Global Wire and Cable Materials Market Forecast

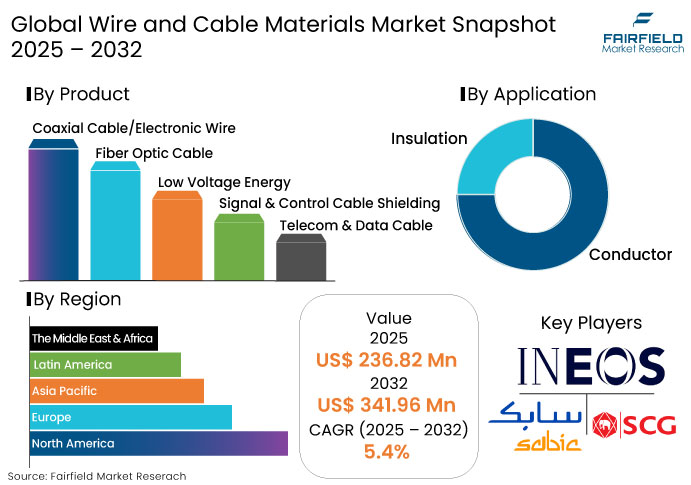

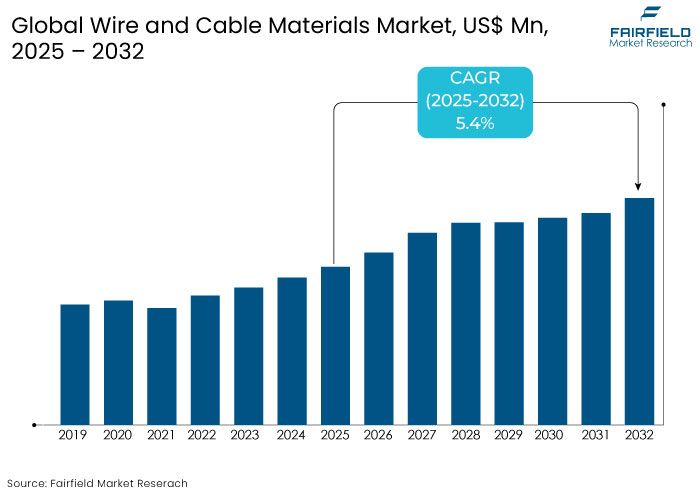

- The wire and cable materials market is projected to reach US$ 341.96 Mn by 2032 from US$ 236.82 Mn predicted in 2025.

- The market for wire and cable materials is likely to showcase a significant CAGR of 5.4% from 2025 to 2032.

Wire and Cable Materials Market Insights

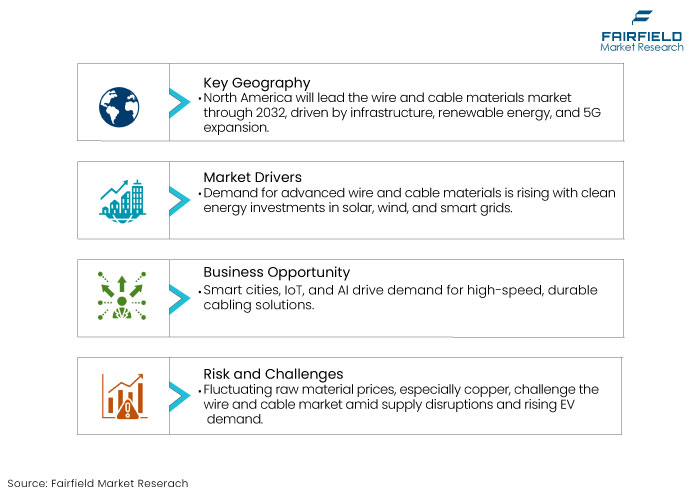

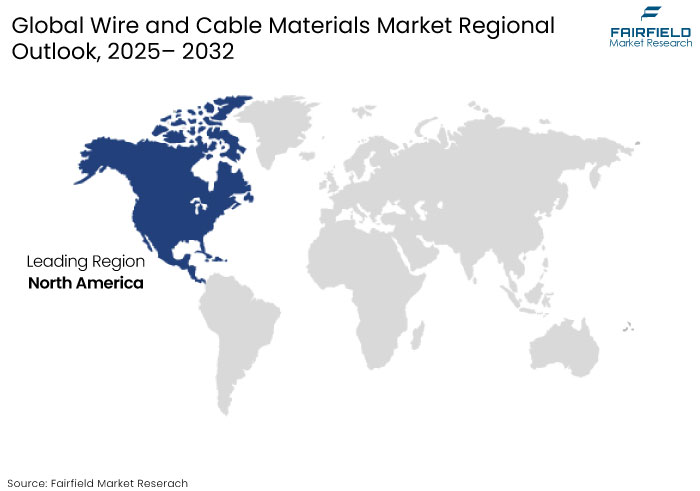

- North America is the dominant region in the wire and cable materials market, driven by robust renewable energy investments.

- Global shift toward clean energy solutions like solar and wind is bolstering demand for novel cable materials for energy distribution.

- Increasing adoption of smart grids for energy efficiency fuels the need for high-performance wires, especially fiber optic and low-voltage cables.

- With the rising Electric Vehicle (EV) market, demand for high-voltage cables and specialized wiring materials for EV charging infrastructure is increasing.

- IoT devices and smart city initiatives are creating a rising demand for high-speed, low-latency, and durable cabling solutions.

- Offshore wind farms and solar power plants are significantly increasing the demand for High-Voltage Direct Current (HVDC) cables.

- Need for high-performance, lightweight wiring solutions is skyrocketing in aviation and defense applications.

- Increased automation in industries is augmenting demand for flexible and high-temperature-resistant cables.

Key Growth Determinants

- Rising Demand for Renewable Energy and Smart Grid Expansion

Demand for high-performance wire and cable materials is soaring as the world shifts toward clean energy solutions. Governments and private sectors invest heavily in solar farms, wind power projects, and smart grid infrastructure, all of which require novel cabling systems for efficient energy distribution.

Smart grids, which enhance energy efficiency and reliability, rely on fiber optic cables and low-voltage power cables for real-time monitoring and seamless transmission. Offshore wind farms require High-Voltage Direct Current (HVDC) cables with durable insulation to withstand harsh marine environments. This transition is particularly evident in North America and Europe, where renewable energy adoption is accelerating.

In 2023, the world added a record 473 gigawatts (GW) of renewable energy capacity, marking a 13.9% increase from the previous year. This surge brought the total renewable energy capacity to approximately 3,865 GW, with solar and wind power accounting for a substantial portion of this growth.

- Surging Electrification in Automotive Industry

The Electric Vehicle (EV) revolution is transforming the wire and cable materials industry, with automakers pushing for lightweight, high-efficiency wiring solutions. EVs require innovative insulated cables, high-voltage connectors, and thermally stable conductors to support battery performance and energy transfer.

Governments worldwide offer incentives to accelerate EV adoption, leading to a surge in production and charging infrastructure. Fast-charging stations, on-board battery management systems, and in-vehicle electronics all demand specialized cable materials that can withstand high temperatures and electrical loads.

Rise of autonomous vehicles, connected cars, and Advanced Driver-Assistance Systems (ADAS) is increasing the need for high-speed signal cables and data transmission wiring. As EV technology advances, manufacturers focus on lightweight, durable, high-conductivity materials to enhance vehicle efficiency.

Key Growth Barriers

- Volatility in Raw Material Prices and Supply Chain Disruptions

One of the main challenges facing the wire and cable materials market is the fluctuating prices of raw materials, particularly copper, aluminum, and polymers used for insulation. Copper, a key conductor material, has seen price spikes due to global supply chain disruptions, geopolitical tensions, and increased demand from industries like renewable energy and EVs.

Supply chain bottlenecks caused by shipping delays, labor shortages, and trade restrictions have made it harder for manufacturers to source high-quality materials at stable costs. Several companies are now looking for alternative materials or recycled metals, but these substitutes often come with performance trade-offs.

Wire and Cable Materials Market Trends and Opportunities

- Increasing Smart City Projects and IoT Integration

The rise of smart cities, connected homes, and industrial automation creates a massive opportunity in the wire and cable materials market. With increasing adoption of Internet of Things (IoT) devices, Artificial Intelligence (AI), and automation, demand for high-speed, durable, and low-latency cabling solutions are surging.

Smart infrastructure projects, including intelligent traffic systems, energy-efficient buildings, and digital healthcare, require fiber optic cables, novel signal and control cables, and high-performance insulated conductors to enable real-time communication and data transmission. IoT-powered industrial automation is driving the need for heat-resistant and flexible wiring solutions that can support robotics and smart manufacturing processes.

- Developments in Electric Vehicle Charging Infrastructure

With the EV revolution gaining momentum, one of the most transformative opportunities in the wire and cable materials market is the expansion of EV charging networks. As governments and private investors push for widespread fast-charging stations, demand for high-voltage power cables, insulated conductors, and heat-resistant wiring materials is skyrocketing.

EVs require specialized wiring systems for battery management, on-board chargers, and Vehicle-to-Grid (V2G) connectivity, all of which need unique cable materials to ensure efficiency and safety. The rollout of ultra-fast charging stations (350 kW and above) is pushing the industry to develop high-performance insulation and durable conductor materials that can withstand extreme electrical loads.

As of 2023, there are nearly 4 million public EV charging points worldwide. This number is projected to exceed 15 million by 2030, representing a fourfold increase.

Segment Covered in the Report

- Conductors Gain Impetus Amid Superior Durability and Malleability

In the wire and cable materials market, copper stands out as the dominant conductor material, cherished for its exceptional electrical conductivity, malleability, and durability. Copper is the preferred choice for various applications, from residential wiring to intricate electronic devices. While aluminum offers a lighter and more cost-effective alternative, copper's superior performance ensures its continued prominence in the industry.

Polyvinyl Chloride (PVC) leads the market on the insulation front, accounting for approximately 46% of the share as of 2025. Its popularity stems from its excellent insulation properties, flexibility, and resistance to environmental factors, making it ideal for safeguarding wires and cables across various sectors.

- Low Voltage Energy Cables are Preferred for Smart Meter Installations

Based on cable type, low voltage energy cables dominate the wire and cable materials market, holding around 45% of the total share in 2025. These cables are considered the backbone of modern electrical infrastructure, powering homes, businesses, and smart technologies worldwide.

One key factor driving dominance is the global expansion of smart meter installations. These cables ensure seamless energy distribution, allowing for real-time monitoring and efficient power management. Rise of LED lighting systems in homes and commercial spaces has fueled demand, as these cables provide the necessary power while supporting energy-efficient solutions.

Regional Analysis

- North America Sees High Demand Amid 5G and Solar Power Grid Innovations

North America is projected to dominate the wire and cable materials market through 2032, driven by large-scale investments in infrastructure, renewable energy, and 5G technology. One of the key factors propelling North America’s market is its transition toward renewable energy sources.

With increasing deployment of offshore wind farms and solar power grids, demand for high-performance cables has surged. Companies like Prysmian Group and Southwire are investing heavily in high-voltage connectors and durable insulation materials to support the expansion of clean energy projects.

Another key contributor is the 5G rollout and extension of smart grid networks. The U.S. and Canada are seeing significant upgrades in telecommunications and energy distribution systems, increasing the demand for fiber optic cables, low voltage energy cables, and novel conductor materials like copper and aluminum.

- Asia Pacific to Witness Steady Growth with Launch of High-speed Rail Networks

Asia Pacific is likely to be the fastest-growing region in the wire and cable materials market. Rapid urbanization and industrialization, particularly in China and India are the primary growth drivers in the region. The region’s massive infrastructure development projects, including smart cities, high-speed rail networks, and energy distribution grids, have significantly increased the demand for low-voltage energy cables, telecom cables, and fiber optics.

China, in particular, dominates the Electric Vehicle (EV) market, with a 4.4% year-on-year increase in passenger car sales, reaching 20.15 million units in 2022. This growth is primarily fueled by the rise of New Energy Vehicles (NEVs), which require high-quality insulated wiring and lightweight conductive materials to enhance efficiency.

The telecommunications sector in Asia Pacific is booming, with countries like Japan, South Korea, and India investing heavily in 5G networks and data centers. Demand for fiber optic cables in these markets is skyrocketing, pushing manufacturers to develop high-speed, durable, and cost-effective solutions.

Fairfield’s Competitive Landscape Analysis

The wire and cable materials market is highly competitive, with key players continuously innovating to meet the rising demand for efficient, durable wiring solutions. Industry leaders such as Prysmian Group, Nexans, Southwire, and Sumitomo Electric dominate the space, leveraging novel materials like high-performance polymers and eco-friendly insulation.

Mid-sized companies and new entrants are transforming the market with cost-effective and sustainable alternatives. They are focusing on lightweight, fire-resistant, and recyclable materials. Regional manufacturers also play a key role, catering to localized needs and regulatory requirements.

With rising energy, telecom, and automotive demand, companies are investing in research and development as well as strategic partnerships to stay ahead of their competitors. Sustainability and regulatory compliance are key differentiators in this evolving market.

Key Market Companies

- SABIC

- INEOS

- SCG

- BASF SE

- Avient Corporation

- Arkema S.A.

- Solvay S.A.

- Borealis AG

- 3M

- LyondellBasell Industries N.V.

- Repsol S.A.

- The Dow Chemical Company

- International Wire

- Elcowire

- CHAL Aluminum Corporation

Recent Industry Developments

- In June 2024, Nexans signed an acquisition deal to buy La Triveneta Cavi, an Europe-based manufacturer of medium and low-voltage cables to broaden its clientele and augment its business range in the continent.

- In April 2024, Finolex Cables launched a collection of environmentally friendly wires under the FinoGreen brand. This launch is anticipated to constitute around 5% of the company's wire operations.

Global Wire and Cable Materials Market is Segmented as-

By Material

- Insulation

- Polyvinyl Chloride

- Polyethylene

- Cross Linked Polyethylene (XLPE)

- Polypropylene (PP)

- Thermoplastic Elastomers (TPE)

- Polyamides

- Fluoropolymers

- Conductor

- Aluminum

- Copper

By Cable Type

- Coaxial Cable/Electronic Wire

- Fiber Optic Cable

- Low Voltage Energy

- Signal & Control Cable

- Telecom & Data Cable

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Wire and Cable Materials Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Wire and Cable Materials Market Outlook, 2019 - 2032

3.1. Global Wire and Cable Materials Market Outlook, by Material, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Insulation

3.1.1.1.1. Polyvinyl Chloride

3.1.1.1.2. Polyethylene

3.1.1.1.3. Cross Linked Polyethylene (XLPE)

3.1.1.1.4. Polypropylene (PP)

3.1.1.1.5. Thermoplastic Elastomers (TPE)

3.1.1.1.6. Polyamides

3.1.1.1.7. Fluoropolymers

3.1.1.2. Conductor

3.1.1.2.1. Aluminum

3.1.1.2.2. Copper

3.2. Global Wire and Cable Materials Market Outlook, by Cable Type, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Coaxial Cable/Electronic Wire

3.2.1.2. Fiber Optic Cable

3.2.1.3. Low Voltage Energy

3.2.1.4. Signal & Control Cable

3.2.1.5. Telecom & Data Cable

3.3. Global Wire and Cable Materials Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Wire and Cable Materials Market Outlook, 2019 - 2032

4.1. North America Wire and Cable Materials Market Outlook, by Material, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Insulation

4.1.1.1.1. Polyvinyl Chloride

4.1.1.1.2. Polyethylene

4.1.1.1.3. Cross Linked Polyethylene (XLPE)

4.1.1.1.4. Polypropylene (PP)

4.1.1.1.5. Thermoplastic Elastomers (TPE)

4.1.1.1.6. Polyamides

4.1.1.1.7. Fluoropolymers

4.1.1.2. Conductor

4.1.1.2.1. Aluminum

4.1.1.2.2. Copper

4.2. North America Wire and Cable Materials Market Outlook, by Cable Type, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Coaxial Cable/Electronic Wire

4.2.1.2. Fiber Optic Cable

4.2.1.3. Low Voltage Energy

4.2.1.4. Signal & Control Cable

4.2.1.5. Telecom & Data Cable

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Wire and Cable Materials Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. U.S. Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

4.3.1.2. U.S. Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

4.3.1.3. U.S. Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

4.3.1.4. Canada Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

4.3.1.5. Canada Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

4.3.1.6. Canada Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Wire and Cable Materials Market Outlook, 2019 - 2032

5.1. Europe Wire and Cable Materials Market Outlook, by Material, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Insulation

5.1.1.1.1. Polyvinyl Chloride

5.1.1.1.2. Polyethylene

5.1.1.1.3. Cross Linked Polyethylene (XLPE)

5.1.1.1.4. Polypropylene (PP)

5.1.1.1.5. Thermoplastic Elastomers (TPE)

5.1.1.1.6. Polyamides

5.1.1.1.7. Fluoropolymers

5.1.1.2. Conductor

5.1.1.2.1. Aluminum

5.1.1.2.2. Copper

5.2. Europe Wire and Cable Materials Market Outlook, by Cable Type, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Coaxial Cable/Electronic Wire

5.2.1.2. Fiber Optic Cable

5.2.1.3. Low Voltage Energy

5.2.1.4. Signal & Control Cable

5.2.1.5. Telecom & Data Cable

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Wire and Cable Materials Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Germany Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.2. Germany Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

5.3.1.3. Germany Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.4. U.K. Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.5. U.K. Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

5.3.1.6. U.K. Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.7. France Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.8. France Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

5.3.1.9. France Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.10. Italy Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.11. Italy Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

5.3.1.12. Italy Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.13. Turkey Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.14. Turkey Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

5.3.1.15. Turkey Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.16. Russia Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.17. Russia Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

5.3.1.18. Russia Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.19. Rest of Europe Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.20. Rest of Europe Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

5.3.1.21. Rest of Europe Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Wire and Cable Materials Market Outlook, 2019 - 2032

6.1. Asia Pacific Wire and Cable Materials Market Outlook, by Material, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Insulation

6.1.1.1.1. Polyvinyl Chloride

6.1.1.1.2. Polyethylene

6.1.1.1.3. Cross Linked Polyethylene (XLPE)

6.1.1.1.4. Polypropylene (PP)

6.1.1.1.5. Thermoplastic Elastomers (TPE)

6.1.1.1.6. Polyamides

6.1.1.1.7. Fluoropolymers

6.1.1.2. Conductor

6.1.1.2.1. Aluminum

6.1.1.2.2. Copper

6.2. Asia Pacific Wire and Cable Materials Market Outlook, by Cable Type, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Coaxial Cable/Electronic Wire

6.2.1.2. Fiber Optic Cable

6.2.1.3. Low Voltage Energy

6.2.1.4. Signal & Control Cable

6.2.1.5. Telecom & Data Cable

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Wire and Cable Materials Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. China Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

6.3.1.2. China Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

6.3.1.3. China Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.4. Japan Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

6.3.1.5. Japan Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

6.3.1.6. Japan Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.7. South Korea Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

6.3.1.8. South Korea Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

6.3.1.9. South Korea Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.10. India Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

6.3.1.11. India Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

6.3.1.12. India Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.13. Southeast Asia Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

6.3.1.14. Southeast Asia Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

6.3.1.15. Southeast Asia Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.16. Rest of Asia Pacific Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

6.3.1.17. Rest of Asia Pacific Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

6.3.1.18. Rest of Asia Pacific Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Wire and Cable Materials Market Outlook, 2019 - 2032

7.1. Latin America Wire and Cable Materials Market Outlook, by Material, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Insulation

7.1.1.1.1. Polyvinyl Chloride

7.1.1.1.2. Polyethylene

7.1.1.1.3. Cross Linked Polyethylene (XLPE)

7.1.1.1.4. Polypropylene (PP)

7.1.1.1.5. Thermoplastic Elastomers (TPE)

7.1.1.1.6. Polyamides

7.1.1.1.7. Fluoropolymers

7.1.1.2. Conductor

7.1.1.2.1. Aluminum

7.1.1.3. Copper

7.2. Latin America Wire and Cable Materials Market Outlook, by Cable Type, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Coaxial Cable/Electronic Wire

7.2.1.2. Fiber Optic Cable

7.2.1.3. Low Voltage Energy

7.2.1.4. Signal & Control Cable

7.2.1.5. Telecom & Data Cable

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Wire and Cable Materials Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Brazil Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

7.3.1.2. Brazil Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

7.3.1.3. Brazil Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

7.3.1.4. Mexico Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

7.3.1.5. Mexico Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

7.3.1.6. Mexico Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

7.3.1.7. Argentina Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

7.3.1.8. Argentina Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

7.3.1.9. Argentina Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

7.3.1.10. Rest of Latin America Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

7.3.1.11. Rest of Latin America Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

7.3.1.12. Rest of Latin America Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Wire and Cable Materials Market Outlook, 2019 - 2032

8.1. Middle East & Africa Wire and Cable Materials Market Outlook, by Material, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Insulation

8.1.1.1.1. Polyvinyl Chloride

8.1.1.1.2. Polyethylene

8.1.1.1.3. Cross Linked Polyethylene (XLPE)

8.1.1.1.4. Polypropylene (PP)

8.1.1.1.5. Thermoplastic Elastomers (TPE)

8.1.1.1.6. Polyamides

8.1.1.1.7. Fluoropolymers

8.1.1.2. Conductor

8.1.1.2.1. Aluminum

8.1.1.3. Copper

8.2. Middle East & Africa Wire and Cable Materials Market Outlook, by Cable Type, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Coaxial Cable/Electronic Wire

8.2.1.2. Fiber Optic Cable

8.2.1.3. Low Voltage Energy

8.2.1.4. Signal & Control Cable

8.2.1.5. Telecom & Data Cable

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Wire and Cable Materials Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. GCC Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

8.3.1.2. GCC Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

8.3.1.3. GCC Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

8.3.1.4. South Africa Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

8.3.1.5. South Africa Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

8.3.1.6. South Africa Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

8.3.1.7. Egypt Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

8.3.1.8. Egypt Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

8.3.1.9. Egypt Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

8.3.1.10. Nigeria Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

8.3.1.11. Nigeria Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

8.3.1.12. Nigeria Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

8.3.1.13. Rest of Middle East & Africa Wire and Cable Materials Market by Material, Value (US$ Bn), 2019 - 2032

8.3.1.14. Rest of Middle East & Africa Wire and Cable Materials Market by Cable Type, Value (US$ Bn), 2019 - 2032

8.3.1.15. Rest of Middle East & Africa Wire and Cable Materials Market by Application, Value (US$ Bn), 2019 - 2032

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Cable Type Heatmap

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. SABIC

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. INEOS

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. SCG

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. BASF SE

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Avient Corporation

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Arkema S.A.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Solvay S.A.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Borealis AG

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. 3M

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. LyondellBasell Industries N.V.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Repsol S.A.

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. The Dow Chemical Company

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. International Wire

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Elcowire

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. CHAL Aluminum Corporation

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Material Coverage |

|

|

Cable Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |