U.S. Dishwasher Market Forecast

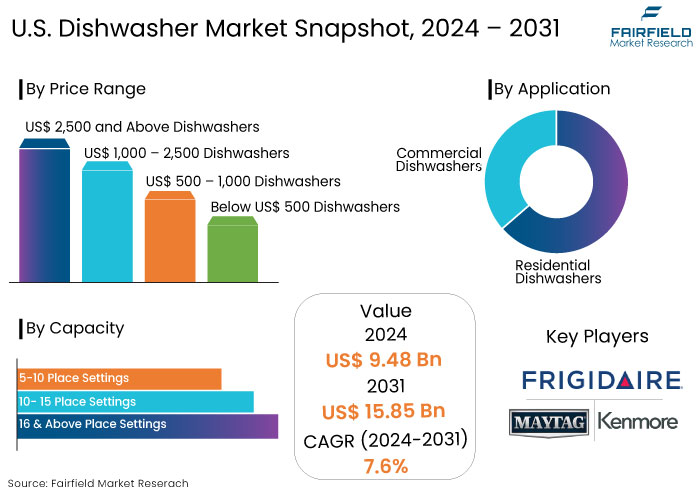

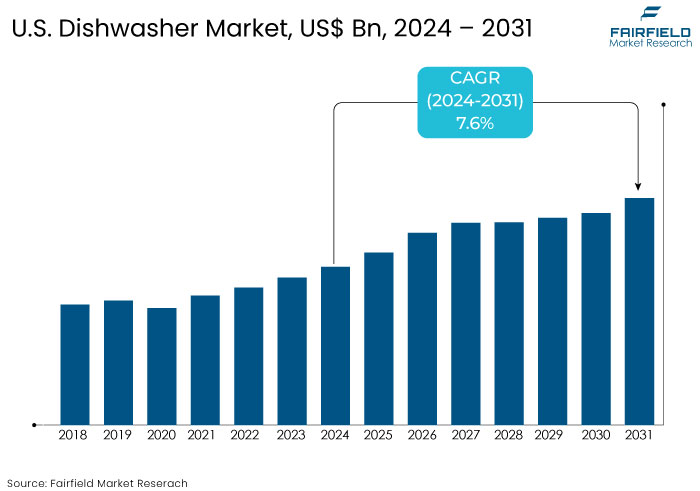

- The U.S. dishwasher market is projected to reach a size of US$15.85 Bn by 2031, showing significant growth from the US$9.48 Bn achieved in 2024.

- The market for U.S. dishwasher is expected to show a significant expansion rate, with an estimated CAGR of 7.6% from 2024 to 2031.

U.S. Dishwasher Market Insights

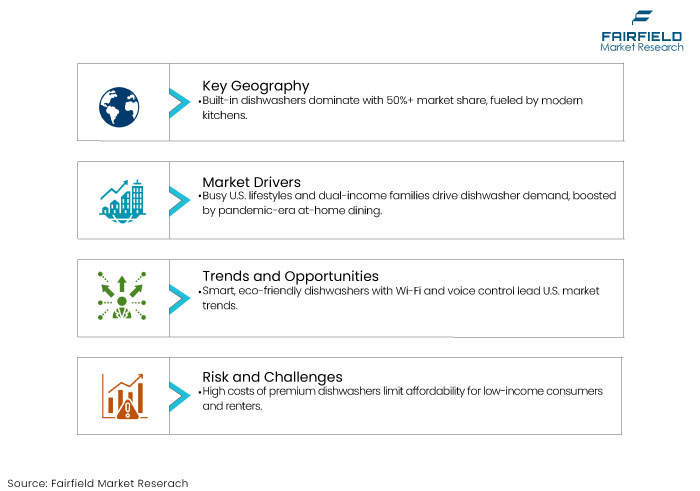

- Built-in dishwashers account for over 50% of the market share, driven by modern kitchen designs and large household demands.

- Eco-friendly and Energy Star-certified dishwashers are in high demand, with water-saving sensors and energy-efficient drying features.

- Wi-Fi-enabled dishwashers with app-based controls and voice assistant compatibility are becoming a standard, boosting consumer interest.

- Convenience and time-saving benefits drive dishwasher adoption, particularly among dual-income and large households.

- Online sales of dishwashers are increasing, with e-commerce channels driving accessibility and consumer reach.

- Innovations such as low-noise operations, specialized wash cycles, and self-cleaning technologies enhance product appeal.

- Compact and portable dishwashers are gaining traction in urban markets and among small households.

- Tightening energy and water usage standards fosters innovation while posing cost challenges for manufacturers.

A Look Back and a Look Forward - Comparative Analysis

The U.S. dishwasher market experienced steady growth, driven by rising consumer demand for time-saving and energy-efficient appliances. The shift towards built-in dishwashers as a standard in modern kitchen designs boosted market penetration. Technological advancements, such as low-noise operations, specialized wash cycles, and improved energy efficiency, appealed to environmentally conscious consumers.

The COVID-19 pandemic also influenced market trends, with increased home cooking and cleaning routines driving demand for dishwashers. Key players like Whirlpool, Bosch, and GE Appliances led with innovative products and widespread distribution networks.

The market is projected to expand significantly over the forecast period, where the increasing adoption of smart home technologies and energy-efficient models fuels the growth. Consumers’ preference for sustainability drives innovation in eco-friendly dishwashers, with manufacturers prioritizing recyclable materials and water conservation technologies.

Rising disposable incomes and kitchen renovation trends will further boost demand for built-in dishwashers, which dominate the market. Portable and countertop dishwashers will grow in niche segments, targeting smaller households. Enhanced distribution channels, including e-commerce, are expected to broaden accessibility, contributing to the sustained growth of market.

Key Growth Determinants

- Rising Consumer Demand for Time-Saving Appliances

As lifestyles in the U.S. grow busy, consumers increasingly seek household solutions that save time and effort, making dishwashers a staple in modern kitchens. Dual-income households, which now constitute nearly half of U.S. families, particularly benefit from the efficiency offered by dishwashers. The pandemic accelerated this trend, with increased at-home dining driving a surge in appliance sales.

According to study, dishwasher sales grew by over 12% in 2021 compared to pre-pandemic levels, as consumers prioritized convenience and hygiene. Built-in dishwashers are favoured for their capacity to handle 10–12 place settings and meet the needs of large households. Models featuring express wash cycles, drying technology, and automated cleaning modes provide time-saving benefits that resonate with modern buyers.

A survey in 2023 found that 68% of U.S. consumers viewed dishwashers as essential kitchen appliances, up from 60% in 2019. This sustained demand for efficient cleaning solutions is a key driver for the U.S. dishwasher market.

- Technological Advancements and Smart Home Integration to Propel Market Expansion

Technological innovation has revolutionized the U.S. dishwasher market, making it a significant growth driver. Smart dishwashers with Wi-Fi and app-based controls allow users to operate and monitor cycles remotely.

Features such as voice command compatibility with Alexa or Google Home add further convenience, aligning with the rapid adoption of smart home ecosystems. Research from 2023 shows that 43% of U.S. households now own at least one smart home device, with appliances being a major category.

Beyond connectivity, innovations like noise reduction (operating below 40 decibels), sensor-driven water usage optimization, and customizable cycles cater to consumer preferences for functionality and environmental efficiency. In 2023, Energy Star-certified models accounted for nearly 70% of dishwasher sales in the U.S., reflecting the growing demand for sustainable, technologically advanced solutions.

Surveys indicate that consumers are willing to pay a 15–20% premium for smart-enabled dishwashers, showcasing the strong market pull for these cutting-edge features.

Key Growth Barriers

- High Initial Cost and Installation Requirements

One of the significant restraints for the U.S. dishwasher market is the high initial cost of purchase and installation. Premium built-in dishwashers, equipped with advanced features such as smart connectivity and energy-efficient technologies, can cost upwards of $1,000. This price point can be prohibitive for many consumers, especially those in lower-income brackets or renters.

Built-in dishwashers often require professional installation, including plumbing and electrical work, further increasing costs. A survey in 2022 revealed that 38% of consumers hesitated to purchase a dishwasher due to affordability concerns. The lack of installation flexibility can deter renters or individuals in older homes without pre-existing dishwasher hook-ups, restricting market penetration in certain demographics.

- Competition from Alternative Cleaning Methods

Despite advancements, many households rely on traditional handwashing or low-cost alternatives, such as portable or countertop dishwashers, which offer flexibility and affordability. Handwashing remains a cultural preference in some households, driven by perceptions of better cleaning results or concerns about water and energy usage.

Portable and countertop models target urban or small households but still compete with built-in dishwashers. In 2023, approximately 24% of U.S. households without a dishwasher cited a lack of perceived need as the primary reason. The said resistance to adoption, compounded by alternative methods, slows the market growth potential for high-end dishwasher categories.

U.S. Dishwasher Market Trends and Opportunities

- Integration of Smart and Sustainable Technologies

A dominant trend in the U.S. dishwasher market is the integration of smart and sustainable technologies, which aligns with evolving consumer preferences for convenience and environmental responsibility. Smart dishwashers, equipped with Wi-Fi connectivity, smartphone control, and voice command compatibility, are increasingly popular in the U.S.

As of 2023, nearly 43% of U.S. households own at least one smart home appliance, and the adoption of smart dishwashers has grown by 25% over the past two years. These appliances offer remote monitoring, customizable cleaning cycles, and diagnostic capabilities, making them ideal for tech-savvy consumers seeking time-saving and efficient solutions.

Sustainability is also a driving force, with Energy Star-certified models gaining significant traction. Such dishwashers consume up to 30% less water and 20% less energy than their non-certified counterparts. Innovations like sensor-based water usage optimization and low-energy drying cycles cater to eco-conscious buyers.

A recent study found that 72% of U.S. consumers consider sustainability when purchasing home appliances, reflecting the importance of this trend. Manufacturers focusing on smart, eco-friendly features will likely maintain a competitive edge as consumers prioritize convenience and environmental impact.

- Expanding Adoption in Small Households and Urban Markets

The U.S. dishwasher market presents a significant opportunity to target small households and urban markets, which remain underpenetrated segments. Nearly 28% of U.S. households comprise one or two individuals, and compact, portable, or countertop dishwashers cater to this growing demographic. Such models are affordable, space-efficient, and require minimal installation, addressing common barriers that renters and urban dwellers face.

Urban areas, with high concentrations of renters and small living spaces, represent untapped potential for manufacturers. By developing innovative solutions such as slim, multifunctional dishwashers or foldable designs, companies can address the unique needs of this market.

E-commerce platforms provide a robust channel to reach these consumers, as online sales of appliances have grown by 20% annually since 2022. Partnerships with apartment developers or furniture retailers can further boost adoption in urban markets. By focusing on these opportunities, manufacturers can expand their consumer base and unlock new growth avenues.

How Does Regulatory Scenario Shaping the Industry?

The regulatory scenario plays a pivotal role in driving the U.S. dishwasher market, particularly through policies emphasizing energy efficiency and environmental sustainability. The Department of Energy (DOE) and the Environmental Protection Agency (EPA) set stringent standards under programs like Energy Star, mandating manufacturers to develop appliances that consume less water and electricity.

Energy Star-certified dishwashers, for instance, use approximately 30% less energy and 40% less water than standard models, driving innovation in eco-friendly designs. State-level initiatives, such as California’s water conservation policies, push for further reductions in water consumption, impacting product designs nationwide.

Segments Covered in the Report

- Built-in Dishwashers to Account for 50% of the Market Share

Built-in dishwashers, designed to be installed under countertops, blend seamlessly with kitchen cabinetry, offering a streamlined appearance. These dishwashers typically accommodate 10 to 12 place settings, making them suitable for larger households or those who entertain frequently.

Equipped with multiple spray arms, specialized wash cycles, and targeted sprays for hard-to-clean items like pans and baking dishes. The preference for built-in dishwashers is driven by their seamless integration into modern kitchen designs, larger capacity, and advanced features that enhance convenience and efficiency in dishwashing tasks.

The dominance of built-in dishwashers in the U.S. dishwater market is driven by their capacity, convenience, and alignment with modern kitchen trends. Its ability to offer advanced functionality while integrating seamlessly into kitchen designs ensures it remains the preferred choice for consumers. With evolving technologies and increasing customization options, their position as the dominant product in the dishwasher market is likely to strengthen further.

- Residential Dishwashers Take the Lead

Residential dishwashers are the dominant application in the U.S. dishwasher market significantly outpacing their commercial counterparts. Several factors drive this dominance, including increasing consumer demand for convenience, rising disposable incomes, and the growing adoption of modern kitchen appliances in households.

The increasing shift from hand washing to using dishwashing systems to save water and time has increased demand for residential dishwashers. Consumers seek energy-efficient and multifunctional appliances that can perform multiple functions, maximizing space and efficiency in their homes.

Modern residential dishwashers have advanced features such as adjustable racks, specialized wash cycles, and smart technology integration, including Wi-Fi connectivity and smartphone controls. These innovations enhance user convenience and align with the growing trend of smart home technologies.

The dishwasher market has a growing trend toward sustainability and eco-friendly products. Consumers are becoming more environmentally conscious and prefer eco-friendly cleaning products. Manufacturers are responding by developing green cleaning products and forming strategic alliances to promote sustainability.

Fairfield’s Competitive Landscape Analysis

The U.S. dishwasher market is highly competitive, with leading players like Whirlpool Corporation, Bosch (BSH Home Appliances), GE Appliances, and Samsung Electronics leading the industry. These companies compete on technological innovation, energy efficiency, and product design, catering to evolving consumer preferences.

New entrants and smaller players focus on niche markets, such as portable and countertop dishwashers. Sustainability trends, including energy-saving technologies and eco-friendly materials, shape product development. Strategic partnerships, extensive distribution networks, and strong brand recognition are key competitive advantages, enabling established brands to maintain dominance in the market.

Key Market Companies

- BSH Home Appliances Corporation

- Maytag Corporation

- KitchenAid

- Kenmore

- Frigidaire Appliance Company

- Amana Corporation

- Electrolux AB

- Samsung Electronics Co., Ltd

- LG appliance

- Sunpentown International Inc.

- Danby Products Inc

- Whirlpool Corporation

- Haier America Company LLC

- GE Appliances (Haier)

- BPL Ltd.

- IFB Industries Limited

- Smeg S.p.A

- Asko Appliances AB

Recent Industry Developments

In June 2024, Whirlpool has been undergoing restructuring efforts, including job cuts and strategic partnerships, to enhance profitability and market position. The company's market valuation, which had seen declines due to reduced consumer spending and increased competition, received a temporary boost from the speculation.

In October 2023, GE Appliances completed a US$450 million investment in its Appliance Park facility in Louisville, Kentucky, enhancing its dishwasher manufacturing capabilities. This expansion includes two new production lines to increase output and incorporate advanced technologies to meet growing consumer demand.

An Expert’s Eye

- Experts highlight robust growth potential, driven by increasing consumer preference for time-saving appliances and rising disposable incomes.

- The S. dishwasher market is being reshaped by advancements in smart dishwashers, including Wi-Fi connectivity, app-based control, and energy-efficient technologies.

- Analysts emphasize the role of eco-friendly products in driving market expansion, with Energy Star-certified models and water-efficient technologies becoming a priority.

- Experts see significant opportunities in compact, portable models targeting urban markets and smaller households.

U.S. Dishwasher Market is Segmented as-

By Product

- Freestanding/Portable dishwashers

- Built-in Dishwashers

- Countertop Dishwashers

By Capacity

- 5-10 Place Settings

- 10- 15 Place Settings

- 16 & Above Place Settings

By Application

- Residential Dishwashers

- Commercial Dishwashers

By Price Range

- Below US$ 500 Dishwashers

- US$ 500 – 1,000 Dishwashers

- US$ 1,000 – 2,500 Dishwashers

- US$ 2,500 and Above Dishwashers

By Sales Channel

- Wholesalers/ Distributors

- Hypermarkets/ Supermarkets

- Convenience Stores

- Specialty Stores

- Departmental Stores

- Online Retailers

1. Executive Summary

1.1. U.S. Dishwasher Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Price Analysis, 2019 - 2023

3.1. U.S. Average Price Analysis, by Product, US$ Per Unit, 2019 - 2023

3.2. Prominent Factor Affecting Dishwasher Prices

3.3. Global Average Price Analysis, by Region, US$ Per Unit

4. U.S. Dishwasher Market Outlook, 2019 - 2031

4.1. U.S. Dishwasher Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Freestanding/Portable dishwashers

4.1.1.2. Built-in Dishwashers

4.1.1.3. Countertop Dishwashers

4.2. U.S. Dishwasher Market Outlook, by Capacity, Value (US$ Bn) and Volume (Units), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. 5-10 Place Settings

4.2.1.2. 10- 15 Place Settings

4.2.1.3. 16 & Above Place Settings

4.3. U.S. Dishwasher Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Residential Dishwashers

4.3.1.2. Commercial Dishwashers

4.3.1.2.1. Hotels & Restaurants

4.3.1.2.2. Schools & Institutions

4.3.1.2.3. Others

4.4. U.S. Dishwasher Market Outlook, by Price Range, Value (US$ Bn) and Volume (Units), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Below US$ 500 Dishwashers

4.4.1.2. US$ 500 – 1,000 Dishwashers

4.4.1.3. US$ 1,000 – 2,500 Dishwashers

4.4.1.4. US$ 2,500 and Above Dishwashers

4.5. U.S. Dishwasher Market Outlook, by Sales Channel, Value (US$ Bn) and Volume (Units), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. Wholesalers/ Distributors

4.5.1.2. Hypermarkets/ Supermarkets

4.5.1.3. Convenience Stores

4.5.1.4. Specialty Stores

4.5.1.5. Departmental Stores

4.5.1.6. Online Retailers

4.5.1.7. Other Retail Formats

4.6. U.S. Dishwasher Market Outlook, by Zones, Value (US$ Bn) and Volume (Units), 2019 - 2031

4.6.1. Key Highlights

4.6.1.1. West

4.6.1.2. Midwest

4.6.1.3. Southwest

4.6.1.4. Southeast

4.6.1.5. Northeast

5. West Dishwasher Market Outlook, 2019 - 2031

5.1. West Dishwasher Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Freestanding/Portable dishwashers

5.1.1.2. Built-in Dishwashers

5.1.1.3. Countertop Dishwashers

5.2. West Dishwasher Market Outlook, by Capacity, Value (US$ Bn) and Volume (Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. 5-10 Place Settings

5.2.1.2. 10- 15 Place Settings

5.2.1.3. 16 & Above Place Settings

5.3. West Dishwasher Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Residential Dishwashers

5.3.1.2. Commercial Dishwashers

5.3.1.2.1. Hotels & Restaurants

5.3.1.2.2. Schools & Institutions

5.3.1.2.3. Others

5.4. West Dishwasher Market Outlook, by Price Range, Value (US$ Bn) and Volume (Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Below US$ 500 Dishwashers

5.4.1.2. US$ 500 – 1,000 Dishwashers

5.4.1.3. US$ 1,000 – 2,500 Dishwashers

5.4.1.4. US$ 2,500 and Above Dishwashers

5.5. West Dishwasher Market Outlook, by Sales Channel, Value (US$ Bn) and Volume (Units), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. Wholesalers/ Distributors

5.5.1.2. Hypermarkets/ Supermarkets

5.5.1.3. Convenience Stores

5.5.1.4. Specialty Stores

5.5.1.5. Departmental Stores

5.5.1.6. Online Retailers

5.5.1.7. Other Retail Formats

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Midwest Dishwasher Market Outlook, 2019 - 2031

6.1. Midwest Dishwasher Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Freestanding/Portable dishwashers

6.1.1.2. Built-in Dishwashers

6.1.1.3. Countertop Dishwashers

6.2. Midwest Dishwasher Market Outlook, by Capacity, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. 5-10 Place Settings

6.2.1.2. 10- 15 Place Settings

6.2.1.3. 16 & Above Place Settings

6.3. Midwest Dishwasher Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Residential Dishwashers

6.3.1.2. Commercial Dishwashers

6.3.1.2.1. Hotels & Restaurants

6.3.1.2.2. Schools & Institutions

6.3.1.2.3. Others

6.4. Midwest Dishwasher Market Outlook, by Price Range, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Below US$ 500 Dishwashers

6.4.1.2. US$ 500 – 1,000 Dishwashers

6.4.1.3. US$ 1,000 – 2,500 Dishwashers

6.4.1.4. US$ 2,500 and Above Dishwashers

6.5. Midwest Dishwasher Market Outlook, by Sales Channel, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. Wholesalers/ Distributors

6.5.1.2. Hypermarkets/ Supermarkets

6.5.1.3. Convenience Stores

6.5.1.4. Specialty Stores

6.5.1.5. Departmental Stores

6.5.1.6. Online Retailers

6.5.1.7. Other Retail Formats

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Southwest Dishwasher Market Outlook, 2019 - 2031

7.1. Southwest Dishwasher Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Freestanding/Portable dishwashers

7.1.1.2. Built-in Dishwashers

7.1.1.3. Countertop Dishwashers

7.2. Southwest Dishwasher Market Outlook, by Capacity, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. 5-10 Place Settings

7.2.1.2. 10- 15 Place Settings

7.2.1.3. 16 & Above Place Settings

7.3. Southwest Dishwasher Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Residential Dishwashers

7.3.1.2. Commercial Dishwashers

7.3.1.2.1. Hotels & Restaurants

7.3.1.2.2. Schools & Institutions

7.3.1.2.3. Others

7.4. Southwest Dishwasher Market Outlook, by Price Range, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Below US$ 500 Dishwashers

7.4.1.2. US$ 500 – 1,000 Dishwashers

7.4.1.3. US$ 1,000 – 2,500 Dishwashers

7.4.1.4. US$ 2,500 and Above Dishwashers

7.5. Southwest Dishwasher Market Outlook, by Sales Channel, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Wholesalers/ Distributors

7.5.1.2. Hypermarkets/ Supermarkets

7.5.1.3. Convenience Stores

7.5.1.4. Specialty Stores

7.5.1.5. Departmental Stores

7.5.1.6. Online Retailers

7.5.1.7. Other Retail Formats

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Southeast Dishwasher Market Outlook, 2019 - 2031

8.1. Southeast Dishwasher Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Freestanding/Portable dishwashers

8.1.1.2. Built-in Dishwashers

8.1.1.3. Countertop Dishwashers

8.2. Southeast Dishwasher Market Outlook, by Capacity, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. 5-10 Place Settings

8.2.1.2. 10- 15 Place Settings

8.2.1.3. 16 & Above Place Settings

8.3. Southeast Dishwasher Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Residential Dishwashers

8.3.1.2. Commercial Dishwashers

8.3.1.2.1. Hotels & Restaurants

8.3.1.2.2. Schools & Institutions

8.3.1.2.3. Others

8.4. Southeast Dishwasher Market Outlook, by Price Range, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Below US$ 500 Dishwashers

8.4.1.2. US$ 500 – 1,000 Dishwashers

8.4.1.3. US$ 1,000 – 2,500 Dishwashers

8.4.1.4. US$ 2,500 and Above Dishwashers

8.5. Southeast Dishwasher Market Outlook, by Sales Channel, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. Wholesalers/ Distributors

8.5.1.2. Hypermarkets/ Supermarkets

8.5.1.3. Convenience Stores

8.5.1.4. Specialty Stores

8.5.1.5. Departmental Stores

8.5.1.6. Online Retailers

8.5.1.7. Other Retail Formats

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Northeast Dishwasher Market Outlook, 2019 - 2031

9.1. Northeast Dishwasher Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Freestanding/Portable dishwashers

9.1.1.2. Built-in Dishwashers

9.1.1.3. Countertop Dishwashers

9.2. Northeast Dishwasher Market Outlook, by Capacity, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. 5-10 Place Settings

9.2.1.2. 10- 15 Place Settings

9.2.1.3. 16 & Above Place Settings

9.3. Northeast Dishwasher Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Residential Dishwashers

9.3.1.2. Commercial Dishwashers

9.3.1.2.1. Hotels & Restaurants

9.3.1.2.2. Schools & Institutions

9.3.1.2.3. Others

9.4. Northeast Dishwasher Market Outlook, by Price Range, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. Below US$ 500 Dishwashers

9.4.1.2. US$ 500 – 1,000 Dishwashers

9.4.1.3. US$ 1,000 – 2,500 Dishwashers

9.4.1.4. US$ 2,500 and Above Dishwashers

9.5. Northeast Dishwasher Market Outlook, by Sales Channel, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.5.1. Key Highlights

9.5.1.1. Wholesalers/ Distributors

9.5.1.2. Hypermarkets/ Supermarkets

9.5.1.3. Convenience Stores

9.5.1.4. Specialty Stores

9.5.1.5. Departmental Stores

9.5.1.6. Online Retailers

9.5.1.7. Other Retail Formats

9.5.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Company Market Share Analysis, 2023

10.2. Competitive Dashboard

10.3. Company Profiles

10.3.1. BSH Home Appliances Corporation

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. Maytag Corporation

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. KitchenAid

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. Kenmore

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. Frigidaire Appliance Company

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Amana Corporation

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. Electrolux AB

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. Samsung Electronics Co., Ltd

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. LG appliance

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. Sunpentown International Inc.

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

10.3.11. Danby Products Inc

10.3.11.1. Company Overview

10.3.11.2. Product Portfolio

10.3.11.3. Financial Overview

10.3.11.4. Business Strategies and Development

10.3.12. Whirlpool Corporation

10.3.12.1. Company Overview

10.3.12.2. Product Portfolio

10.3.12.3. Financial Overview

10.3.12.4. Business Strategies and Development

10.3.13. Haier America Company LLC

10.3.13.1. Company Overview

10.3.13.2. Product Portfolio

10.3.13.3. Financial Overview

10.3.13.4. Business Strategies and Development

10.3.14. GE Appliances (Haier)

10.3.14.1. Company Overview

10.3.14.2. Product Portfolio

10.3.14.3. Financial Overview

10.3.14.4. Business Strategies and Development

10.3.15. BPL Ltd.

10.3.15.1. Company Overview

10.3.15.2. Product Portfolio

10.3.15.3. Financial Overview

10.3.15.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Capacity Coverage |

|

|

Application Coverage |

|

|

Price Range Coverage |

|

|

Sales Channel Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |