Global Vascular Stent Market Forecast

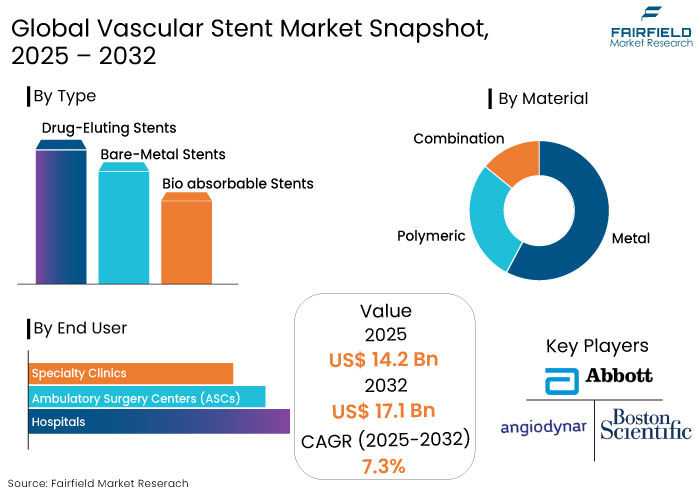

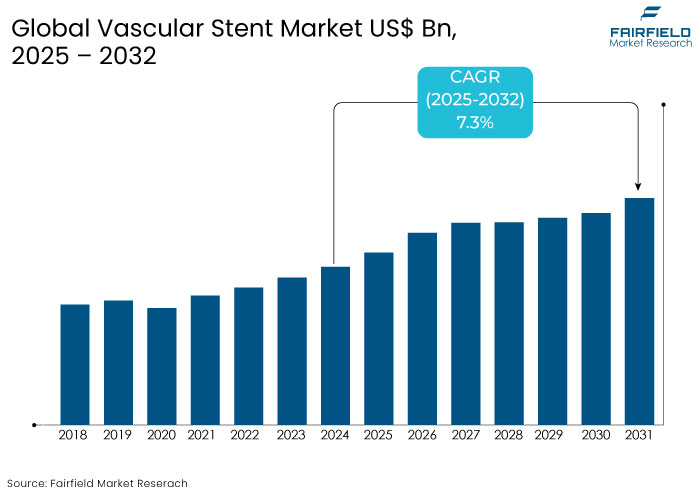

- The vascular stent market is projected to reach a size of US$17.1 Bn by 2032, exhibiting growth from the US$14.2 Bn achieved in 2025.

- The market for vascular stent is projected to record a CAGR of 7.3% from 2025 to 2032.

Vascular Stent Market Insights

- DES to account for over 55% of the market share in 2025 due to their superior ability to prevent restenosis.

- Increased coronary artery disease and atherosclerosis cases are driving demand for vascular stents globally.

- Advances in bio-absorbable and combination-material stents are revolutionizing the market by offering improved safety and efficacy.

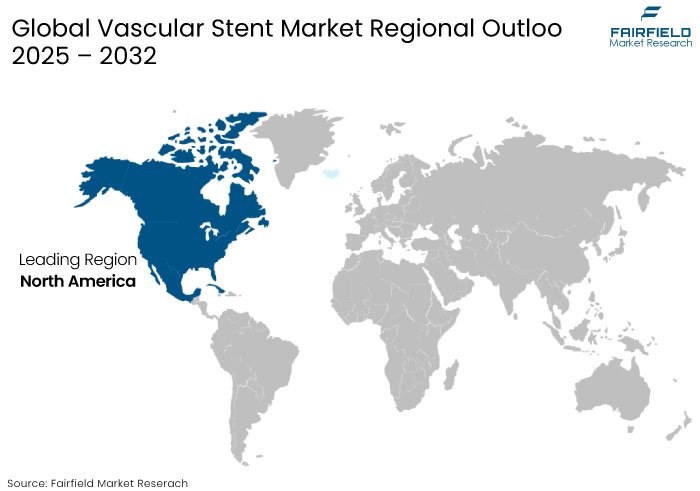

- North America leads the market due to advanced healthcare systems, while Asia Pacific is the rapidly growing region due to healthcare investments and rising disease prevalence.

- Growing healthcare infrastructure in Asia Pacific and Latin America presents lucrative opportunities for market expansion.

- Increased preference for minimally invasive procedures is boosting stent adoption globally.

- Biocompatibility and long-term safety remain key drivers for new stent designs and material innovations.

A Look Back and a Look Forward - Comparative Analysis

The global vascular stent market experienced steady growth during the historical period from 2019 to 2023, driven by a rising global burden of cardiovascular diseases (CVDs) due to lifestyle changes, aging populations, and increasing rates of diabetes and hypertension.

Technological advancements, such as the development of drug-eluting stents (DES) with enhanced safety and efficacy, significantly boosted adoption rates. The market also benefited from increasing healthcare expenditure and infrastructure improvements in emerging economies, particularly in Asia Pacific

The vascular stent market is estimated to experience accelerated growth due to bio-absorbable and combination-material stent advancements over the forecast period. Emerging regions like Asia Pacific and Latin America are expected to play a large role in market expansion, fueled by increasing healthcare investments and better access to advanced medical devices.

Government initiatives to combat CVDs and promote minimally invasive procedures will further drive demand. Continued research and development efforts to improve biocompatibility and long-term efficacy will sustain growth despite persistent challenges like cost pressures and competition.

Key Growth Determinants

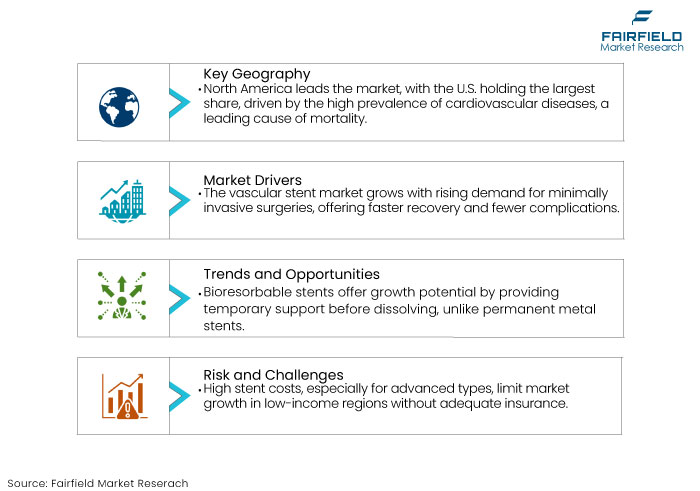

- Increasing Inclination Towards Minimally Invasive Techniques

The vascular stent market is mainly propelled by the increasing inclination and demand for minimally invasive surgical techniques. Patients increasingly choose angioplasty and comparable operations because of several benefits, such as reduced recovery times, low postoperative problems, and smaller incisions.

Preserving arterial blood flow is crucial for managing peripheral artery disease (PAD) and coronary artery disease (CAD). As a result, there is an increasing demand for sophisticated medical interventions, including stenting, a conventional technique employed in angioplasty.

The concurrent increase in chronic heart diseases propels the growing demand for vascular stents. According to reports, in 2021, more than one million percutaneous coronary interventions (PCIs) were conducted annually in the United States, while 1.1 million transluminal coronary angioplasties were executed throughout 25 European Union countries. These figures illustrate the essential function of stents in providing modern vascular treatment.

- Advancements in Stent Technologies Remain a Key Driver

Innovative advancements in vascular stent technologies are driving vascular stent market growth over the forecast period. The development of drug-eluting stents (DES) with medications that prevent restenosis has significantly improved patient outcomes compared to traditional bare-metal stents.

Bio-absorbable stents, designed to dissolve after fulfilling their purpose, have emerged as a breakthrough, reducing long-term complications. Enhanced imaging and delivery systems have improved stent placement precision, reducing procedural risks.

These technological advancements enhance treatment efficacy and attract healthcare providers to adopt the latest devices, boosting market expansion.

Innovations in imaging technologies, such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT), have also improved stent placement precision, minimizing complications and procedural risks. Advancements in stent technologies have driven higher adoption rates, expanded the patient base, and solidified the position of stents in modern cardiovascular care.

Key Growth Barriers

- High Cost of Stent Procedures and Devices

The high cost of vascular stents and the associated procedures is a key restraint for the vascular stent market growth, particularly in low and middle-income countries. Advanced stents like drug-eluting stents (DES) and bio-absorbable stents often come at premium prices, which can be prohibitive for patients without adequate insurance coverage.

The cost of minimally invasive stenting procedures, including hospital charges, physician fees, and post-operative care, further limits accessibility. Adopting advanced stent technologies remains limited in regions with constrained healthcare budgets or inadequate reimbursement frameworks. Such financial barriers restrict market expansion, especially in underserved populations, despite the growing burden of cardiovascular diseases globally.

- Stringent Regulatory Requirements Governing Device Approval

The vascular stent market faces growth challenges due to stringent regulatory frameworks governing device approval and quality standards. Stents must undergo rigorous preclinical and clinical testing to ensure safety and efficacy, prolonging the market for new products.

The lengthy and costly processes can deter smaller companies from entering the market, limiting competition and innovation. Regulatory inconsistencies across regions create additional hurdles for manufacturers aiming to commercialize their products globally. Such challenges slow the introduction of advanced stent technologies and increase costs, which are often passed on to consumers, further restricting market growth.

Vascular Stent Market Trends and Opportunities

- Advancement of Bioresorbable Vascular Scaffold Stents

Vascular stents present a significant growth opportunity in developing bioresorbable vascular scaffold (BRS) stents. Unlike permanent metallic stents, bio-resorbable scaffolds (BRSs) provide temporary mechanical support to the vascular wall before gradually disintegrating.

BRSs minimizes the risk of adverse reactions and decreasing the presence of foreign materials over time. The increasing prevalence of bioresorbable materials is anticipated to enhance market expansion. Ongoing innovations in medical devices are anticipated to enhance the safety and efficacy of vascular stents in the forthcoming years.

As research progresses, newer bio-absorbable stents with improved designs and materials are entering the market, offering greater efficacy and safety. With growing patient and physician preference for less invasive and temporary solutions, bio-absorbable stents have the potential to become a significant market segment, particularly as regulatory approvals increase and production costs decrease.

- Integration of Artificial Intelligence (AI) and Robotics

The integration of AI and robotics in interventional cardiology is revolutionizing stent procedures, providing a transformative opportunity for the vascular stent market. AI-powered imaging and diagnostic tools enhance the precision of stent placement, reducing complications and improving patient outcomes.

Robotic-assisted procedures allow for great accuracy and consistency, even in complex cases, while minimizing radiation exposure for clinicians. These technological advancements also improve procedural efficiency, making stenting more accessible and attractive to healthcare providers. As the adoption of AI and robotics grows, they will play a critical role in driving demand for high-performance stents designed for advanced techniques.

How Does Regulatory Scenario Shape the Industry?

The regulatory scenario plays a critical role in shaping the vascular stent market by ensuring device safety, efficacy, and quality. Stringent regulatory frameworks are in place to evaluate stents through rigorous preclinical and clinical trials, focusing on material durability, biocompatibility, and risk of complications like restenosis or thrombosis.

Regulatory harmonization across regions remains an ongoing effort, which, if achieved, could reduce approval delays and foster notable adoption of innovative technologies. The regulatory environment is steering the market toward high quality and safety benchmarks, stimulating technological advancements while moderating market entry for new players.

Segments Covered in the Report

- Drug-Eluting Stents (DES) Take the Lead with Their Superior Performance in Reducing Restenosis

Drug-eluting stents (DES) are the dominant type, accounting for around 55% of the total market share as of 2025. These specialized devices treat narrowed or blocked arteries. DES are coated with medication that is gradually released to prevent the recurrence of arterial blockages, known as restenosis, which significantly reduces the need for repeat procedures compared to bare-metal stents.

The medication released by DES inhibits cell proliferation, minimizing the risk of the artery becoming narrow again. DES further helps improve patient outcomes by maintaining arterial openness and enhancing blood flow, leading to better overall patient health post-procedure.

Continuous improvements have led to the development of newer DES with enhanced efficacy and safety profiles. The preference for DES over other types, such as bare-metal stents and bio-absorbable stents, is largely due to their superior performance in reducing restenosis and improving long-term patient outcomes.

- Metal Stents Remain the Dominant Material Type

Metal stents are small, expandable mesh tubes made from metals such as stainless steel, cobalt-chromium alloys, or nickel-titanium (Nitinol). They are inserted into narrowed or blocked blood vessels to restore and maintain proper blood flow. Inherent strength of metals and flexibility make these stents effective in providing immediate structural support to the vessel walls.

Metal stents offer robust mechanical support, ensuring the vessel remains open over time. The adaptable nature of metals allows these stents to conform to various vessel anatomies, enhancing their applicability across different vascular conditions.

Recent advancements in metal alloys have improved their compatibility with body tissues, reducing the risk of adverse reactions, which is one of the prime reasons for their dominance over other materials. Cost-effectiveness is a key factor in the dominance of metallic stents. Compared to some new materials, metallic stents are generally affordable, contributing to their widespread use, especially in regions with limited healthcare budgets.

Regional Analysis

- North America’s Dominance Prevails in the Vascular Stent Market

North America dominates the market, with the United States contributing the largest share. The regional growth is driven by a high prevalence of cardiovascular diseases (CVDs), which remain a leading cause of mortality in the region.

The presence of advanced healthcare systems ensures rapid adoption of innovative stent technologies, including drug-eluting stents and bio-absorbable stents. Substantial investments in research and development, coupled with favourable reimbursement policies, enhance market growth.

The region also benefits from a strong network of key players and clinical research organizations, accelerating the approval and commercialization of new stent products.

- Europe to be the Second Largest Contributor with Rapid Adoption of Advanced Medical Devices

Europe holds the second largest share of the vascular stents market, driven by increasing awareness of vascular diseases and widespread adoption of advanced medical devices. Countries like Germany, the UK, and France lead the market, supported by robust healthcare systems and a growing emphasis on minimally invasive procedures. Europe market is also characterized by strong government support for healthcare innovation and rising healthcare expenditure.

Aging population and lifestyle changes lead to higher incidences of CVDs have significantly boosted demand for vascular stents. Regulatory frameworks like CE marking ensure the availability of safe and effective stent technologies across the region.

Fairfield’s Competitive Landscape Analysis

The vascular stent market is highly competitive, with key players focusing on innovation and strategic collaborations to maintain market dominance. Leading companies include Boston Scientific Corporation, Medtronic PLC, and Abbott Laboratories, recognized for their extensive product portfolios and advanced technologies.

Emerging players and regional firms, particularly in Asia Pacific, are intensifying competition with cost-effective solutions. Strategic mergers, acquisitions, and partnerships are common, aiming to expand market reach and technological capabilities.

Significant research and development investments drive the development of next-generation stents with improved safety and efficacy profiles. Regulatory approvals and robust distribution networks further solidify the competitive positioning of major players in this dynamic market.

Key Market Companies

- Medtronic

- Abbott

- Cardiovascular Systems, Inc.

- Boston Scientific Corporation

- AngioDynamics

- Edwards Lifesciences Corporation

- Biosensors International Group, Ltd.

- L. Gore & Associates, Inc.

- Merit Medical Systems

Recent Industry Developments

- In May 2024, Abbott Laboratories introduced the XIENCE Sierra Everolimus Drug-eluting Coronary Stent System in India. XIENCE Sierra is a state-of-the-art stent within the XIENCE family, intended for patients with occluded coronary arteries.

- In January 2023, BioMatrix™ Alpha presented the best-in-class stent platform design with a unique pro-healing coating from the pioneer in abluminal biodegradable technology.

An Expert’s Eye

- Innovations like drug-eluting stents (DES), bioabsorbable stents, and AI assisted procedures are transforming the market.

- Rapid healthcare infrastructure development and rising cardiovascular disease prevalence in Asia Pacific and Latin America offer significant growth opportunities for stent manufacturers.

- The demand for minimally invasive procedures and stents with enhanced biocompatibility is shaping product innovation and adoption trends.

- Experts emphasize the need for cost-effective solutions to improve accessibility, especially in underdeveloped and emerging regions.

Global Vascular Stent Market is Segmented as-

By Type

- Drug-Eluting Stents

- Bare-Metal Stents

- Bio absorbable Stents

By Material

- Metal

- Polymeric

- Combination

By End User

- Hospitals

- Ambulatory Surgery Centers (ASCs)

- Specialty Clinics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Vascular Stent Market Snapsshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Economic Overview

2.7. PESTLE Analysis

3. Price Analysis, 2025

3.1. Global Average Price Analysis, by Type, US$ Per Unit, 2025

3.2. Prominent Factor Affecting Vascular Stent Market Prices

3.3. Global Average Price Analysis, by Region, US$ Per Unit

4. Global Vascular Stent Market Outlook, 2019 - 2032

4.1. Global Vascular Stent Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Drug-Eluting Stents

4.1.1.2. Bare-Metal Stents

4.1.1.3. Bio absorbable Stents

4.1.1.4. Others

4.2. Global Vascular Stent Market Outlook, by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Metal

4.2.1.2. Polymeric

4.2.1.3. Combination

4.3. Global Vascular Stent Market Outlook, by End User, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Ambulatory Surgery Centers (ASCs)

4.3.1.3. Specialty Clinics

4.4. Global Vascular Stent Market Outlook, by Region, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Latin America

4.4.1.5. Middle East & Africa

5. North America Vascular Stent Market Outlook, 2019 - 2032

5.1. North America Vascular Stent Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Drug-Eluting Stents

5.1.1.2. Bare-Metal Stents

5.1.1.3. Bio absorbable Stents

5.1.1.4. Others

5.2. North America Vascular Stent Market Outlook, by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Metal

5.2.1.2. Polymeric

5.2.1.3. Combination

5.3. North America Vascular Stent Market Outlook, by End User, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Ambulatory Surgery Centers (ASCs)

5.3.1.3. Specialty Clinics

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. North America Vascular Stent Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. U.S. Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.2. U.S. Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

5.4.1.3. U.S. Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

5.4.1.4. Canada Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.5. Canada Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

5.4.1.6. Canada Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Vascular Stent Market Outlook, 2019 - 2032

6.1. Europe Vascular Stent Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Drug-Eluting Stents

6.1.1.2. Bare-Metal Stents

6.1.1.3. Bio absorbable Stents

6.1.1.4. Others

6.2. Europe Vascular Stent Market Outlook, by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Metal

6.2.1.2. Polymeric

6.2.1.3. Combination

6.3. Europe Vascular Stent Market Outlook, by End User, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Ambulatory Surgery Centers (ASCs)

6.3.1.3. Specialty Clinics

6.3.2. Attractiveness Analysis

6.4. Europe Vascular Stent Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Germany Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.2. Germany Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

6.4.1.3. Germany Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

6.4.1.4. U.K. Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.5. U.K. Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

6.4.1.6. U.K. Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

6.4.1.7. France Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.8. France Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

6.4.1.9. France Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

6.4.1.10. Italy Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.11. Italy Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

6.4.1.12. Italy Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

6.4.1.13. Turkey Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.14. Turkey Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

6.4.1.15. Turkey Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

6.4.1.16. Russia Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.17. Russia Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

6.4.1.18. Russia Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

6.4.1.19. Rest of Europe Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.20. Rest of Europe Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

6.4.1.21. Rest of Europe Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Vascular Stent Market Outlook, 2019 - 2032

7.1. Asia Pacific Vascular Stent Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Drug-Eluting Stents

7.1.1.2. Bare-Metal Stents

7.1.1.3. Bio absorbable Stents

7.1.1.4. Others

7.2. Asia Pacific Vascular Stent Market Outlook, by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Metal

7.2.1.2. Polymeric

7.2.1.3. Combination

7.3. Asia Pacific Vascular Stent Market Outlook, by End User, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Ambulatory Surgery Centers (ASCs)

7.3.1.3. Specialty Clinics

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Asia Pacific Vascular Stent Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. China Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.2. China Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

7.4.1.3. China Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

7.4.1.4. Japan Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.5. Japan Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

7.4.1.6. Japan Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

7.4.1.7. South Korea Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.8. South Korea Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

7.4.1.9. South Korea Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

7.4.1.10. India Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.11. India Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

7.4.1.12. India Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

7.4.1.13. Southeast Asia Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.14. Southeast Asia Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

7.4.1.15. Southeast Asia Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

7.4.1.16. Rest of Asia Pacific Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.17. Rest of Asia Pacific Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

7.4.1.18. Rest of Asia Pacific Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Vascular Stent Market Outlook, 2019 - 2032

8.1. Latin America Vascular Stent Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Drug-Eluting Stents

8.1.1.2. Bare-Metal Stents

8.1.1.3. Bio absorbable Stents

8.1.1.4. Others

8.2. Latin America Vascular Stent Market Outlook, by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Metal

8.2.1.2. Polymeric

8.2.1.3. Combination

8.3. Latin America Vascular Stent Market Outlook, by End User, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Ambulatory Surgery Centers (ASCs)

8.3.1.3. Specialty Clinics

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Latin America Vascular Stent Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Brazil Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.2. Brazil Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

8.4.1.3. Brazil Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

8.4.1.4. Mexico Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.5. Mexico Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

8.4.1.6. Mexico Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

8.4.1.7. Argentina Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.8. Argentina Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

8.4.1.9. Argentina Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

8.4.1.10. Rest of Latin America Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.11. Rest of Latin America Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

8.4.1.12. Rest of Latin America Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Vascular Stent Market Outlook, 2019 - 2032

9.1. Middle East & Africa Vascular Stent Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.1.1. Key Highlights

9.1.1.1. Drug-Eluting Stents

9.1.1.2. Bare-Metal Stents

9.1.1.3. Bio absorbable Stents

9.1.1.4. Others

9.2. Middle East & Africa Vascular Stent Market Outlook, by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.2.1. Key Highlights

9.2.1.1. Metal

9.2.1.2. Polymeric

9.2.1.3. Combination

9.3. Middle East & Africa Vascular Stent Market Outlook, by End User, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.3.1. Key Highlights

9.3.1.1. Hospitals

9.3.1.2. Ambulatory Surgery Centers (ASCs)

9.3.1.3. Specialty Clinics

9.3.2. BPS Analysis/Market Attractiveness Analysis

9.4. Middle East & Africa Vascular Stent Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.4.1. Key Highlights

9.4.1.1. GCC Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.4.1.2. GCC Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

9.4.1.3. GCC Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

9.4.1.4. South Africa Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.4.1.5. South Africa Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

9.4.1.6. South Africa Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

9.4.1.7. Egypt Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.4.1.8. Egypt Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

9.4.1.9. Egypt Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

9.4.1.10. Nigeria Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.4.1.11. Nigeria Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

9.4.1.12. Nigeria Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

9.4.1.13. Rest of Middle East & Africa Vascular Stent Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.4.1.14. Rest of Middle East & Africa Vascular Stent Market by Material, Value (US$ Bn), 2019 - 2032

9.4.1.15. Rest of the Middle East & Africa Vascular Stent Market by End User, Value (US$ Bn), 2019 - 2032

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Company Market Share Analysis, 2025

10.2. Competitive Dashboard

10.3. Company Profiles

10.3.1. Medtronic

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. Abbott

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. Cardiovascular Systems, Inc.

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. Boston Scientific Corporation

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. AngioDynamics

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Edwards Lifesciences Corporation

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. Biosensors International Group, Ltd.

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. W. L. Gore & Associates, Inc.

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. Merit Medical Systems.

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. Others

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Material Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |