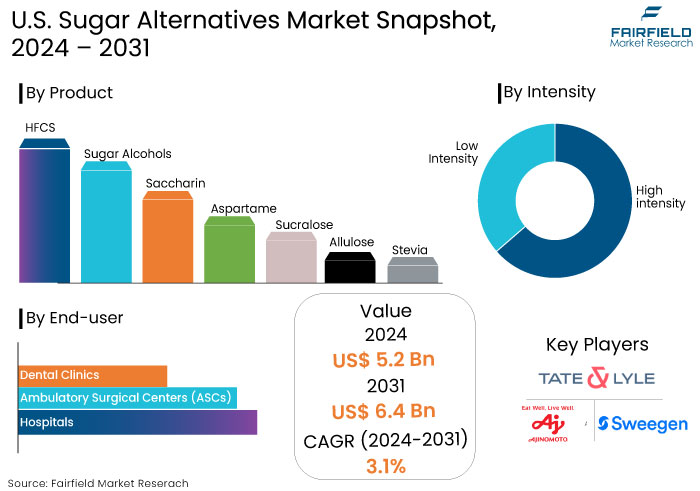

U.S. Sugar Alternatives Market Forecast

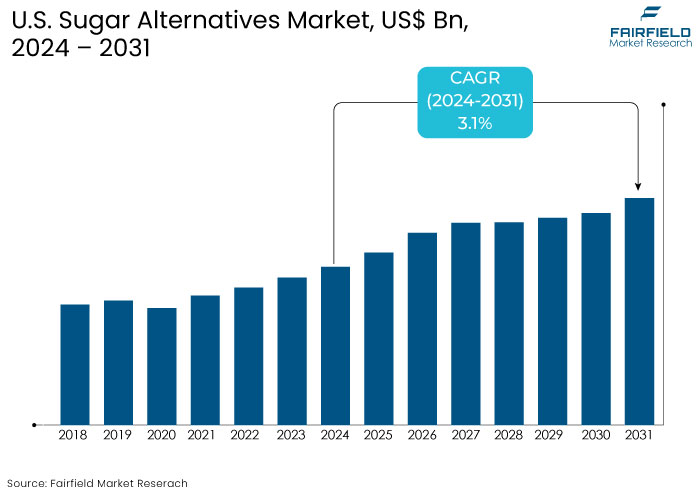

- The U.S. Sugar Alternatives market is slated to be valued at US$6.4 Bn by 2031, experiencing notable growth from the US$5.2 Bn achieved in 2024.

- The market is anticipated to grow substantially with a CAGR of 3.1% in the forthcoming years from 2024 to 2031.

U.S. Sugar Alternatives Market Insights

- Increasing awareness of the health risks associated with high sugar consumption is driving the market.

- Consumers are increasingly prioritizing sweeteners with transparent ingredient lists, driven by a growing interest in health-conscious choices and natural products.

- Consumer demand for sugar-free products with an authentic taste and texture is growing as health-conscious consumers seek alternatives that replicate the experience of traditional sugar-based products.

- The rise in vegan and plant-based diets is boosting the demand for sugar alternatives, as consumers seek products without refined sugars or animal-derived ingredients.

- HFCS (high fructose corn syrup) holds more than 50% market share in the S. sugar alternatives market due to its cost-effectiveness and widespread availability. It also provides similar sweetness and stability, making it a preferred choice for manufacturers in processed foods and beverages.

- Growing demand for natural, clean label products with simple, transparent ingredients lists, leading to the adoption of natural sugar alternatives like stevia, agave, and coconut sugar.

- Increasing Demand for Functional Foods remains a key driver for market growth in the U.S.

A Look Back and a Look Forward - Comparative Analysis

The market expanded steadily as people became more conscious of health problems including obesity, diabetes, and heart disease during the period from 2019 to 2023. The market was driven by consumer demand for sugar-free and low-calorie products. Aspartame, sucralose, and saccharin were the most popular artificial sweeteners available.

Growth in the U.S. sugar alternatives market is anticipated to accelerate during the forecast period from 2024 to 2031 as a result of growing use of natural sweeteners such as stevia, monk fruit, and allulose. The market for these substitutes is expected to be driven by the move toward clean-label and plant-based components as well as increased regulatory pressure on sugar consumption.

The rising number of diabetics and advancements in food and beverage formulations will accelerate the anticipated increase. Talking about sugar alternatives for tea, tea drinkers particularly those in regions where tea consumption is high are mainly looking for sugar alternatives for sweetening their beverages.

Key Growth Determinants

- Growing Diabetes Rates Propel the Need for Sugar Substitutes Among Affected Individuals

The rising prevalence of diabetes in the U.S. has significantly boosted the demand for sugar alternatives, positioning it as a key driver for the U.S. sugar alternatives market. The Centers for Disease Control and Prevention (CDC) reports, over 37 million Americans are currently living with diabetes, and an additional 97.6 million adults are prediabetic. This growing diabetic population has created a strong consumer base seeking sugar substitutes that help manage blood sugar levels without compromising on taste.

Traditional sugar can cause dangerous spikes in blood glucose levels for people with diabetes making it essential to find alternatives. As a result, sugar substitutes such as stevia, sucralose, allulose, and monk fruit have gained popularity for offering the sweetness of sugar without the negative glycemic impact.

Alternatives enable diabetic individuals to enjoy sweetened foods and beverages while adhering to medical guidelines. Consequently, the market for diabetic-friendly products has expanded, and food manufacturers have been quick to reformulate their offerings with these sugar substitutes.

- Growing Health Awareness Among U.S. Consumers

Health awareness has surged across the U.S. as consumers become more conscious of the link between diet and long-term health outcomes. The rising prevalence of lifestyle diseases like obesity and type 2 diabetes has heightened public focus on reducing sugar intake, driving increased demand for sugar substitutes.

According to the CDC, about 42.4% of U.S. adults were classified as obese by 2020, a significant rise from past decades. This alarming trend has made sugar reduction a priority, with many consumers turning to alternative sweeteners to manage caloric intake and control blood sugar levels without sacrificing sweetness.

Consumers, particularly Millennials and Generation Z, are more informed and empowered by readily available nutritional information, prompting them to seek out healthy alternatives. As health risks tied to excessive sugar consumption become more widely known, sugar substitutes such as stevia, monk fruit, and allulose have gained traction. It is due to their ability to provide sweetness with fewer or no calories.

The trend toward natural and clean-label products has fueled demand for plant-based sweeteners, as consumers opt for minimally processed, transparent alternatives. Government agencies and the food industry have responded with initiatives to reduce sugar content in products, such as the FDA’s regulations requiring disclosure of added sugars on nutrition labels, which help consumers make informed choices.

Key Growth Barriers

- Sugar Alternatives Struggle to Deliver the Same Taste and Mouthfeel as Sugar

One of the primary challenges facing the U.S. sugar alternatives market is the difficulty many of these alternatives have in replicating the taste and texture of sugar. This limitation affects consumer satisfaction and hinders growth potential in specific food and beverage applications.

The sensory experience of sweetness is intricate; sugar uniquely combines sweetness with texture, mouthfeel, and flavor enhancement. Many artificial sweeteners, despite being low in calories or calorie-free, do not effectively replicate this sweetness profile. For instance, some sweeteners can leave an unpleasant aftertaste or a bit note that consumers find off-putting.

Natural options like stevia, while marketed as healthy, often present an intense sweetness that can result in lingering bitterness or a licorice-like flavor when consumed in larger amounts. Additionally, the inability of many sugar substitutes to mimic the functional properties of sugar restricts their application in highly processed foods.

Sugar serves not only as a sweetener but also as a preservative, texture modifier, and bulking agent. In products such as jams, jellies, sauces, and condiments, sugar helps to extend shelf life and inhibit microbial growth. Many sugar substitutes may effectively sweeten but fall short in providing the same preservative qualities, resulting in short shelf lives or the need for additional processing aids.

U.S. Sugar Alternatives Market Trends and Opportunities

- Growing Innovations and Developments in the Market

The U.S. sugar substitutes market is witnessing significant innovation driven by the increasing consumer demand for healthy alternatives to traditional sugars. As awareness grows regarding the health risks associated with excessive sugar consumption, manufacturers are prioritizing the development of products that align with consumer preferences while offering functional benefits. Key trends in this evolving market include advancements in sweetener formulations, extraction processes, and diverse applications.

In the beverage sector, achieving the ideal balance of sweetness without the calories associated with sugar remains a challenge. Consumers desire a specific sweetness level, yet traditional high-intensity sweeteners often leave undesirable aftertastes. To address this, Suntory Holdings Ltd has introduced a pioneering beverage formula that combines high-intensity sweeteners with small amounts of amino acids or their derivatives.

Innovative combination enhances perceived sweetness by over 10% beyond what the sweeteners alone can provide, allowing for low-calorie beverages that meet consumer sweetness expectations without the drawbacks of conventional sweeteners.

Food and beverage companies are increasingly focused on utilizing ingredients that deliver greater value with smaller quantities. For instance, Ingredion’s Sugar Reduction Life Cycle Assessment (LCA) highlights Reb M stevia as a preferable solution for brands seeking better-tasting alternatives to previous generations of stevia.

- Partnership with Health and Wellness Brands by Companies to Develop Products Featuring Sugar Alternatives

As consumers become health-conscious, they are actively seeking products that align with their wellness goals, including reduced sugar intake. Collaborating with established health and wellness brands allows sugar alternative companies to leverage these brands’ credibility and consumer trust, enhancing the marketability of their products.

Partnerships can lead to the creation of unique formulations that combine sugar substitutes with functional ingredients, such as vitamins, minerals, and superfoods, appealing to health-conscious consumers. For instance, a sugar alternative company could work with a wellness brand to develop a low-calorie snack bar that incorporates natural sweeteners, providing a guilt-free indulgence that does not compromise on taste or nutritional value. These collaborations allow for cross-promotion, tapping into each other's customer base and expanding U.S. alternatives market reach. For example,

- In July 2024, Roquette and Bonumose, announced a Cooperation Agreement to advance the development of tagatose, a natural-origin sweetener with clinically proven health benefits. The partnership aims to bring innovative, healthy sugar alternatives to the market.

How does Regulatory Scenario Shape this Industry?

The regulatory landscape for the U.S. sugar alternatives market is primarily governed by the Food and Drug Administration (FDA), which classifies sweeteners into two categories such as food additives and Generally Recognized as Safe (GRAS) substances. Food additives must undergo a rigorous pre-market approval process, which can be lengthy and complex, while GRAS substances do not require such approval if they meet specific criteria established by qualified experts.

There is heightened scrutiny regarding the safety and efficacy of sugar substitutes, prompting regulatory changes aimed at enhancing transparency as consumer awareness of health and wellness increases. For instance, amendments to the Nutrition Labeling and Education Act now mandate clear labeling of added sugars, encouraging companies to reformulate their products and disclose the presence and quantity of sugar substitutes on packaging.

Segments Covered in the Report

- Low Intensity Sweeteners Lead Intensity Category

Low-intensity sweeteners are increasingly gaining traction over high-intensity sweeteners in the U.S. sugar alternatives market due to several consumer preferences and industry dynamics. While high-intensity sweeteners, such as aspartame and sucralose offer significant sweetness with minimal calories, they often leave undesirable aftertastes that can deter consumers. This has led to a growing demand for sweeteners that provide a more balanced taste profile without compromising on sweetness.

Low-intensity sweeteners, such as erythritol and agave nectar offer a more sugar-like taste and mouthfeel, making them appealing to consumers who prioritize flavor experience. Moreover, the health conscious trend among consumers in America is shifting focus toward natural and minimally processed ingredients.

Many low-intensity sweeteners are derived from plant sources, appealing to the clean-label movement that emphasizes transparency and simplicity in food ingredients. Consumers are increasingly looking for sweeteners that not only enhance flavor but also align with their dietary preferences, such as organic or non-GMO certifications. Low-intensity sweeteners typically have fewer processing steps and are perceived as more natural, further enhancing their appeal.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the U.S. sugar alternatives market is characterized by a mix of established brands and specialized retailers. Top sugar alternatives market companies are IFF, ADM, Cargill, Inc, Ingredion, Tate & Lyle, Roquette dominate the market by leveraging extensive distribution networks and robust research and development capabilities.

Small companies and startups, such as Pyure Brands LLC and Sweegen have emerged by specializing in natural and organic sweeteners. These players are increasingly appealing to health-conscious consumers seeking clean-label options, often capitalizing on the growing trend of plant-based and organic ingredients.

Key Market Companies

- IFF

- ADM

- Cargill, Inc

- Ingredion

- Tate & Lyle

- Ajinomoto Co., Inc.

- Celanese Corporation (Nutrinova)

- Roquette

- Sweegen

- Merck KGaA

- GLG Life Tech Corp.

- Pyure Brands LLC

- B&G Foods, Inc.

- Cumberland Packing Corp.

- Whole Earth Brands

- Heartland Food Products Group

Recent Industry Developments

- In December 2023, Tate & Lyle expanded its sugar reduction toolkit with the launch of TASTEVA® Sol, a patented breakthrough in stevia technology known for its exceptional solubility, aimed at co-creating exceptional reduced-sugar products.

- In August 2024, Ajinomoto, through its U.S. subsidiary Ajinomoto Health & Nutrition North America (AHN), partnered with Shiru to develop sweet proteins for beverages and specialty products. Shiru’s AI-driven protein discovery and AHN’s fermentation expertise aimed to create natural sweeteners with sugar-like taste, derived from fruits and berries near the equator.

- In July 2024, Roquette and Bonumose, announced a Cooperation Agreement to advance the development of tagatose, a natural-origin sweetener with clinically proven health benefits. The partnership aims to bring innovative, healthier sugar alternatives to the market.

An Expert’s Eye

- A significant shift is occurring toward low-intensity sweeteners, which are favored for their superior taste profiles compared to high-intensity sweeteners. These which can leave unpleasant aftertaste.

- The regulatory landscape, primarily governed by the FDA, emphasizes the need for clear labeling of added sugars. This is pushing manufacturers to reformulate products to align with consumer demand for transparency, particularly regarding sugar substitutes.

- Partnerships between sugar alternative companies and health/wellness brands are emerging as a strategic approach to enhance product offerings.

U.S. Sugar Alternatives Market is Segmented as-

By Product Type

- HFCS

- Sugar Alcohols

- Saccharin

- Aspartame

- Sucralose

- Allulose

- Stevia

- (Ace-K, Monk fruit, Neotame)

By Intensity

- High intensity

- Low Intensity

By Application

- Food

- Beverage

- Healthcare & Personal care

By Distribution Channel

- B2B

- B2C

- Hypermarkets/Supermarkets

- Specialty Stores

- Pharmacies and Drugstores

- Online retail

- Others

By Country

- U.S.

1. Executive Summary

1.1. U.S. Sugar Alternatives Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume and Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Pestle Analysis

2.6. Covid-19 Impact Analysis

3. Price Analysis, 2019 - 2023

3.1. Average Price Analysis, by Product Type, US$ Per Ton, 2019 - 2023

3.2. Prominent Factor Affecting Sugar Alternatives Prices

4. U.S. Sugar Alternatives Market Outlook, 2019 - 2031

4.1. U.S. Sugar Alternatives Market Outlook, by Product Type, Value (US$ Mn) and Volume (Kilo Tons), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. HFCS

4.1.1.2. Sugar Alcohols

4.1.1.3. Saccharin

4.1.1.4. Aspartame

4.1.1.5. Sucralose

4.1.1.6. Allulose

4.1.1.7. Stevia

4.1.1.8. Misc. (Ace-K, Monk fruit, Neotame)

4.2. U.S. Sugar Alternatives Market Outlook, by Intensity, Value (US$ Mn) and Volume (Kilo Tons), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. High intensity

4.2.1.2. Low Intensity

4.3. U.S. Sugar Alternatives Market Outlook, by Application, Value (US$ Mn) and Volume (Kilo Tons), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Food

4.3.1.2. Beverage

4.3.1.3. Healthcare & Personal care

4.4. U.S. Sugar Alternatives Market Outlook, by Distribution Channel, Value (US$ Mn) and Volume (Kilo Tons), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. B2B

4.4.1.2. B2C

4.4.1.2.1. Hypermarkets/Supermarkets

4.4.1.2.2. Specialty Stores

4.4.1.2.3. Pharmacies and Drugstores

4.4.1.2.4. Online retail

4.4.1.2.5. Others

5. Competitive Landscape

5.1. Company Market Share Analysis, 2024

5.2. Competitive Dashboard

5.3. Company Profiles

5.3.1. IFF

5.3.1.1. Company Overview

5.3.1.2. Type Portfolio

5.3.1.3. Financial Overview

5.3.1.4. Business Strategies and Development

5.3.2. ADM

5.3.2.1. Company Overview

5.3.2.2. Type Portfolio

5.3.2.3. Financial Overview

5.3.2.4. Business Strategies and Development

5.3.3. Cargill, Inc

5.3.3.1. Company Overview

5.3.3.2. Type Portfolio

5.3.3.3. Financial Overview

5.3.3.4. Business Strategies and Development

5.3.4. Ingredion

5.3.4.1. Company Overview

5.3.4.2. Type Portfolio

5.3.4.3. Financial Overview

5.3.4.4. Business Strategies and Development

5.3.5. Tate & Lyle

5.3.5.1. Company Overview

5.3.5.2. Type Portfolio

5.3.5.3. Financial Overview

5.3.5.4. Business Strategies and Development

5.3.6. Ajinomoto Co., Inc.

5.3.6.1. Company Overview

5.3.6.2. Type Portfolio

5.3.6.3. Financial Overview

5.3.6.4. Business Strategies and Development

5.3.7. Merck KGaA

5.3.7.1. Company Overview

5.3.7.2. Type Portfolio

5.3.7.3. Financial Overview

5.3.7.4. Business Strategies and Development

5.3.8. Pyure Brands LLC

5.3.8.1. Company Overview

5.3.8.2. Type Portfolio

5.3.8.3. Financial Overview

5.3.8.4. Business Strategies and Development

5.3.9. B&G Foods, Inc.

5.3.9.1. Company Overview

5.3.9.2. Type Portfolio

5.3.9.3. Financial Overview

5.3.9.4. Business Strategies and Development

5.3.10. Cumberland Packing Corp.

5.3.10.1. Company Overview

5.3.10.2. Type Portfolio

5.3.10.3. Financial Overview

5.3.10.4. Business Strategies and Development

6. Appendix

6.1. Research Methodology

6.2. Report Assumptions

6.3. Acronyms And Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Intensity Coverage |

|

|

Application Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2018-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, COVID-19 Impact Analysis |