Global Edible Oils Market Forecast

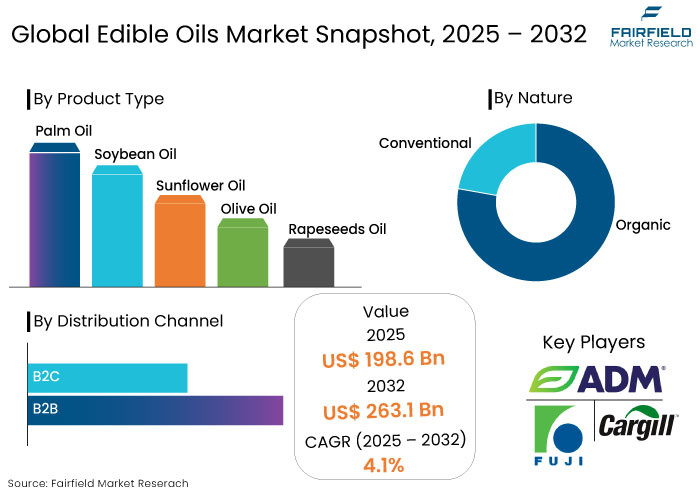

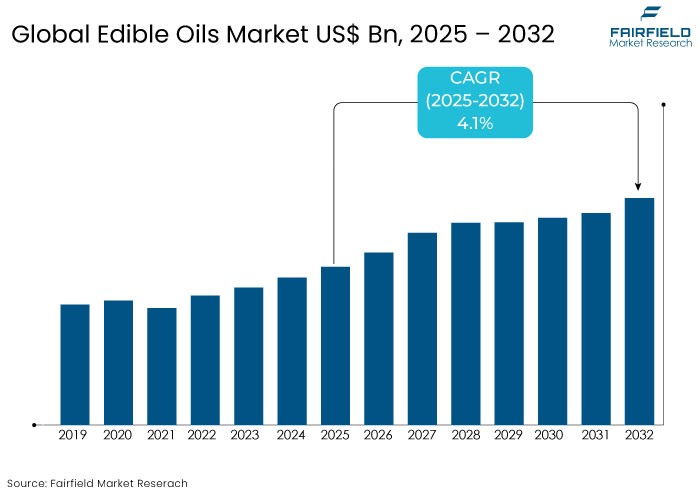

- The edible oils market is projected to reach a size of US$ 263.1 Bn by 2032, showing significant growth from US$ 198.6 Bn achieved in 2025.

- The market for edible oils is expected to show a significant expansion rate, with an estimated CAGR of 4.1% through 2032.

Edible Oils Market Insights

- The market is driven by a significant shift toward clean-label products, with consumers preferring oils that are free from artificial additives and chemicals.

- Organic and non-GMO oils are experiencing robust growth as consumers prioritize natural and pesticide-free options in their diets.

- Functional oils enriched with omega-3 fatty acids, antioxidants, or other health benefits are becoming popular owing to the growing wellness trend.

- Consumers are increasingly opting for oils having healthier profiles, such as olive, avocado, and flaxseed, owing to growing concerns over heart health and nutrition.

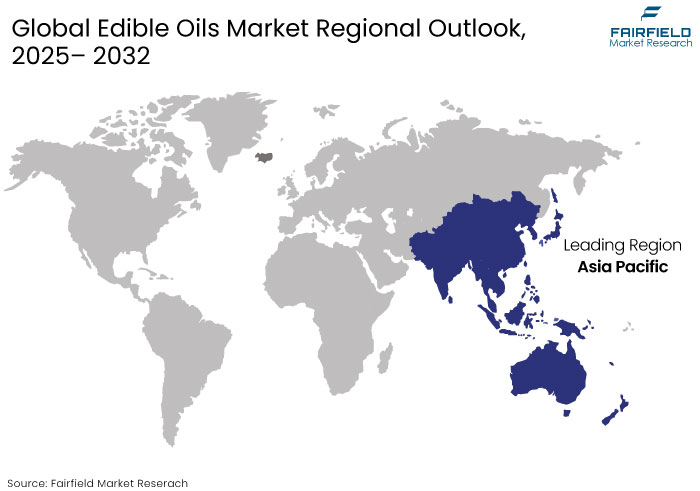

- The Asia-Pacific region, especially countries like India and China, are predicted to dominate the global edible oil market in terms of volume.

- Premium oils, including extra virgin olive and cold-pressed oils, are gaining traction owing to their perceived health benefits and quality.

- Governments worldwide are introducing stringent food safety, labelling, and environmental regulations, driving innovation toward healthier and more sustainable oils.

- Companies are diversifying in new oil sources, like camelina, algae, and hemp, to meet the growing demand for plant-based and alternative oils.

A Look Back and a Look Forward - Comparative Analysis

The edible oil market growth during the historical period ranging between 2019 and 2023, was significantly impacted by the increasing demand for vegetable oils, notably palm oil, soybean oil, and sunflower oil. Expansion in the market was also propelled by the increasing vegan population worldwide along with evolving dietary trends.

The growing preference for economical cooking oils and the escalating demand in emerging markets like India and China propelled growth. Demand in the food processing sector, encompassing ready-to-eat meals and packaged foods, has also led to growth in the use of edible oils.

Over the forecast period, consumer demand for healthier, organic, and sustainable oils is expected to rise. Increasing emphasis on oils abundant in omega-3 fatty acids, like flaxseed and avocado oils is anticipated to propel growth.

The emergence of plant-based and clean-label trends and advancements in healthy oil compositions will continue to transform the market. Growing inclination towards environmentally sustainable production techniques and responsible sourcing is likely to bolster market growth over the forecast period.

Key Growth Determinants

- Growing Trends among Consumers for Health-Conscious Diets

A key growth factor for the edible oils market is the rising consumer awareness of health and nutrition. As individuals increasingly prioritize health, there is a notable transition towards healthier oil alternatives with superior nutritional characteristics.

Oils characterized by reduced saturated fat content, elevated unsaturated fat levels, and vital elements like omega-3 fatty acids are increasingly favoured. Such oils tend to be especially pronounced in the desire for olive, avocado, and flaxseed, which are recognized for their cardiovascular health advantages.

As consumers increasingly reject oils rich in trans fats and detrimental saturated fats, the demand for plant-based and organic oils is anticipated to increase. It prompts food producers to develop healthier oil formulations, stimulating growth.

- Rising Demand for Organic and Non-GMO Oils

A prominent market driver is the increasing preference for organic and non-GMO (genetically modified organism) products. Consumers are becoming selective about the quality and sourcing of their food, including oils.

Organic edible oils, produced without synthetic fertilizers or pesticides, are gaining traction owing to their perceived health benefits and environmental sustainability. Non-GMO oils, made from crops that have not been genetically modified, are also highly sought after by consumers who prioritize natural and unprocessed products.

Growing demand for organic and non-GMO oils prompts manufacturers to shift toward sustainable production practices, further accelerating growth. The demand is particularly notable in regions like Europe and North America, where regulatory standards for GMOs are stricter, and consumers are more inclined to choose products with labels like non-GMO or organic.

Key Growth Barriers

- Environmental and Sustainability Concerns Over Palm Oil Production

Palm oil is one of the most widely used edible oils globally. Its production, however, faces significant criticism owing to environmental concerns. Widespread deforestation and destruction of natural habitats to cultivate palm oil plantations have raised concerns about biodiversity loss, greenhouse gas emissions, and negative impacts on local communities.

Growing awareness about these environmental issues has led governments and non-governmental organizations across the globe to push for stringent regulations around palm oil production. There is a shift in consumer demand toward sustainable oil alternatives, like olive oil or coconut oil, as they are considered more environmentally friendly.

Companies in the market for edible oils may be forced to invest in sustainable sourcing and certifications like RSPO (Roundtable on Sustainable Palm Oil) to address consumer and regulatory demands. While this benefits the environment, it could increase production costs and limit the scalability of palm oil, thereby restraining its growth in the edible oils sector.

Edible Oils Market Trends and Opportunities

- Innovation in Healthier Oils

Innovation of healthier alternatives to traditional oils presents transformative opportunities in the market. Brands have an opportunity to develop oils that offer superior nutritional benefits owing to the growing consumer concerns over health and wellness.

Oils like avocado, flaxseed, and walnut are gaining traction for their heart-healthy properties. A growing interest in oils with functional health benefits, like those promoting cognitive function, weight management, or skin health, bolsters market prospects.

Brands can innovate by creating blends of oils that balance healthy fats while maintaining flavour, versatility, and affordability, meeting the demand for healthier dietary options. It also opens new market opportunities, especially in developed economies where consumers are becoming more conscious of the oils they use in their daily cooking.

- Sustainable and Eco-Friendly Sourcing

Sustainability is a key area of growth owing to the increase in environmental awareness. Consumers are becoming selective about their products, with a strong preference for sustainably sourced products.

Companies have a growing opportunity to focus on sustainable sourcing practices, particularly for oils that have been historically linked to deforestation and environmental degradation. Obtaining certifications like RSPO (Roundtable on Sustainable Palm Oil) or creating traceable supply chains that ensure ethical practices can give companies a competitive edge.

Exploring new sources of plant-based oils, like algae or camelina oil, which have lower environmental impact than traditional oil crops, can further enhance the market appeal. Sustainable practices address consumer concerns and comply with global regulations, which are becoming stricter around environmental impact. This presents a long-term opportunity for growth.

How is Regulatory Scenario Shaping this Industry?

The regulatory scenario significantly shapes the edible oils market by influencing production practices, labelling standards, and consumer preferences. Governments worldwide are introducing stringent regulations on food safety, sustainability, and health labelling, impacting the edible oils industry.

In regions like Europe and North America, regulatory bodies enforce stringent labelling requirements, compelling manufacturers to disclose detailed nutritional information on their products. This includes mentioning the levels of trans fats, saturated fats, and omega-3 fatty acids.

Environmental regulations also play a significant role, particularly in the palm oil sector, where concerns over deforestation and biodiversity loss have established sustainable sourcing standards like the Roundtable on Sustainable Palm Oil (RSPO). Such regulations push companies to adopt eco-friendly production practices, thereby impacting costs and market dynamics.

Governments around the world are promoting organic and non-GMO oils by incentivizing farmers and manufacturers to adopt these practices. The regulatory landscape is driving the growth of cleaner, sustainable, and health-conscious oil products, thereby reshaping the market.

Segment Covered in the Report

- Soybean Oil is Preferred for its High Nutritional Advantages

Based on product type, the soybean oil segment is anticipated to account for a share of 35% in 2025. It is considered as one of the healthiest cooking oils owing to its elevated polyunsaturated and monounsaturated fatty acids. It is devoid of cholesterol and has a low saturated fat content, thereby increasing its use.

- According to reports, the market share of soybean oil in terms of volume is estimated to reach 72.3 million tons by 2032 and is predicted to grow at a CAGR of 1.7% over the forecast period.

Soybean oil's Omega-3 and Omega-6 fatty acids contribute to cardiovascular and cognitive health when included in a balanced diet. Dietitians and nutritionists frequently advocate that consumers progressively pursue oil products that offer nutritional advantages rather than just flavour.

Research consistently supports the inclusion of soybean oil in a heart-healthy diet. From an agricultural perspective, soybeans are among the most versatile crops extensively produced globally.

- Rising Demand for Bakery Products Foster Growth in Food Service

Rising demand for edible oils in baking, frying, and processed food manufacturing underpins growth, as most edible oils improve the texture, flavour, and shelf life of these items. This is essential for mass production and product consistency.

Germany, France, and the U.K., where breads and pastries are primary foods, lead in the production and consumption of bakery products. Robust demand for baked goods necessitates the use of edible oils, such as palm oil and sunflower oil, which are vital components in bakery processes.

As bakeries expand their operations to satisfy domestic and export requirements, the industry is anticipated to have a growing need for a reliable edible oil supply chain. This indicates that the food processing industry plays a crucial role in propelling the market, thereby ensuring a viable basis for continued growth.

Regional Analysis

- Rising Awareness of Nutrition Propels the Need for Edible Oils in Asia Pacific

Large population and the presence of emerging economies is likely to foster the dominance of Asia Pacific in the market. China, India, Indonesia, and Thailand are significant consumers and producers of edible oils, utilizing a diverse range of oils for cooking, frying, and food processing.

The region exhibits the highest palm oil usage, predominantly generated in Southeast Asian nations like Indonesia and Malaysia. The expanding middle-class section in these countries is progressively pursuing superior-quality oils, such as soybean, sunflower, and rapeseed, in alignment with a transition towards healthier dietary practices.

Increasing awareness of health and nutrition propels the need for oils with superior nutritional profiles, particularly those high in Omega-3 fatty acids and low in saturated fats. The region's agricultural foundation, characterized by vast oilseed production in nations like India and China, guarantees a consistent supply of raw materials for oil extraction.

Rising urbanization and modernization of food services in the Asia Pacific, coupled with expansion of the packaged food and ready-to-eat meals, enhances the demand for edible oils. This further solidifies Asia-Pacific's status as the largest and most influential region in this market.

- Europe Ranks as the Second-largest Region in the Edible Oils Market.

Demand for edible oils in Europe is influenced by evolving customer preferences for healthier oils, like olive oil and rapeseed oil. Increasing trend in plant-based diets further augments growth. Consumption of olive oil is notably elevated in Southern European nations like Spain, Italy and Greece, where it serves as a fundamental component of everyday cuisine.

Increasing demand for organic and non-GMO oils coupled with a transition towards sustainable food production positions Europe as a significant participant in this industry. Regulatory restrictions concerning food quality and labelling along with a pronounced emphasis on nutrition assists in fostering innovation and expansion in the region.

Rising awareness regarding the benefits of cooking with oils that support heart health contribute to continuous growth. Increasing adoption of low-fat and plant-based diets augment expansion in Europe. The region’s mature market and strong focus on wellness and sustainability position it as a key player in the global market.

Fairfield’s Competitive Landscape Analysis

The edible oils market is highly competitive, with a mix of global and regional players. Key companies in the industry include Cargill, Bunge Limited, and ADM. These brands dominate the market with their extensive product portfolios and large-scale production capabilities.

Regional players like Wilmar International and Marico hold a strong position in key markets, leveraging local expertise and distribution networks. Competitive strategies include product innovation, sustainability efforts, and acquisitions to expand market presence.

Rising consumer preferences for organic, non-GMO, and clean-label oils has led companies to invest in research and development to offer differentiated products and capitalize on the growing demand for healthier and environmentally sustainable options.

Key Market Companies

- Cargill, Incorporated

- Archer Daniels Midland Company

- Fuji Vegetable Oil, Inc.

- Bunge Limited

- Conagra Brands, Inc.

- Marico

- The Adams Group Inc.

- American Vegetable Oils, Inc.

- COFCO

- The Nisshin OilliO Group, Ltd.

- Associated British Foods plc

- Borges International Group S.L.

Recent Industry Developments

- In August 2024, Bunge (US) introduced Fiona Refined Sunflower Oil in Hyderabad, Telangana. It is enhanced with vitamins A, D, and E and features the innovative VitoProtect technology, which amplifies vitamin transfer while cooking by up to 50 percent compared to conventional sunflower oils.

- In September 2024, ADM signed an acquisition deal with Vandamme Hungaria Kft, which added a 700-metric-ton-per-day non-GM multi-seed and corn germ processing factory to meet the rising demand for non-GM edible oils in Europe.

An Expert’s Eye

- Increasing consumer awareness about the health risks of certain oils is driving the demand for healthier alternatives, like olive, avocado, and flaxseed oils.

- Organic and non-GMO oils are gaining traction as consumers seek cleaner and natural products.

- Experts foresee strong growth in oils with added health benefits, like those fortified with omega-3 fatty acids or antioxidants, to cater to the evolving wellness-driven market.

- Prominent companies are diversifying their portfolios and focusing on clean-label and healthier oils to stay competitive in an increasingly crowded market.

Global Edible Oils Market is Segmented as-

By Product Type

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Olive Oil

- Rapeseeds Oil

- Others

By Nature

- Organic

- Conventional

By End Use

- Industrial

- Food Service

- Household Retail

By Distribution Channel

- B2B

- B2C

- Hypermarkets/Supermarkets

- Traditional Grocery Stores

- Convenience Stores

- Online Retail

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Edible Oils Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact Of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. Pestle Analysis

3. Price Trend Analysis, 2019 - 2032

3.1. Key Factors Impacting Product Prices

3.2. Prices by Product Type

4. Global Edible Oils Market Outlook, 2019 - 2032

4.1. Global Edible Oils Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Palm Oil

4.1.1.2. Soybean Oil

4.1.1.3. Sunflower Oil

4.1.1.4. Olive Oil

4.1.1.5. Rapeseeds Oil

4.1.1.6. Others

4.2. Global Edible Oils Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Organic

4.2.1.2. Conventional

4.3. Global Edible Oils Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Industrial

4.3.1.2. Food Service

4.3.1.3. Household Retail

4.4. Global Edible Oils Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Business to Business

4.4.1.2. Business to Consumer

4.4.1.2.1. Hypermarkets/Supermarkets

4.4.1.2.2. Traditional Grocery Stores

4.4.1.2.3. Convenience Stores

4.4.1.2.4. Online Retail

4.4.1.2.5. Others

4.5. Global Edible Oils Market Outlook, by Region, Value (US$ Bn) and Volume (Tons) 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. North America

4.5.1.2. Europe

4.5.1.3. Asia Pacific

4.5.1.4. Latin America

4.5.1.5. Middle East & Africa

5. North America Edible Oils Market Outlook, 2019 - 2032

5.1. North America Edible Oils Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Palm Oil

5.1.1.2. Soybean Oil

5.1.1.3. Sunflower Oil

5.1.1.4. Olive Oil

5.1.1.5. Rapeseeds Oil

5.1.1.6. Others

5.2. North America Edible Oils Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Organic

5.2.1.2. Conventional

5.3. North America Edible Oils Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Industrial

5.3.1.2. Food Service

5.3.1.3. Household Retail

5.4. North America Edible Oils Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Business to Business

5.4.1.2. Business to Consumer

5.4.1.2.1. Hypermarkets/Supermarkets

5.4.1.2.2. Traditional Grocery Stores

5.4.1.2.3. Convenience Stores

5.4.1.2.4. Online Retail

5.4.1.2.5. Others

5.5. North America Edible Oils Market Outlook, by Country, Value (US$ Bn) and Volume (Tons) 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. U.S. Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

5.5.1.2. U.S. Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

5.5.1.3. U.S. Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

5.5.1.4. U.S. Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

5.5.1.5. Canada Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

5.5.1.6. Canada Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

5.5.1.7. Canada Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

5.5.1.8. Canada Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Edible Oils Market Outlook, 2019 - 2032

6.1. Europe Edible Oils Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Palm Oil

6.1.1.2. Soybean Oil

6.1.1.3. Sunflower Oil

6.1.1.4. Olive Oil

6.1.1.5. Rapeseeds Oil

6.1.1.6. Others

6.2. Europe Edible Oils Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Organic

6.2.1.2. Conventional

6.3. Europe Edible Oils Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Industrial

6.3.1.2. Food Service

6.3.1.3. Household Retail

6.4. Europe Edible Oils Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Business to Business

6.4.1.2. Business to Consumer

6.4.1.2.1. Hypermarkets/Supermarkets

6.4.1.2.2. Traditional Grocery Stores

6.4.1.2.3. Convenience Stores

6.4.1.2.4. Online Retail

6.4.1.2.5. Others

6.5. Europe Edible Oils Market Outlook, by Country, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. Germany Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.2. Germany Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.3. Germany Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.4. Germany Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.5. U.K. Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.6. U.K. Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.7. U.K. Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.8. U.K. Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.9. France Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.10. France Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.11. France Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.12. France Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.13. Italy Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.14. Italy Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.15. Italy Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.16. Italy Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.17. Turkey Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.18. Turkey Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.19. Turkey Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.20. Turkey Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.21. Russia Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.22. Russia Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.23. Russia Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.24. Russia Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.25. Rest Of Europe Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.26. Rest Of Europe Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.27. Rest Of Europe Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.1.28. Rest of Europe Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Edible Oils Market Outlook, 2019 - 2032

7.1. Asia Pacific Edible Oils Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Palm Oil

7.1.1.2. Soybean Oil

7.1.1.3. Sunflower Oil

7.1.1.4. Olive Oil

7.1.1.5. Rapeseeds Oil

7.1.1.6. Others

7.2. Asia Pacific Edible Oils Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Organic

7.2.1.2. Conventional

7.3. Asia Pacific Edible Oils Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Industrial

7.3.1.2. Food Service

7.3.1.3. Household Retail

7.4. Asia Pacific Edible Oils Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Business to Business

7.4.1.2. Business to Consumer

7.4.1.2.1. Hypermarkets/Supermarkets

7.4.1.2.2. Traditional Grocery Stores

7.4.1.2.3. Convenience Stores

7.4.1.2.4. Online Retail

7.4.1.2.5. Others

7.5. Asia Pacific Edible Oils Market Outlook, by Country, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. China Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.2. China Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.3. China Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.4. China Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.5. Japan Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.6. Japan Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.7. Japan Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.8. Japan Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.9. South Korea Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.10. South Korea Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.11. South Korea Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.12. South Korea Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.13. India Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.14. India Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.15. India Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.16. India Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.17. Southeast Asia Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.18. Southeast Asia Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.19. Southeast Asia Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.20. Southeast Asia Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.21. Rest Of Asia Pacific Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.22. Rest Of Asia Pacific Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.23. Rest Of Asia Pacific Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.1.24. Rest of Asia Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Edible Oils Market Outlook, 2019 - 2032

8.1. Latin America Edible Oils Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Palm Oil

8.1.1.2. Soybean Oil

8.1.1.3. Sunflower Oil

8.1.1.4. Olive Oil

8.1.1.5. Rapeseeds Oil

8.1.1.6. Others

8.2. Latin America Edible Oils Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Organic

8.2.1.2. Conventional

8.3. Latin America Edible Oils Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Industrial

8.3.1.2. Food Service

8.3.1.3. Household Retail

8.4. Latin America Edible Oils Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Business to Business

8.4.1.2. Business to Consumer

8.4.1.2.1. Hypermarkets/Supermarkets

8.4.1.2.2. Traditional Grocery Stores

8.4.1.2.3. Convenience Stores

8.4.1.2.4. Online Retail

8.4.1.2.5. Others

8.5. Latin America Edible Oils Market Outlook, by Country, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. Brazil Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.2. Brazil Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.3. Brazil Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.4. Brazil Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.5. Mexico Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.6. Mexico Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.7. Mexico Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.8. Mexico Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.9. Argentina Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.10. Argentina Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.11. Argentina Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.12. Argentina Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.13. Rest Of Latin America Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.14. Rest Of Latin America Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.15. Rest Of Latin America Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.1.16. Rest of Latin America Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Edible Oils Market Outlook, 2019 - 2032

9.1. Middle East & Africa Edible Oils Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.1.1. Key Highlights

9.1.1.1. Palm Oil

9.1.1.2. Soybean Oil

9.1.1.3. Sunflower Oil

9.1.1.4. Olive Oil

9.1.1.5. Rapeseeds Oil

9.1.1.6. Others

9.2. Middle East & Africa Edible Oils Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.2.1. Key Highlights

9.2.1.1. Organic

9.2.1.2. Conventional

9.3. Middle East & Africa Edible Oils Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.3.1. Key Highlights

9.3.1.1. Industrial

9.3.1.2. Food Service

9.3.1.3. Household Retail

9.4. Middle East & Africa Edible Oils Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.4.1. Key Highlights

9.4.1.1. Business to Business

9.4.1.2. Business to Consumer

9.4.1.2.1. Hypermarkets/Supermarkets

9.4.1.2.2. Traditional Grocery Stores

9.4.1.2.3. Convenience Stores

9.4.1.2.4. Online Retail

9.4.1.2.5. Others

9.5. Middle East & Africa Edible Oils Market Outlook, by Country, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1. Key Highlights

9.5.1.1. GCC Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.2. GCC Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.3. GCC Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.4. GCC Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.5. South Africa Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.6. South Africa Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.7. South Africa Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.8. South Africa Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.9. Egypt Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.10. Egypt Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.11. Egypt Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.12. Egypt Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.13. Nigeria Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.14. Nigeria Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.15. Nigeria Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.16. Nigeria Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.17. Rest Of Middle East & Africa Edible Oils Market by Product Type, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.18. Rest Of Middle East & Africa Edible Oils Market by Nature, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.19. Rest Of Middle East & Africa Edible Oils Market by End Use, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.1.20. Rest of Middle East & Africa Edible Oils Market by Distribution Channel, Value (US$ Bn) and Volume (Tons) 2019 - 2032

9.5.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Company Market Share Analysis, 2025

10.2. Competitive Dashboard

10.3. Company Profiles

10.3.1. Cargill, Incorporated

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. Archer Daniels Midland Company

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. Fuji Vegetable Oil, Inc.

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. Bunge Limited

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. Conagra Brands, Inc.

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Marico

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. The Adams Group Inc.

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. American Vegetable Oils, Inc.

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. COFCO

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. The Nisshin OilliO Group, Ltd.

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

10.3.11. Associated British Foods plc

10.3.11.1. Company Overview

10.3.11.2. Product Portfolio

10.3.11.3. Financial Overview

10.3.11.4. Business Strategies and Development

10.3.12. Borges International Group S.L.

10.3.12.1. Company Overview

10.3.12.2. Product Portfolio

10.3.12.3. Financial Overview

10.3.12.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms And Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Nature Coverage |

|

|

End Use Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |