic Stroke

4.2.1.3. Transient Ischemic Attack

4.3. North America Stroke Rehabilitation Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Specialty Clinics

4.3.1.3. Ambulatory Surgical Centers

4.3.1.4. Long Term Treatment Centers

4.3.1.5. Home Care Settings

4.3.1.6. Rehabilitation Centers

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Stroke Rehabilitation Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

4.4.1.2. U.S. Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

4.4.1.3. U.S. Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

4.4.1.4. Canada Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

4.4.1.5. Canada Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

4.4.1.6. Canada Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Stroke Rehabilitation Market Outlook, 2019 - 2031

5.1. Europe Stroke Rehabilitation Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Electrical Stimulators

5.1.1.1.1. Table Top

5.1.1.1.2. Wearable

5.1.1.2. Robotic Stimulators

5.1.1.3. Wireless Stimulators

5.1.1.4. Non-Invasive Stimulators

5.1.1.5. Cognitive Stimulators

5.1.1.6. Others

5.2. Europe Stroke Rehabilitation Market Outlook, by Stroke Type, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Ischemic Stroke

5.2.1.2. Hemorrhagic Stroke

5.2.1.3. Transient Ischemic Attack

5.3. Europe Stroke Rehabilitation Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Specialty Clinics

5.3.1.3. Ambulatory Surgical Centers

5.3.1.4. Long Term Treatment Centers

5.3.1.5. Home Care Settings

5.3.1.6. Rehabilitation Centers

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Stroke Rehabilitation Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.2. Germany Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

5.4.1.3. Germany Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.4. U.K. Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.5. U.K. Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

5.4.1.6. U.K. Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.7. France Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.8. France Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

5.4.1.9. France Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.10. Italy Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.11. Italy Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

5.4.1.12. Italy Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.13. Turkey Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.14. Turkey Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

5.4.1.15. Turkey Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.16. Russia Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.17. Russia Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

5.4.1.18. Russia Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.19. Rest of Europe Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.20. Rest of Europe Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

5.4.1.21. Rest of Europe Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Stroke Rehabilitation Market Outlook, 2019 - 2031

6.1. Asia Pacific Stroke Rehabilitation Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Electrical Stimulators

6.1.1.1.1. Table Top

6.1.1.1.2. Wearable

6.1.1.2. Robotic Stimulators

6.1.1.3. Wireless Stimulators

6.1.1.4. Non-Invasive Stimulators

6.1.1.5. Cognitive Stimulators

6.1.1.6. Others

6.2. Asia Pacific Stroke Rehabilitation Market Outlook, by Stroke Type, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Ischemic Stroke

6.2.1.2. Hemorrhagic Stroke

6.2.1.3. Transient Ischemic Attack

6.3. Asia Pacific Stroke Rehabilitation Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Specialty Clinics

6.3.1.3. Ambulatory Surgical Centers

6.3.1.4. Long Term Treatment Centers

6.3.1.5. Home Care Settings

6.3.1.6. Rehabilitation Centers

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Stroke Rehabilitation Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.2. China Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

6.4.1.3. China Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.4. Japan Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.5. Japan Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

6.4.1.6. Japan Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.7. South Korea Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.8. South Korea Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

6.4.1.9. South Korea Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.10. India Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.11. India Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

6.4.1.12. India Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.13. Southeast Asia Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.14. Southeast Asia Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

6.4.1.15. Southeast Asia Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Stroke Rehabilitation Market Outlook, 2019 - 2031

7.1. Latin America Stroke Rehabilitation Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Electrical Stimulators

7.1.1.1.1. Table Top

7.1.1.1.2. Wearable

7.1.1.2. Robotic Stimulators

7.1.1.3. Wireless Stimulators

7.1.1.4. Non-Invasive Stimulators

7.1.1.5. Cognitive Stimulators

7.1.1.6. Others

7.2. Latin America Stroke Rehabilitation Market Outlook, by Stroke Type, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Ischemic Stroke

7.2.1.2. Hemorrhagic Stroke

7.2.1.3. Transient Ischemic Attack

7.3. Latin America Stroke Rehabilitation Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Specialty Clinics

7.3.1.3. Ambulatory Surgical Centers

7.3.1.4. Long Term Treatment Centers

7.3.1.5. Home Care Settings

7.3.1.6. Rehabilitation Centers

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Stroke Rehabilitation Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.2. Brazil Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

7.4.1.3. Brazil Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.4. Mexico Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.5. Mexico Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

7.4.1.6. Mexico Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.7. Argentina Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.8. Argentina Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

7.4.1.9. Argentina Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.10. Rest of Latin America Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.11. Rest of Latin America Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

7.4.1.12. Rest of Latin America Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Stroke Rehabilitation Market Outlook, 2019 - 2031

8.1. Middle East & Africa Stroke Rehabilitation Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Electrical Stimulators

8.1.1.1.1. Table Top

8.1.1.1.2. Wearable

8.1.1.2. Robotic Stimulators

8.1.1.3. Wireless Stimulators

8.1.1.4. Non-Invasive Stimulators

8.1.1.5. Cognitive Stimulators

8.1.1.6. Others

8.2. Middle East & Africa Stroke Rehabilitation Market Outlook, by Stroke Type, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Ischemic Stroke

8.2.1.2. Hemorrhagic Stroke

8.2.1.3. Transient Ischemic Attack

8.3. Middle East & Africa Stroke Rehabilitation Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Specialty Clinics

8.3.1.3. Ambulatory Surgical Centers

8.3.1.4. Long Term Treatment Centers

8.3.1.5. Home Care Settings

8.3.1.6. Rehabilitation Centers

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Stroke Rehabilitation Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.2. GCC Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

8.4.1.3. GCC Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.4. South Africa Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.5. South Africa Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

8.4.1.6. South Africa Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.7. Egypt Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.8. Egypt Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

8.4.1.9. Egypt Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.10. Nigeria Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.11. Nigeria Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

8.4.1.12. Nigeria Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Stroke Rehabilitation Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Stroke Rehabilitation Market by Stroke Type, Value (US$ Bn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Stroke Rehabilitation Market by End User, Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Distribution Channel vs by Stroke Type Heat map

9.2. Manufacturer vs by Stroke Type Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Penumbra, Inc. (REAL System)

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Saebo Inc

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Shanghai Siyi Intelligent Technology Co., Ltd.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. DJO Global.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Shenzhen XFT Medical

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Shenzhen XFT Medical

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Shenzhen XFT Medical

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Shenzhen XFT Medical

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Shenzhen XFT Medical

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Shenzhen XFT Medical

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Stroke Coverage

|

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |