Global Transforming Growth Factor Market Forecast

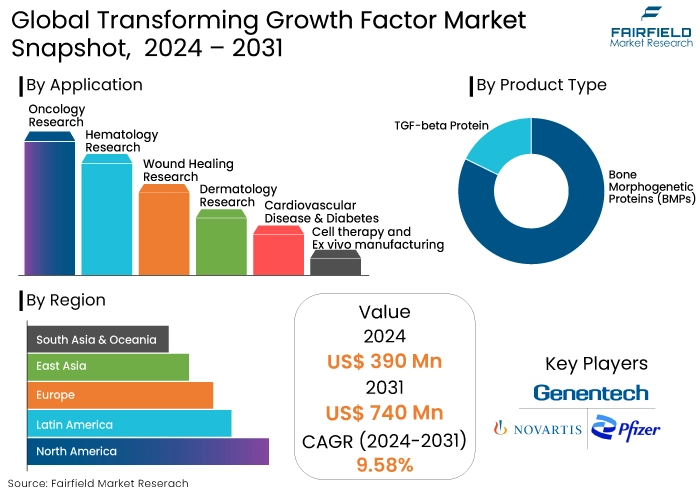

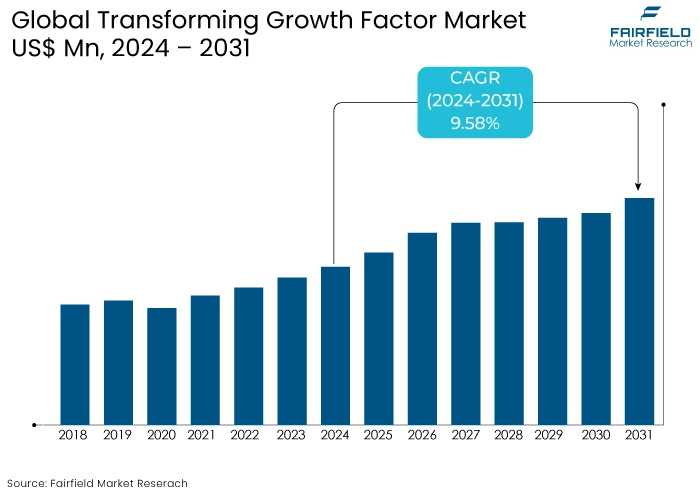

- The global transforming growth factor market is projected to reach a size of US$740 Mn by 2031, showing significant growth from the US$390 Mn achieved in 2024.

- The market is expected to obtain a notable growth rate with an estimated CAGR of 9.58% during the forecast period from 2024 to 2031.

Transforming Growth Factor Market Insights

- TGFs, including recombinant proteins, antibodies, assays, and inhibitors, are gaining interest in biopharmaceutical companies due to their therapeutic potential.

- Rising drug development and discovery activities contribute to the market revenue, subject to regulatory oversight for safety, efficacy, and compliance with standards.

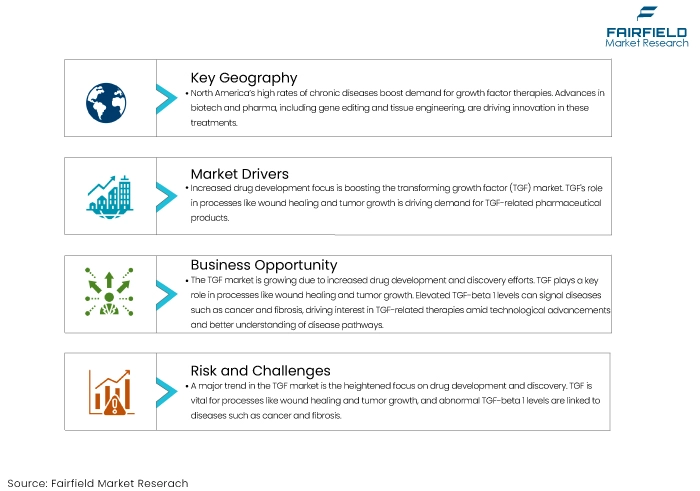

- Increasing prevalence of chronic diseases, advancements in biotechnology, and rising demand for regenerative medicine are key factors driving market growth.

- Regulatory requirements aim to maintain market integrity and protect client interests, with compliance and risk departments monitoring conflicts of interest and preventing market abuse.

- One significant trend in the TGF market is the increasing focus on drug development and drug discovery activities

- Growth factors driving the TGF market include increasing focus on drug development and drug discovery, and research and development of new products.

- Based on product type, the bone morphogenetic proteins (BMPs) segment is projected to hold a 43.7% market share in 2024,

A Look Back and a Look Forward - Comparative Analysis

The market analysis for the transforming growth factor can be divided into two periods: pre-2023 and post-2024. According to industry assessment, the market in 2019 reached a valuation of US$214.2 Mn.

The market size is projected to grow to US$266.4 Mn over the next four years from 2019 to 2023, exhibiting a growth rate of 5.6%. The demand for TGF-related products is driven by tissue repair and regeneration, as well as the evolution of healthcare systems worldwide.

The transforming growth factor market shares are expected to reach US$282.9 Mn in 2024. Looking ahead, the market is projected to continue growing, with a forecasted market size of US$431.0 Mn in 2031. This indicates a growth rate of 6.2% from 2024 to 2031.

TGFs have therapeutic potential in treating various conditions, driving biopharmaceutical companies to invest in developing TGF-based therapies. The TGF market, which includes recombinant proteins, antibodies, assays, and inhibitors, is influenced by biomedical research and global healthcare expenditure.

Key Growth Determinants

- Rising Drug Development and Drug Discovery Activities

The increasing focus on drug development and drug discovery activities is expected to provide traction to the overall transforming growth factor market growth. TGF plays a crucial role in various cellular processes, including embryogenesis, wound healing, fibrosis, inflammation, and tumor growth. As a result, there is a growing demand for TGF-related products in the pharmaceutical industry.

- Market Share Expansion and Market Shaping Strategies

Companies that develop and provide innovative TGF-related products have the potential to gain market share and become growth stocks. By introducing new services and gaining market share, these companies can drive transforming growth factor market revenue. For example, companies like Amazon Inc. have been considered growth stocks due to their ability to provide new services and expand their market presence.

- Research and Development of New Products

Ongoing research and development activities focused on TGF-related products are expected to contribute to the transforming growth factor market expansion. Growth factors, including TGF, play critical roles in cellular growth, differentiation, and gene expression. By investing in research and development, companies can develop new concepts and technologies that meet the needs of the consumer market.

Key Growth Barriers

- Regulatory Challenges

The regulatory landscape surrounding the development and commercialization of TGF-related products can pose challenges to market growth. Regulatory agencies impose strict guidelines and requirements to ensure the safety, efficacy, and quality of these products.

Compliance with these regulations can be time-consuming and costly for transforming growth factor market companies. Additionally, changes in regulations or the introduction of new regulations can impact market dynamics and hinder growth.

- High Development Costs

The development and commercialization of TGF-related products involve significant research and development costs. This includes costs associated with preclinical and clinical trials, manufacturing, and obtaining regulatory approvals.

The high costs involved in the development process can be a barrier for small companies or startups looking to enter the market. Moreover, the uncertainty of success in clinical trials and the potential for regulatory setbacks can further increase the financial risks associated with TGF product development.

Transforming Growth Factor Market Trends and Opportunities

- Focus on Drug Development and Discovery

One significant trend in the TGF market is the increasing focus on drug development and drug discovery activities. TGF plays a crucial role in various cellular processes, including embryogenesis, wound healing, fibrosis, inflammation, and tumor growth.

Normal human transforming growth factor-beta 1 (TGF-beta 1) levels indicate a healthy immune system, while high levels can indicate diseases like chronic inflammatory response syndrome, cancer, tumor cells, and fibrosis. The trend of increasing drug development and drug discovery activities in the TGF market is driven by advancements in technology, and a growing understanding of TGF's role in disease pathway.

These transforming growth factor market trends are expected to continue as the pharmaceutical industry recognizes the potential of TGF in addressing unmet medical needs. The ongoing research and development activities in the TGF market are paving the way for the introduction of new therapies and treatment options that can improve patient outcomes and quality of life.

- Novel Strategies and Market Expansion

One significant opportunity in the transforming growth factor (TGF) market lies in market share expansion and market shaping strategies. Companies that develop and provide innovative TGF-related products have the potential to gain market share and drive growth in the market.

Companies that transform existing market configurations or introduce new market configurations can influence market dynamics and create new growth avenues. By identifying unmet needs, understanding consumer preferences, and adapting to changing market trends, companies can position themselves for success and capitalize on emerging opportunities.

Transforming growth factor market opportunities, market share expansion, and market shaping strategies are driven by the increasing demand for TGF-related products, technological advancements, and the evolving needs of patients and healthcare providers. Companies that can effectively leverage these opportunities have the potential to drive growth, gain a competitive edge, and contribute to the overall development of the TGF market.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario plays a crucial role in shaping the transforming growth factor market demand. Government regulations have a significant influence on market trends and growth. Fiscal and monetary policies implemented by governments and central banks can affect the financial marketplace and impact the growth of industries, including the TGF market.

Rising drug development and drug discovery activities contribute to the industry growth. These activities are subject to regulatory oversight to ensure safety, efficacy, and compliance with established standards.

As per the transforming growth factor market analysis, regulatory requirements and enforcement actions aim to maintain market integrity and protect the interests of clients. Compliance and risk departments play a crucial role in monitoring conflicts of interest and preventing market abuse.

Regulatory guidelines and approvals are essential for the research and development of new TGF-related products. Compliance with regulatory standards ensures the safety and effectiveness of these products.

Segments Covered in the Report

- Bone Morphogenetic Proteins (BMPs) Lead the Market Through Superior Impact

Based on product type, the bone morphogenetic proteins (BMPs) segment is projected to hold a 43.7% market share in 2024, while the TGF-beta Protein segment is expected to secure a 33.8% share, driving significant growth in the transforming growth factor market.

As per the transform existing market forecast, the bone morphogenetic proteins (BMPs) segment is predicted to account for a substantial market share of 44.6% by 2034. The significance of BMPs extends beyond bone formation, playing vital roles in the development and maintenance of various organ systems. Their broad impact underscores their paramount importance in the market landscape.

- Cell Therapy and Ex Vivo Manufacturing Segment Holds 29.7% Market Share

The cell therapy and ex vivo manufacturing segment is projected to secure a substantial 29.7% market share by 2034, driven by the escalating prevalence of chronic diseases and the significant global burden of cancer. Notably, TGF-beta plays diverse roles in malignancy development, inhibiting the proliferation of epithelial, hematopoietic, and stromal cells. As per

Regional Analysis

- High Prevalence of Chronic Diseases Drive North America Market

North America grapples with a significant burden of chronic diseases like cancer, cardiovascular diseases, and diabetes. Growth factors play a crucial role in treating and managing these conditions, resulting in a growing demand for growth factor therapies.

The region boasts a strong biotechnology and pharmaceutical industry, with substantial investments in research and development. The transforming growth factor market overview shows that advancements in biotechnology, such as gene editing, tissue engineering, and recombinant DNA technology, have paved the way for the development of innovative therapies based on growth factors.

- Asia Pacific's Biotechnology Investments Drive the Growth Factor Therapies

Asia Pacific countries are making significant investments in biotechnology research and development. These countries lead to advancements in understanding molecular pathways and the development of novel growth factor-based therapies for various medical conditions.

The region is witnessing a surge in the incidence of chronic diseases like cancer, cardiovascular diseases, and diabetes, creating a growing need for effective treatment options such as growth factors. With a robust biotechnology industry and technological advancements, Asia Pacific is at the forefront of driving innovation in growth factor therapies

Fairfield’s Competitive Landscape Analysis

A competitive landscape analysis for the transforming growth factor market involves identifying and analyzing various factors that influence the competitive environment of a company including market trends, customer needs, and competitor activities. The transforming growth factor market report involves identifying and analyzing key players in the market, their market share, product offerings, and competitive advantages.

Key Market Companies

- Genentech

- Novartis

- Pfizer

- Roche

- Merck & Co.

- Johnson & Johnson

- Amgen

- Eli Lilly and Company

- Sanofi

- AstraZeneca

- AbbVie

- Bristol Myers Squibb

Recent Industry Developments

- In May 2024, the study explores the role of SETDB1, a histone lysine methyltransferase in muscle differentiation, in Duchenne muscular dystrophy (DMD). It found that depletion of SETDB1 in DMD myotubes down-regulates TGFβ target genes, thereby impairing myoblast pro-fibrotic response. This suggests that SETDB1 potentiates the TGFβ-driven fibrotic response in DMD muscles, offering potential therapeutic intervention.

- In April 2024, A study has generated a knockout mouse of the TGF-β2 gene, revealing a differential dependency of developing and adult neurons on TGF-β2. The mouse model, which was knocked out of the Tgf-β2 gene, showed decreased caudal 5-HT neurons and impaired development of other neurons. Serotonin levels were decreased in hindbrain but increased in cortex of adult mutant mice, indicating TGF-β2's potency to modulate neurotransmitter synthesis and metabolism.

An Expert’s Eye

- Enforcement actions aim to maintain market integrity and protect client interests.

- Regulatory guidelines and approvals are essential for the research and development of new TGF-related products.

- Rising focus on drug development and drug discovery activities drive market growth.

- Bone Morphogenetic Proteins (BMPs) lead the market through superior impact.

Global Transforming Growth Factor Market is Segmented as -

By Product type

- Bone Morphogenetic Proteins (BMPs)

- TGF-beta Protein

By Application

- Oncology Research

- Hematology Research

- Wound Healing Research

- Dermatology Research

- Cardiovascular Disease & Diabetes

- Cell therapy and Ex vivo manufacturing

- Others

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

1. Executive Summary

1.1. Global Transforming Growth Factor Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Transforming Growth Factor Market Outlook, 2019 - 2031

3.1. Global Transforming Growth Factor Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Activin

3.1.1.2. Bone Morphogenetic Proteins (BMPs)

3.1.1.3. TGF-beta Proteins

3.2. Global Transforming Growth Factor Market Outlook, by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. GMP Grade

3.2.1.2. Non-GMP Grade

3.3. Global Transforming Growth Factor Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Oncology Research

3.3.1.2. Hematology Research

3.3.1.3. Wound Healing Research

3.3.1.4. Dermatology Research

3.3.1.5. Cardiovascular Disease & Diabetes

3.3.1.6. Cell Therapy and Ex vivo Manufacturing

3.3.1.7. Others

3.4. Global Transforming Growth Factor Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. Pharmaceutical and Biotechnology Companies

3.4.1.2. Research Centers & Academic Institutes

3.4.1.3. CMO and CDMO

3.5. Global Transforming Growth Factor Market Outlook, by Region, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Transforming Growth Factor Market Outlook, 2019 - 2031

4.1. North America Transforming Growth Factor Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Activin

4.1.1.2. Bone Morphogenetic Proteins (BMPs)

4.1.1.3. TGF-beta Proteins

4.2. North America Transforming Growth Factor Market Outlook, by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. GMP Grade

4.2.1.2. Non-GMP Grade

4.3. North America Transforming Growth Factor Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Oncology Research

4.3.1.2. Hematology Research

4.3.1.3. Wound Healing Research

4.3.1.4. Dermatology Research

4.3.1.5. Cardiovascular Disease & Diabetes

4.3.1.6. Cell Therapy and Ex vivo Manufacturing

4.3.1.7. Others

4.4. North America Transforming Growth Factor Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Pharmaceutical and Biotechnology Companies

4.4.1.2. Research Centers & Academic Institutes

4.4.1.3. CMO and CDMO

4.5. North America Transforming Growth Factor Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. U.S. Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1.2. U.S. Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1.3. U.S. Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031 by End User

4.5.1.4. U.S. Transforming Growth Factor Market, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1.5. Canada Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1.6. Canada Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1.7. Canada Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.1.8. Canada Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Transforming Growth Factor Market Outlook, 2019 - 2031

5.1. Europe Transforming Growth Factor Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Activin

5.1.1.2. Bone Morphogenetic Proteins (BMPs)

5.1.1.3. TGF-beta Proteins

5.2. Europe Transforming Growth Factor Market Outlook, by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. GMP Grade

5.2.1.2. Non-GMP Grade

5.3. Europe Transforming Growth Factor Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Oncology Research

5.3.1.2. Hematology Research

5.3.1.3. Wound Healing Research

5.3.1.4. Dermatology Research

5.3.1.5. Cardiovascular Disease & Diabetes

5.3.1.6. Cell Therapy and Ex vivo Manufacturing

5.3.1.7. Others

5.4. Europe Transforming Growth Factor Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Pharmaceutical and Biotechnology Companies

5.4.1.2. Research Centers & Academic Institutes

5.4.1.3. CMO and CDMO

5.5. Europe Transforming Growth Factor Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. Germany Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.2. Germany Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.3. Germany Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.4. Germany Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.5. U.K. Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.6. U.K. Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.7. U.K. Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.8. U.K. Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.9. France Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.10. France Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.11. France Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.12. France Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.13. Italy Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.14. Italy Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.15. Italy Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.16. Italy Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.17. Turkey Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.18. Turkey Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.19. Turkey Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.20. Turkey Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.21. Russia Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.22. Russia Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.23. Russia Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.24. Russia Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.25. Rest of Europe Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.26. Rest of Europe Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.27. Rest of Europe Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1.28. Rest of Europe Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Transforming Growth Factor Market Outlook, 2019 - 2031

6.1. Asia Pacific Transforming Growth Factor Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Activin

6.1.1.2. Bone Morphogenetic Proteins (BMPs)

6.1.1.3. TGF-beta Proteins

6.2. Asia Pacific Transforming Growth Factor Market Outlook, by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. GMP Grade

6.2.1.2. Non-GMP Grade

6.3. Asia Pacific Transforming Growth Factor Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Oncology Research

6.3.1.2. Hematology Research

6.3.1.3. Wound Healing Research

6.3.1.4. Dermatology Research

6.3.1.5. Cardiovascular Disease & Diabetes

6.3.1.6. Cell Therapy and Ex vivo Manufacturing

6.3.1.7. Others

6.4. Asia Pacific Transforming Growth Factor Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Pharmaceutical and Biotechnology Companies

6.4.1.2. Research Centers & Academic Institutes

6.4.1.3. CMO and CDMO

6.5. Asia Pacific Transforming Growth Factor Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. China Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.2. China Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.3. China Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.4. China Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.5. Japan Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.6. Japan Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.7. Japan Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.8. Japan Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.9. South Korea Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.10. South Korea Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.11. South Korea Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.12. South Korea Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.13. India Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.14. India Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.15. India Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.16. India Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.17. Southeast Asia Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.18. Southeast Asia Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.19. Southeast Asia Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.20. Southeast Asia Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.21. Rest of Asia Pacific Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.22. Rest of Asia Pacific Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.23. Rest of Asia Pacific Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.24. Rest of Asia Pacific Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Transforming Growth Factor Market Outlook, 2019 - 2031

7.1. Latin America Transforming Growth Factor Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Activin

7.1.1.2. Bone Morphogenetic Proteins (BMPs)

7.1.1.3. TGF-beta Proteins

7.2. Latin America Transforming Growth Factor Market Outlook, by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. GMP Grade

7.2.1.2. Non-GMP Grade

7.3. Latin America Transforming Growth Factor Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Oncology Research

7.3.1.2. Hematology Research

7.3.1.3. Wound Healing Research

7.3.1.4. Dermatology Research

7.3.1.5. Cardiovascular Disease & Diabetes

7.3.1.6. Cell Therapy and Ex vivo Manufacturing

7.3.1.7. Others

7.4. Latin America Transforming Growth Factor Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Pharmaceutical and Biotechnology Companies

7.4.1.2. Research Centers & Academic Institutes

7.4.1.3. CMO and CDMO

7.5. Latin America Transforming Growth Factor Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Brazil Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.2. Brazil Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.3. Brazil Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.4. Brazil Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.5. Mexico Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.6. Mexico Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.7. Mexico Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.8. Mexico Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.9. Argentina Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.10. Argentina Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.11. Argentina Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.12. Argentina Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.13. Rest of Latin America Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.14. Rest of Latin America Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.15. Rest of Latin America Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.16. Rest of Latin America Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Transforming Growth Factor Market Outlook, 2019 - 2031

8.1. Middle East & Africa Transforming Growth Factor Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Activin

8.1.1.2. Bone Morphogenetic Proteins (BMPs)

8.1.1.3. TGF-beta Proteins

8.2. Middle East & Africa Transforming Growth Factor Market Outlook, by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. GMP Grade

8.2.1.2. Non-GMP Grade

8.3. Middle East & Africa Transforming Growth Factor Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Oncology Research

8.3.1.2. Hematology Research

8.3.1.3. Wound Healing Research

8.3.1.4. Dermatology Research

8.3.1.5. Cardiovascular Disease & Diabetes

8.3.1.6. Cell Therapy and Ex vivo Manufacturing

8.3.1.7. Others

8.4. Middle East & Africa Transforming Growth Factor Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Pharmaceutical and Biotechnology Companies

8.4.1.2. Research Centers & Academic Institutes

8.4.1.3. CMO and CDMO

8.5. Middle East & Africa Transforming Growth Factor Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. GCC Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.2. GCC Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.3. GCC Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.4. GCC Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.5. South Africa Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.6. South Africa Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.7. South Africa Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.8. South Africa Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.9. Egypt Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.10. Egypt Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.11. Egypt Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.12. Egypt Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.13. Nigeria Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.14. Nigeria Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.15. Nigeria Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.16. Nigeria Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.17. Rest of Middle East & Africa Transforming Growth Factor Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.18. Rest of Middle East & Africa Transforming Growth Factor Market by Grade, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.19. Rest of Middle East & Africa Transforming Growth Factor Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.20. Rest of Middle East & Africa Transforming Growth Factor Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. by Application vs by Grade Heatmap

9.2. Manufacturer vs by Grade Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Thermo Fisher Scientific

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Lonza Group AG

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Merck KGaA

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. F. Hoffmann-La Roche Ltd

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Abcam plc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Bio-Techne.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Sartorius CellGenix GmbH

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Proteintech Group, Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. PeproTech Inc.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Cell Signaling Technology, Inc.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Meridian Bioscience Inc.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Applied Biological Materials (abm), Inc.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Akron Biotech

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Leadgene Biomedical, Inc

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. GE Healthcare

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |