Global Transformer Market Forecast

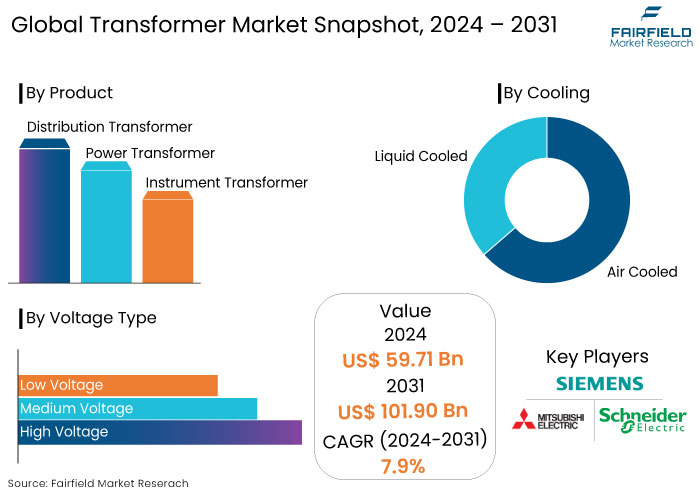

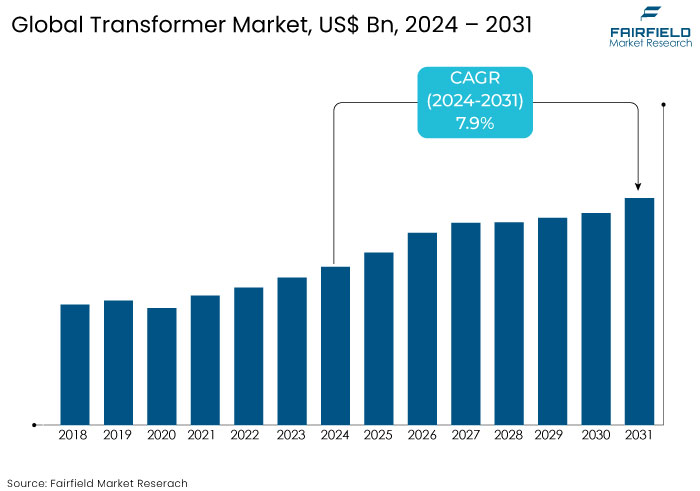

- The transformer market is projected to grow from US$59.71 Bn in 2024 to US$101.90 Bn by 2031.

- The market for transformer is likely to exhibit a significant expansion rate, with an estimated CAGR of 7.9% from 2024 to 2031.

Transformer Market Insights

- The increasing integration of wind and solar power into grids is driving demand for specialized transformers.

- The rising adoption of smart grids globally boosts the need for IoT-enabled and digitally connected transformers.

- Aging power infrastructure in developed regions like North America and Europe is creating demand for energy-efficient transformers.

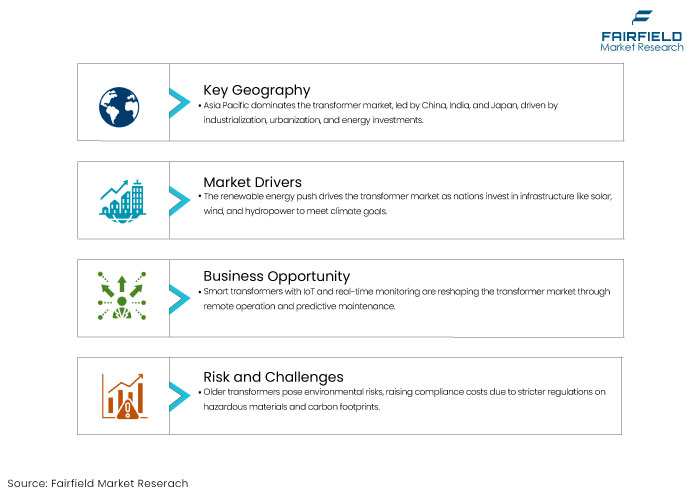

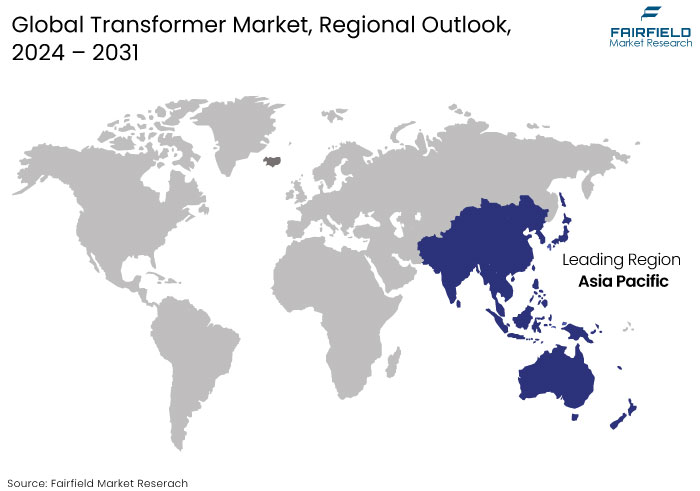

- Asia Pacific dominates the market, driven by industrialization, renewable energy projects, and infrastructure development.

- Focus on eco-friendly and low-loss transformers aligns with global climate and regulatory goals.

- Air-cooled transformers find significant applications in diverse industrial domains, leading the transformer market.

- Power transformers are the leading product type owing to its reliable power supply and minimal energy loss.

- Global players like ABB, Siemens, and General Electric drive innovation, while regional manufacturers compete with cost-effective solutions.

A Look Back and a Look Forward - Comparative Analysis

The global transformer market witnessed stable growth during the period from 2019 to 2023, driven by increasing demand for electricity, urbanization, and industrialization. The expansion of renewable energy projects, including wind and solar farms, created a significant need for transformers capable of integrating variable power sources into the grid.

Technological advancements such as smart transformers supported the modernization of power distribution networks. Key regions like Asia Pacific, particularly China and India, experienced rapid transformer demand due to large-scale infrastructure projects and growing electrification initiatives.

The market is poised for accelerated growth post-2024, fueled by a surge in smart grid developments and increased emphasis on decarbonization. Governments worldwide are investing significantly in upgrading aging grid infrastructure and expanding renewable energy capacities to meet ambitious climate goals.

The rise of electric vehicles (EVs) and the subsequent need for charging infrastructure is expected to drive demand for distribution transformers. Technological innovations, such as solid-state transformers and digitally connected systems, will likely redefine market dynamics.

Emerging markets in Africa and Southeast Asia are projected to witness substantial growth due to electrification and industrial development, making the post-2024 period a transformative phase for the industry.

Key Growth Determinants

- Expansion of Renewable Energy Projects to Shape Market Growth

The global push toward renewable energy is one of the most prominent growth drivers for the transformer market. As nations strive to reduce greenhouse gas emissions and meet ambitious climate goals, investments in renewable energy infrastructure, such as solar farms, wind turbines, and hydropower plants have surged. These renewable energy sources generate variable power outputs that require efficient transformation and integration into existing power grids.

Transformers, particularly step-up and step-down types are essential in ensuring the smooth transmission of energy from renewable sources to end users or energy storage systems.

Solar parks in sunny regions like the Middle East and parts of Africa depend on transformers for voltage regulation and power quality management. As energy storage systems like lithium-ion batteries become more common, bidirectional transformers capable of handling energy input and output are also in demand. This growing reliance on renewable energy projects ensures a sustained and robust demand for transformers, driving market growth globally.

- Increasing Electrification in Emerging Economies Surges Transformer Demand

Emerging economies across Asia Pacific, Africa, and Latin America are witnessing rapid electrification spurred by urbanization, industrialization, and government-led infrastructure development programs.

Expanding access to electricity is a top priority in many rural and remote areas, and transformers are a cornerstone of this effort. They are critical in enabling electricity transmission over long distances, stepping up voltage for efficient transmission, and stepping it down for safe distribution to homes and industries.

Programs like India’s “Saubhagya Scheme,” which aims to provide electricity to millions of households, and similar rural electrification projects in Africa have significantly increased the demand for transformers. In addition to residential electrification, these regions are experiencing growth in industrial activity, requiring robust and reliable power supply solutions.

Industrial transformers, tailored to meet the demands of heavy machinery and manufacturing plants, are in high demand in these developing markets. The rise of urbanization in these regions has spurred investments in smart cities, energy-efficient infrastructure, and renewable energy projects, all of which require transformers for energy transmission and distribution. These trends collectively position emerging economies as a critical driver for the global transformer market, with immense growth potential in the coming years.

Key Growth Barriers

- Environmental Concerns and Regulatory Challenges

Transformers, especially older models, often rely on materials like oil and insulation systems that pose environmental risks, including potential leaks and hazardous waste. Strict environmental regulations aimed at reducing carbon footprints and managing hazardous materials are increasing compliance costs for manufacturers.

Regulations around the use of eco-friendly transformer oils and the recycling of transformer components add to production expenses. Furthermore, the complexity of adhering to different regional standards can slow down product deployment and international trade.

In some cases, outdated grid infrastructure in emerging markets struggles to accommodate modern transformers, creating additional challenges in upgrading systems while complying with regulations. Such environmental and regulatory hurdles present significant obstacles to transformer market growth, particularly in regions where infrastructure modernization is slow.

- High Initial Costs and Capital-Intensive Nature

The transformer market faces a significant growth restraint due to the high initial costs associated with manufacturing, installation, and maintenance of transformers. These costs are particularly challenging for developing economies and small to medium-sized enterprises (SMEs), which often operate on limited budgets.

Advanced transformers, such as those integrated with smart technologies are more expensive, further restricting adoption in cost-sensitive markets. Large-scale infrastructure projects that require multiple transformers demand substantial capital investment, making them financially burdensome for governments and private entities.

High costs also extend to regular maintenance and the replacement of aging equipment, which is essential to ensure safety and efficiency. The financial barrier posed by these expenses often delays or reduces transformer deployment, particularly in regions with constrained resources, limiting the overall market growth.

Transformer Market Trends and Opportunities

- Adoption of Smart Transformers Remains a Key Trends

The growing adoption of smart transformers is a key trend reshaping the transformer market. Smart transformers, integrated with digital monitoring systems, sensors, and IoT technology, allow real-time data collection, remote operation, and predictive maintenance.

Unlike traditional transformers, smart versions are designed to optimize grid performance by automatically adjusting voltage levels and responding to grid fluctuations. They enhance energy efficiency, reduce transmission losses, and support renewable energy integration, making them essential for modernizing power grids.

The trend is driven by the increasing deployment of smart grids globally as utilities strive to meet the demands of decentralized energy generation, electric vehicles (EVs), and distributed energy resources (DERs). Countries like the U.S., Germany, and China are leading the transition to smart grids, creating substantial demand for smart transformers.

The emphasis on reducing operational costs and improving grid reliability makes these devices a preferred choice for utilities and industrial applications. As more stakeholders invest in grid modernization and sustainability, the adoption of smart transformers is expected to accelerate.

- Expansion in Renewable Energy Projects Creates Opportunities for Market Players

The rapid expansion of renewable energy projects presents a transformative opportunity for the transformer market. Wind and solar energy installations require specialized transformers to manage variable energy outputs and ensure efficient power transmission to the grid.

As governments and organizations worldwide focus on decarbonization and renewable energy targets, the demand for such transformers is increasing significantly. Offshore wind farms and large-scale solar parks necessitate advanced transformer solutions, such as step-up transformers, to handle high-capacity power transmission over long distances.

Emerging markets, particularly in Asia Pacific, the Middle East, and Africa increasingly adopt renewable energy technologies, providing lucrative opportunities for transformer manufacturers.

Developing energy storage systems, like battery storage, also requires bidirectional transformers, opening new revenue streams. By innovating in eco-friendly materials and energy-efficient designs, companies can capitalize on this opportunity and contribute to global sustainability goals.

How Does Regulatory Scenario Shape the Industry?

The regulatory environment plays a pivotal role in shaping the transformer market by driving technological advancements and influencing manufacturing, installation, and maintenance standards. Governments and regulatory bodies globally are imposing stringent environmental and energy efficiency regulations to promote sustainability and reduce carbon footprints.

The European Union's Eco-design Directive mandates energy efficiency improvements for transformers, encouraging manufacturers to develop eco-friendly and low-loss models. The U.S. Department of Energy (DOE) has established minimum efficiency standards for transformers under the Energy Conservation Standards Program, fostering innovation in energy-efficient designs.

Energy efficiency and environmental regulations are compelling the adoption of sustainable materials and technologies. Restrictions on using traditional transformer oils and insulating materials with high environmental risks have led to the rise of biodegradable and eco-friendly alternatives.

Compliance with recycling and waste management guidelines becomes critical as older transformers are phased out in favour of new and efficient models. Such regulations also emphasize grid reliability and safety, pushing manufacturers to incorporate digital monitoring systems, IoT capabilities, and predictive maintenance features. While compliance increases production costs, it simultaneously accelerates the development of advanced transformers, shaping a sustainable, efficient market and aligned with global energy transition goals.

Segments Covered in the Report

- Reliable Power Supply & Minimal Energy Losses Spurs the Demand for Power Transformers

The power transformers segment is anticipated to dominate the transformer market share throughout the forecast period. The dominance of power transformers can be attributed to its advantages, which include a reliable power supply, less energy losses, and improved grid performance.

Power transformers facilitate the transformation of voltage levels, permitting the transmission of power over extensive distances at elevated voltages to reduce energy losses, followed by distribution at low and safe voltages to consumers. By increasing voltage for long-distance transmission, power transformers diminish energy losses attributed to resistance in power lines, enhancing the overall efficiency of the transmission process.

Power transformers contribute to grid stability by regulating voltage levels and managing variations in power supply and demand. Consequently, reducing voltage sags, surges, and blackouts, which eventually propels the expansion of this segment.

- Air Cooled Transformers Continue to Lead the Market

It is anticipated that the air cooled transformers will continue to exhibit notable growth rate during the forecast period. Air cooled transformers or dry-type transformers refer to electrical transformers that use air as the cooling medium to disperse heat created during operation.

Air cooled transformers rely on natural convection and forced air circulation to keep the temperature of the transformer within acceptable ranges. Unlike liquid-cooled transformers, which use oil or other fluids for cooling purposes, these transformers mostly rely of air movement for cooling purpose.

Regional Analysis

- Asia Pacific Transformer Market Retains the Top Position with Large Scale Electrification Efforts

Asia Pacific is the largest and rapidly growing region in the transformer market, driven by rapid industrialization, urbanization, and electrification efforts. Countries like China, India, and Japan lead the region due to significant investments in energy infrastructure and renewable energy projects.

China, being the world's largest energy consumer, is heavily investing in innovative grid technologies and renewable energy integration. The aggressive push of the country towards wind and solar energy has increased the demand for specialized transformers capable of managing variable outputs.

India's electrification programs, such as the "Saubhagya Scheme," focus on providing electricity to rural areas, significantly boosting transformer deployment. Large-scale industrialization and urbanization drive the need for distribution and power transformers.

The region's focus on renewable energy integration and the development of smart grids is driving the demand for advanced transformers with IoT-enabled monitoring systems.

- North America Transformer Market to Stand out with the U.S. and Canada’s Primary Contribution

There are substantial growth opportunities in North America arising from grid modernization and renewable energy expansion. The U.S. and Canada are the primary contributors to North America transformer market growth.

The U.S. leads in smart grid adoption, driven by government investments and the need to modernize aging infrastructure. Renewable energy projects, such as large-scale solar farms and wind parks, require advanced transformers for efficient power transmission.

Canada’s emphasis on sustainable energy solutions, including hydropower, creates a demand for high-capacity and environmentally friendly transformers. With aging grid infrastructure, North America is heavily investing in replacing old transformers with energy-efficient and smart technologies. The demand for solid-state and IoT-enabled transformers is rising as utilities prioritize grid reliability and operational efficiency.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the transformer market is defined by the presence of established global players and regional manufacturers striving to meet diverse industry demands.

Key companies such as ABB Ltd., Siemens AG, General Electric, Schneider Electric, and Mitsubishi Electric Corporation dominate the market through technological innovation, extensive research and development, and strategic partnerships. These players focus on developing energy-efficient, smart, and eco-friendly transformers to cater to evolving grid modernization and renewable energy needs.

Regional players in Asia-Pacific, particularly in China and India, are gaining prominence by offering cost-effective solutions tailored for local infrastructure projects. The market is also witnessing consolidation through mergers and acquisitions to expand product portfolios and geographical presence. Intense competition is driving innovation, particularly in smart transformers and IoT-enabled systems.

Key Market Companies

- ABB Ltd.

- Schneider Electric

- Siemens

- Mitsubishi Electric

- Toshiba

- TBEA

- General Electric

- Toshiba

- Hyundai Heavy Industries

- Eaton Corporation

- Hyosung Heavy Industries Co., Ltd.

- Kirloskar Electric Company

Recent Industry Developments

- In March 2024, GE Vernova and Montana Technologies close Joint Venture to manufacture transformational air conditioning and atmospheric water harvesting products.

- In February2023, Mitsubishi Electric Acquired DC Circuit Breaker Developer Scibreak. Mitsubishi Electric Corporation has announced a share transfer agreement, to fully acquire Scibreak AB, a Swedish-based firm focused on creating direct current circuit breakers.

- In November 2023, TOKYO - Toshiba Corporation and Toshiba Energy Systems & Solutions Corporation were exhibiting innovating technologies at the Japan Pavilion. The exhibition accompanying the 28th Conference of the Parties to the United Nations Framework Convention on Climate Change (“COP28”) in Dubai, UAE, from November 30 to December 12.

An Expert’s Eye

- The growing demand for transformers to support renewable energy projects like wind and solar farms ensures efficient power transmission.

- The shift towards smart grids is driving innovation in transformer technology, with a focus on IoT integration and real-time monitoring.

- Increasing emphasis on eco-friendly materials and energy-efficient transformers aligns with global climate goals and regulatory requirements.

- Electrification and industrialization in developing regions particularly in Asia Pacific and Africa present significant growth opportunities in the transformer market.

Global Transformer Market is Segmented as-

By Product Type

- Distribution Transformer

- Power Transformer

- Instrument Transformer

By Cooling Type

- Air Cooled

- Liquid Cooled

By Voltage Type

- Low Voltage

- Medium Voltage

- High Voltage

By Phase

- Single Phase

- Three Phase

By End User

- Residential & Commercial

- Industrial

- Utility

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Transformer Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Transformer Market Outlook, 2019 - 2031

3.1. Global Transformer Market Outlook, by Product Type, Value (US$ Mn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Distribution Transformer

3.1.1.2. Power Transformer

3.1.1.3. Instrument Transformer

3.1.1.4. Misc.

3.2. Global Transformer Market Outlook, by Cooling Type, Value (US$ Mn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Air-cooled

3.2.1.2. Liquid Cooled

3.3. Global Transformer Market Outlook, by Voltage Type, Value (US$ Mn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Low Voltage

3.3.1.2. Medium Voltage

3.3.1.3. High Voltage

3.4. Global Transformer Market Outlook, by Phase, Value (US$ Mn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. Single-phase

3.4.1.2. Three-phase

3.5. Global Transformer Market Outlook, by End-user, Value (US$ Mn), 2019 - 2031

3.5.1. Key Highlights

3.5.1.1. Residential & Commercial

3.5.1.2. Industrial

3.5.1.3. Utility

3.6. Global Transformer Market Outlook, by Region, Value (US$ Mn), 2019 - 2031

3.6.1. Key Highlights

3.6.1.1. North America

3.6.1.2. Europe

3.6.1.3. Asia Pacific

3.6.1.4. Latin America

3.6.1.5. Middle East & Africa

4. North America Transformer Market Outlook, 2019 - 2031

4.1. North America Transformer Market Outlook, by Product Type, Value (US$ Mn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Distribution Transformer

4.1.1.2. Power Transformer

4.1.1.3. Instrument Transformer

4.1.1.4. Misc.

4.2. North America Transformer Market Outlook, by Cooling Type, Value (US$ Mn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Air-cooled

4.2.1.2. Liquid Cooled

4.3. North America Transformer Market Outlook, by Voltage Type, Value (US$ Mn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Low Voltage

4.3.1.2. Medium Voltage

4.3.1.3. High Voltage

4.4. North America Transformer Market Outlook, by Phase, Value (US$ Mn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Single-phase

4.4.1.2. Three-phase

4.5. North America Transformer Market Outlook, by End-user, Value (US$ Mn), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. Residential & Commercial

4.5.1.2. Industrial

4.5.1.3. Utility

4.5.2. BPS Analysis/Market Attractiveness Analysis

4.6. North America Transformer Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

4.6.1. Key Highlights

4.6.1.1. U.S. Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

4.6.1.2. U.S. Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

4.6.1.3. U.S. Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

4.6.1.4. U.S. Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

4.6.1.5. U.S. Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

4.6.1.6. Canada Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

4.6.1.7. Canada Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

4.6.1.8. Canada Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

4.6.1.9. Canada Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

4.6.1.10. Canada Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

4.6.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Transformer Market Outlook, 2019 - 2031

5.1. Europe Transformer Market Outlook, by Product Type, Value (US$ Mn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Distribution Transformer

5.1.1.2. Power Transformer

5.1.1.3. Instrument Transformer

5.1.1.4. Misc.

5.2. Europe Transformer Market Outlook, by Cooling Type, Value (US$ Mn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Air-cooled

5.2.1.2. Liquid Cooled

5.3. Europe Transformer Market Outlook, by Voltage Type, Value (US$ Mn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Low Voltage

5.3.1.2. Medium Voltage

5.3.1.3. High Voltage

5.4. Europe Transformer Market Outlook, by Phase, Value (US$ Mn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Single-phase

5.4.1.2. Three-phase

5.5. Europe Transformer Market Outlook, by End-user, Value (US$ Mn), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. Residential & Commercial

5.5.1.2. Industrial

5.5.1.3. Utility

5.5.2. BPS Analysis/Market Attractiveness Analysis

5.6. Europe Transformer Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

5.6.1. Key Highlights

5.6.1.1. Germany Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

5.6.1.2. Germany Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

5.6.1.3. Germany Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

5.6.1.4. Germany Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

5.6.1.5. Germany Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

5.6.1.6. U.K. Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

5.6.1.7. U.K. Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

5.6.1.8. U.K. Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

5.6.1.9. U.K. Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

5.6.1.10. U.K. Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

5.6.1.11. France Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

5.6.1.12. France Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

5.6.1.13. France Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

5.6.1.14. France Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

5.6.1.15. France Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

5.6.1.16. Italy Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

5.6.1.17. Italy Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

5.6.1.18. Italy Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

5.6.1.19. Italy Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

5.6.1.20. Italy Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

5.6.1.21. Turkey Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

5.6.1.22. Turkey Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

5.6.1.23. Turkey Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

5.6.1.24. Turkey Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

5.6.1.25. Turkey Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

5.6.1.26. Russia Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

5.6.1.27. Russia Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

5.6.1.28. Russia Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

5.6.1.29. Russia Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

5.6.1.30. Russia Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

5.6.1.31. Rest of Europe Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

5.6.1.32. Rest of Europe Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

5.6.1.33. Rest of Europe Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

5.6.1.34. Rest of Europe Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

5.6.1.35. Rest of Europe Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

5.6.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Transformer Market Outlook, 2019 - 2031

6.1. Asia Pacific Transformer Market Outlook, by Product Type, Value (US$ Mn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Distribution Transformer

6.1.1.2. Power Transformer

6.1.1.3. Instrument Transformer

6.1.1.4. Misc.

6.2. Asia Pacific Transformer Market Outlook, by Cooling Type, Value (US$ Mn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Air-cooled

6.2.1.2. Liquid Cooled

6.3. Asia Pacific Transformer Market Outlook, by Voltage Type, Value (US$ Mn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Low Voltage

6.3.1.2. Medium Voltage

6.3.1.3. High Voltage

6.4. Asia Pacific Transformer Market Outlook, by Phase, Value (US$ Mn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Single-phase

6.4.1.2. Three-phase

6.5. Asia Pacific Transformer Market Outlook, by End-user, Value (US$ Mn), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. Residential & Commercial

6.5.1.2. Industrial

6.5.1.3. Utility

6.5.2. BPS Analysis/Market Attractiveness Analysis

6.6. Asia Pacific Transformer Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

6.6.1. Key Highlights

6.6.1.1. China Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

6.6.1.2. China Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

6.6.1.3. China Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

6.6.1.4. China Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

6.6.1.5. China Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

6.6.1.6. Japan Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

6.6.1.7. Japan Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

6.6.1.8. Japan Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

6.6.1.9. Japan Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

6.6.1.10. Japan Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

6.6.1.11. South Korea Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

6.6.1.12. South Korea Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

6.6.1.13. South Korea Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

6.6.1.14. South Korea Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

6.6.1.15. South Korea Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

6.6.1.16. India Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

6.6.1.17. India Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

6.6.1.18. India Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

6.6.1.19. India Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

6.6.1.20. India Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

6.6.1.21. Southeast Asia Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

6.6.1.22. Southeast Asia Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

6.6.1.23. Southeast Asia Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

6.6.1.24. Southeast Asia Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

6.6.1.25. Southeast Asia Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

6.6.1.26. Rest of Asia Pacific Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

6.6.1.27. Rest of Asia Pacific Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

6.6.1.28. Rest of Asia Pacific Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

6.6.1.29. Rest of Asia Pacific Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

6.6.1.30. Rest of Asia Pacific Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

6.6.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Transformer Market Outlook, 2019 - 2031

7.1. Latin America Transformer Market Outlook, by Product Type, Value (US$ Mn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Distribution Transformer

7.1.1.2. Power Transformer

7.1.1.3. Instrument Transformer

7.1.1.4. Misc.

7.2. Latin America Transformer Market Outlook, by Cooling Type, Value (US$ Mn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Air-cooled

7.2.1.2. Liquid Cooled

7.3. Latin America Transformer Market Outlook, by Voltage Type, Value (US$ Mn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Low Voltage

7.3.1.2. Medium Voltage

7.3.1.3. High Voltage

7.4. Latin America Transformer Market Outlook, by Phase, Value (US$ Mn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Single-phase

7.4.1.2. Three-phase

7.5. Latin America Transformer Market Outlook, by End-user, Value (US$ Mn), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Residential & Commercial

7.5.1.2. Industrial

7.5.1.3. Utility

7.5.2. BPS Analysis/Market Attractiveness Analysis

7.6. Latin America Transformer Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

7.6.1. Key Highlights

7.6.1.1. Brazil Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

7.6.1.2. Brazil Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

7.6.1.3. Brazil Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

7.6.1.4. Brazil Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

7.6.1.5. Brazil Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

7.6.1.6. Mexico Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

7.6.1.7. Mexico Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

7.6.1.8. Mexico Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

7.6.1.9. Mexico Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

7.6.1.10. Mexico Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

7.6.1.11. Argentina Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

7.6.1.12. Argentina Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

7.6.1.13. Argentina Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

7.6.1.14. Argentina Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

7.6.1.15. Argentina Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

7.6.1.16. Rest of Latin America Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

7.6.1.17. Rest of Latin America Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

7.6.1.18. Rest of Latin America Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

7.6.1.19. Rest of Latin America Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

7.6.1.20. Rest of Latin America Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

7.6.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Transformer Market Outlook, 2019 - 2031

8.1. Middle East & Africa Transformer Market Outlook, by Product Type, Value (US$ Mn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Distribution Transformer

8.1.1.2. Power Transformer

8.1.1.3. Instrument Transformer

8.2. Middle East & Africa Transformer Market Outlook, by Cooling Type, Value (US$ Mn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Air-cooled

8.2.1.2. Liquid Cooled

8.3. Middle East & Africa Transformer Market Outlook, by Voltage Type, Value (US$ Mn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Low Voltage

8.3.1.2. Medium Voltage

8.3.1.3. High Voltage

8.4. Middle East & Africa Transformer Market Outlook, by Phase, Value (US$ Mn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Single-phase

8.4.1.2. Three-phase

8.5. Middle East & Africa Transformer Market Outlook, by End-user, Value (US$ Mn), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. Residential & Commercial

8.5.1.2. Industrial

8.5.1.3. Utility

8.5.2. BPS Analysis/Market Attractiveness Analysis

8.6. Middle East & Africa Transformer Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

8.6.1. Key Highlights

8.6.1.1. GCC Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

8.6.1.2. GCC Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

8.6.1.3. GCC Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

8.6.1.4. GCC Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

8.6.1.5. GCC Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

8.6.1.6. South Africa Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

8.6.1.7. South Africa Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

8.6.1.8. South Africa Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

8.6.1.9. South Africa Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

8.6.1.10. South Africa Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

8.6.1.11. Egypt Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

8.6.1.12. Egypt Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

8.6.1.13. Egypt Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

8.6.1.14. Egypt Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

8.6.1.15. Egypt Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

8.6.1.16. Nigeria Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

8.6.1.17. Nigeria Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

8.6.1.18. Nigeria Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

8.6.1.19. Nigeria Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

8.6.1.20. Nigeria Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

8.6.1.21. Rest of Middle East & Africa Transformer Market by Product Type, Value (US$ Mn), 2019 - 2031

8.6.1.22. Rest of Middle East & Africa Transformer Market by Cooling Type, Value (US$ Mn), 2019 - 2031

8.6.1.23. Rest of Middle East & Africa Transformer Market by Voltage Type, Value (US$ Mn), 2019 - 2031

8.6.1.24. Rest of Middle East & Africa Transformer Market by Phase, Value (US$ Mn), 2019 - 2031

8.6.1.25. Rest of Middle East & Africa Transformer Market by End-user, Value (US$ Mn), 2019 - 2031

8.6.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Voltage Type vs by Cooling Type Heat map

9.2. Manufacturer vs by Cooling Type Heat map

9.3. Company Market Share Analysis, 2023

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. ABB Ltd.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Schneider Electric

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Siemens

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Mitsubishi Electric

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Toshiba

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. TBEA

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. General Electric

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Toshiba

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Hyundai Heavy Industries

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Eaton Corporation

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Hyosung Heavy Industries Co., Ltd.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Kirloskar Electric Company

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Cooling Type Coverage |

|

|

Voltage Type Coverage |

|

|

Phase Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |