Global Infectious Disease In-Vitro Diagnostic Market Forecast`

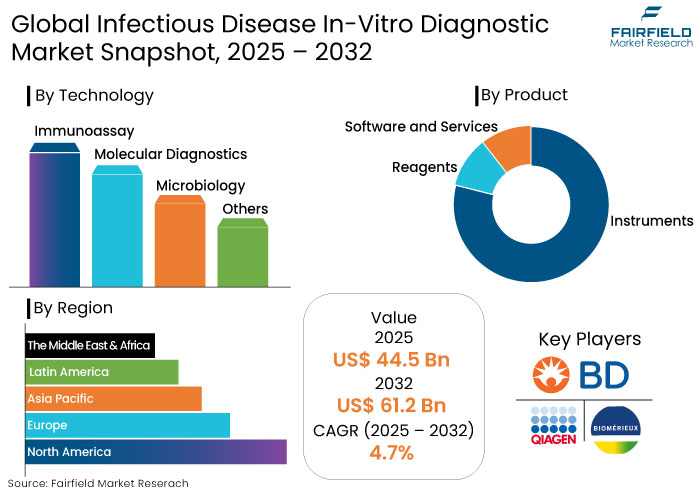

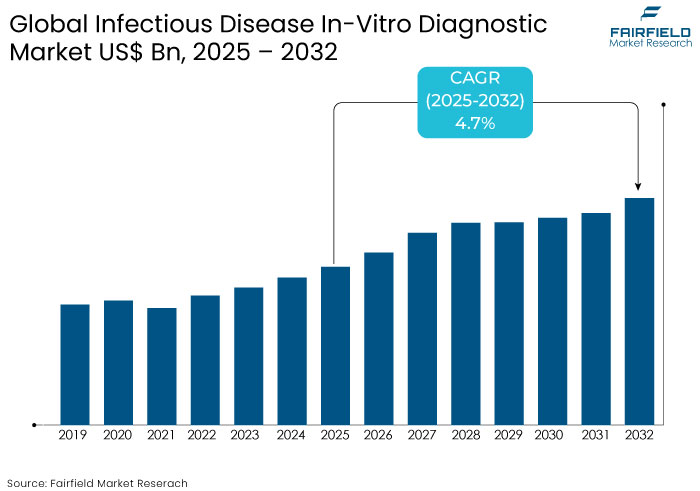

- The infectious disease in-vitro diagnostic market is projected to be valued at US$ 61.2 Bn by 2032, exhibiting significant growth from US$ 44.5 Bn achieved in 2025.

- The market for infectious disease in-vitro diagnostic is predicted to showcase a CAGR of 4.7% during the forecast period ranging between 2025 and 2032.

Infectious Disease In-Vitro Diagnostic Market Insights

- Increasing burden of diseases like HIV, tuberculosis, and COVID-19 drives demand for advanced diagnostic solutions to ensure timely detection, monitoring, and effective management of these conditions.

- Key products in this market includes instruments, reagents and software and services, each offering different applications and ease of use.

- Innovations in molecular diagnostics, point-of-care testing, and AI-powered platforms enhance accuracy, efficiency, and accessibility.

- Advancements fuel growth by addressing the need for rapid and reliable infectious disease testing solutions.

- Substantial funding for disease surveillance, healthcare infrastructure improvements, and research and development initiatives boost the availability and adoption of cutting-edge diagnostic technologies.

- North America is predicted to hold a significant share owing to advanced healthcare infrastructure, extensive adoption of innovative diagnostic technologies, and significant government funding for disease surveillance and prevention.

A Look Back and a Look Forward - Comparative Analysis

The infectious disease in-vitro diagnostics (IVD) market growth was steady during the historical period. Immunoassays and traditional molecular diagnostic tests dominated the market. Technological advancements, like PCR testing, rapid antigen tests, and next-generation sequencing, revolutionized disease detection during the period.

The COVID-19 pandemic acted as a catalyst for the market, increasing the demand for testing kits and rapid diagnostic tools. Companies rapidly scaled production while new players entered the market. Manufacturers drove innovation in point-of-care testing and real-time diagnostics. These developments not only improved the speed and accuracy of detection but also increased global accessibility.

Looking ahead, the market is poised for continued growth with a focus on technological advancements. Integration of artificial intelligence (AI) and machine learning is predicted to drive improvements in diagnostic accuracy and efficiency, enabling faster results and automated workflows.

Increasing shift towards multiplex testing, where multiple pathogens can be identified in a single test, is likely to offer comprehensive diagnostic solutions. With the rise of antimicrobial resistance and new infectious threats, the demand for next-generation diagnostic solutions will only continue to grow, making the future of the infectious disease IVD market promising and dynamic.

Key Growth Determinants

- Convenience of Home Testing and Telemedicine is Facilitating Adoption

Rise in home-based testing for infectious diseases including HIV, COVID-19, and STIs are driving the demand for IVD market. Consumers across the globe are seeking at-home diagnostic solutions for convenience and timely results.

The emergence of telemedicine also supports the requirement for remote diagnostic tools that can be used at home or in non-clinical settings. Infectious disease in-vitro diagnostics market growth is closely linked to the rising demand for self-testing kits, telehealth platforms, and home diagnostics, especially with a focus on disease prevention and management.

- Molecular Advancements and Precision Medicine Innovations

The field of molecular diagnostics has seen remarkable progress, transforming disease detection and monitoring at the genetic level. Techniques like polymerase chain reaction (PCR) and next-generation sequencing (NGS) have improved diagnostic accuracy and speed, resulting in better patient outcomes. Leading companies are actively expanding their portfolios with cutting-edge products.

- In April 2023, ELITechGroup announced its plan to introduce a high-throughput sample-to-result molecular diagnostics equipment, expected to launch in Europe by the end of 2024.

NGS technologies are making a significant impact by enabling detailed genomic analysis, paving the way for advancements in personalized medicine. Enhancements in PCR methods, like real-time PCR and reverse transcription PCR (RT-PCR), have broadened their application in healthcare.

Growing investment in research and development, especially in precision medicine and genomics, is fueling innovation. The COVID-19 pandemic highlighted the need for rapid diagnostic solutions, thereby boosting the demand for innovative IVD technologies.

Key Growth Barriers

- Evolving Regulatory Requirements to Increase Costs and Complexity

Manufacturers in the market are likely to face challenges as regulatory bodies worldwide including the FDA, EMA, and other national agencies, continuously update their standards and guidelines to ensure patient safety and product efficacy. These evolving regulations often necessitate additional investments in research and development, clinical trials, and compliance processes.

Increased regulatory burden can lead to higher operational costs, which may be passed on to consumers, potentially impacting growth. The complexity of meeting diverse regulatory requirements across different regions can hinder the global expansion of IVD products.

Presence of several regulations can delay product launches while increasing the risk of non-compliance. This evolving landscape requires continuous adaptation and significant resources to ensure compliance, thereby impacting the overall efficiency and profitability of IVD manufacturers.

Infectious Disease In-Vitro Diagnostic Market Trends and Opportunities

- Biosensors to Expanding Companion Diagnostics

Biosensors have become a critical component in the infectious disease IVD market owing to their critical role in companion diagnostics (CDx). These analytical devices combine biological components with physicochemical detectors to enable highly accurate and real-time detection of infectious agents.

The above capability is pivotal in the context of companion diagnostics, where identifying patient-specific biomarkers assists in tailoring treatment approaches for better outcomes. This is particularly relevant in infectious diseases such as HIV, HCV, and emerging viruses like COVID-19, where rapid diagnostics are essential for effective treatment planning.

- OraSure has integrated biosensor technology into products like the OraQuick® rapid test for HIV, enabling clinicians to not only detect the virus but also make decisions about patient-specific treatment based on the results.

Biosensors are also used in COVID-19 diagnostics, where rapid detection played a critical role in controlling the pandemic. Biosensors integrated into companion diagnostics improve the precision of therapeutic interventions, by identifying how a patient responds to antiviral treatments or vaccines.

- Clinical Utility of Multiplex Molecular Tests for Respiratory and GI Pathogens

Clinical utility of multiplex tests for respiratory and gastrointestinal (GI) pathogens is gaining traction as a transformative trend in the infectious disease IVD market. These syndromic-based panels, like the BioFire FilmArray® and GenMark ePlex® systems, offer the capability to simultaneously detect, differentiate, and even subtype multiple pathogens, bacterial, viral, and parasitic, from a single patient sample.

Utilizing advanced technologies like PCR and microarrays, multiplex tests deliver rapid and highly accurate results, often within an hour. This quick turnaround time is particularly crucial in managing infectious diseases like respiratory viruses and GI infections, where timely diagnosis can significantly impact clinical decision-making, enabling the swift initiation of appropriate treatments, such as antivirals.

Segments Covered in the Report

- Reagents are Essential to Deliver Accurate Disease Testing

Reagents are predicted to dominate the infectious disease IVD market owing to their essential role in pathogen detection, particularly in PCR and immunoassay tests. Growing demand for specialized reagents significantly drives growth.

Frequent use of reagents in diagnostic laboratories ensures consistent demand, creating recurring revenue for manufacturers. Innovations in reagent formulations enhance efficiency while decreasing testing times, further strengthening their position. As a fundamental component across diagnostic platforms, reagents are indispensable for delivering accurate and reliable infectious disease testing.

- Immunoassay’s Ability to Process Multiple Samples Likely to Augment Growth

Immunoassays are predicted to lead the infectious disease in-vitro diagnostics market owing to their exceptional accuracy and effectiveness in detecting specific antigens or antibodies in infections. Widely utilized for conditions like HIV, hepatitis, and respiratory diseases, immunoassays deliver rapid results, making them vital for timely diagnosis and treatment.

Advancements in technology, including automated platforms, have enhanced their efficiency and scalability. Cost-effectiveness and adaptability for large-scale testing further bolster their demand. Used across hospitals, laboratories, and point-of-care settings, immunoassays are highly valued for their sensitivity, specificity, and ability to process multiple samples efficiently.

Regional Analysis

- North America to Witness Growth Owing to Advanced Healthcare Sector

North America is anticipated to dominate the infectious disease in-vitro diagnostics market owing to the region’s widespread adoption of innovative diagnostic technologies. Substantial government investments in disease surveillance and prevention further bolster growth.

The region benefits from the strong presence of leading market players, extensive research and development efforts, and the prevalent use of precision diagnostics for early disease detection. Factors like aging population, high infectious disease prevalence, and well-established regulatory frameworks further bolster growth. North America's proactive adoption of advanced solutions, including AI-driven diagnostics and molecular testing, reinforces its leadership in the global infectious disease IVD market.

- Government Investments in Healthcare Infrastructure to Bolster Growth in Asia Pacific

The World Health Organization (WHO) reported that Asia Pacific accounted for 44% of global tuberculosis cases. Annual dengue cases in the region have increased by 30% in the last decade, necessitating reliable diagnostic tools. Government authorities across Asia-Pacific are increasing investments in healthcare infrastructure and diagnostic capabilities to combat the spread of infectious diseases.

- India's National Tuberculosis Elimination Program (NTEP) aims to screen 100 million people annually.

The expanding middle-class population, with increasing disposable incomes, is driving demand for quality healthcare and diagnostics. By 2030, 1.2 billion people in Asia-Pacific are expected to enter the middle class, enhancing the market potential for diagnostic solutions.

Fairfield’s Competitive Landscape Analysis

The competitive landscape in the infectious disease IVD market highlights a dynamic and highly competitive environment driven by innovation, partnerships, and global expansion strategies. Key players like Abbott Laboratories, Roche Diagnostics, and Siemens Healthineers, dominate the market owing to their comprehensive portfolio of diagnostic tools. These companies leverage extensive research and development capabilities, robust distribution networks, and strategic acquisitions to maintain leadership.

Emerging companies and regional players are gaining traction by focusing on niche markets and developing cost-effective diagnostic solutions tailored to underserved regions. Technological advancements like AI-based diagnostics and multiplex testing are reshaping the market, with smaller firms collaborating with research institutions to accelerate innovation. Fairfield’s analysis emphasizes the importance of adaptability and investment in precision diagnostics to remain competitive in this rapidly evolving market.

Key Market Companies

- QIAGEN

- Becton, Dickinson and Company

- bioMérieux SA

- Hoffmann-La Roche, Ltd.

- Hologic, Inc. (Gen Probe)

- Abbott

- Quidel Corporation

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- Danaher

- OraSure Technologies, Inc.

- Others

Recent Industry Developments

- In September 2024, BD acquired Edwards Lifesciences' Critical Care product group, which was renamed BD Advanced Patient Monitoring.

- In July 2024, Roche acquired LumiraDx’s Point of Care technology, following the receipt of all necessary antitrust and regulatory clearances. This acquisition enhanced Roche’s diagnostics portfolio with a user-friendly platform.

- In January 2024, BD and Techcyte announced a strategic collaboration to offer an AI-based algorithm designed to assist cytologists and pathologists in identifying cervical cancer and precancer evidence using whole-slide imaging. This partnership combined BD's global medical technology expertise with Techcyte's leadership in AI-based digital diagnostics, aiming to enhance the efficiency and effectiveness of cervical cancer screening and diagnosis.

An Expert’s Eye

- Integration of AI, multiplex testing, and molecular diagnostics is transforming the market.

- Technological advancements enable faster and accurate pathogen detection, ensuring timely interventions and improved patient outcomes.

- Developing regions present significant opportunities for growth owing to rising disease prevalence and a growing demand for affordable diagnostic solutions tailored to local healthcare requirements.

- Government initiatives are increasing healthcare access in emerging countries, thereby fostering growth.

Global Infectious Disease In-Vitro Diagnostic Market is Segmented as-

By Product Type

- Instruments

- Reagents

- Software and Services

By Technology

- Immunoassay

- Molecular Diagnostics

- Microbiology

- Others

By Application

- MRSA

- Clostridium Difficile

- Respiratory Virus

- TB and Drug-resistant TB

- Gonorrhea

- HPV

- HIV

- Hepatitis C

- Hepatitis B

- COVID-19

- Others

By End User

- Point-of-care

- Central Laboratories

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Growth Factors Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Economic Overview

2.6.1. World Economic Projections

2.7. PESTLE Analysis

2.8. Growth Factors Market, Product Adoption

2.9. Regulatory Scenario by Region

2.10. Value Chain Analysis

3. Global Growth Factors Market Outlook, 2019 - 2032

3.1. Global Growth Factors Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Instruments

3.1.1.2. Reagents

3.1.1.3. Software and Services

3.2. Global Growth Factors Market Outlook, by Technology, Value (US$ Bn) and 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Immunoassay

3.2.1.2. Molecular Diagnostics

3.2.1.3. Microbiology

3.2.1.4. Others

3.3. Global Growth Factors Market Outlook, Application, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. MRSA

3.3.1.2. Clostridium Difficile

3.3.1.3. Respiratory Virus

3.3.1.4. TB and Drug-resistant TB

3.3.1.5. Gonorrhea

3.3.1.6. HPV

3.3.1.7. HIV

3.3.1.8. Hepatitis C

3.3.1.9. Hepatitis B

3.3.1.10. COVID-19

3.3.1.11. Others

3.4. Global Growth Factors Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Point-of-care

3.4.1.2. Central Laboratories

3.4.1.3. Others

3.5. Global Growth Factors Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. East Asia

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Growth Factors Market Outlook, 2019 - 2032

4.1. North America Growth Factors Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Instruments

4.1.1.2. Reagents

4.1.1.3. Software and Services

4.2. North America Growth Factors Market Outlook, by Technology, Value (US$ Bn) and 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Immunoassay

4.2.1.2. Molecular Diagnostics

4.2.1.3. Microbiology

4.2.1.4. Others

4.3. North America Growth Factors Market Outlook, Application, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. MRSA

4.3.1.2. Clostridium Difficile

4.3.1.3. Respiratory Virus

4.3.1.4. TB and Drug-resistant TB

4.3.1.5. Gonorrhea

4.3.1.6. HPV

4.3.1.7. HIV

4.3.1.8. Hepatitis C

4.3.1.9. Hepatitis B

4.3.1.10. COVID-19

4.3.1.11. Others

4.4. North America Growth Factors Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Point-of-care

4.4.1.2. Central Laboratories

4.4.1.3. Others

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Growth Factors Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. U.S. Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

4.5.1.2. U.S. Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

4.5.1.3. U.S. Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

4.5.1.4. U.S. Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

4.5.1.5. Canada Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

4.5.1.6. Canada Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

4.5.1.7. Canada Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

4.5.1.8. Canada Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Growth Factors Market Outlook, 2019 - 2032

5.1. Europe Growth Factors Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Instruments

5.1.1.2. Reagents

5.1.1.3. Software and Services

5.2. Europe Growth Factors Market Outlook, by Technology, Value (US$ Bn) and 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Immunoassay

5.2.1.2. Molecular Diagnostics

5.2.1.3. Microbiology

5.2.1.4. Others

5.3. Europe Growth Factors Market Outlook, Application, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. MRSA

5.3.1.2. Clostridium Difficile

5.3.1.3. Respiratory Virus

5.3.1.4. TB and Drug-resistant TB

5.3.1.5. Gonorrhea

5.3.1.6. HPV

5.3.1.7. HIV

5.3.1.8. Hepatitis C

5.3.1.9. Hepatitis B

5.3.1.10. COVID-19

5.3.1.11. Others

5.4. Europe Growth Factors Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Point-of-care

5.4.1.2. Central Laboratories

5.4.1.3. Others

5.4.1.4.

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Growth Factors Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Germany Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

5.5.1.2. Germany Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

5.5.1.3. Germany Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.4. Germany Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

5.5.1.5. U.K. Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

5.5.1.6. U.K. Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

5.5.1.7. U.K. Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.8. U.K. Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

5.5.1.9. France Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

5.5.1.10. France Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

5.5.1.11. France Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.12. France Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

5.5.1.13. Spain Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

5.5.1.14. Spain Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

5.5.1.15. Spain Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.16. Spain Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

5.5.1.17. Italy Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

5.5.1.18. Italy Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

5.5.1.19. Italy Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.20. Italy Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

5.5.1.21. Russia Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

5.5.1.22. Russia Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

5.5.1.23. Russia Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.24. Russia Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

5.5.1.25. Rest of Europe Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

5.5.1.26. Rest of Europe Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

5.5.1.27. Rest of Europe Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.28. Rest of Europe Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia & Pacific Growth Factors Market Outlook, 2019 - 2032

6.1. Asia Pacific Growth Factors Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Instruments

6.1.1.2. Reagents

6.1.1.3. Software and Services

6.2. Asia Pacific Growth Factors Market Outlook, by Technology, Value (US$ Bn) and 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Immunoassay

6.2.1.2. Molecular Diagnostics

6.2.1.3. Microbiology

6.2.1.4. Others

6.3. Asia Pacific Growth Factors Market Outlook, Application, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. MRSA

6.3.1.2. Clostridium Difficile

6.3.1.3. Respiratory Virus

6.3.1.4. TB and Drug-resistant TB

6.3.1.5. Gonorrhea

6.3.1.6. HPV

6.3.1.7. HIV

6.3.1.8. Hepatitis C

6.3.1.9. Hepatitis B

6.3.1.10. COVID-19

6.3.1.11. Others

6.4. Asia Pacific Growth Factors Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Point-of-care

6.4.1.2. Central Laboratories

6.4.1.3. Others

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia & Pacific Growth Factors Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. China Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

6.5.1.2. China Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

6.5.1.3. China Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.4. China Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

6.5.1.5. Japan Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

6.5.1.6. Japan Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

6.5.1.7. Japan Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.8. Japan Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

6.5.1.9. South Korea Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

6.5.1.10. South Korea Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

6.5.1.11. South Korea Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.12. South Korea Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

6.5.1.13. India Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

6.5.1.14. India Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

6.5.1.15. India Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.16. India Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

6.5.1.17. Southeast Asia Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

6.5.1.18. Southeast Asia Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

6.5.1.19. Southeast Asia Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.20. Southeast Asia Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

6.5.1.21. Rest of Asia Pacific Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

6.5.1.22. Rest of Asia Pacific Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

6.5.1.23. Rest of Asia Pacific Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.24. Rest of Asia Pacific Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Growth Factors Market Outlook, 2019 - 2032

7.1. Latin America Growth Factors Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Instruments

7.1.1.2. Reagents

7.1.1.3. Software and Services

7.2. Latin America Growth Factors Market Outlook, by Technology, Value (US$ Bn) and 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Immunoassay

7.2.1.2. Molecular Diagnostics

7.2.1.3. Microbiology

7.2.1.4. Others

7.3. Latin America Growth Factors Market Outlook, Application, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. MRSA

7.3.1.2. Clostridium Difficile

7.3.1.3. Respiratory Virus

7.3.1.4. TB and Drug-resistant TB

7.3.1.5. Gonorrhea

7.3.1.6. HPV

7.3.1.7. HIV

7.3.1.8. Hepatitis C

7.3.1.9. Hepatitis B

7.3.1.10. COVID-19

7.3.1.11. Others

7.4. Latin America Growth Factors Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Point-of-care

7.4.1.2. Central Laboratories

7.4.1.3. Others

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Growth Factors Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Brazil Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

7.5.1.2. Brazil Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

7.5.1.3. Brazil Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

7.5.1.4. Brazil Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

7.5.1.5. Mexico Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

7.5.1.6. Mexico Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

7.5.1.7. Mexico Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

7.5.1.8. Mexico Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

7.5.1.9. Rest of Latin America Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

7.5.1.10. Rest of Latin America Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

7.5.1.11. Rest of Latin America Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

7.5.1.12. Rest of Latin America Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Growth Factors Market Outlook, 2019 - 2032

8.1. Middle East & Africa Growth Factors Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Instruments

8.1.1.2. Reagents

8.1.1.3. Software and Services

8.2. Middle East & Africa Growth Factors Market Outlook, by Technology, Value (US$ Bn) and 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Immunoassay

8.2.1.2. Molecular Diagnostics

8.2.1.3. Microbiology

8.2.1.4. Others

8.3. Middle East & Africa Growth Factors Market Outlook, Application, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. MRSA

8.3.1.2. Clostridium Difficile

8.3.1.3. Respiratory Virus

8.3.1.4. TB and Drug-resistant TB

8.3.1.5. Gonorrhea

8.3.1.6. HPV

8.3.1.7. HIV

8.3.1.8. Hepatitis C

8.3.1.9. Hepatitis B

8.3.1.10. COVID-19

8.3.1.11. Others

8.4. Middle East & Africa Growth Factors Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Point-of-care

8.4.1.2. Central Laboratories

8.4.1.3. Others

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Growth Factors Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. GCC Countries Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

8.5.1.2. GCC Countries Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

8.5.1.3. GCC Countries Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.4. GCC Countries Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

8.5.1.5. South Africa Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

8.5.1.6. South Africa Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

8.5.1.7. South Africa Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.8. GCC Countries Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

8.5.1.9. Nigeria Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

8.5.1.10. Nigeria Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

8.5.1.11. Nigeria Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.12. Nigeria Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

8.5.1.13. Nigeria Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

8.5.1.14. Nigeria Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

8.5.1.15. Nigeria Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.16. Nigeria Growth Factors Market by End User, Value (US$ Bn), 2019 - 2032

8.5.1.17. Rest of Middle East & Africa Growth Factors Market by Product Type, Value (US$ Bn), 2019 - 2032

8.5.1.18. Rest of Middle East & Africa Growth Factors Market by Technology, Value (US$ Bn), 2019 - 2032

8.5.1.19. Rest of Middle East & Africa Growth Factors Market by Application, Value (US$ Bn), 2019 - 2032

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product Type vs by Technology Heatmap

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. QIAGEN

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Becton, Dickinson and Company

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. bioMérieux SA

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. F. Hoffmann-La Roche, Ltd.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Hologic, Inc. (Gen Probe)

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Abbott

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Quidel Corporation

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Siemens Healthineers AG

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Bio-Rad Laboratories, Inc.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Danaher

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. OraSure Technologies, Inc.

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type |

|

|

Technology |

|

|

Application |

|

|

End User |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2018-2022), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |