Global Wound Healing Ointment Market Forecast

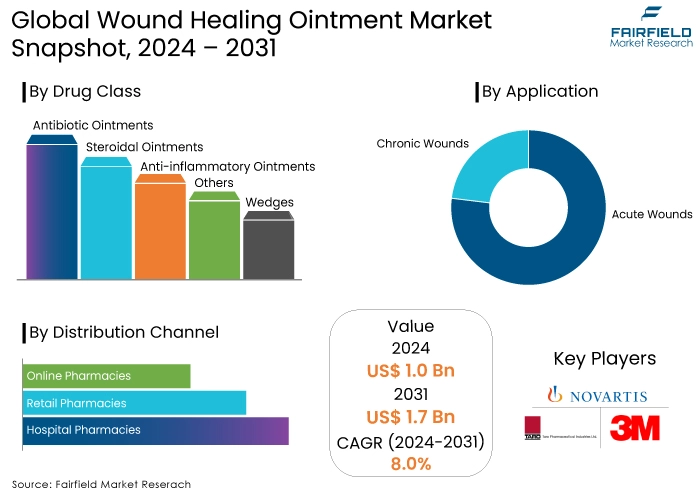

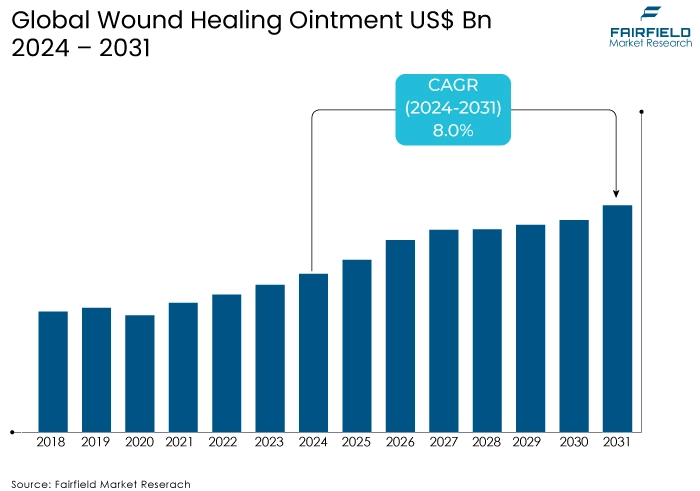

- The wound healing ointment market size worth around US$1.0 Bn in 2024 poised to reach US$1.7 Bn in 2031

- Wound healing ointment market revenue expansion projected at a CAGR of 8.0% over 2024-2031

Wound Healing Ointment Market Insights

- The wound healing ointment market is experiencing growth driven by an expanding aging population, the increasing prevalence of chronic diseases, and advancements in wound care technology.

- High product costs for advanced wound care ointments and a stringent regulatory environment pose significant challenges to market growth.

- A growing consumer preference for natural and organic products, coupled with the rise of telemedicine, presents new opportunities for the wound healing ointment market.

- Antibiotic ointments continue to dominate the market due to their versatility and effectiveness in treating a wide range of wounds.

- Ointments designed for acute wounds maintain a substantial market share due to the high incidence of accidental injuries and their suitability for treating these wounds.

- Retail pharmacies are the primary distribution channel for wound healing ointments, offering convenience and accessibility to consumers.

- North America is the leading regional market for wound healing ointments due to its aging population, advanced healthcare infrastructure, and high healthcare expenditure.

- Europe is a significant regional market for wound healing ointments, although market growth is tempered by stringent healthcare budgets and a preference for generic products.

- The wound healing ointment market is competitive, with established pharmaceutical companies and specialized wound care companies vying for market share.

- Ongoing innovation and adaptation to changing consumer preferences and technological advancements will be crucial for success in the wound healing ointment market.

A Look Back and a Look Forward - Comparative Analysis

The wound healing ointment market experienced steady growth, driven by increasing prevalence of chronic diseases, aging populations, and rising incidence of accidents and injuries. Advancements in wound care technology and a growing preference for home-based care also contributed to market expansion. However, factors such as generic competition, and price pressures limited growth to a certain extent.

The wound healing ointment market experienced steady growth in recent years, driven by surging chronic wound rates due to diabetes, obesity, and surgical procedures. This upward trend is projected to accelerate, with a remarkable CAGR. Factors such as the global burden of chronic diseases and the increasing elderly population will continue to fuel demand. While the COVID-19 pandemic temporarily disrupted elective surgeries, the subsequent backlog is expected to further stimulate market growth. Ongoing research and development efforts by manufacturers to introduce innovative products and expand distribution channels will also contribute to market expansion.

The market is anticipated to witness accelerated growth due to several factors. The COVID-19 pandemic highlighted the importance of wound care, leading to increased awareness and demand for effective wound healing products. Moreover, the rising geriatric population, coupled with the growing prevalence of diabetes and obesity, is expected to drive market expansion. Additionally, ongoing research and development in wound care technologies, such as advanced dressings and bioengineered skin substitutes, will create new growth opportunities.

How is Regulatory Scenario Shaping this Industry?

The regulatory landscape significantly influences the wound healing ointment market. Stringent regulations governing the development, manufacturing, and marketing of wound care products ensure product safety and efficacy. Obtaining necessary approvals and complying with quality standards can be time-consuming and expensive, impacting market entry for new players. However, well-established regulatory frameworks also create a level playing field and foster consumer trust.

Furthermore, regulatory bodies are increasingly focusing on promoting the use of cost-effective and evidence-based wound care products. This trend is driving the adoption of generic alternatives and biosimilars, while also encouraging manufacturers to invest in clinical research to demonstrate product efficacy. Additionally, evolving reimbursement policies for wound care treatments can impact market dynamics, as they influence product pricing and accessibility.

Key Growth Determinants

Expanding Aging Population

The global population is aging rapidly. This demographic shift is a significant driver for the wound healing ointment market. Older individuals are more susceptible to chronic conditions like diabetes, circulatory problems, and pressure ulcers, which often lead to non-healing wounds. The increasing geriatric population consequently drives demand for effective wound care solutions, including ointments.

Rising Prevalence of Chronic Diseases

The incidence of chronic diseases such as diabetes, obesity, and cardiovascular diseases is on the rise worldwide. These conditions often lead to complications like diabetic foot ulcers, pressure ulcers, and surgical wounds that require specialized wound care. The growing burden of chronic diseases is a key factor propelling the growth of the wound healing ointment market.

Advancements in Wound Care Technology

Continuous advancements in wound care technology are driving market growth. The development of innovative wound healing ointments with enhanced properties like antimicrobial, anti-inflammatory, and regenerative capabilities is expanding treatment options. Additionally, the integration of nanotechnology and biomaterials into wound care products is creating new opportunities for market expansion.

Key Growth Barriers

High Cost of Advanced Wound Care Products

While advancements in wound care technology have led to the development of highly effective ointments, they often come with a high price tag. This can limit accessibility for a significant portion of the population, especially in developing countries with lower healthcare spending. The high cost of these products can hinder market growth.

Stringent Regulatory Environment

The wound healing ointment market is subject to strict regulatory guidelines to ensure product safety and efficacy. Obtaining necessary approvals and complying with quality standards can be time-consuming and expensive for manufacturers. The stringent regulatory environment can pose challenges for market entry and product launch, thereby impacting overall market growth.

Wound Healing Ointments Market Trends and Opportunities

Increasing Focus on Natural and Organic Products

The global shift towards health and wellness has significantly influenced consumer preferences, with a pronounced inclination towards natural and organic products. This trend is particularly evident in the personal care and healthcare sectors. The wound healing ointment market is no exception. Consumers are increasingly seeking wound care solutions that align with their holistic approach to health, prioritizing products with natural ingredients and minimal synthetic additives.

This growing demand presents a substantial opportunity for manufacturers to develop and market natural-based wound healing ointments. By emphasizing the use of plant-derived extracts, essential oils, and other natural components, companies can differentiate their products and appeal to a wider consumer base. Moreover, highlighting the potential benefits of natural ingredients, such as antimicrobial and anti-inflammatory properties, can further enhance product appeal. However, ensuring the efficacy and safety of natural-based ointments through rigorous testing and clinical trials is crucial to building consumer trust and establishing a strong market position.

Telemedicine, and Remote Wound Care

The integration of telemedicine into healthcare delivery has accelerated in recent years, driven by technological advancements, increasing healthcare costs, and the desire for convenient access to care. This trend has far-reaching implications for the wound care industry, as it enables remote monitoring and management of wounds.

Telemedicine offers several opportunities for the wound healing ointment market. By providing patients with access to healthcare professionals through virtual consultations, manufacturers can offer guidance on product usage, monitor wound healing progress, and address any concerns. Additionally, telemedicine platforms can be utilized to educate patients about wound care best practices and the importance of consistent ointment application. Furthermore, integrating digital technologies into product packaging, such as QR codes linked to educational content or remote monitoring tools, can enhance the overall patient experience.

While telemedicine presents significant opportunities, addressing challenges such as data privacy, regulatory compliance, and ensuring reliable internet connectivity is essential for successful implementation. By overcoming these hurdles and capitalizing on the potential of telemedicine, manufacturers can position themselves as leaders in the evolving wound care landscape.

Category-wise Insights

Demand for Antibiotic Ointments Remains Maximum

Antibiotic ointments have long been a mainstay in wound care, and their dominance within the wound healing ointment market is evident. In 2023, they captured a substantial share and the trend will continue through the end of forecast period. Several factors contribute to the sustained demand for antibiotic ointments. Their broad spectrum of application makes them indispensable in treating a variety of wounds, from minor abrasions to surgical incisions.

The prophylactic use of antibiotic ointments to prevent infections, particularly in high-risk scenarios such as burns and post-operative care, has bolstered their market position. The ease of accessibility through both prescription and over-the-counter channels has made these ointments widely available to consumers. Finally, the consistent reliance on antibiotic ointments within standard first aid practices further solidifies their market dominance.

Ointments for Acute Wounds Expected to Remain High

Ointments designed for acute wounds have historically been the primary focus of the wound healing ointment market. In 2023, this segment commanded a share of more than 56%, a reflection of the prevalence of acute injuries. The market for acute wound ointments is anticipated to maintain a steady growth trajectory, expanding at a promising CAGR of 5.9% by the end of 2031.

The consistent demand for ointments in treating acute wounds can be attributed to several factors. The high incidence of accidental injuries, such as cuts, scrapes, and burns, necessitates the use of wound healing ointments. The predictable healing process of acute wounds often responds well to standard ointment treatments, making them a preferred choice for consumers. The availability of over-the-counter acute wound ointments has contributed to their widespread use. The relatively short duration of treatment for acute wounds compared to chronic wounds drives repeat purchases, sustaining market demand.

Highest Sales Contribution Comes from Retail Pharmacies

Retail pharmacies have emerged as the primary distribution channel for wound healing ointments, holding a remarkable share of over 42% of the global market size in 2023. The convenience and accessibility of retail pharmacies have been instrumental in driving sales. Consumers can easily purchase both prescription and over-the-counter wound healing ointments at these outlets.

Furthermore, retail pharmacies often have dedicated healthcare professionals available for product recommendations and advice, enhancing customer confidence in their purchases. The strategic placement of wound healing ointments in easily accessible locations within pharmacies further contributes to impulse buying and increased sales. As the retail pharmacy landscape continues to expand and evolve, it is expected to remain a dominant distribution channel for wound healing ointments in the foreseeable future.

Regional Analysis

North America Provides the Most Favourable Growth Environment

The North American market is characterized by a mature wound care industry with a strong focus on advanced wound care products. The region has witnessed significant growth due to factors such as an aging population, increasing prevalence of chronic diseases, and rising healthcare expenditure. Moreover, the presence of key market players, and robust healthcare infrastructure has contributed to market expansion.

North America, comprising the US, and Canada, undeniably remains the leading regional market for wound healing ointments. The region's dominance is attributed to several factors. The aging population, coupled with a high prevalence of chronic diseases like diabetes and obesity, has led to a surge in chronic wound cases. Advanced healthcare infrastructure and a robust pharmaceutical industry have facilitated the development and adoption of innovative wound care products. A strong focus on patient outcomes and a relatively high healthcare expenditure drive demand for effective wound healing solutions.

Europe Emerging as a Significant Market

On the other hand, the European wound healing ointment market is relatively mature, with a focus on cost-effective and generic products. The region has a well-developed healthcare system, which supports the adoption of advanced wound care technologies. However, stringent healthcare budgets and the preference for generic alternatives pose challenges for market growth.

Europe has emerged as the second-largest regional market for wound healing ointments. The region's mature healthcare system, coupled with a substantial geriatric population, creates a conducive environment for market growth.

Additionally, the presence of key market players and a focus on cost-effective treatments has shaped the European wound care landscape. However, stringent healthcare regulations and price pressures can pose challenges for market expansion. Despite these factors, the region's large population and increasing prevalence of chronic wounds contribute to its significant market size.

Fairfield’s Competitive Landscape Analysis

The wound healing ointment market is characterized by a mix of established pharmaceutical giants and specialized wound care companies. Key players compete on factors such as product innovation, distribution networks, and brand reputation.

While established players benefit from strong brand recognition and extensive distribution channels, smaller companies often focus on niche product offerings and rapid innovation. The market is witnessing increasing competition due to the entry of generic players and private label brands, exerting pressure on pricing and profitability.

Key Market Players

- 3M

- Taro Pharmaceutical Industries Ltd

- Smith & Nephew

- Novartis AG

- Pfizer Inc.

- Mölnlycke Health Care AB

- ConvaTec

- Coloplast

- MiMedx

- Cardinal Health

- Integra LifeSciences Corporation

- Johnson & Johnson Services, Inc.

- Teva Pharmaceuticals USA, Inc.

- Angelini Pharma Inc.

- BD

- B. Braun Melsungen AG

- PSK Pharma Pvt. Ltd.

- Schülke & Mayr GmbH

- Ecolab

- Mylan N.V.

Recent Industry Developments

- In July 2024, La Mer, a luxury skincare brand known for its pricey Miracle Broth, has launched a new night cream. The article doesn't disclose the price, but focuses on the product's claims to improve skin texture, firmness, and hydration while reducing the appearance of wrinkles. It also highlights the use of the brand's signature ingredient, the Miracle Broth, which is said to be a sea kelp ferment with regenerative properties.

- In December 2023, Russian scientists developed an innovative wound healing aid. Traditional wound healing agents often have limitations. A group of Russian scientists discovered that incorporating gasoline fractions into the ointments can accelerate healing. They experimented with various gasoline fractions, finding those with higher boiling points to be most effective.

- In February 2024, a study explored the potential use of topical phenytoin to enhance wound healing. It analyzes a systematic review of clinical trials that investigated the effects of topical phenytoin on wounds. The review concluded that topical phenytoin can expedite wound healing, promote granulation tissue formation, minimize bacterial contamination, and reduce pain. It emerged as a safe and effective treatment with minimal side effects.

Global Wound Healing Ointments Market is Segmented as-

By Drug Class:

- Antibiotic Ointments

- Steroidal Ointments

- Anti-inflammatory Ointments

- Others

By Application:

- Acute Wounds

- Chronic Wounds

By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By Region:

- North America

- Latin America

- Europe

- South Asia

- East Asia

- Oceania

- Middle East and Africa (MEA)

1. Executive Summary

1.1. Global Wound Healing Ointment Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Wound Healing Ointment Market Outlook, 2019-2031

3.1. Global Wound Healing Ointment Market Outlook, by Drug Class, Value (US$ Bn), 2019-2031

3.1.1. Key Highlights

3.1.1.1. Antibiotic Ointments

3.1.1.2. Steroidal Ointments

3.1.1.3. Anti-Inflammatory Ointments

3.1.1.4. Others

3.2. Global Wound Healing Ointment Market Outlook, by Application, Value (US$ Bn), 2019-2031

3.2.1. Key Highlights

3.2.1.1. Acute wound

3.2.1.2. Chronic wound

3.3. Global Wound Healing Ointment Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

3.3.1. Key Highlights

3.3.1.1. Hospital Pharmacy

3.3.1.2. Retail Pharmacy

3.3.1.3. Online Pharmacy

3.3.1.4. Others

3.4. Global Wound Healing Ointment Market Outlook, by Region, Value (US$ Bn), 2019-2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Wound Healing Ointment Market Outlook, 2019-2031

4.1. North America Wound Healing Ointment Market Outlook, by Drug Class, Value (US$ Bn), 2019-2031

4.1.1. Key Highlights

4.1.1.1. Antibiotic Ointments

4.1.1.2. Steroidal Ointments

4.1.1.3. Anti-Inflammatory Ointments

4.1.1.4. Others

4.2. North America Wound Healing Ointment Market Outlook, by Application, Value (US$ Bn), 2019-2031

4.2.1. Key Highlights

4.2.1.1. Acute wound

4.2.1.2. Chronic wound

4.3. North America Wound Healing Ointment Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

4.3.1. Key Highlights

4.3.1.1. Hospital Pharmacy

4.3.1.2. Retail Pharmacy

4.3.1.3. Online Pharmacy

4.3.1.4. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Wound Healing Ointment Market Outlook, by Country, Value (US$ Bn), 2019-2031

4.4.1. Key Highlights

4.4.1.1. U.S. Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

4.4.1.2. U.S. Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

4.4.1.3. U.S. Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

4.4.1.4. Canada Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

4.4.1.5. Canada Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

4.4.1.6. Canada Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Wound Healing Ointment Market Outlook, 2019-2031

5.1. Europe Wound Healing Ointment Market Outlook, by Drug Class, Value (US$ Bn), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Antibiotic Ointments

5.1.1.2. Steroidal Ointments

5.1.1.3. Anti-Inflammatory Ointments

5.1.1.4. Others

5.2. Europe Wound Healing Ointment Market Outlook, by Application, Value (US$ Bn), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Acute wound

5.2.1.2. Chronic wound

5.3. Europe Wound Healing Ointment Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

5.3.1. Key Highlights

5.3.1.1. Hospital Pharmacy

5.3.1.2. Retail Pharmacy

5.3.1.3. Online Pharmacy

5.3.1.4. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Wound Healing Ointment Market Outlook, by Country, Value (US$ Bn), 2019-2031

5.4.1. Key Highlights

5.4.1.1. Germany Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.2. Germany Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

5.4.1.3. Germany Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.4. U.K. Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.5. U.K. Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

5.4.1.6. U.K. Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.7. France Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.8. France Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

5.4.1.9. France Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.10. Italy Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.11. Italy Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

5.4.1.12. Italy Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.13. Turkey Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.14. Turkey Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

5.4.1.15. Turkey Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.16. Russia Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.17. Russia Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

5.4.1.18. Russia Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.19. Rest of Europe Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.20. Rest of Europe Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

5.4.1.21. Rest of Europe Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Wound Healing Ointment Market Outlook, 2019-2031

6.1. Asia Pacific Wound Healing Ointment Market Outlook, by Drug Class, Value (US$ Bn), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Antibiotic Ointments

6.1.1.2. Steroidal Ointments

6.1.1.3. Anti-Inflammatory Ointments

6.1.1.4. Others

6.2. Asia Pacific Wound Healing Ointment Market Outlook, by Application, Value (US$ Bn), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Acute wound

6.2.1.2. Chronic wound

6.3. Asia Pacific Wound Healing Ointment Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

6.3.1. Key Highlights

6.3.1.1. Hospital Pharmacy

6.3.1.2. Retail Pharmacy

6.3.1.3. Online Pharmacy

6.3.1.4. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Wound Healing Ointment Market Outlook, by Country, Value (US$ Bn), 2019-2031

6.4.1. Key Highlights

6.4.1.1. China Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

6.4.1.2. China Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

6.4.1.3. China Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.4. Japan Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

6.4.1.5. Japan Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

6.4.1.6. Japan Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.7. South Korea Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

6.4.1.8. South Korea Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

6.4.1.9. South Korea Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.10. India Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

6.4.1.11. India Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

6.4.1.12. India Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.13. Southeast Asia Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

6.4.1.14. Southeast Asia Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

6.4.1.15. Southeast Asia Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.16. Rest of Asia Pacific Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

6.4.1.17. Rest of Asia Pacific Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

6.4.1.18. Rest of Asia Pacific Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Wound Healing Ointment Market Outlook, 2019-2031

7.1. Latin America Wound Healing Ointment Market Outlook, by Drug Class, Value (US$ Bn), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Antibiotic Ointments

7.1.1.2. Steroidal Ointments

7.1.1.3. Anti-Inflammatory Ointments

7.1.1.4. Others

7.2. Latin America Wound Healing Ointment Market Outlook, by Application, Value (US$ Bn), 2019-2031

7.2.1. Key Highlights

7.2.1.1. Acute wound

7.2.1.2. Chronic wound

7.3. Latin America Wound Healing Ointment Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

7.3.1. Key Highlights

7.3.1.1. Hospital Pharmacy

7.3.1.2. Retail Pharmacy

7.3.1.3. Online Pharmacy

7.3.1.4. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Wound Healing Ointment Market Outlook, by Country, Value (US$ Bn), 2019-2031

7.4.1. Key Highlights

7.4.1.1. Brazil Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

7.4.1.2. Brazil Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

7.4.1.3. Brazil Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.4.1.4. Mexico Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

7.4.1.5. Mexico Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

7.4.1.6. Mexico Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.4.1.7. Argentina Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

7.4.1.8. Argentina Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

7.4.1.9. Argentina Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.4.1.10. Rest of Latin America Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

7.4.1.11. Rest of Latin America Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

7.4.1.12. Rest of Latin America Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Wound Healing Ointment Market Outlook, 2019-2031

8.1. Middle East & Africa Wound Healing Ointment Market Outlook, by Drug Class, Value (US$ Bn), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Antibiotic Ointments

8.1.1.2. Steroidal Ointments

8.1.1.3. Anti-Inflammatory Ointments

8.1.1.4. Others

8.2. Middle East & Africa Wound Healing Ointment Market Outlook, by Application, Value (US$ Bn), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Acute wound

8.2.1.2. Chronic wound

8.3. Middle East & Africa Wound Healing Ointment Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

8.3.1. Key Highlights

8.3.1.1. Hospital Pharmacy

8.3.1.2. Retail Pharmacy

8.3.1.3. Online Pharmacy

8.3.1.4. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Wound Healing Ointment Market Outlook, by Country, Value (US$ Bn), 2019-2031

8.4.1. Key Highlights

8.4.1.1. GCC Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

8.4.1.2. GCC Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

8.4.1.3. GCC Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.1.4. South Africa Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

8.4.1.5. South Africa Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

8.4.1.6. South Africa Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.1.7. Egypt Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

8.4.1.8. Egypt Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

8.4.1.9. Egypt Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.1.10. Nigeria Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

8.4.1.11. Nigeria Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

8.4.1.12. Nigeria Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.1.13. Rest of Middle East & Africa Wound Healing Ointment Market by Drug Class, Value (US$ Bn), 2019-2031

8.4.1.14. Rest of Middle East & Africa Wound Healing Ointment Market by Application, Value (US$ Bn), 2019-2031

8.4.1.15. Rest of Middle East & Africa Wound Healing Ointment Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Distribution Channel vs by Application Heat map

9.2. Manufacturer vs by Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Taro Pharmaceutical Industries Ltd

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. 3M

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Smith & Nephew

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Novartis AG

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Pfizer Inc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Mölnlycke Health Care AB

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. ConvaTec, Coloplast

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. MiMedx

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Cardinal Health

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Integra LifeSciences Corporation

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Johnson & Johnson Services, Inc.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Teva Pharmaceuticals USA, Inc.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Angelini Pharma Inc.

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. BD

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. B. Braun Melsungen AG

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2022 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Drug Class Coverage |

|

|

Application Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |