Global Transcatheter Heart Valve Replacement Repair Market Forecast

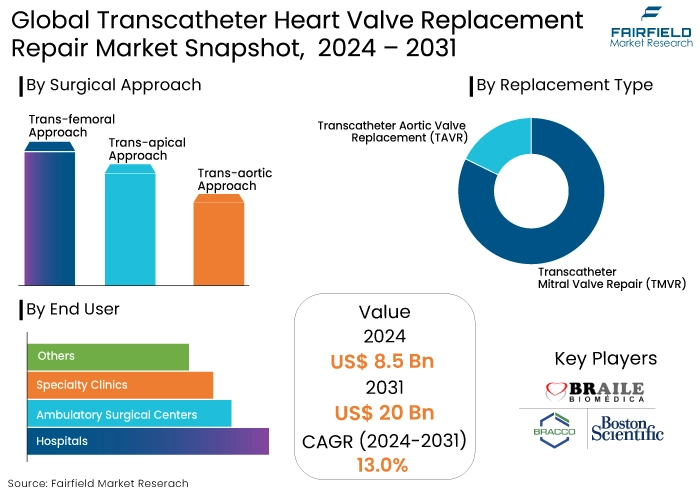

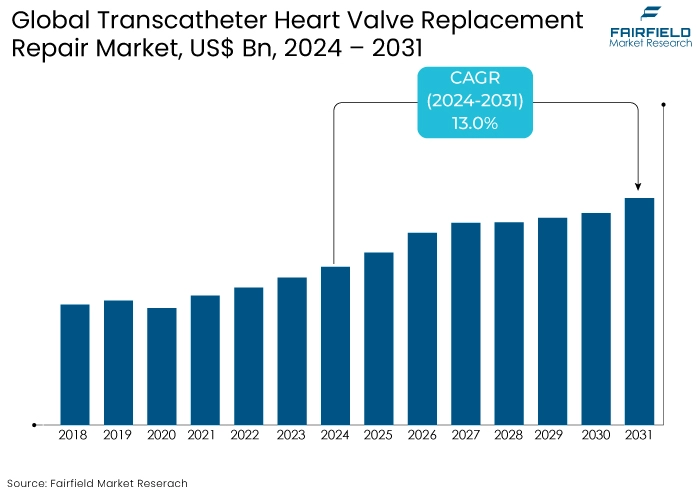

- The global transcatheter heart valve replacement repair market is projected to reach a size of US$20 Bn by 2031 showing significant growth from the US$5 Bn achieved in 2024.

- The market revenue is expected to exhibit a remarkable rate of expansion, with an estimated CAGR of 13.0% during the forecast period from 2024 to 2031.

Transcatheter Heart Valve Replacement Repair Market Insights

- The global aging population increases the incidence of heart valve diseases creating a large patient pool.

- Based on surgical approach, trans-femoral approach leads the transcatheter heart valve replacement repair market with a 79.9% share.

- Factors like sedentary lifestyles, unhealthy diets, and high obesity rates contribute to the rise in heart-related conditions.

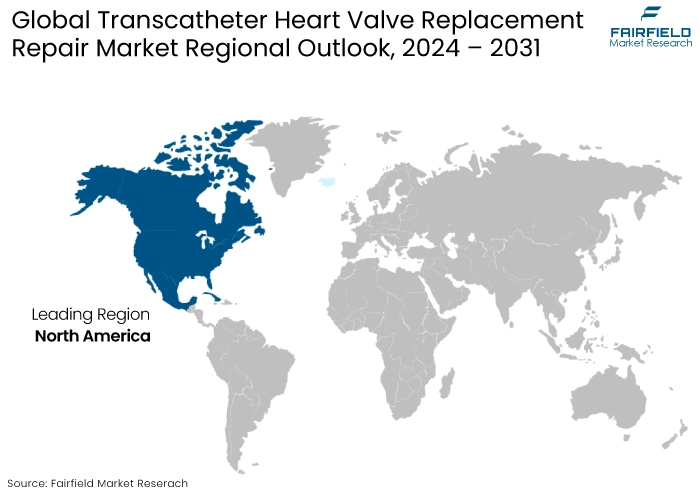

- North America led the market with a 49.1% revenue share in 2022.

- Asia Pacific market is estimated to record a CAGR of 15.3% during the forecast period from 2024 to 2031.

- Favorable reimbursement policies incentivize hospitals and clinics to adopt advanced therapies.

- Based on replacement type, transcatheter aortic valve replacement (TAVR) dominates the market with a 78.9% revenue share.

- Improved delivery systems, and enhanced imaging techniques are the key driving factors for market growth.

A Look Back and a Look Forward - Comparative Analysis

Transcatheter heart valve replacement (THVR) refers to a minimally invasive procedure used to replace malfunctioning heart valves without the need for open-heart surgery. This approach utilizes catheter-based techniques to deliver artificial valves directly to the heart, significantly reducing recovery time and associated risks.

The market for THVR repair encompasses various types of procedures, including transcatheter aortic valve replacement (TAVR) and transcatheter mitral valve repair (TMVR), among others.

There are many benefits of THVR. These benefits include reduced procedural risks, short hospital stays, and quick recovery times compared to traditional surgical methods. The increasing prevalence of heart valve diseases particularly among aging population is driving demand for these innovative solutions.

One of the most notable transcatheter heart valve replacement repair market trends is the advancement in technology. The technological evolution is encouraging more healthcare providers to adopt these procedures, thereby expanding the market.

Another market trend is the shift toward outpatient procedures. This shift not only enhances patient convenience but also reduces healthcare costs making these procedures more accessible.

Key Growth Determinants

- Continuous Evolution of Transcatheter Heart Valve Technologies

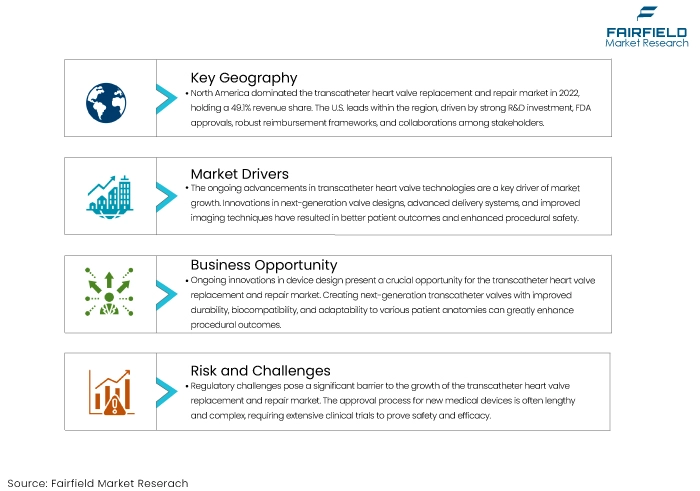

The continuous evolution of transcatheter heart valve technologies is a significant growth driver in the market. Innovations such as next-generation valve designs, improved delivery systems, and enhanced imaging techniques have led to better patient outcomes and increased procedural safety.

Advancements enable healthcare providers to perform complex cases with great precision, expanding the range of patients eligible for treatment. As manufacturers invest in research and development, the introduction of novel devices is estimated to stimulate transcatheter heart valve replacement repair market demand further.

- Growing Aging Population

The global aging population is a primary driver of growth in the market. As individuals age, the incidence of heart valve diseases, such as aortic stenosis and mitral regurgitation, increases significantly. This demographic shift creates a larger patient pool, requiring effective treatment options.

Old patients often prefer minimally invasive procedures, which offer shorter recovery times and lower risks compared to traditional surgeries. This growing demand for less invasive interventions among elderly patients will continue to propel the transcatheter heart valve replacement repair market expansion.

- Rising Prevalence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases globally is a key driver for the transcatheter heart valve replacement market. Factors such as sedentary lifestyles, unhealthy diets, and high rates of obesity contribute to the rise in heart-related conditions.

The demand for effective treatments like transcatheter heart valve replacements will increase as more patients are diagnosed with heart valve disorders. Consequently, healthcare systems are focusing on providing minimally invasive solutions that can address these growing health concerns further accelerating transcatheter heart valve replacement repair market share.

Key Growth Barriers

- High Costs of Procedures

One of the significant factors impeding the growth of the transcatheter heart valve replacement repair market sales is the high cost associated with these procedures. The expenses related to advanced medical devices, hospital stays, and specialized healthcare personnel can be substantial.

Many healthcare systems and patients may find it challenging to afford these costs particularly in regions with limited healthcare budgets. This financial barrier can restrict access to transcatheter procedures ultimately slowing market growth and limiting the number of patients who can benefit from these innovative treatments.

- Regulatory Challenges Remain a Big Obstacle

Regulatory hurdles present another obstacle to the expansion of the transcatheter heart valve replacement repair market revenue. The approval process for new medical devices can be lengthy and complex, often requiring extensive clinical trials to demonstrate safety and efficacy.

Regulatory challenges can delay the introduction of innovative products into the market, hindering competition and limiting options for healthcare providers and patients. Additionally, varying regulations across different countries can complicate market entry for manufacturers, further impeding the growth of this promising sector in the healthcare industry.

Transcatheter Heart Valve Replacement Repair Market Trends and Opportunities

- Continuous Innovations in Device Design

Continuous innovations in device design represent a vital opportunity for the transcatheter heart valve replacement repair market. Developing next-generation transcatheter valves that offer enhanced durability, biocompatibility, and adaptability to diverse patient anatomies can significantly improve procedural outcomes.

Advancements in delivery systems such as fully repositionable and retrievable devices, can increase the safety and efficacy of procedures. Investing in research and development focused on these innovations will not only expand the range of treatable conditions but also elevate the overall standard of care in cardiovascular interventions, driving market growth.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario plays a pivotal role in shaping the transcatheter heart valve replacement repair market growth by establishing guidelines that influence product development, approval timelines, and market entry. In regions like North America and Europe, stringent regulatory frameworks ensure that new devices meet high safety and efficacy standards before reaching the market. The U.S. FDA's approval process, particularly for innovative therapies, is crucial for commercialization, as it builds trust among healthcare providers and patients.

Moreover, favorable reimbursement policies can significantly enhance market growth by incentivizing hospitals and clinics to adopt these advanced therapies. Regulatory bodies also promote clinical trials that validate the effectiveness of transcatheter heart valve technologies, facilitating faster adoption.

Collaborative efforts between manufacturers and regulatory agencies can streamline the approval process, encouraging innovation while ensuring regulation compliance. A supportive regulatory environment fosters the market growth and development enhancing patient care and outcomes.

Fairfield’s Ranking Board

Segments Covered in the Report

- TAVR Dominates the Market with a 78.9% Revenue Share

The industry is divided into transcatheter aortic valve replacement (TAVR) and transcatheter mitral valve repair (TMVR) based on replacement type. As per the transcatheter heart valve replacement repair market forecast, TAVR dominates with a 78.9% market share as it can be used for patients across all risk levels without requiring open-heart surgery.

Minimally invasive nature of TAVR often allows for minimal anesthesia and same-day discharge. In contrast, TMVR accounts for 20.4% of the market with a projected CAGR of 12.4% through 2031 reflecting its growing adoption of heart valve procedures.

- Trans-Femoral Surgical Approaches Lead the Market with 79.9% Market Share

The market is categorized into trans-femoral, trans-apical, and trans-aortic based on surgical approach. The trans-femoral approach leads the transcatheter heart valve replacement repair market with a 79.9% share and is expected to capture a CAGR of 12.2%. This growth is driven by an increased emphasis on investigational products and advancements in minimally invasive techniques. The trans-femoral approach's dominance highlights its preference among healthcare providers for delivering effective treatment options in valve replacement procedures.

- Hospitals Emerge as Ruling End User Segment Accounting for 66.2% Share

Hospitals led the market with a 66.2% share in 2022 and is projected to expand at a CAGR of 14.2% during the forecast period. This growth is driven by patients seeking efficient treatments that minimize recovery time and hospital stays. Additionally, the increasing adoption of advanced medical devices and technologies in hospitals will further support this segment's expansion over the coming years.

- Transcatheter Aortic Valve Set Bar in the Market for Sales with 84.55%

The transcatheter heart valve replacement repair market is segmented into transcatheter aortic, pulmonary, and mitral valves based on application. Among these, transcatheter aortic valve segment dominated the market driven by rising healthcare spending, increasing chronic heart disease prevalence, and more cases of severe aortic stenosis.

Technological advancements in tricuspid interventions and neochord systems are anticipated to further boost usage. Clinical trials, such as the PARTNER II study involving over 1,000 patients, have highlighted the effectiveness of transcatheter aortic valve replacement for inoperable patients, facilitating quick adoption in the United States and EU.

Regional Analysis

- North America Led the Market by Acquiring 49.1% Share in 2022

North America transcatheter heart valve replacement repair market led with a revenue share of 49.1% in 2022. Key factors for this dominance include increased investment in research and development, and heightened awareness of advanced transcatheter therapies.

The United States holds the largest share within the region, with FDA approvals acting as significant milestones for commercialization. Additionally, a strong reimbursement framework, incentives for developing new applications, and, most importantly collaboration among stakeholders further contribute to the region's growth and market leadership.

- Asia Pacific to Expand at a CAGR of 15.3%

The Asia Pacific region is projected to experience the significant CAGR of 15.3% during the forecast period. Key markets like Japan and China are driving this growth, fueled by rising demand for innovative heart valve therapy devices, an expanding healthcare sector, and a growing elderly population.

Increased healthcare spending also supports transcatheter heart valve replacement repair market expansion. In India, favorable government initiatives and reimbursement policies, such as Aarogyasri and Jeevandayee Arogya Yojana, enhance coverage for transcatheter heart therapies, further boosting market potential.

Fairfield’s Competitive Landscape Analysis

The transcatheter heart valve replacement repair market is characterized by intense competition among innovative medical device companies focused on enhancing procedural outcomes and patient care. The market is driven by increasing healthcare expenditures, a rising prevalence of heart diseases, and a growing demand for minimally invasive procedures.

Strategic collaborations, technological advancements, and ongoing clinical trials are crucial for maintaining competitive advantage and fostering market growth particularly in regions like North America, Asia Pacific and Europe.

Key Market Companies

- Boston Scientific Corporation

- Bracco Group

- Braile Biomedica

- Direct Flow Medical

- JenaValve, St. Jude Medical

- Symetis

- ValveXchange, Inc

- Abbott

- Edwards Lifesciences Corporation

- Medtronic plc

- Meril Life Sciences

- Sahajanand Medical Technologies Limited

Recent Industry Developments

- January 2024

Kalinga Institute of Medical Sciences (KIMS) in Bhubaneswar has successfully performed the first transcatheter mitral valve replacement (TMVR) procedure in Odisha, repairing damaged valves. The 69-year-old patient, with a complex medical history, underwent the procedure, despite his high-risk profile. The team, led by Assistant Professor Dr. Anupam Jena, successfully replaced the malfunctioning valve, reducing costs and saving time. The patient made a swift recovery and was discharged within a short period.

- June 2024

Prasad Hospitals in Hyderabad has successfully performed Trans Aortic Valve Implantation (TAVI) on a 79-year-old patient with complex valvular heart disease. The procedure, which is the latest and most advanced for this type of heart disease, is less risky, done while the patient is awake, and has no significant incisions. The patient is recovering well and will be discharged in a couple of days.

An Expert’s Eye

- Regulatory bodies promote clinical trials validating the effectiveness of transcatheter heart valve technologies.

- The United States holds the significant share in the region with FDA approvals acting as significant milestones for commercialization.

- The approval process for new medical devices can be lengthy and complex, delaying the introduction of innovative products.

- Hospitals emerge as the ruling end-user segment with a 66.2% share.

- Innovations include next-generation valve designs, improved delivery systems, and enhanced imaging techniques.

- The global aging population is a primary driver for the market growth which boosts sales in the industry.

Global Transcatheter Heart Valve Replacement Repair Market is Segmented as-

By Replacement Type

- Transcatheter Aortic Valve Replacement (TAVR)

- Transcatheter Mitral Valve Repair (TMVR)

By Surgical Approach

- Trans-femoral Approach

- Trans-apical Approach

- Trans-aortic Approach

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

By Application

- Transcatheter Aortic Valve

- Transcatheter Pulmonary Valve

- Transcatheter Mitral Valve

By Region

- North America

- Asia Pacific

- Latin America

- Europe

- East Asia

- The Middle and East Africa

1. Executive Summary

1.1. Global Transcatheter Heart Valve Replacement Repair Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Transcatheter Heart Valve Replacement Repair Market Outlook, 2019 - 2031

3.1. Global Transcatheter Heart Valve Replacement Repair Market Outlook, by Product, Value (US$ Mn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Transcatheter Aortic Valve Replacement (TAVR)

3.1.1.1.1. Self – Expandable Transcatheter Aortic Valves

3.1.1.1.2. Balloon-Expandable Transcatheter Aortic Valves

3.1.1.1.3. Mechanically Expanded Transcatheter Aortic Valves

3.1.1.2. Transcatheter Mitral Valve Repair (TMVR)

3.2. Global Transcatheter Heart Valve Replacement Repair Market Outlook, by Indication, Value (US$ Mn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Severe Aortic Valve Stenosis

3.2.1.2. Valve-in-Valve Procedures (Failed Bioprosthesis)

3.2.1.3. Aortic Regurgitation

3.3. Global Transcatheter Heart Valve Replacement Repair Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Independent Cardiac Catheterization Labs

3.3.1.3. Ambulatory Surgical Centres

3.4. Global Transcatheter Heart Valve Replacement Repair Market Outlook, by Region, Value (US$ Mn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Transcatheter Heart Valve Replacement Repair Market Outlook, 2019 - 2031

4.1. North America Transcatheter Heart Valve Replacement Repair Market Outlook, by Product, Value (US$ Mn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Transcatheter Aortic Valve Replacement (TAVR)

4.1.1.1.1. Self – Expandable Transcatheter Aortic Valves

4.1.1.1.2. Balloon-Expandable Transcatheter Aortic Valves

4.1.1.1.3. Mechanically Expanded Transcatheter Aortic Valves

4.1.1.2. Transcatheter Mitral Valve Repair (TMVR)

4.2. North America Transcatheter Heart Valve Replacement Repair Market Outlook, by Indication, Value (US$ Mn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Severe Aortic Valve Stenosis

4.2.1.2. Valve-in-Valve Procedures (Failed Bioprosthesis)

4.2.1.3. Aortic Regurgitation

4.3. North America Transcatheter Heart Valve Replacement Repair Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Independent Cardiac Catheterization Labs

4.3.1.3. Ambulatory Surgical Centres

4.4. North America Transcatheter Heart Valve Replacement Repair Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

4.4.1.2. U.S. Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

4.4.1.3. U.S. Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

4.4.1.4. Canada Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

4.4.1.5. Canada Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

4.4.1.6. Canada Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

4.4.2. Market Attractiveness Analysis

5. Europe Transcatheter Heart Valve Replacement Repair Market Outlook, 2019 - 2031

5.1. Europe Transcatheter Heart Valve Replacement Repair Market Outlook, by Product, Value (US$ Mn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Transcatheter Aortic Valve Replacement (TAVR)

5.1.1.1.1. Self – Expandable Transcatheter Aortic Valves

5.1.1.1.2. Balloon-Expandable Transcatheter Aortic Valves

5.1.1.1.3. Mechanically Expanded Transcatheter Aortic Valves

5.1.1.2. Transcatheter Mitral Valve Repair (TMVR)

5.2. Europe Transcatheter Heart Valve Replacement Repair Market Outlook, by Indication, Value (US$ Mn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Severe Aortic Valve Stenosis

5.2.1.2. Valve-in-Valve Procedures (Failed Bioprosthesis)

5.2.1.3. Aortic Regurgitation

5.3. Europe Transcatheter Heart Valve Replacement Repair Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Independent Cardiac Catheterization Labs

5.3.1.3. Ambulatory Surgical Centres

5.3.2. Market Attractiveness Analysis

5.4. Europe Transcatheter Heart Valve Replacement Repair Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

5.4.1.2. Germany Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

5.4.1.3. Germany Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

5.4.1.4. U.K. Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

5.4.1.5. U.K. Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

5.4.1.6. U.K. Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

5.4.1.7. France Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

5.4.1.8. France Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

5.4.1.9. France Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

5.4.1.10. Italy Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

5.4.1.11. Italy Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

5.4.1.12. Italy Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

5.4.1.13. Turkey Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

5.4.1.14. Turkey Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

5.4.1.15. Turkey Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

5.4.1.16. Russia Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

5.4.1.17. Russia Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

5.4.1.18. Russia Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

5.4.1.19. Rest of Europe Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

5.4.1.20. Rest of Europe Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

5.4.1.21. Rest of Europe Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

5.4.2. Market Attractiveness Analysis

6. Asia Pacific Transcatheter Heart Valve Replacement Repair Market Outlook, 2019 - 2031

6.1. Asia Pacific Transcatheter Heart Valve Replacement Repair Market Outlook, by Product, Value (US$ Mn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Transcatheter Aortic Valve Replacement (TAVR)

6.1.1.1.1. Self – Expandable Transcatheter Aortic Valves

6.1.1.1.2. Balloon-Expandable Transcatheter Aortic Valves

6.1.1.1.3. Mechanically Expanded Transcatheter Aortic Valves

6.1.1.2. Transcatheter Mitral Valve Repair (TMVR)

6.2. Asia Pacific Transcatheter Heart Valve Replacement Repair Market Outlook, by Indication, Value (US$ Mn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Severe Aortic Valve Stenosis

6.2.1.2. Valve-in-Valve Procedures (Failed Bioprosthesis)

6.2.1.3. Aortic Regurgitation

6.3. Asia Pacific Transcatheter Heart Valve Replacement Repair Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Independent Cardiac Catheterization Labs

6.3.1.3. Ambulatory Surgical Centres

6.3.2. Market Attractiveness Analysis

6.4. Asia Pacific Transcatheter Heart Valve Replacement Repair Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

6.4.1.2. China Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

6.4.1.3. China Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

6.4.1.4. Japan Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

6.4.1.5. Japan Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

6.4.1.6. Japan Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

6.4.1.7. South Korea Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

6.4.1.8. South Korea Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

6.4.1.9. South Korea Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

6.4.1.10. India Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

6.4.1.11. India Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

6.4.1.12. India Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

6.4.1.13. Southeast Asia Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

6.4.1.14. Southeast Asia Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

6.4.1.15. Southeast Asia Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

6.4.2. Market Attractiveness Analysis

7. Latin America Transcatheter Heart Valve Replacement Repair Market Outlook, 2019 - 2031

7.1. Latin America Transcatheter Heart Valve Replacement Repair Market Outlook, by Product, Value (US$ Mn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Transcatheter Aortic Valve Replacement (TAVR)

7.1.1.1.1. Self – Expandable Transcatheter Aortic Valves

7.1.1.1.2. Balloon-Expandable Transcatheter Aortic Valves

7.1.1.1.3. Mechanically Expanded Transcatheter Aortic Valves

7.1.1.2. Transcatheter Mitral Valve Repair (TMVR)

7.2. Latin America Transcatheter Heart Valve Replacement Repair Market Outlook, by Indication, Value (US$ Mn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Severe Aortic Valve Stenosis

7.2.1.2. Valve-in-Valve Procedures (Failed Bioprosthesis)

7.2.1.3. Aortic Regurgitation

7.3. Latin America Transcatheter Heart Valve Replacement Repair Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Independent Cardiac Catheterization Labs

7.3.1.3. Ambulatory Surgical Centres

7.3.2. Market Attractiveness Analysis

7.4. Latin America Transcatheter Heart Valve Replacement Repair Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

7.4.1.2. Brazil Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

7.4.1.3. Brazil Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

7.4.1.4. Mexico Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

7.4.1.5. Mexico Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

7.4.1.6. Mexico Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

7.4.1.7. Argentina Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

7.4.1.8. Argentina Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

7.4.1.9. Argentina Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

7.4.1.10. Rest of Latin America Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

7.4.1.11. Rest of Latin America Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

7.4.1.12. Rest of Latin America Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

7.4.2. Market Attractiveness Analysis

8. Middle East & Africa Transcatheter Heart Valve Replacement Repair Market Outlook, 2019 - 2031

8.1. Middle East & Africa Transcatheter Heart Valve Replacement Repair Market Outlook, by Product, Value (US$ Mn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Transcatheter Aortic Valve Replacement (TAVR)

8.1.1.1.1. Self – Expandable Transcatheter Aortic Valves

8.1.1.1.2. Balloon-Expandable Transcatheter Aortic Valves

8.1.1.1.3. Mechanically Expanded Transcatheter Aortic Valves

8.1.1.2. Transcatheter Mitral Valve Repair (TMVR)

8.2. Middle East & Africa Transcatheter Heart Valve Replacement Repair Market Outlook, by Indication, Value (US$ Mn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Severe Aortic Valve Stenosis

8.2.1.2. Valve-in-Valve Procedures (Failed Bioprosthesis)

8.2.1.3. Aortic Regurgitation

8.3. Middle East & Africa Transcatheter Heart Valve Replacement Repair Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Independent Cardiac Catheterization Labs

8.3.1.3. Ambulatory Surgical Centres

8.3.2. Market Attractiveness Analysis

8.4. Middle East & Africa Transcatheter Heart Valve Replacement Repair Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

8.4.1.2. GCC Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

8.4.1.3. GCC Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

8.4.1.4. South Africa Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

8.4.1.5. South Africa Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

8.4.1.6. South Africa Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

8.4.1.7. Egypt Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

8.4.1.8. Egypt Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

8.4.1.9. Egypt Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

8.4.1.10. Nigeria Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

8.4.1.11. Nigeria Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

8.4.1.12. Nigeria Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Transcatheter Heart Valve Replacement Repair Market by Product, Value (US$ Mn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Transcatheter Heart Valve Replacement Repair Market by Indication, Value (US$ Mn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Transcatheter Heart Valve Replacement Repair Market by End User, Value (US$ Mn), 2019 - 2031

8.4.2. Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Product vs By Application Heat map

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Abbott

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Edwards Lifesciences Corporation

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Medtronic plc

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Boston Scientific Corporation

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. JenaValve Technology, Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Meril Life Sciences

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Sahajanand Medical Technologies Limited

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. MicroPort Scientific Corporation

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Venus Medtech (Hangzhou) Inc.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Suzhou Jiecheng Medical Technology Co. Ltd.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Replacement Type Coverage |

|

|

Surgical Approach Coverage |

|

|

End User Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |