Global Iron Ore Pellets Market Forecast

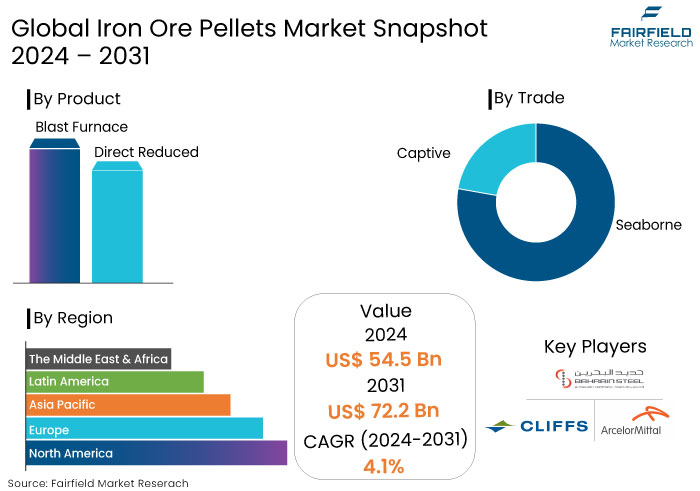

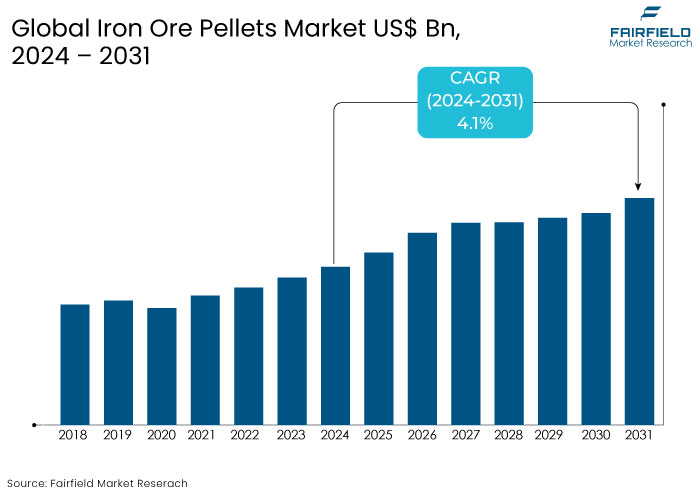

- The iron ore pellets market is expected to be valued at US$72.2 Bn by 2031, showing significant growth from the US$54.5 Bn achieved in 2024.

- The market for iron ore pellets is projected to show a notable expansion rate, with an estimated CAGR of 4.1% from 2024 to 2031.

Iron Ore Pellets Market Insights

- The iron ore pellets market is driven by steel production, particularly in emerging markets like India and Southeast Asia.

- Increasing demand for high-grade pellets due to the transition to low-carbon steelmaking, including hydrogen-based production.

- Based on product type, blast furnace dominates the market with a 56% of the total market share.

- Infrastructure investments and urbanization drive substantial growth opportunities in Asia Pacific.

- Captive trade is the leading trade segment of the market accounting for a 60% of the market share.

- Increasing emphasis on producing eco-friendly, energy-efficient pellets to meet global emission reduction targets.

- The market is primarily dominated by industry giants such as Vale S.A., Rio Tinto, BHP Group, and Cleveland-Cliffs.

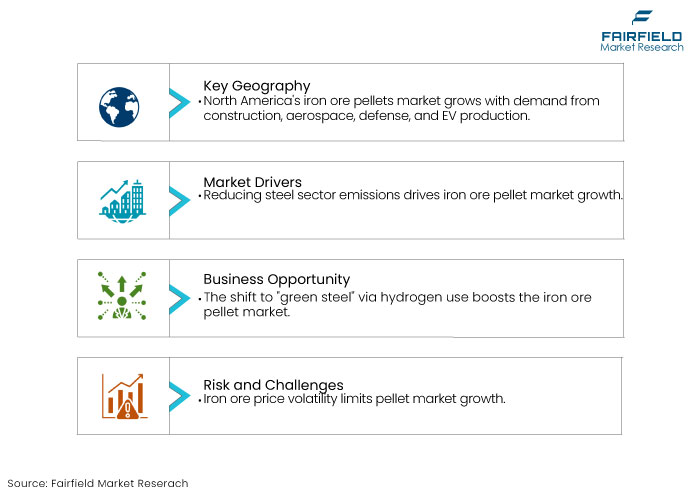

- North America dominates the global market accumulating around 34% of the market share.

A Look Back and a Look Forward - Comparative Analysis

The iron ore pellet market witnessed consistent expansion during the historical period from 2019 to 2023, propelled by rising demand from the steel sector, especially in emerging economies like China and India. Pellets possess a high iron content and are favoured for blast furnaces owing to their reduced impurities and energy efficiency.

The increasing emphasis on minimizing carbon emissions in steel manufacturing and governmental programs promoting clean production techniques have led to heightened demand for high-quality pellets instead of sinter and lump ores.

The market is anticipated to expand at an accelerated pace owing to various factors over the forecast period. A primary catalyst is the global initiative for decarbonisation, particularly in sectors such as steel production. Demand is anticipated to increase due to the proliferation of electric arc furnaces (EAFs), which employ scrap and premium raw materials such as iron ore pellets.

The growing implementation of green hydrogen in steel manufacturing reinforces this tendency. Supply chain optimization and innovations in pelletizing technologies are expected to increase production capacity, lower expenses, and stimulate market expansion. Asia Pacific especially India, is positioned for substantial development due to increasing investments in steel infrastructure projects.

Key Growth Determinants

- Decarbonization of Steel Manufacturing Fuels Market Expansion

A primary catalyst for expanding the iron ore pellet market is the worldwide transition to diminish carbon emissions within the steel sector. With raw iron ore and coke, conventional blast furnaces produce significant CO2 emissions.

Iron ore pellets, characterized by their elevated iron concentration and reduced impurities, are favored in energy-efficient manufacturing methods such as Direct Reduced Iron (DRI) and Electric Arc Furnaces (EAF). Such methods facilitate a reduction in greenhouse gas emissions.

Governments and businesses, especially in Europe and North America, are advocating for more stringent environmental rules and promoting the adoption of low-carbon technology. Consequently, increasing the need for pellets in place of traditional sintered ores.

The prospective application of green hydrogen in steel manufacturing, necessitating high-grade iron inputs like pellets. This factor is anticipated to enhance demand as the sector transitions towards more environmentally sustainable methods.

- Growth of the Global Steel Sector Accelerates Sales

The ongoing growth of the global steel industry, especially in emerging regions such as India, China, and Southeast Asia, is a significant factor for the iron ore pellet market. Iron ore pellets are essential raw materials in steel manufacturing. As these areas prioritize urbanization, infrastructural advancement, and industrial expansion, the need for steel and iron ore pellets is increasing.

Countries such as India are making substantial expenditures in infrastructure, construction, and automotive sectors, necessitating considerable steel. Iron ore pellet makers are increasing production to satisfy rising demand, bolstered by technological breakthroughs in pelletizing processes that improve efficiency and productivity.

Asia Pacific has some of the top steel manufacturers globally, which is anticipated to be a significant catalyst for pellet market expansion, with government-supported initiatives.

Key Growth Barriers

- Fluctuations in Iron Ore Prices Pose a Key Barrier

A key constraint in the iron ore pellets market is the volatility of iron ore prices. Various factors, including fluctuations in demand from steel makers, geopolitical tensions, and disruptions in the supply chain, influence iron ore pricing.

Disruptions in significant iron ore-producing regions such as Brazil and Australia, either by environmental causes or political instability, can result in price surges. Such changes impact the profitability and production planning of pellet makers.

Elevated iron ore costs may drive steel producers to explore alternate raw materials, such as scrap metal or more economical sintered ores, restraining the market growth. Price fluctuation engenders uncertainty in long-term contracts and investments in pelletizing facilities, constraining market expansion, particularly in areas with narrow profit margins.

- Environmental Regulations and Sustainability Challenges

The iron ore pellet market faces significant restraints due to stringent environmental regulations to reduce emissions and minimize environmental degradation. Pellet production involves high energy consumption and carbon dioxide emissions, primarily during pelletizing and sintering processes.

Governments and international bodies are imposing strict limits on emissions, compelling manufacturers to adopt green technologies. Such technologies, however, often come with high costs, impacting profit margins and increasing production expenses.

The push for sustainable mining practices pressures raw material suppliers to comply with environmental norms, potentially reducing supply and increasing costs. As industries strive for decarbonization, demand may shift towards alternative materials, further limiting market growth.

Iron Ore Pellets Market Trends and Opportunities

- Implementation of Green Steel and Hydrogen-based Manufacturing

A significant opportunity in the iron ore pellet market is the increasing emphasis on "green steel" production, motivated by the necessity to decarbonize the steel sector. Conventional steelmaking methods are carbon-heavy, although the hydrogen substitution for coal in reducing iron ore is increasingly being adopted.

Hydrogen-based steel production techniques, including Direct Reduced Iron (DRI) utilizing green hydrogen, necessitate high-quality iron ore pellets to guarantee effective reduction and superior steel yield. The transition offers substantial potential for pellet manufacturers to serve the burgeoning green steel sector. The market for these specialty pellets is anticipated to increase with global legislation and corporate sustainability objectives increasingly prioritizing low-carbon steel production.

- Innovations in Pellet Manufacturing

The continuous progress in pelletizing technology presents a significant opportunity for the iron ore pelleted market. Innovations are transforming the business, including energy-efficient pelletizing techniques, enhanced binders, and the capacity to process lower-grade ores. Such innovations diminish the ecological impact of pellet manufacturing and save operational expenses.

Pellet manufacturers can employ these technologies to enhance production efficiency, diminish emissions, and generate superior-quality pellets for conventional steelmakers. Implementing these technological advancements will preserve a competitive advantage as the global demand for high-quality pellets increases.

How Does Regulatory Scenario Shape the Industry?

The regulatory scenario shapes the iron ore pellets market by driving sustainability and efficiency improvements while imposing challenges. Governments and international organizations enforce strict environmental regulations to curb carbon emissions, significantly impacting pellet production processes.

Policies like carbon taxation, emission trading systems, and mandatory adoption of clean energy technologies are pushing pellet manufacturers to innovate and invest in eco-friendly production methods. The adoption of hydrogen-based direct reduction processes, which emit lower carbon dioxide compared to traditional methods, is gaining traction.

Mining regulations concerning land use, water management, and waste disposal affect the supply of high-grade iron ore, the primary input for pellet production. Compliance with these regulations increases operational costs, impacting profitability for market players.

Regulatory incentives for clean technologies, such as subsidies for renewable energy and carbon credits, allow companies to offset costs and align with sustainability goals.

Regulations encourage technological advancements and market differentiation. These also create financial and operational challenges, influencing production costs, pricing strategies, and competitive dynamics in the market.

Segments Covered in the Report

- Blast Furnace Product Dominates the Market with a 56% of Market Share

The products utilized in the BF method are of inferior quality relative to those employed in the direct reduced (DR) approach. These are more economical than their equivalents, as integrated steel plants often employ the Blast Furnace technique.

The reduced expense of these pellets, coupled with the prevalence of integrated steel mills in developed nations, is the principal reason for propelling expansion in the iron ore pellets market. The direct reduced segment is anticipated to demonstrate the highest CAGR of 3.8% from 2024 to 2031 in revenue terms.

Subsequent to discharge, these pellets generally exhibit elevated mechanical strength. These products demonstrate enhanced reducibility, swelling, and softening melting properties, leading to superior performance in the blast furnace.

- Captive Trade Segment Takes the Lead

The market is divided into captive and seaborne, based on trade. Out of these, the captive trade segment dominates the iron ore pellets market. The captive trade sector leads the market in terms of revenue share. Iron ore pellets are utilized for internal production or delivered to proximate clients for steel fabrication.

Global steel production is influenced by leading steel corporations such as ArcelorMittal, which is vital in sourcing their iron ore pellets from their production plan, further solidifying their position in the industry.

Regional Analysis

- North America’s Dominance Prevails in the Iron Ore Pellets Market

The iron ore pellets market in North America is anticipated to exhibit the high growth rate as a result of the strong demand from the construction, aerospace, defence, and automotive industries. It is anticipated that the demand for steel will be driven by the resurrection of aircraft manufacturing operations and the growing production of electric vehicles (EVs) in the region.

The market for iron ore pellets in the United States held the significant revenue share. The rise in the production of steel and the movement toward environmentally responsible manufacturing techniques are the factors that have contributed to the expansion of the market.

The market in the United States is expanding as a result of shifting trends toward carbon-less steelmaking. Steel demand is anticipated to be driven by rising electric vehicle production and the revival of aircraft manufacturing industries. As a consequence of this, the demand for iron ore pellets is projected to increase over the course of the coming years.

- Europe to Witness Notable Growth due to Transition Towards Green Steelmaking

Europe iron ore pellets market is undergoing a significant transformation driven by the region's commitment to reducing carbon emissions and transitioning toward sustainable industrial practices. The European Union's Green Deal and stringent emission reduction targets are crucial in shaping the demand and production of iron ore pellets.

Steel manufacturers increasingly adopt direct reduction (DR) processes, which require high-quality DR-grade iron ore pellets to align with these sustainability goals. Countries like Germany, Sweden, and Finland are at the forefront of this transition.

Sweden, for example, is advancing hydrogen-based steel production technologies through initiatives like HYBRIT, which relies on low-carbon iron ore pellets. Government subsidies and incentives for renewable energy adoption further encourage pellet production and processing innovation.

The market faces challenges such as high production costs associated with green technologies and the limited availability of suitable raw materials. Despite these hurdles, Europe remains a key player in the global market, driven by policy support, industrial innovation, and growing demand for eco-friendly steel.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the iron ore pellets market is dominated by a few key players, including Vale S.A., Rio Tinto, BHP Group, and Cleveland-Cliffs. They hold substantial market share due to their extensive mining operations, advanced pelletizing technologies, and strong global distribution networks.

Leading companies benefit from vertical integration, controlling both mining and pellet production, which ensures supply chain stability and cost efficiency. Emerging players in regions like India and Southeast Asia are gaining traction due to rising steel production in these areas.

Competitive differentiation is increasingly driven by innovation in pellet quality, sustainability practices, and the ability to cater to the growing demand for low-carbon, high-grade pellets for green steel production. Strategic partnerships and capacity expansions are key growth strategies.

Key Market Companies

- ArcelorMittal

- Bahrain Steel

- Cleveland-Cliffs

- Ferrexpo PLC

- JSW

- LKAB

- METALLOINVEST MC LLC

- Rio Tinto

- Samarco

- Tata Steel

- Vale

Recent Industry Developments

- In March 2023, Blastr Green Steel announced the creation of an iron ore pellet production facility in Northern Norway, with a projected investment of EUR 1.00 billion (USD 1.10 billion). The facility's production will furnish a green steel mill in Finland. A definitive decision on the investment will be made by 2025, dependent on the necessary approvals and agreements.

- In May 2023, JSW announced an investment of USD 1,077.8 million to develop an 8 million tons per annum pallet manufacturing factory in Odisha, India.

An Expert’s Eye

- Experts highlight the growing demand for high-grade iron ore pellets as steel manufacturers adopt environment-friendly practices and aim to reduce carbon emissions in response to stringent global regulations.

- Advanced pelletizing technologies, such as hydrogen-based direct reduction, are pivotal for achieving sustainability goals and maintaining market competitiveness.

- Asia Pacific, particularly China and India, is expected to dominate demand due to industrial expansion.

- Europe is likely to focus on green steel initiatives, driving demand for DR-grade pellets.

- Increased focus on decarbonization and infrastructure projects in emerging economies presents significant growth opportunities for pellet producers.

Global Iron Ore Pellets Market is Segmented as-

By Product

- Blast Furnace

- Direct Reduced

By Trade

- Captive

- Seaborne

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Iron Ore Pellets Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Landscape

2.6. COVID-19 Impact Analysis

2.6.1. Supply

2.6.2. Demand

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Price Trend Analysis, 2019 - 2031,

3.1. Key Highlights

3.2. Global Average Price Analysis, by Type, US$ per Unit

3.3. Prominent Factors Affecting Iron Ore Pellets Prices

3.4. Global Average Price Analysis, by Region, US$ per Unit

4. Global Iron Ore Pellets Market Outlook, 2019 - 2031

4.1. Global Iron Ore Pellets Market Outlook, by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Blast Furnace Pellets

4.1.1.2. Direct Reduced Grade Pellets

4.2. Global Iron Ore Pellets Market Outlook, by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Steel Production

4.2.1.2. Iron-Based Chemicals

4.2.1.3. Others

4.3. Global Iron Ore Pellets Market Outlook, by Region, Value (US$ Mn) & Volume (Tons), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. North America

4.3.1.2. Europe

4.3.1.3. Asia Pacific

4.3.1.4. Latin America

4.3.1.5. Middle East & Africa

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. North America Iron Ore Pellets Market Outlook, 2019 - 2031

5.1. North America Iron Ore Pellets Market Outlook, by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Blast Furnace Pellets

5.1.1.2. Direct Reduced Grade Pellets

5.2. North America Iron Ore Pellets Market Outlook, by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Steel Production

5.2.1.2. Iron-Based Chemicals

5.2.1.3. Others

5.3. North America Iron Ore Pellets Market Outlook, by Country, Value (US$ Mn) & Volume (Tons), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. U.S. Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

5.3.1.2. U.S. Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

5.3.1.3. Canada Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

5.3.1.4. Canada Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Iron Ore Pellets Market Outlook, 2019 - 2031

6.1. Europe Iron Ore Pellets Market Outlook, by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Blast Furnace Pellets

6.1.1.2. Direct Reduced Grade Pellets

6.2. Europe Iron Ore Pellets Market Outlook, by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Steel Production

6.2.1.2. Iron-Based Chemicals

6.2.1.3. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Europe Iron Ore Pellets Market Outlook, by Country, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Germany Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1.2. Germany Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1.3. U.K. Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1.4. U.K. Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1.5. France Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1.6. France Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1.7. Italy Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1.8. Italy Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1.9. Turkey Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1.10. Turkey Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1.11. Russia Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1.12. Russia Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1.13. Rest of Europe Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.1.14. Rest of Europe Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Iron Ore Pellets Market Outlook, 2019 - 2031

7.1. Asia Pacific Iron Ore Pellets Market Outlook, by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Blast Furnace Pellets

7.1.1.2. Direct Reduced Grade Pellets

7.2. Asia Pacific Iron Ore Pellets Market Outlook, by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Steel Production

7.2.1.2. Iron-Based Chemicals

7.2.1.3. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Asia Pacific Iron Ore Pellets Market Outlook, by Country, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. China Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.3.1.2. China Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.3.1.3. Japan Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.3.1.4. Japan Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.3.1.5. South Korea Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.3.1.6. South Korea Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.3.1.7. India Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.3.1.8. India Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.3.1.9. Southeast Asia Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.3.1.10. Southeast Asia Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.3.1.11. Rest of Asia Pacific Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.3.1.12. Rest of Asia Pacific Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Iron Ore Pellets Market Outlook, 2019 - 2031

8.1. Latin America Iron Ore Pellets Market Outlook, by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Blast Furnace Pellets

8.1.1.2. Direct Reduced Grade Pellets

8.2. Latin America Iron Ore Pellets Market Outlook, by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Steel Production

8.2.1.2. Iron-Based Chemicals

8.2.1.3. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Latin America Iron Ore Pellets Market Outlook, by Country, Value (US$ Mn) & Volume (Tons), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Brazil Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

8.3.1.2. Brazil Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

8.3.1.3. Mexico Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

8.3.1.4. Mexico Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

8.3.1.5. Argentina Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

8.3.1.6. Argentina Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

8.3.1.7. Rest of Latin America Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

8.3.1.8. Rest of Latin America Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Iron Ore Pellets Market Outlook, 2019 - 2031

9.1. Middle East & Africa Iron Ore Pellets Market Outlook, by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Blast Furnace Pellets

9.1.1.2. Direct Reduced Grade Pellets

9.2. Middle East & Africa Iron Ore Pellets Market Outlook, by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Steel Production

9.2.1.2. Iron-Based Chemicals

9.2.1.3. Others

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Middle East & Africa Iron Ore Pellets Market Outlook, by Country, Value (US$ Mn) & Volume (Tons), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. GCC Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

9.3.1.2. GCC Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

9.3.1.3. South Africa Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

9.3.1.4. South Africa Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

9.3.1.5. Egypt Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

9.3.1.6. Egypt Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

9.3.1.7. Nigeria Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

9.3.1.8. Nigeria Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

9.3.1.9. Rest of Middle East & Africa Iron Ore Pellets Market by Type, Value (US$ Mn) & Volume (Tons), 2019 - 2031

9.3.1.10. Rest of Middle East & Africa Iron Ore Pellets Market by Application, Value (US$ Mn) & Volume (Tons), 2019 - 2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Company Market Share Analysis, 2023

10.2. Competitive Dashboard

10.3. Company Profiles

10.3.1. Vale SA

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. Rio Tinto

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. BHP Billiton

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. ArcelorMittal S.A.

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. Cleveland-Cliffs Inc.

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Metso Outotec

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. Ferrexpo

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. Mitsubishi Corporation

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. LKAB

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. Arya Group

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Trade Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |