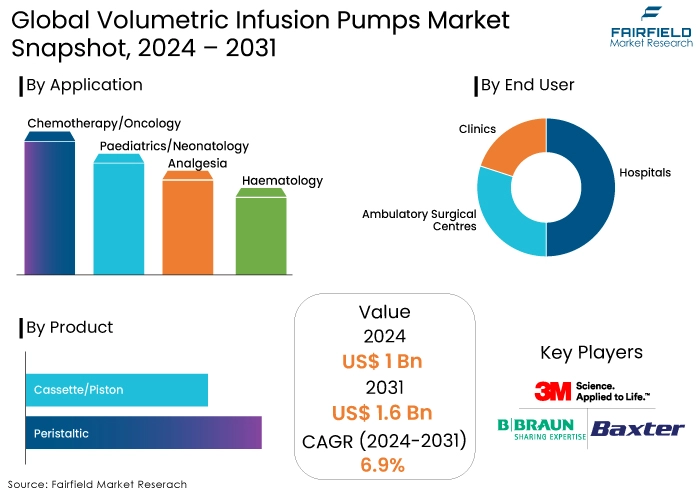

Global Volumetric Infusion Pumps Market Forecast

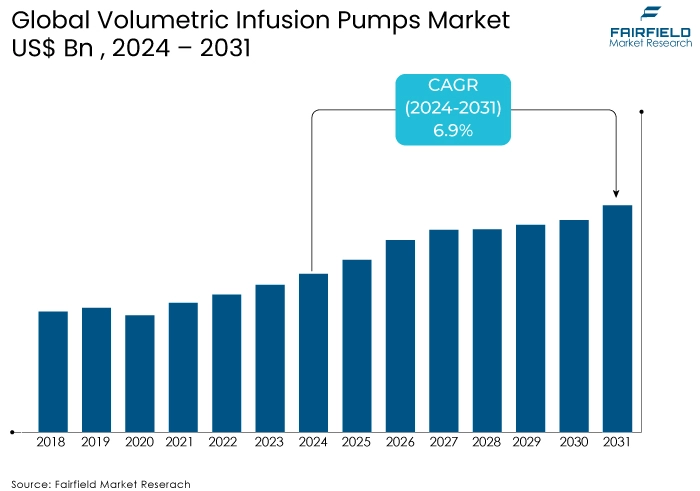

- Volumetric infusion pumps market size expected to reach US$1.6 Bn by 2031, showing significant growth from nearly US$1 Bn estimated in 2024

- Global volumetric infusion pumps market revenue slated for a healthy CAGR of 6.9% from 2024 to 2031

Volumetric Infusion Pumps Market Insights

- Patient safety remains the industry’s primary focus, driven by stringent regulations and technological advancements in error prevention.

- Volumetric infusion pumps are crucial for precise medication administration, especially in critical care settings.

- While initial costs are higher, the long-term benefits in terms of reduced medication errors and improved patient outcomes can offset expenses.

- The demand for portable infusion pumps is increasing to enable patient mobility and home healthcare.

- Integration with electronic health records (EHR) is aiding in enhanced data management, and reduced medication errors.

- The market witnesses drug library integration, providing real-time drug information and dosage limits.

- Remote monitoring has been creating considerable demand, enabling real-time tracking of infusion parameters for improved patient care.

- Customized/tailored infusion solutions for different patient populations and therapeutic needs are trending the volumetric infusion pumps market.

- Ensuring uninterrupted supply of infusion pumps and consumables remains among the key areas of focus for manufacturers.

- Growing focus on sustainable practices in manufacturing and disposal of infusion pumps marks a vital trend in this market.

A Look Back and a Look Forward - Comparative Analysis

The volumetric infusion pumps market is projected to experience significant growth in the coming years, with a CAGR of 6.90%. According to PMR's industry assessment, the market is expected to reach a billion-dollar valuation in 2024 and predicted to further expand to US$1600 Mn by 2031. Prior to 2023, the market expansion witnessed steady growth due to advancements in medical technology and an increasing number of patients requiring infusion therapy. The market was primarily driven by factors such as the rising prevalence of chronic diseases, an aging population, and the need for accurate and controlled drug delivery.

Following 2024, the market revenue is expected to experience a significant boost. This can be attributed to several factors. There is an increasing awareness among healthcare professionals regarding the benefits in terms of precision and patient safety. As a result, the demand for these devices is expected to rise. Additionally, technological advancements, such as the integration of smart features in infusion pumps, are further driving the market growth.

Key Growth Determinants

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases, such as cancer, diabetes, and cardiovascular disorders, is a major driver for sales. These conditions often require long-term medication or therapy, and volumetric infusion pumps provide an accurate and controlled delivery method.

Advancements in Infusion Pump Technology

The emergence of innovative volumetric pumps, along with advancements in infusion pump technology, is driving the volumetric infusion pumps market growth. Manufacturers are introducing features such as wireless connectivity, smart capabilities, and improved user interfaces, enhancing the functionality and usability of these devices.

Growing Demand for Home Healthcare

The trend towards individualized and patient-centered treatment, coupled with the increasing significance of home healthcare, is driving the demand for portable and user-friendly infusion pumps. Volumetric infusion pumps that can be used in home settings enable patients to receive necessary therapy while maintaining their daily activities.

Key Growth Barriers

Higher Cost of Infusion Pumps

One of the key restraints for the volumetric infusion pumps market the higher cost associated with these devices. Volumetric infusion pumps are technologically advanced and require precision engineering, which contributes to their higher price compared to other types of infusion pumps. The cost factor can limit the adoption of volumetric infusion pumps, especially in regions with limited healthcare budgets or in healthcare systems that prioritize cost-effectiveness. The higher cost can pose a challenge for healthcare facilities and patients, potentially restraining the volumetric infusion pumps market expansion.

Potential Safety Concerns

As per the report, another growth restraint for the market is the associated safety issues. While pumps are designed to deliver accurate and controlled amounts of fluids, there have been instances of device malfunctions or errors in drug delivery. These safety concerns can impact the confidence of healthcare professionals and patients in using these devices.

Regulatory bodies have implemented stringent regulations to address these issues, but the potential risks associated with infusion pumps can still be a barrier to market growth. The volumetric infusion pumps market companies need to continuously focus on improving the safety features and reliability to overcome these concerns and drive market expansion.

Volumetric Infusion Pumps Market Trends and Opportunities

Increasing Adoption of Smart Infusion Pumps

One of the notable volumetric infusion pumps market trends is the increasing adoption of smart infusion pumps. Smart infusion pumps are technologically advanced devices that incorporate features such as connectivity, data integration, and advanced safety mechanisms. These pumps are designed to enhance medication administration accuracy, improve patient safety, and streamline workflow for healthcare professionals. Smart infusion pumps offer various benefits over traditional infusion pumps. They can be integrated with electronic health records (EHR) systems, allowing for seamless transfer of patient data and medication orders. This integration reduces the risk of medication errors and enhances medication management efficiency.

Furthermore, smart infusion pumps often include built-in safety features, such as dose error reduction systems (DERS), and drug library databases. These features help prevent medication errors by providing alerts and dosage limits based on pre-programmed guidelines. The pumps can also capture real-time data, such as infusion rates and volumes, which can be used for monitoring and analysis.

According to the market forecast, increasing adoption of smart infusion pumps is driven by the growing emphasis on patient safety, the need for accurate medication administration, and the integration of healthcare technologies. As healthcare facilities strive to improve patient outcomes and reduce medication errors, the demand for smart infusion pumps is expected to continue to rise.

Growing Demand for Home Infusion Therapy

An opportunity for the volumetric infusion pumps market lies in the growing demand for home infusion therapy. Home infusion therapy involves the administration of medications or fluids to patients in their own homes rather than in a hospital or clinical setting. It offers several advantages, including increased patient comfort, reduced healthcare costs, and improved quality of life.

Volumetric infusion pumps play a crucial role in home infusion therapy, as they enable accurate and controlled delivery of medications or fluids. These pumps allow patients to receive necessary treatments, such as chemotherapy, parenteral nutrition, or pain management, in the comfort of their own homes.

As per the market update, the demand for home infusion therapy is driven by factors such as the aging population, the increasing prevalence of chronic diseases, and the desire for patient-centered care. Additionally, advancements in infusion pump technology, such as the development of portable and user-friendly devices, have made home infusion therapy more accessible and convenient.

Industry assessment states that as the demand for home infusion therapy continues to grow, there will be significant market opportunities for industry growth. Manufacturers can focus on developing innovative and user-friendly pumps specifically designed for home use. At the same time, healthcare providers can explore partnerships and services to support the delivery of home infusion therapy.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario plays a crucial role in shaping the demand. Regulatory bodies, such as the FDA (Food and Drug Administration), have established guidelines and standards to ensure the safety and effectiveness of these devices. Compliance with these regulations is essential for manufacturers to obtain regulatory approvals and market their products. Regulatory requirements primarily focus on various aspects, including product quality, safety, and performance. The volumetric infusion pumps market manufacturers must adhere to rigorous testing, validation, and quality control processes to meet these requirements. This ensures that the infusion pumps meet the necessary standards for accurate drug delivery and patient safety.

The impact of the regulatory scenario on the volumetric infusion pumps market is twofold. It ensures that only high-quality and safe devices are available in the market, which enhances patient confidence and promotes market growth. Regulatory approvals provide a competitive advantage to manufacturers who meet the necessary standards as they demonstrate their commitment to quality and compliance. As per the market analysis, regulatory bodies continuously monitor and update regulations to keep pace with technological advancements and address emerging safety concerns. This ongoing oversight helps to maintain the integrity of the market and ensures that patients receive safe and effective treatment.

Segments Covered in Volumetric Infusion Pumps Market Report

Ambulatory Pumps Reflect the Most Significant Growth Potential

Volumetric infusion pumps emerged as the leading segment in the intravenous infusion pump market, capturing a substantial market share of 16.8% in 2022. These pumps are preferred for their ability to deliver precise amounts of fluids at various rates, making them versatile for different patient needs.

Additionally, ambulatory infusion pumps, used in emergencies and chronic conditions, contributed significantly to the volumetric infusion pumps market shares. The availability of other pump types, like patient-controlled analgesia, insulin, and smart pumps, further drives growth. The increasing demand for enteral and syringe pumps also fuels the preference for intravenous infusion pumps, leading to segment expansion.

Advanced Treatment Alternatives, and Growing Birth Rates Account for Highest Prospects in Pediatrics/Neonatology

The pediatrics/neonatology segment emerged as the dominant force in the market, holding the largest volumetric infusion pumps market shares of 26.5% in 2022. This can be attributed to significant advancements in pediatric treatment and the increasing global birth rates, resulting in a growing demand for effective pediatric care. Intravenous infusion pumps play a crucial role in this segment, as they enable the delivery of fluids at precise programmed rates, catering to the specific medical procedures required for pediatric patients. This highlights the segment's reliance on intravenous infusion pumps for optimal care.

Regional Analysis

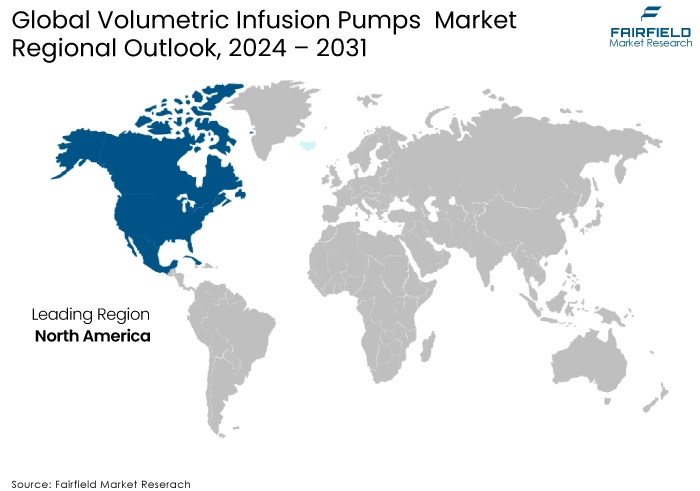

North America Leads with Higher Chronic Disease Prevalence, and Advanced Technology Adoption

As per the market overview, North America emerged as the dominant force in the intravenous infusion pump market, capturing a significant market share of 49.6% in 2022. This trend is expected to continue throughout the forecast period. The region's leadership is attributed to factors such as the increasing incidence of chronic diseases, a rising number of surgical procedures, well-developed research and development (R&D), and the escalating adoption of advanced technology in infusion pumps.

As per Fairfield's volumetric infusion pumps market report, the United States, in particular, holds the largest market share in North America, driven by high disease prevalence, robust healthcare infrastructure, and substantial medical R&D expenditure. The prevalence of diabetes in the US further contributes to the market growth. With a growing number of births globally, the demand for effective pediatric care has surged, leading to the dominance of the pediatrics/neonatology segment in the market.

Asia Pacific Gears up with Growing Burden of Chronic Diseases, and Thriving Medical Tourism

The global volumetric infusion pumps market overview projects that the Asia Pacific market is anticipated to experience a substantial CAGR of 8.8% during the forecast period. The region's population density, coupled with a high prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer, drives the demand for intravenous infusion pumps.

Moreover, industry trends show that Asian countries, including China, Japan, and India, are emerging economies with well-established healthcare infrastructure and facilities, making them attractive destinations for medical tourism due to their cost-effective treatments and surgeries. Factors like government reforms, technology adoption, and affordability contribute to the growth of the intravenous infusion industry in the region.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of this market is characterized by the presence of several key players who offer a range of products and strategies to cater to the growing demand for accurate and controlled drug delivery. The market is highly competitive, with companies focusing on innovation, strategic partnerships, and product launches to gain a competitive edge. These volumetric infusion pumps market players have a strong market presence and offer a wide range of pumps to meet the diverse needs of healthcare facilities and patients.

Key Market Companies

- 3M

- Braun Melsungen AG

- Baxter

- Becton Dickinson and Company

- Fresenius Kabi AG

- ICU Medical Inc

- Smiths Medical

- Terumo Medical Corporation

- Avanos Medical, Inc.

- Medtronic plc

- Hospira (a subsidiary of Pfizer Inc.)

- Roche Diagnostics

Recent Industry Developments

- In April 2024, Baxter received FDA clearance for its Novum IQ infusion pump, ending a three-year back-and-forth with the agency. The clearance follows three years of talks, which led to a $100 million sales loss in 2022 due to a delay in authorization. Baxter will update 2024 guidance in its first-quarter earnings call and expects Novum IQ to contribute to future growth. Evercore ISI analysts believe the $100 million annual sales assumption no longer applies, but Evercore and Stifel analysts called the clearance positive for Baxter.

- In December 2023, Fresenius Kabi signed a multi-year purchase agreement with Mayo Clinic for 10,000 Ivenix pumps for hospitals in Minnesota, Arizona, and Florida. The deal marks the largest contract for Ivenix pumps signed by the company to date. The Ivenix pump technology, which features a smartphone-like touchscreen and patented pumping mechanism, will also interface with hospital information systems and electronic medical records. Fresenius Kabi MedTech's president, Dr. Christian Hauer, said the company aims to scale advanced technologies and essential medicines to benefit more patients.

An Expert’s Eye

- Robust growth prospects have been projected for the volumetric infusion pumps market. The aging population, increasing incidence of chronic diseases, and rising demand for home healthcare are key drivers.

- Advancements in pump technology, including smart features and wireless connectivity, are expected to further boost market expansion.

- Challenges such as regulatory hurdles and high costs might temper growth rates in certain regions.

- The market is poised for significant growth due to the critical role of these pumps in modern healthcare delivery.

Global Volumetric Infusion Pumps Market is Segmented as-

By Product Outlook

- Volumetric Infusion Pumps

- Insulin Infusion Pumps

- Syringe Infusion Pumps

- Enteral Infusion Pumps

- Ambulatory Infusion Pumps

- Patient Controlled Analgesia (PCA)

- Implantable Infusion Pumps

- Others

By Disease Indication

- Chemotherapy

- Diabetes

- Gastroenterology

- Analgesia/Pain Management

- Pediatrics/Neonatology

- Hematology

- Others

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

1. Executive Summary

1.1. Global Volumetric Infusion Pumps Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019 - 2024

3.1. Global Volumetric Infusion Pumps Market Production Output, by Region, Value (US$ Bn) and Volume (Million Units), 2019 - 2024

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East and Africa

4. Price Analysis, 2019 - 2024

4.1. Global Average Price Analysis, by Product/ Material, US$ Per Unit, 2019 - 2024

4.2. Prominent Factor Affecting Volumetric Infusion Pumps Prices

4.3. Global Average Price Analysis, by Region, US$ Per Unit

5. Global Volumetric Infusion Pumps Market Outlook, 2019 - 2031

5.1. Global Volumetric Infusion Pumps Market Outlook, by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Peristaltic

5.1.1.2. Cassette/ Piston

5.2. Global Volumetric Infusion Pumps Market Outlook, by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Chemotherapy/ Oncology

5.2.1.2. Paediatrics/Neonatology

5.2.1.3. Analgesia

5.2.1.4. Hematology

5.3. Global Volumetric Infusion Pumps Market Outlook, by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Ambulatory Surgical Centers

5.3.1.3. Clinics

5.3.1.4. Others

5.4. Global Volumetric Infusion Pumps Market Outlook, by Region, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America Volumetric Infusion Pumps Market Outlook, 2019 - 2031

6.1. North America Volumetric Infusion Pumps Market Outlook, by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Peristaltic

6.1.1.2. Cassette/ Piston

6.2. North America Volumetric Infusion Pumps Market Outlook, by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Chemotherapy/ Oncology

6.2.1.2. Paediatrics/Neonatology

6.2.1.3. Analgesia

6.2.1.4. Hematology

6.3. North America Volumetric Infusion Pumps Market Outlook, by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Ambulatory Surgical Centers

6.3.1.3. Clinics

6.3.1.4. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. North America Volumetric Infusion Pumps Market Outlook, by Country, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. U.S. Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

6.4.1.2. U.S. Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

6.4.1.3. U.S. Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

6.4.1.4. Canada Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

6.4.1.5. Canada Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

6.4.1.6. Canada Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Volumetric Infusion Pumps Market Outlook, 2019 - 2031

7.1. Europe Volumetric Infusion Pumps Market Outlook, by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Peristaltic

7.1.1.2. Cassette/ Piston

7.2. Europe Volumetric Infusion Pumps Market Outlook, by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Chemotherapy/ Oncology

7.2.1.2. Paediatrics/Neonatology

7.2.1.3. Analgesia

7.2.1.4. Hematology

7.3. Europe Volumetric Infusion Pumps Market Outlook, by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Ambulatory Surgical Centers

7.3.1.3. Clinics

7.3.1.4. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Europe Volumetric Infusion Pumps Market Outlook, by Country, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Germany Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.2. Germany Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.3. Germany Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.4. U.K. Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.5. U.K. Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.6. U.K. Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.7. France Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.8. France Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.9. France Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.10. Italy Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.11. Italy Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.12. Italy Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.13. Turkey Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.14. Turkey Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.15. Turkey Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.16. Russia Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.17. Russia Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.18. Russia Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.19. Rest of Europe Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.20. Rest of Europe Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.1.21. Rest of Europe Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Volumetric Infusion Pumps Market Outlook, 2019 - 2031

8.1. Asia Pacific Volumetric Infusion Pumps Market Outlook, by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Peristaltic

8.1.1.2. Cassette/ Piston

8.2. Asia Pacific Volumetric Infusion Pumps Market Outlook, by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Chemotherapy/ Oncology

8.2.1.2. Paediatrics/Neonatology

8.2.1.3. Analgesia

8.2.1.4. Hematology

8.3. Asia Pacific Volumetric Infusion Pumps Market Outlook, by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Ambulatory Surgical Centers

8.3.1.3. Clinics

8.3.1.4. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Asia Pacific Volumetric Infusion Pumps Market Outlook, by Country, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. China Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.2. China Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.3. China Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.4. Japan Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.5. Japan Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.6. Japan Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.7. South Korea Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.8. South Korea Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.9. South Korea Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.10. India Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.11. India Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.12. India Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.13. Southeast Asia Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.14. Southeast Asia Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.15. Southeast Asia Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.16. Rest of Asia Pacific Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.17. Rest of Asia Pacific Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.1.18. Rest of Asia Pacific Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Volumetric Infusion Pumps Market Outlook, 2019 - 2031

9.1. Latin America Volumetric Infusion Pumps Market Outlook, by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Peristaltic

9.1.1.2. Cassette/ Piston

9.2. Latin America Volumetric Infusion Pumps Market Outlook, by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Chemotherapy/ Oncology

9.2.1.2. Paediatrics/Neonatology

9.2.1.3. Analgesia

9.2.1.4. Hematology

9.3. Latin America Volumetric Infusion Pumps Market Outlook, by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Hospitals

9.3.1.2. Ambulatory Surgical Centers

9.3.1.3. Clinics

9.3.1.4. Others

9.3.2. BPS Analysis/Market Attractiveness Analysis

9.4. Latin America Volumetric Infusion Pumps Market Outlook, by Country, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. Brazil Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.4.1.2. Brazil Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.4.1.3. Brazil Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.4.1.4. Mexico Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.4.1.5. Mexico Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.4.1.6. Mexico Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.4.1.7. Argentina Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.4.1.8. Argentina Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.4.1.9. Argentina Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.4.1.10. Rest of Latin America Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.4.1.11. Rest of Latin America Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.4.1.12. Rest of Latin America Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Volumetric Infusion Pumps Market Outlook, 2019 - 2031

10.1. Middle East & Africa Volumetric Infusion Pumps Market Outlook, by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Peristaltic

10.1.1.2. Cassette/ Piston

10.2. Middle East & Africa Volumetric Infusion Pumps Market Outlook, by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Chemotherapy/ Oncology

10.2.1.2. Paediatrics/Neonatology

10.2.1.3. Analgesia

10.2.1.4. Hematology

10.3. Middle East & Africa Volumetric Infusion Pumps Market Outlook, by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. Hospitals

10.3.1.2. Ambulatory Surgical Centers

10.3.1.3. Clinics

10.3.1.4. Others

10.3.2. BPS Analysis/Market Attractiveness Analysis

10.4. Middle East & Africa Volumetric Infusion Pumps Market Outlook, by Country, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1. Key Highlights

10.4.1.1. GCC Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.2. GCC Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.3. GCC Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.4. South Africa Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.5. South Africa Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.6. South Africa Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.7. Egypt Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.8. Egypt Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.9. Egypt Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.10. Nigeria Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.11. Nigeria Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.12. Nigeria Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.13. Rest of Middle East & Africa Volumetric Infusion Pumps Market by Product, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.14. Rest of Middle East & Africa Volumetric Infusion Pumps Market by Application, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.1.15. Rest of Middle East & Africa Volumetric Infusion Pumps Market by End User, Value (US$ Bn) and Volume (Billion Units), 2019 - 2031

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. By End User vs by Application Heat map

11.2. Manufacturer vs by Application Heatmap

11.3. Company Market Share Analysis, 2024

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. B. Braun Melsungen AG

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Fresenius Kabi AG

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Terumo Corporation

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. ICU Medical, Inc.

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Becton, Dickinson and Company

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Smiths Medical

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Woodley Equipment Company Ltd.

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Mindray Medical International Ltd

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. ADOX S.A

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Sino-Hero (Shenzhen) Bio-Medical Electronics Co. Ltd

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Guangzhou Huaxi Medical Science Technology Co. Ltd.

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. ASCOR

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. Shenzhen Shenke Medical Instrument Technical Development Co. Ltd.

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. Daiwaha corp. ltd.

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

11.5.15. CONTEC MEDICAL SYSTEMS Co. Ltd

11.5.15.1. Company Overview

11.5.15.2. Product Portfolio

11.5.15.3. Financial Overview

11.5.15.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Outlook Coverage |

|

|

Disease Indication Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |