Global Turf Care Equipment Market Forecast

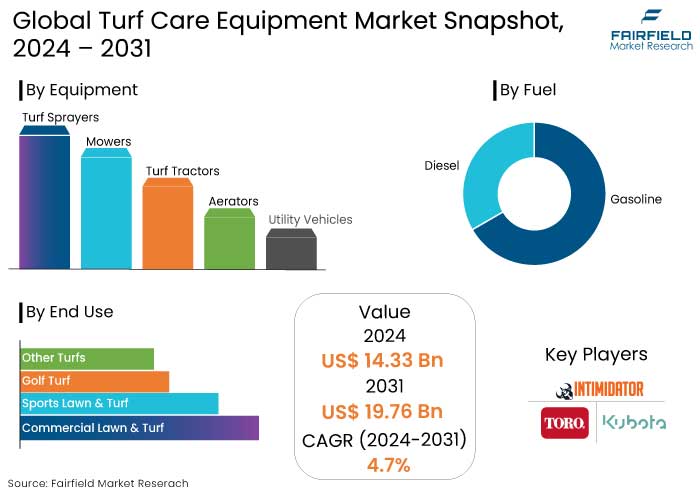

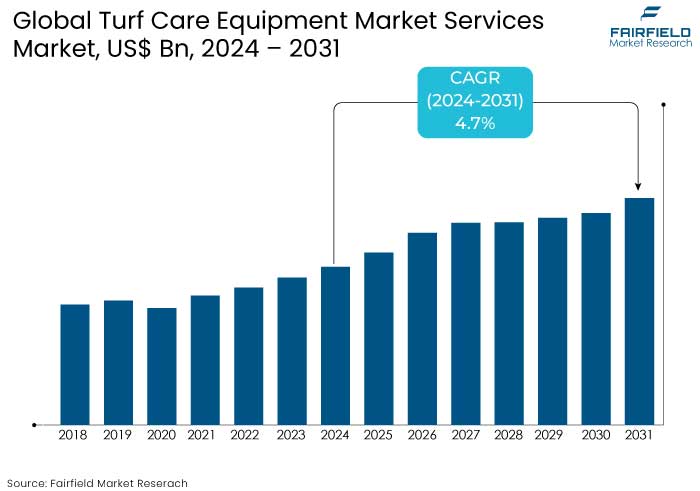

- The turf care equipment market is projected to reach a size of US$19.76 Bn by 2031, showing significant growth from the US$14.33 Bn achieved in 2024.

- The market for turf care equipment is expected to show a significant expansion rate, with an estimated CAGR of 4.7% during the period from 2024 to 2031.

Turf Care Equipment Market Insights

- Demand for battery-powered and electric equipment is significantly increasing driven by environmental regulations and reduced emissions especially in North America and Europe.

- Robotic mowers and automated equipment are transforming turf care for large areas like sports fields enhancing efficiency and reducing labour costs.

- Regulations focused on emissions and noise reduction are pushing manufacturers to develop eco-friendly options, accelerating the market shift toward sustainable solutions.

- Asia Pacific and Latin America show strong growth potential due to urbanization, increased infrastructure, and expanding green spaces.

- The professional segment remains a key driver, with increased investments in golf courses, sports complexes, and residential landscaping services.

- The integration of IoT and connectivity features for remote equipment management enhances product efficiency and performance.

- Hybrid equipment combining electric and fuel sources offers versatility, appealing to users seeking sustainable yet powerful options.

- Rising disposable income and interest in home lawn care are boosting demand for residential-friendly, compact, and affordable equipment.

A Look Back and a Look Forward - Comparative Analysis

The turf care equipment market experienced steady growth during the period from 2019 to 2023 primarily due to increasing demand from the sports industry, and rising public and private investments in lawn aesthetics.

Factors such as the popularity of golf courses and the trend toward urban green spaces fueled the market. Technological advances such as robotic mowers and electric lawn tools appealed to a consumer base focused on convenience and sustainability further expanding market reach.

The market is projected to experience accelerated growth due to heightened interest in sustainable and smart landscaping solutions. The significant role of governmental and organizational on eco-friendly practices will likely to boost demand for electric and battery-powered equipment, shifting from traditional gas-powered machines, a direction that should encourage stakeholders.

Adopting automation technologies including robotic mowers and AI-driven systems for large-scale grounds keeping will expand especially within the sports and golf course management sectors.

Increasing urbanization in emerging economies like India and China is set to foster new investments in turf care products. This transition toward more advanced, environmentally friendly, and efficient turf care equipment will drive substantial market growth post-2024.

Key Growth Determinants

- Introduction of Innovative Products and Technologies to Accelerate Market

Utilizing technology, manufacturers of turf care equipment are developing unique goods in order to meet the ever-changing demands of the industry.

The utilization of drones to monitor the turf, artificial intelligence to forecast the weather, and lawnmowers that are capable of communicating with other machines are some examples of modern technology that is being incorporated into turf care equipment.

The methods of turf management are being revolutionized by new technologies, which is leading to the production of turfs that are in pristine condition. Because of this, there is a growing demand for cutting-edge technology that can care for turfs, driving the turf care equipment market forward.

- Growth in Sports Facilities and Green Urban Spaces

The global rise in sports infrastructure development and urban green spaces has driven demand for turf care equipment. Sports facilities, golf courses, parks, and urban green zones require specialized maintenance for aesthetic appeal and playability, which increases the need for advanced turf care solutions.

Governments and private players are investing heavily in sports and recreational areas to promote community health and wellness particularly in regions like Asia Pacific and the Middle East, where sports tourism is rising.

The expansion of these green and recreational spaces, combined with the emphasis on maintaining high-quality turf creates an increasing demand for diverse, efficient turf care equipment tailored to specific landscaping needs.

Key Growth Barriers

- Environmental Concerns Related to Traditional Turf Care Equipment

While sustainability is a growth driver, it is also a restraint for turf care equipment market reliant on traditional, and gas-powered machines. These machines contribute to air and noise pollution. With rising regulatory scrutiny on emissions, they are increasingly seen as environmentally unfavourable.

Some regions have implemented strict environmental regulations with requirements for emissions reductions or outright bans on gas-powered equipment in certain areas. This regulatory pressure not only impacts manufacturing costs but also challenges consumers who rely on conventional equipment for large-scale turf maintenance.

As regulations become more stringent, the market may face a transitional period where manufacturers and users alike must adapt to sustainable alternatives, potentially slowing growth for conventional equipment types.

- High Initial Cost of Advanced Equipment

The high cost of technologically advanced turf care equipment such as robotic mowers and AI-driven maintenance systems presents a significant barrier for turf care equipment market growth. While these innovations offer long-term savings and operational efficiency, their upfront costs can be prohibitive for small landscaping businesses, residential consumers, and some municipalities. The cost includes not only the equipment purchase but also the necessary training and maintenance to ensure optimal performance.

For many potential buyers, the return on investment (ROI) can be difficult to justify compared to traditional and lower-cost equipment. High initial expenditure limits accessibility and adoption particularly in price-sensitive markets where affordability is a critical factor.

Turf Care Equipment Market Trends and Opportunities

- Adoption of Smart and Connected Turf Care Solutions

One of the most prominent trends in the turf care equipment market is the integration of smart technology, including IoT connectivity and advanced data analytics, into turf maintenance equipment.

Manufacturers are incorporating IoT capabilities and real-time data monitoring into products like robotic mowers and irrigation systems as consumers and commercial operators increasingly seek efficient and precise turf care.

Smart solutions can provide insights into turf health, soil conditions, and equipment performance, allowing users to optimize maintenance schedules, reduce water and energy usage, and prevent costly equipment failures. For example, golf courses and sports facilities can use connected equipment to automatically adjust mowing patterns or irrigation based on weather forecasts conserving resources while maintaining ideal turf conditions.

Devices can be managed remotely via mobile applications, making turf care more convenient and accessible. This trend is expected to deepen as the market embraces sustainability and efficiency, driven by consumer demand and technological advancements in automation and artificial intelligence.

- Expansion of Environment-Friendly Turf Care Equipment

As environmental awareness grows, there is a significant opportunity for manufacturers to lead the shift toward eco-friendly turf care solutions, such as electric and battery-powered equipment. While effective, traditional gas-powered turf care equipment has a high carbon footprint and emits pollutants that contribute to air and noise pollution.

Electric and battery-powered alternatives address these concerns, offering quieter, lower-emission options suited to both residential and commercial applications. Governments, particularly in North America and Europe, are implementing stricter emissions regulations and providing incentives for green technology adoption, which can stimulate demand for sustainable turf care products.

Companies investing in this eco-friendly transformation have a unique chance to capture market share and set industry standards as environmental policies push the turf care equipment market in a sustainable direction.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape is increasingly shaping the turf care equipment market, mainly through environmental policies to reduce emissions and promote sustainable practices.

Regions like North America and Europe are enforcing stricter emissions standards, especially for gas-powered equipment, which has traditionally contributed to air and noise pollution. For example, the European Union’s regulations under the Non-Road Mobile Machinery (NRMM) directive require turf care equipment to meet specific emission limits, pushing manufacturers to invest in eco-friendly technologies.

The said regulatory shift is encouraging the adoption of electric, battery-powered, and hybrid turf care equipment as alternatives to traditional gasoline-powered machines. Additionally, noise pollution regulations in urban and suburban areas are fostering demand for quieter equipment.

Electric and robotic mowers, which operate with minimal noise, are gaining popularity as a result. In response, companies are developing products that align with these environmental and noise standards, positioning themselves competitively in a market increasingly geared toward sustainability. Such regulatory pressures are expected to drive continuous innovation making sustainable, low-emission turf care solutions a focal point for future growth in the industry.

Segments Covered in the Report

- Diesel Fuel Type Dominates the Market with its Superior Performance

Diesel is the predominant fuel utilized in commercial grass care machinery, commanding a substantial market share in volume and value. Diesel offers superior performance, efficiency, and greater energy density per unit volume.

Diesel is a more favoured fuel option among makers and users of grass care equipment due to its lower cost than gasoline. Gasoline contains ethanol, which can be caustic and absorb moisture, leading to difficulties in starting or operating a lawn mower and potentially resulting in fuel system damage under certain conditions.

Alternative fuels like electric, hybrid, and propane are anticipated to have significant demand growth shortly because of their inherent benefits over traditional fuels.

- Commercial Lawn & Turf Dominates the End Use Segment

Turf care equipment commands a significant market share in commercial lawns and turfs. It constitutes up to fifty percent of the market share by value. Commercial lawns are used in diverse enterprises, industrial zones, governmental assets, parks, public and private educational institutions, and service sites.

Lawns and other grass areas are valuable assets as they preserve open space, provide recreational opportunities, enhance property value, and contribute positively to the environment. Sports lawns and turfs are significantly driving the turf care equipment market.

Regional Analysis

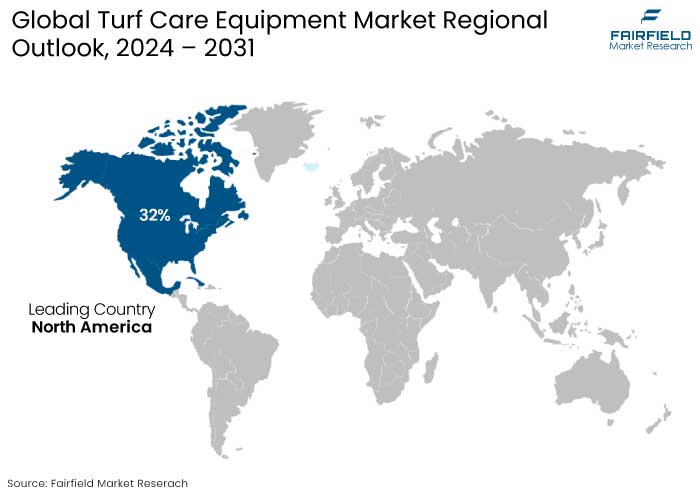

- North America Prevails Dominance in the Turf Care Equipment Market

North America dominates the turf care equipment market due to the increased per capita income of the people in North America, which presents a lucrative market opportunity. The market is projected to advance robustly in North America from 2024 to 2034, with a steady CAGR rate. Further, North America is expected to dominate the market with a share of 32%.

Canada is poised to become one of the most promising nations for the turf care equipment sector expanding at a steady rate over the forecast period. As financial levels increase nationwide, Canadians demand seamless turf experiences. Consequently, grass proprietors in Canada are willing to invest in high-quality equipment to preserve turf excellence. Manufacturers are adhering to compliance by rapidly introducing innovative products.

Fairfield’s Competitive Landscape Analysis

The turf care equipment market is competitive, with key players such as Deere & Company, Husqvarna Group, Honda Power Equipment, and Toro Company leading the industry. These companies hold significant market share due to their extensive product portfolios, technological innovations, and established brand reputation.

Increasing demand for eco-friendly, electric, and automated equipment prompts market leaders to innovate with investments in battery technology, robotic mowers, and IoT-enabled solutions. Small companies are finding opportunities by focusing on niche segments, such as compact equipment for residential use or low-cost, durable solutions for emerging markets.

Mergers, acquisitions, and partnerships are common strategies among these players as they aim to expand geographically and diversify product offerings shaping the market's competitive dynamics.

Key Market Companies

- Husqvarna AB

- Honda Motor Co.

- Deere & Company

- The Toro Company

- MTD Products, Inc.

- Intimidator Group

- Kubota Corporation

- Briggs & Stratton Corporation

- BLACK+DECKER Inc.

- Textron Inc.

Recent Industry Developments

September 2023 -

Stanley Black & Decker declared its acquisition of Excel Industries, through this, Stanley Black & Decker penetrated the turf care equipment sector.

February 2023 -

Toro expanded its electric lineup, introducing battery-powered mowers and trimmers for residential and commercial use, which supports Toro's sustainability objectives, as these tools align with environmental regulations and the shift toward zero-emission equipment.

An Expert’s Eye

- Experts foresee a shift from gas-powered to electric and battery-powered turf care equipment, driven by both environmental concerns and rising fuel costs.

- Robotic mowers and AI-driven monitoring systems are gaining traction as they help save on labor and maintenance costs, marking a key technological trend.

- With increasing urbanization in Asia Pacific and Latin America, these regions present significant growth opportunities.

- Leading players are rapidly expanding eco-friendly product portfolios and enhancing smart features to meet market demand, with Toro, John Deere, and STIHL at the forefront.

Global Turf Care Equipment Market is Segmented as-

By Equipment Type

- Turf Sprayers

- Mowers

- Turf Tractors

- Aerators

- Utility Vehicles

By Fuel

- Gasoline

- Diesel

- Others

By End Use

- Commercial Lawn & Turf

- Sports Lawn & Turf

- Golf Turf

- Other Turfs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Turf Care Equipment Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Price Analysis, 2019 - 2023

3.1. Global Average Price Analysis, by Equipment Type, US$ Per Unit, 2019 - 2023

3.2. Prominent Factor Affecting Turf Care Equipment

3.3. Global Average Price Analysis, by Region, US$ Per Unit

4. Global Turf Care Equipment Market Outlook, 2019 - 2031

4.1. Global Turf Care Equipment Market Outlook, by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Turf Sprayers

4.1.1.2. Mowers

4.1.1.3. Turf Tractors

4.1.1.4. Aerators

4.1.1.5. Utility Vehicles

4.1.1.6. Others

4.2. Global Turf Care Equipment Market Outlook, by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Gasoline

4.2.1.2. Diesel

4.2.1.3. Others

4.3. Global Turf Care Equipment Market Outlook, by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Commercial Lawn & Turf

4.3.1.2. Sports Lawn & Turf

4.3.1.3. Golf Turf

4.3.1.4. Other Turfs

4.4. Global Turf Care Equipment Market Outlook, by Region, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Latin America

4.4.1.5. Middle East & Africa

5. North America Turf Care Equipment Market Outlook, 2019 - 2031

5.1. North America Turf Care Equipment Market Outlook, by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Turf Sprayers

5.1.1.2. Mowers

5.1.1.3. Turf Tractors

5.1.1.4. Aerators

5.1.1.5. Utility Vehicles

5.1.1.6. Others

5.2. North America Turf Care Equipment Market Outlook, by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Gasoline

5.2.1.2. Diesel

5.2.1.3. Others

5.3. North America Turf Care Equipment Market Outlook, by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Commercial Lawn & Turf

5.3.1.2. Sports Lawn & Turf

5.3.1.3. Golf Turf

5.3.1.4. Other Turfs

5.4. North America Turf Care Equipment Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. U.S. Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1.2. U.S. Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1.3. U.S. Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1.4. Canada Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1.5. Canada Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1.6. Canada Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Turf Care Equipment Market Outlook, 2019 - 2031

6.1. Europe Turf Care Equipment Market Outlook, by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Turf Sprayers

6.1.1.2. Mowers

6.1.1.3. Turf Tractors

6.1.1.4. Aerators

6.1.1.5. Utility Vehicles

6.1.1.6. Others

6.2. Europe Turf Care Equipment Market Outlook, by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Gasoline

6.2.1.2. Diesel

6.2.1.3. Others

6.3. Europe Turf Care Equipment Market Outlook, by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Commercial Lawn & Turf

6.3.1.2. Sports Lawn & Turf

6.3.1.3. Golf Turf

6.3.1.4. Other Turfs

6.4. Europe Turf Care Equipment Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Germany Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.2. Germany Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.3. Germany Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.4. U.K. Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.5. U.K. Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.6. U.K. Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.7. France Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.8. France Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.9. France Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.10. Italy Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.11. Italy Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.12. Italy Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.13. Turkey Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.14. Turkey Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.15. Turkey Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.16. Russia Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.17. Russia Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.18. Russia Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.19. Rest of Europe Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.20. Rest of Europe Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1.21. Rest of Europe Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Turf Care Equipment Market Outlook, 2019 - 2031

7.1. Asia Pacific Turf Care Equipment Market Outlook, by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Turf Sprayers

7.1.1.2. Mowers

7.1.1.3. Turf Tractors

7.1.1.4. Aerators

7.1.1.5. Utility Vehicles

7.1.1.6. Others

7.2. Asia Pacific Turf Care Equipment Market Outlook, by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Gasoline

7.2.1.2. Diesel

7.2.1.3. Others

7.3. Asia Pacific Turf Care Equipment Market Outlook, by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Commercial Lawn & Turf

7.3.1.2. Sports Lawn & Turf

7.3.1.3. Golf Turf

7.3.1.4. Other Turfs

7.4. Asia Pacific Turf Care Equipment Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. China Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.2. China Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.3. China Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.4. Japan Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.5. Japan Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.6. Japan Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.7. South Korea Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.8. South Korea Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.9. South Korea Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.10. India Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.11. India Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.12. India Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.13. Southeast Asia Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.14. Southeast Asia Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.15. Southeast Asia Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.16. Rest of Asia Pacific Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.17. Rest of Asia Pacific Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1.18. Rest of Asia Pacific Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Turf Care Equipment Market Outlook, 2019 - 2031

8.1. Latin America Turf Care Equipment Market Outlook, by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Turf Sprayers

8.1.1.2. Mowers

8.1.1.3. Turf Tractors

8.1.1.4. Aerators

8.1.1.5. Utility Vehicles

8.1.1.6. Others

8.2. Latin America Turf Care Equipment Market Outlook, by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Gasoline

8.2.1.2. Diesel

8.2.1.3. Others

8.3. Latin America Turf Care Equipment Market Outlook, by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Commercial Lawn & Turf

8.3.1.2. Sports Lawn & Turf

8.3.1.3. Golf Turf

8.3.1.4. Other Turfs

8.4. Latin America Turf Care Equipment Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Brazil Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.2. Brazil Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.3. Brazil Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.4. Mexico Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.5. Mexico Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.6. Mexico Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.7. Argentina Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.8. Argentina Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.9. Argentina Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.10. Rest of Latin America Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.11. Rest of Latin America Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1.12. Rest of Latin America Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Turf Care Equipment Market Outlook, 2019 - 2031

9.1. Middle East & Africa Turf Care Equipment Market Outlook, by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Turf Sprayers

9.1.1.2. Mowers

9.1.1.3. Turf Tractors

9.1.1.4. Aerators

9.1.1.5. Utility Vehicles

9.1.1.6. Others

9.2. Middle East & Africa Turf Care Equipment Market Outlook, by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Gasoline

9.2.1.2. Diesel

9.2.1.3. Others

9.3. Middle East & Africa Turf Care Equipment Market Outlook, by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Commercial Lawn & Turf

9.3.1.2. Sports Lawn & Turf

9.3.1.3. Golf Turf

9.3.1.4. Other Turfs

9.4. Middle East & Africa Turf Care Equipment Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. GCC Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.2. GCC Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.3. GCC Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.4. South Africa Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.5. South Africa Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.6. South Africa Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.7. Egypt Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.8. Egypt Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.9. Egypt Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.10. Nigeria Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.11. Nigeria Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.12. Nigeria Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.13. Rest of Middle East & Africa Turf Care Equipment Market by Equipment Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.14. Rest of Middle East & Africa Turf Care Equipment Market by Fuel, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1.15. Rest of Middle East & Africa Turf Care Equipment Market by End Use, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Equipment Type vs Fuel Heatmap

10.2. Company Market Share Analysis, 2024

10.3. Competitive Dashboard

10.4. Company Profiles

10.4.1. Husqvarna AB

10.4.1.1. Company Overview

10.4.1.2. Product Portfolio

10.4.1.3. Financial Overview

10.4.1.4. Business Strategies and Development

10.4.2. Honda Motor Co.

10.4.2.1. Company Overview

10.4.2.2. Product Portfolio

10.4.2.3. Financial Overview

10.4.2.4. Business Strategies and Development

10.4.3. Deere & Company

10.4.3.1. Company Overview

10.4.3.2. Product Portfolio

10.4.3.3. Financial Overview

10.4.3.4. Business Strategies and Development

10.4.4. The Toro Company

10.4.4.1. Company Overview

10.4.4.2. Product Portfolio

10.4.4.3. Financial Overview

10.4.4.4. Business Strategies and Development

10.4.5. MTD Products, Inc.

10.4.5.1. Company Overview

10.4.5.2. Product Portfolio

10.4.5.3. Financial Overview

10.4.5.4. Business Strategies and Development

10.4.6. Intimidator Group

10.4.6.1. Company Overview

10.4.6.2. Product Portfolio

10.4.6.3. Financial Overview

10.4.6.4. Business Strategies and Development

10.4.7. Kubota Corporation

10.4.7.1. Company Overview

10.4.7.2. Product Portfolio

10.4.7.3. Financial Overview

10.4.7.4. Business Strategies and Development

10.4.8. Briggs & Stratton Corporation

10.4.8.1. Company Overview

10.4.8.2. Product Portfolio

10.4.8.3. Financial Overview

10.4.8.4. Business Strategies and Development

10.4.9. BLACK+DECKER Inc.

10.4.9.1. Company Overview

10.4.9.2. Product Portfolio

10.4.9.3. Financial Overview

10.4.9.4. Business Strategies and Development

10.4.10. Textron Inc.

10.4.10.1. Company Overview

10.4.10.2. Product Portfolio

10.4.10.3. Financial Overview

10.4.10.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Equipment Type Coverage |

|

|

Fuel Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |