Global Water Pump Market Forecast

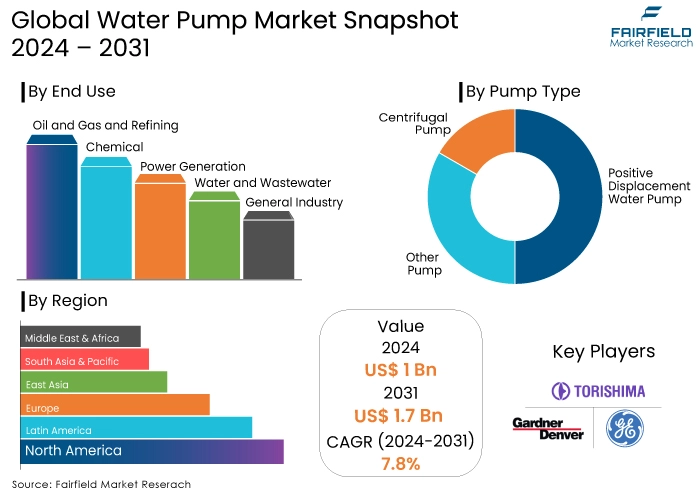

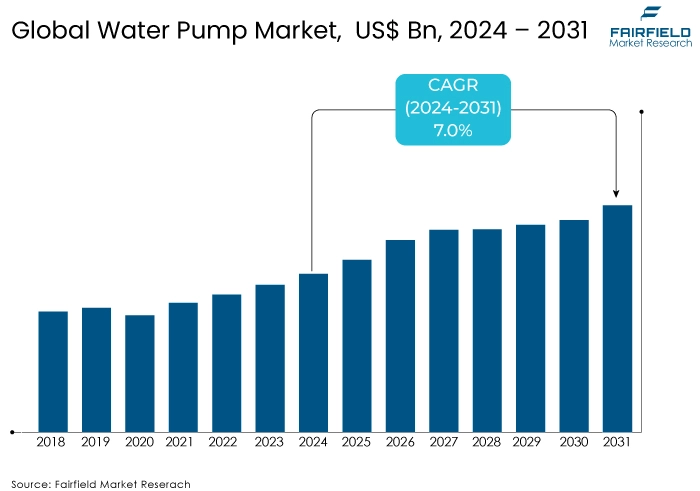

- The global water pump market size projected to reach US$1.7 Bn in 2031, up from US$1 Bn estimated in the year 2024

- Water pump market revenue poised to witness a CAGR of 7.8% during 2024-2031

Water Pump Market Insights

- Centrifugal pumps, characterized by their versatility, efficiency, and suitability for handling large liquid volumes at relatively low pressures, dominate the global water pump market due to their simple design and robust construction.

- The water and wastewater treatment industry stands as the primary consumer sector for water pumps, driven by the critical role of pumps in water supply, distribution, and treatment processes amidst growing urbanization and stringent regulations.

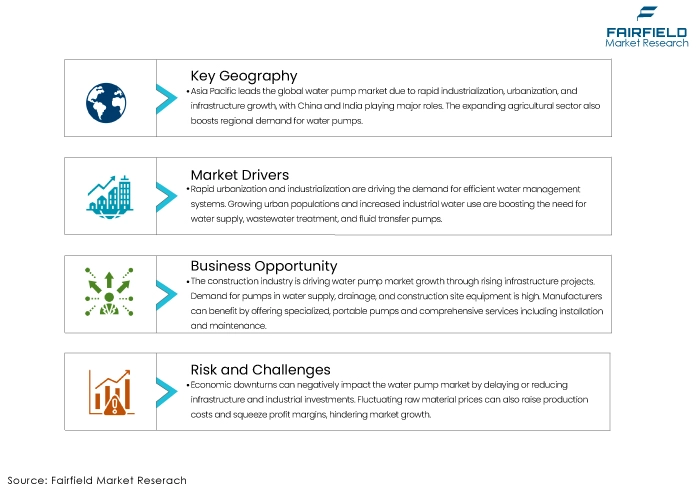

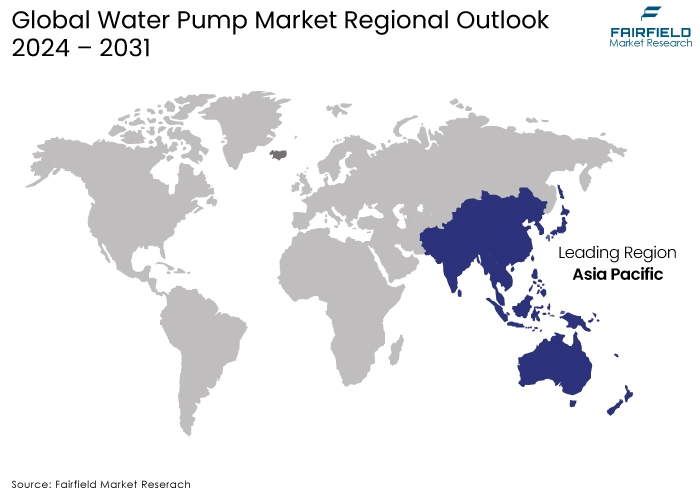

- Asia Pacific, experiencing rapid industrialization, urbanization, and robust infrastructure development, leads the market, with countries like China and India contributing significantly to growth.

- While North America and Europe represent mature markets, they continue to exhibit steady growth driven by the replacement of older pump systems with energy-efficient models and a focus on sustainability.

- Increasing urbanization and industrialization, necessitating expanded water supply and wastewater treatment infrastructure, serve as primary growth determinants for the market.

- The growing global population and the consequent demand for food production, coupled with the need for efficient irrigation systems, position agriculture as a significant growth driver for the market.

- Government initiatives and investments in water infrastructure projects, aimed at ensuring water security and improving water quality, create substantial opportunities for water pump manufacturers.

- Economic downturns, leading to reduced investments in infrastructure and industrial projects, coupled with fluctuating commodity prices affecting production costs, pose significant challenges to the water pump market.

- Rising energy costs and increasing environmental concerns necessitate energy-efficient pumps, presenting opportunities for manufacturers but also requiring substantial investments in research and development to meet stringent regulations.

- The construction industry's growth, driven by booming infrastructure projects, presents opportunities for specialized pump offerings, while customization demands and the rise of smart, energy-efficient pumps shape the market's future trajectory.

A Look Back and a Look Forward - Comparative Analysis

The water pump market experienced steady growth primarily driven by urbanization, industrialization, and agricultural expansion. The increasing demand for water resources and efficient water management systems propelled market expansion. However, growth was somewhat constrained by factors such as economic fluctuations, energy costs, and environmental concerns.

The water pump market is anticipated to witness accelerated growth due to several factors. The global focus on sustainability and climate change is driving the demand for energy-efficient and eco-friendly pumps. Advancements in technology, such as IoT integration and smart pumps, are expected to revolutionize the industry.

Additionally, growing investments in infrastructure development, particularly in emerging economies, will create significant opportunities for pump manufacturers. While challenges like supply chain disruptions and material costs persist, the overall market outlook is positive.

How is Regulatory Scenario Shaping this Industry?

The water pump industry is significantly influenced by a complex regulatory landscape. Environmental regulations, energy efficiency standards, and safety guidelines are key factors shaping the market. Governments worldwide are imposing stringent norms to protect water resources, reduce energy consumption, and ensure product safety. These regulations have compelled manufacturers to invest in research and development to produce environmentally friendly and energy-efficient pumps.

Key regulatory bodies influencing the water pump market include:

- Environmental Protection Agencies (EPAs): These agencies set standards for water quality, wastewater treatment, and pollution control, impacting pump design and materials.

- Energy Regulatory Commissions: These bodies establish energy efficiency standards for pumps, encouraging manufacturers to develop products with lower energy consumption.

- Occupational Safety and Health Administration (OSHA): This agency enforces safety regulations for pump manufacturing and operation, ensuring worker protection.

- Standards Organizations: Bodies like ANSI, ISO, and IEC develop technical standards for pumps, promoting product compatibility and quality.

Compliance with these regulations can be challenging but also presents opportunities for innovative product development and market differentiation.

Major Growth Determinants

Increasing Urbanization, and Industrialization

Rapid urbanization across the globe is driving the demand for efficient water management systems. The growing population in urban areas necessitates the expansion of water supply and wastewater treatment infrastructure, which significantly boosts the demand in water pump market. Additionally, industrialization is leading to increased water consumption in various sectors such as manufacturing, power generation, and oil and gas. These industries rely heavily on pumps for fluid transfer and process operations.

Growing Emphasis on Agriculture and Irrigation

The global population is on the rise, leading to increased demand for food production. Agriculture is a major consumer of water, and efficient irrigation systems are crucial for maximizing crop yields. This has resulted in a surge in demand for water pumps, particularly in regions with water scarcity. Moreover, advancements in agricultural practices and the adoption of precision agriculture are driving the need for specialized pumps.

Government Initiatives, and Investments in Water Infrastructure

Governments worldwide are investing heavily in water infrastructure projects to ensure water security and improve water quality. This includes initiatives to expand water supply networks, build new wastewater treatment plants, and implement water conservation measures. These projects create significant opportunities for water pump manufacturers as they require a wide range of pumping solutions.

Major Growth Barriers

Economic Downturns, and Fluctuating Commodity Prices

Economic downturns can adversely impact the water pump market as investments in infrastructure and industrial projects are often delayed or reduced. Moreover, fluctuations in commodity prices, particularly for raw materials used in pump manufacturing, can affect production costs and profitability. These factors can hinder market growth and put pressure on manufacturers' margins.

Energy Costs, and Environmental Concerns

Rising energy costs and growing environmental concerns are putting pressure on the water pump industry. Energy-efficient pumps are becoming increasingly important to reduce operational expenses and minimize environmental impact. While this presents an opportunity for manufacturers to develop and market energy-saving products, it also requires significant investments in research and development. Additionally, stringent environmental regulations can increase production costs and limit the use of certain materials.

Water Pump Market Trends and Opportunities

Construction Industry’s Growth

The construction industry is a significant growth driver for the water pump market. Booming infrastructure projects globally are creating substantial demand for pumps in applications such as water supply, drainage, and construction site equipment. Manufacturers can capitalize on this by offering specialized pumps tailored to construction site requirements, such as portable and durable models. Additionally, there's an opportunity to provide comprehensive pumping solutions, including installation, maintenance, and repair services.

Boom Around Customization

Customization is another key trend shaping the water pump market. As end-users seek tailored solutions for specific applications, manufacturers can differentiate themselves by offering flexible product configurations and rapid customization options. This requires agile production processes and a deep understanding of customer needs. Moreover, there's potential to develop modular pump systems that can be easily customized to suit various applications.

The Rise of Smart and Energy-Efficient Pumps

A prominent trend reshaping the water pump market is the increasing adoption of smart and energy-efficient technologies. Driven by the twin imperatives of sustainability and cost reduction, manufacturers are developing pumps equipped with advanced sensors, controllers, and connectivity features. These smart pumps can optimize performance, monitor system health, and provide real-time data for predictive maintenance.

Furthermore, the escalating cost of energy has spurred the demand for pumps that consume less power while delivering high efficiency. Manufacturers are focusing on improving pump hydraulics, reducing friction losses, and incorporating variable speed drives to enhance energy efficiency. This trend is not only beneficial for reducing operational costs but also aligns with global efforts to mitigate climate change.

Segments Covered in Water Pump Market Report

Centrifugal Pumps Remain the Dominant Pump Type

Centrifugal pumps undeniably hold the lion's share of the global water pump market. Their dominance is attributed to their versatility, efficiency, and suitability for a wide range of applications. These pumps excel in handling large volumes of liquids with relatively low pressures. Their simple design and robust construction contribute to their popularity across various industries.

The increasing emphasis on energy efficiency has further solidified the position of centrifugal pumps. Advancements in impeller design and material science have led to the development of energy-saving models, making them a preferred choice for cost-conscious end-users. As the global focus on sustainability intensifies, the demand for efficient centrifugal pumps is expected to grow significantly.

Water & Wastewater Industry to be the Prime Consumer Sector

The water and wastewater treatment industry emerges as the most prominent end-use segment for water pumps. The critical role of pumps in water supply, distribution, and treatment processes is undeniable. The growing global population, coupled with increasing urbanization, has placed immense pressure on water resources, driving the demand for efficient and reliable pumping solutions.

Moreover, the stringent regulations governing wastewater treatment and the rising awareness about water pollution have necessitated the adoption of advanced pump technologies. These pumps are employed in various stages of wastewater treatment, including pumping raw sewage, sludge handling, and clean water distribution. The industry's continuous focus on improving water quality and resource management is expected to fuel demand in the water pump market in the foreseeable future.

Regional Analysis

Asia Pacific Continues to be at the Forefront

Asia Pacific undeniably leads the global water pump market, capturing the largest market share. This dominance is primarily attributed to the region's rapid industrialization, urbanization, and robust infrastructure development. Countries like China, and India, with their burgeoning populations and expanding economies, are major contributors to this growth. The agricultural sector, a significant water consumer, also drives demand for pumps in the region.

Moreover, government initiatives focused on water conservation and wastewater management are propelling the market forward. The increasing need for efficient water management solutions due to water scarcity in certain areas is further stimulating demand for advanced pump technologies.

Additionally, the region's growing middle class is driving the adoption of water pumps for residential applications, contributing to market expansion. While Asia Pacific currently reigns supreme, the water pump market is witnessing a multi-polar growth trajectory. Factors such as urbanization, industrialization, agricultural needs, and government policies will continue to shape the regional dynamics of this market.

Steady Growth Prevails in North America, and Europe

While Asia Pacific dominates, other regions also exhibit significant growth potential in the water pump market. North America, and Europe, although mature markets, are witnessing steady growth driven by the replacement of old pump systems with energy-efficient models. The focus on sustainability and environmental regulations in these regions is encouraging the adoption of advanced pump technologies. The Middle East and Africa, characterized by their vast geographical expanse and growing industrialization, are emerging as promising markets. The region's reliance on desalination and irrigation systems is creating substantial demand for water pumps.

Key Market Companies

- Gardner Denver

- Torishima Pump Mfg. Co.

- General Electric Company

- Weir Group PLC

- Weatherford International Inc

- ITT Inc.

- PROCON Products

- KSB Group

- Kirloskar Brothers Limited

- Sulzer Ltd.

- Atlas Copco

- Baker Hughes Incorporated

- Busch LLC

- ClydeUnion Pumps

- Ebara Corporation

- Flowserve Corporation

- Halliburton Company

- ULVAC Technologies

- Jyoti Ltd

- Shakti Pumps India Ltd

- CNP Pumps India Pvt Ltd

- CRI Pumps Pvt Ltd

Recent Industry Developments

- In April 2024, ABB launched its new ACQ80 solar pump VSD, designed for sustainable water pumping with solar power. The ACQ80 VSD can operate with both solar panels (DC supply) and the grid or generator (AC supply) for 24/7 water pumping. It also offers built-in features to optimize the process and minimize human intervention. The ACQ80 is labelled a Solar Impulse Efficient Solution for its efficiency and reliability, and it's compatible with submersible and surface type pumps.

- In February 2024, KSB announced the expansion of its water pump range that covers the new RDLO pump series, which are axially split volute casing pumps used in pumping stations around the world for clean water transport. The pumps have a long service life and are low vibration. They are also capable of transporting seawater.

Global Water Pump Market is Segmented as-

By Pump Type

- Centrifugal Pump

- Positive Displacement Water Pump

- Other Pump

By End Use

- Oil and Gas and Refining

- Chemical

- Power Generation

- Water and Wastewater

- General Industry

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

1. Executive Summary

1.1. Global Water Pump Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019-2024

3.1. Global Water Pump, Production Output, by Region, 2019 - 2024

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East & Africa

4. Price Trend Analysis, 2019-2024

4.1. Key Highlights

4.2. Global Average Price Analysis, by Pump Type/ End Use, US$ per Unit

4.3. Prominent Factors Affecting Water Pump Prices

4.4. Global Average Price Analysis, by Region, US$ per Unit

5. Global Water Pump Market Outlook, 2019 - 2031

5.1. Global Water Pump Market Outlook, by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Centrifugal Pump

5.1.1.2. Positive Displacement Water Pump

5.1.1.3. Misc Pump

5.2. Global Water Pump Market Outlook, by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Oil and Gas and Refining

5.2.1.2. Chemical

5.2.1.3. Power Generation

5.2.1.4. Water and Wastewater

5.2.1.5. General Industry

5.3. Global Water Pump Market Outlook, by Region, Value (US$ Bn) & Volume (Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Water Pump Market Outlook, 2019 - 2031

6.1. North America Water Pump Market Outlook, by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Centrifugal Pump

6.1.1.2. Positive Displacement Water Pump

6.1.1.3. Misc Pump

6.2. North America Water Pump Market Outlook, by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Oil and Gas and Refining

6.2.1.2. Chemical

6.2.1.3. Power Generation

6.2.1.4. Water and Wastewater

6.2.1.5. General Industry

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. North America Water Pump Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. U.S. Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.1.2. U.S. Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.1.3. Canada Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.1.4. Canada Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Water Pump Market Outlook, 2019 - 2031

7.1. Europe Water Pump Market Outlook, by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Centrifugal Pump

7.1.1.2. Positive Displacement Water Pump

7.1.1.3. Misc Pump

7.2. Europe Water Pump Market Outlook, by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Oil and Gas and Refining

7.2.1.2. Chemical

7.2.1.3. Power Generation

7.2.1.4. Water and Wastewater

7.2.1.5. General Industry

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Europe Water Pump Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Germany Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.2. Germany Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.3. U.K. Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.4. U.K. Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.5. France Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.6. France Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.7. Italy Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.8. Italy Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.9. Turkey Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.10. Turkey Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.11. Russia Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.12. Russia Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.13. Rest of Europe Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.14. Rest of Europe Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Water Pump Market Outlook, 2019 - 2031

8.1. Asia Pacific Water Pump Market Outlook, by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Centrifugal Pump

8.1.1.2. Positive Displacement Water Pump

8.1.1.3. Misc Pump

8.2. Asia Pacific Water Pump Market Outlook, by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Oil and Gas and Refining

8.2.1.2. Chemical

8.2.1.3. Power Generation

8.2.1.4. Water and Wastewater

8.2.1.5. General Industry

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Asia Pacific Water Pump Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. China Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.2. China Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.3. Japan Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.4. Japan Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.5. South Korea Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.6. South Korea Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.7. India Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.8. India Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.9. Southeast Asia Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.10. Southeast Asia Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.11. Rest of Asia Pacific Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.12. Rest of Asia Pacific Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Water Pump Market Outlook, 2019 - 2031

9.1. Latin America Water Pump Market Outlook, by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Centrifugal Pump

9.1.1.2. Positive Displacement Water Pump

9.1.1.3. Misc Pump

9.2. Latin America Water Pump Market Outlook, by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Oil and Gas and Refining

9.2.1.2. Chemical

9.2.1.3. Power Generation

9.2.1.4. Water and Wastewater

9.2.1.5. General Industry

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Latin America Water Pump Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Brazil Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.2. Brazil Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.3. Mexico Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.4. Mexico Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.5. Argentina Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.6. Argentina Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.7. Rest of Latin America Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.8. Rest of Latin America Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Water Pump Market Outlook, 2019 - 2031

10.1. Middle East & Africa Water Pump Market Outlook, by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Centrifugal Pump

10.1.1.2. Positive Displacement Water Pump

10.1.1.3. Misc Pump

10.2. Middle East & Africa Water Pump Market Outlook, by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Oil and Gas and Refining

10.2.1.2. Chemical

10.2.1.3. Power Generation

10.2.1.4. Water and Wastewater

10.2.1.5. General Industry

10.2.2. BPS Analysis/Market Attractiveness Analysis

10.3. Middle East & Africa Water Pump Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. GCC Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.2. GCC Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.3. South Africa Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.4. South Africa Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.5. Egypt Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.6. Egypt Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.7. Nigeria Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.8. Nigeria Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.9. Rest of Middle East & Africa Water Pump Market by Pump Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.10. Rest of Middle East & Africa Water Pump Market by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Pump Type vs End Use Heatmap

11.2. Manufacturer vs End Use Heatmap

11.3. Company Market Share Analysis, 2024

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. CRI Pumps Pvt Ltd.

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Gardner Denver

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Torishima Pump Mfg. Co.

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. General Electric Company

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Weir Group PLC

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Weatherford International Inc

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. ITT Inc.

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. PROCON Products

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. KSB Group

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Kirloskar Brothers Limited

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Sulzer Ltd.

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. Atlas Copco

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. Baker Hughes Incorporated

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. Busch LLC

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

11.5.15. Clyde Union Pumps

11.5.15.1. Company Overview

11.5.15.2. Product Portfolio

11.5.15.3. Financial Overview

11.5.15.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Pump Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |