Global Oncology Drugs Market Forecast

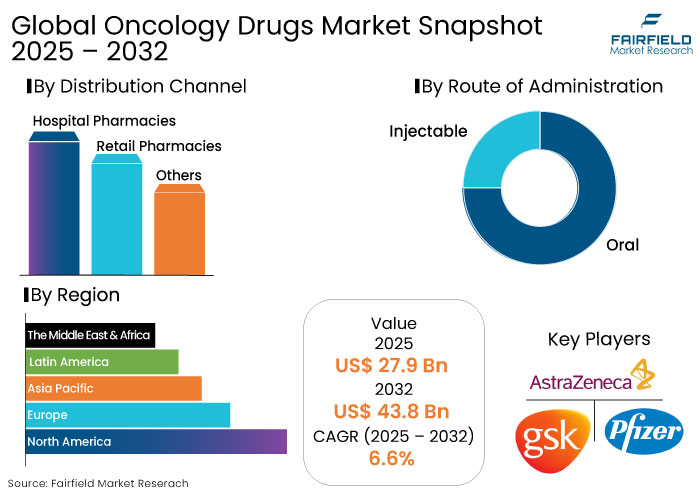

- The oncology drugs market is projected to reach a size of US$ 43.8 Bn by 2032, showing significant growth from the US$ 27.9 Bn achieved in 2025.

- The market for oncology drugs is expected to show a significant expansion rate, with an estimated CAGR of 6.6% from 2025 to 2032.

Oncology Drugs Market Insights

- Immunotherapies and CAR-T cell therapies are rapidly becoming a cornerstone in the oncology drugs market.

- The shift toward personalized cancer treatments based on individual genetic profiles improves efficacy and patient outcomes.

- Rising global incidence of cancer continues to drive the demand for innovative oncology drugs that can address various types of cancer.

- Growing use of combination therapies improves patient outcomes across many cancers.

- Introduction of biosimilars is predicted to decrease the cost burden of oncology drugs while offering affordable treatment options.

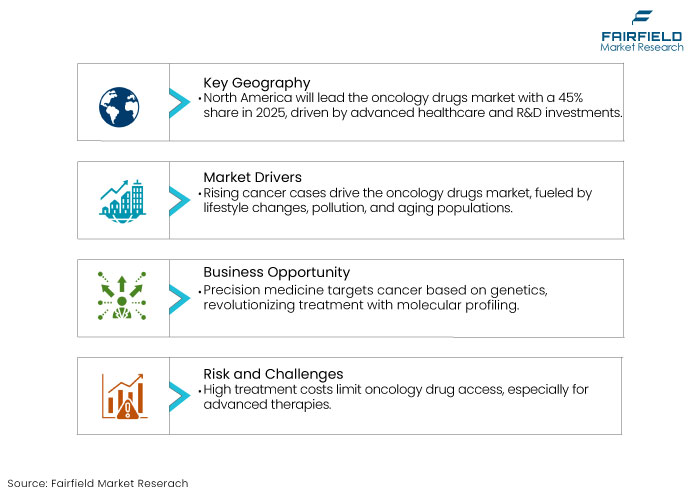

- North America is anticipated to dominate the global market with a share of 45% 2025.

- Chronic lymphocytic leukaemia is predicted to emerge as the leading indication segment, accounting for a share of 20% in 2025.

- Based on distribution channel, the hospital pharmacies segment is projected to lead, accounting for a market share of 58% in 2025.

A Look Back and a Look Forward - Comparative Analysis

The oncology drugs market growth during the historical witnessed several notable developments in oncology drugs and cancer treatments. The market was driven by the increasing prevalence of cancer worldwide and advancements in targeted therapies.

The industry witnessed substantial investments by pharmaceutical companies in research and development activities.

Pfizer's acquisition of Seagen for US$ 43 billion underscores the industry's commitment to enhancing its oncology portfolio, particularly in the realm of antibody-drug conjugates (ADCs).

The oncology drugs industry is anticipated to witness a surge over the forecast period. The growth is likely to be attributed to introducing new oncology drugs and integrating advanced technologies such as AI in drug development. Increasing adoption of immunotherapies and personalized medicine approaches is predicted to propel the market.

Key Growth Determinants

- Rising Prevalence of Cancer

Growing incidence of cancer worldwide is a critical driver for the oncology drugs market. With changing lifestyles, increased pollution, and aging populations, the number of cancer cases is rising at an alarming rate.

According to the World Health Organization, cancer cases are predicted to increase by nearly 47% from 2020 to 2040, emphasizing the urgent need for effective treatments.

Cancers like breast, lung, and colorectal cancer are now more prevalent due to factors like sedentary lifestyles, poor diets, and tobacco use. The surge in cases amplified the demand for advanced drugs for oncology.

Pharmaceutical companies are racing to address this need by developing innovative therapies to improve survival rates and enhance the quality of life. Targeted therapies and immunotherapies have shown remarkable efficacy in treating specific cancer types, attracting significant investment in research and development activities.

- Advancements in Precision Medicine and Immunotherapy

Technological development in precision medicine and immunotherapy is transforming cancer treatment, making it a pivotal growth driver for the oncology drugs market. Precision medicine tailors treatments to a patient's genetic profile, ensuring maximum efficacy with minimal side effects. Drugs targeting mutations like HER2 in breast cancer or EGFR in lung cancer have drastically improved patient outcomes.

Immunotherapies like CAR-T cell therapy and checkpoint inhibitors represent another ground-breaking advancement. These new oncology drugs harness the body's immune system to fight effectively fight cancer. Treatments like pembrolizumab (Keytruda) and nivolumab (Opdivo) have set new standards for managing cancers like melanoma and non-small cell lung cancer.

According to the report, as of 2023, the success rate for CAR-T cell therapy in relapsed or refractory B-cell acute lymphoblastic leukemia (ALL) is approximately 80% to 90% in specific patient populations.

Key Growth Barriers

- High Costs of Oncology Drugs

High cost of cancer treatments is a prominent restraint in the oncology drugs market. Advanced therapies like immunotherapy, CAR-T cell treatments, and targeted drugs for oncology come with hefty price tags.

CAR-T therapies like Kymriah and Yescarta can cost up to US$ 400,000 per patient. These excessive costs make new oncology drugs inaccessible to many, especially in low and middle-income countries.

Even in developed nations, the financial burden of these treatments can lead to significant expenses for patients despite insurance coverage. This financial strain affects treatment adherence and limits the broader adoption of new oncology drugs.

High development and manufacturing costs of such therapies, coupled with stringent regulatory requirements, further contribute to their steep pricing. Addressing this challenge will require innovative pricing models and expanded patient assistance programs to make these life-saving drugs more accessible.

Oncology Drugs Market Trends and Opportunities

- Adoption of Personalized Medicine

Personalized or precision medicine tailor’s cancer treatments based on a patient's genetic makeup, tumour characteristics, and individual health profile. These treatment strategies are particularly beneficial in targeting specific genetic mutations that drive cancer growth, like HER2-positive breast cancer or EGFR-mutant lung cancer. Molecular profiling and diagnostic tool advancements have revolutionized how doctors approach cancer treatment.

Introduction of drugs targeting specific genetic markers, like trastuzumab for HER2-positive breast cancer or osimertinib for EGFR-mutant lung cancer, have marked significant milestones in the oncology drugs market. Rapid development of companion diagnostics has enabled oncologists to identify patients likely to benefit from these new oncology drugs, enhancing their precision and effectiveness.

According to studies, personalized immunotherapies for melanoma have increased the 5-year survival rate for advanced melanoma patients to 52%, from the historical survival rates of just 5% to 10%.

- Expansion of Immunotherapy Treatments

Rise of immunotherapy presents a significant opportunity for growth in the oncology drugs market. Immunotherapy, which leverages the body's immune system to fight cancer, has emerged as a breakthrough treatment for several types of cancer.

As research progresses, there is a growing opportunity to expand immunotherapy to a broader range of cancers and patient populations. Combination therapies, where immunotherapies are paired with traditional treatments like chemotherapy or radiation, are being explored to enhance the overall effectiveness of cancer care.

The increasing focus on immunotherapy attracts significant investment from pharmaceutical giants and emerging biotech companies, driving innovation and further expanding the oncology drugs market. The continued development of new oncology drugs could revolutionize cancer treatment, offering patients more options and improving survival rates across multiple cancer types.

How is Regulatory Scenario Shaping this Industry?

The regulatory landscape in the oncology drugs market plays a pivotal role by driving innovation while ensuring patient safety. Regulatory bodies like the FDA and EMA are streamlining approval processes for oncology drugs.

Expedited pathways like Breakthrough Therapy Designation and Accelerated Approval allow new oncology drugs to reach the market faster, particularly for rising medical needs. Initiatives to enhance clinical trial designs, such as basket and adaptive trials, facilitate quicker and effective drug evaluations.

Regulatory frameworks promote collaboration between pharmaceutical companies and regulatory authorities to foster innovation and address safety concerns. The oncology drugs market is witnessing stringent post-marketing surveillance to monitor the real-world performance of newly approved treatments.

Segment Covered in the Report

- High Prevalence of Chronic lymphocytic Leukaemia Highlights the Need for Advanced Drugs

Chronic lymphocytic leukaemia is predicted to lead the segment with a share of 20% in 2025. Chronic lymphocytic leukaemia category collectively drives demand for innovative treatments. High prevalence of these conditions highlights the critical need for advanced drugs for oncology.

Chronic lymphocytic leukaemia dominance is fuelled by ground-breaking advancements in therapies, particularly targeted treatments and immunotherapies. New oncology drugs like CAR-T therapies, have shown remarkable success, decreasing the risk of death in multiple myeloma patients by 45%.

Pharmaceutical giants are heavily investing in expanding their oncology portfolios. The strong focus on blood cancers, supported by innovative therapies and strategic investments, underscores their prominence in the oncology drugs market.

- Hospital Pharmacies Ability to Provide Integrated Care Facilitate Demand

In the oncology drugs market, hospital pharmacies serve as the primary distribution channel, accounting for 58% of the market share in 2025. Hospitals are central to the administration of complex cancer treatments, including chemotherapy, immunotherapy, and the latest targeted therapies.

The complex nature of these treatments often necessitates professional healthcare settings to ensure patient safety and optimal outcomes. Hospitals provide comprehensive care, integrating diagnosis, treatment, and ongoing monitoring, which is crucial for managing cancer's multifaceted challenges.

Hospitals often have access to new oncology drugs through clinical trials and early access programs, offering patients cutting-edge therapies that are not yet available in retail pharmacies.

Regional Analysis

- Early Acceptance of Novel Cancer Treatments in North America Facilitate Growth

North America is predicted to emerge as the leading region in the global oncology drugs market with a share of 45% in 2025. The region’s dominance is attributed to its sophisticated healthcare systems and high investments in research and development activities.

Early acceptance of novel cancer treatments, including targeted medicines and immunotherapies further facilitates growth. Regulatory bodies like the FDA and EMA are crucial in their respective regions, enforcing stringent drug approval protocols and influencing market dynamics.

The U.S., with its significant concentration of prominent biopharmaceutical firms and healthcare infrastructure, constitutes 40% of the market in North America. Increased acceptance of premium-priced specialty medications by patients and physicians has facilitated companies' successful market entry with their novel medicinal products.

- Asia Pacific to Witness Fastest Growth over the Forecast Period

Asia Pacific is anticipated to emerge as the fastest-growing market for oncology drugs. Enhancing healthcare accessibility, along with increased disposable incomes in countries like China and India, is facilitating market growth.

China and India offer minimal manufacturing and research and development expenses, enticing biopharmaceutical companies to increase local production of generics and biosimilars. This facilitates affordability of oncology treatment.

Growing patient awareness regarding early identification and cancer management signifies substantial long-term business potential. Japan occupies a significant role due to its universal health care, which guarantees extensive access.

Fairfield’s Competitive Landscape Analysis

The oncology drugs market is highly competitive, driven by continuous innovation and growing demand for effective cancer treatments. Prominent players like Pfizer, Roche, Bristol-Myers Squibb, and Merck are predicted to lead the market with their focus on groundbreaking drugs for oncology.

Emerging biotech companies are also making waves by introducing new oncology drugs, particularly in niche areas like precision medicine and antibody-drug conjugates (ADCs). Strategic collaborations, mergers, and acquisitions are common, as seen in Pfizer's acquisition of Seagen to bolster its oncology portfolio.

Increasing competition among generics manufacturers further intensifies market dynamics. With a robust pipeline of innovative therapies and the rising prevalence of cancer, the oncology drugs market is poised for sustained growth and elevated competition.

Key Market Companies

- GlaxoSmithKline

- AstraZeneca plc

- AbbVie

- Pfizer Inc.

- Amgen Inc

- Gilead Sciences, Inc

- Hoffmann-La Roche Ltd

- Bristol-Myers Squibb Company (Celgene Corp)

- Novartis AG

- Johnson & Johnson Merck & Co.

- Eli Lilly and Company

- Sanofi S.A

- Bayer AG

Recent Industry Developments

- In February 2024, AbbVie Inc. signed an acquisition deal with ImmunoGen, a biotechnology firm specializing in antibody-drug conjugate therapies for cancer treatment, to enhance its position in the oncology sector.

- In January 2024, AbbVie Inc. partnered with Umoja Biopharma, a firm specializing in immunotherapy using in vivo T cell reprogramming to target cancer cells, to develop innovative In-Situ CAR-T cell therapeutics.

An Expert’s Eye

- Experts highlight that the oncology drugs market is rapidly evolving with the rise of precision medicine.

- Immunotherapies like checkpoint inhibitors and CAR-T cell therapies are revolutionizing the oncology drugs market.

- Combination therapies, combining traditional treatments with newer oncology drugs like immunotherapy, are gaining traction.

- Experts believe that biosimilars are predicted to play a crucial role in addressing the high price of oncology drugs, making treatment more affordable.

Global Oncology Drugs Market is Segmented as-

By Drug Class

- Chemotherapy

- Alkylating Agents

- Antimetabolites

- Anti-tumour Antibiotics

- Topoisomerase Inhibitors

- Mitotic Inhibitors

- Others

- Targeted Therapy

- Monoclonal Antibodies

- Small molecule Inhibitors

- Immunotherapy

- Immune Checkpoint Inhibitors

- Cell Therapy and Gene Therapy

- Oncolytic Virus Therapy

- Immune System Modulators

- Hormonal Therapy

By Indication

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Multiple Myeloma

- Colorectal Cancer

- Non-Hodgkin's Lymphoma

- Kidney Cancer

- Chronic lymphocytic Leukaemia

- Melanoma

- Others

By Route of Administration

- Oral

- Injectable

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Oncology Drugs Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Oncology Drugs Market Outlook, 2019 - 2032

3.1. Global Oncology Drugs Market Outlook, by Drug Class, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Chemotherapy

3.1.1.1.1. Alkylating Agents

3.1.1.1.2. Antimetabolites

3.1.1.1.3. Anti-tumour Antibiotics

3.1.1.1.4. Topoisomerase Inhibitors

3.1.1.1.5. Mitotic Inhibitors

3.1.1.1.6. Others

3.1.1.2. Targeted Therapy

3.1.1.2.1. Monoclonal Antibodies

3.1.1.2.2. Small molecule Inhibitors

3.1.1.3. Immunotherapy

3.1.1.3.1. Immune Checkpoint Inhibitors

3.1.1.3.2. Cell Therapy and Gene Therapy

3.1.1.3.3. Oncolytic Virus Therapy

3.1.1.3.4. Immune System Modulators

3.1.1.3.5. Others

3.1.1.4. Hormonal Therapy

3.2. Global Oncology Drugs Market Outlook, by Indication, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Breast Cancer

3.2.1.2. Lung Cancer

3.2.1.3. Prostate Cancer

3.2.1.4. Multiple Myeloma

3.2.1.5. Colorectal Cancer

3.2.1.6. Non-Hodgkin's Lymphoma

3.2.1.7. Kidney Cancer

3.2.1.8. Chronic lymphocytic Leukaemia

3.2.1.9. Melanoma

3.2.1.10. Others

3.3. Global Oncology Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Oral

3.3.1.2. Injectable

3.4. Global Oncology Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Hospital Pharmacies

3.4.1.2. Retail Pharmacies

3.4.1.3. Others

3.5. Global Oncology Drugs Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Oncology Drugs Market Outlook, 2019 - 2032

4.1. North America Oncology Drugs Market Outlook, by Drug Class, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Chemotherapy

4.1.1.1.1. Alkylating Agents

4.1.1.1.2. Antimetabolites

4.1.1.1.3. Anti-tumour Antibiotics

4.1.1.1.4. Topoisomerase Inhibitors

4.1.1.1.5. Mitotic Inhibitors

4.1.1.1.6. Others

4.1.1.2. Targeted Therapy

4.1.1.2.1. Monoclonal Antibodies

4.1.1.2.2. Small molecule Inhibitors

4.1.1.3. Immunotherapy

4.1.1.3.1. Immune Checkpoint Inhibitors.

4.1.1.3.2. Cell Therapy and Gene Therapy

4.1.1.3.3. Oncolytic Virus Therapy

4.1.1.3.4. Immune System Modulators

4.1.1.3.5. Others

4.1.1.4. Hormonal Therapy

4.2. North America Oncology Drugs Market Outlook, by Indication, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Breast Cancer

4.2.1.2. Lung Cancer

4.2.1.3. Prostate Cancer

4.2.1.4. Multiple Myeloma

4.2.1.5. Colorectal Cancer

4.2.1.6. Non-Hodgkin's Lymphoma

4.2.1.7. Kidney Cancer

4.2.1.8. Chronic lymphocytic Leukaemia

4.2.1.9. Melanoma

4.2.1.10. Others

4.3. North America Oncology Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Oral

4.3.1.2. Injectable

4.4. North America Oncology Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Hospital Pharmacies

4.4.1.2. Retail Pharmacies

4.4.1.3. Others

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Oncology Drugs Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. U.S. Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

4.5.1.2. U.S. Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

4.5.1.3. U.S. Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

4.5.1.4. U.S. Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

4.5.1.5. Canada Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

4.5.1.6. Canada Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

4.5.1.7. Canada Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

4.5.1.8. Canada Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Oncology Drugs Market Outlook, 2019 - 2032

5.1. Europe Oncology Drugs Market Outlook, by Drug Class, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Chemotherapy

5.1.1.1.1. Alkylating Agents

5.1.1.1.2. Antimetabolites

5.1.1.1.3. Anti-tumour Antibiotics

5.1.1.1.4. Topoisomerase Inhibitors

5.1.1.1.5. Mitotic Inhibitors

5.1.1.1.6. Others

5.1.1.2. Targeted Therapy

5.1.1.2.1. Monoclonal Antibodies

5.1.1.2.2. Small molecule Inhibitors

5.1.1.3. Immunotherapy

5.1.1.3.1. Immune Checkpoint Inhibitors.

5.1.1.3.2. Cell Therapy and Gene Therapy

5.1.1.3.3. Oncolytic Virus Therapy

5.1.1.3.4. Immune System Modulators

5.1.1.3.5. Others

5.1.1.4. Hormonal Therapy

5.2. Europe Oncology Drugs Market Outlook, by Indication, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Breast Cancer

5.2.1.2. Lung Cancer

5.2.1.3. Prostate Cancer

5.2.1.4. Multiple Myeloma

5.2.1.5. Colorectal Cancer

5.2.1.6. Non-Hodgkin's Lymphoma

5.2.1.7. Kidney Cancer

5.2.1.8. Chronic lymphocytic Leukaemia

5.2.1.9. Melanoma

5.2.1.10. Others

5.3. Europe Oncology Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Oral

5.3.1.2. Injectable

5.4. Europe Oncology Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Hospital Pharmacies

5.4.1.2. Retail Pharmacies

5.4.1.3. Others

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Oncology Drugs Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Germany Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

5.5.1.2. Germany Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

5.5.1.3. Germany Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.5.1.4. Germany Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.5.1.5. U.K. Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

5.5.1.6. U.K. Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

5.5.1.7. U.K. Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.5.1.8. U.K. Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.5.1.9. France Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

5.5.1.10. France Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

5.5.1.11. France Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.5.1.12. France Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.5.1.13. Italy Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

5.5.1.14. Italy Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

5.5.1.15. Italy Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.5.1.16. Italy Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.5.1.17. Turkey Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

5.5.1.18. Turkey Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

5.5.1.19. Turkey Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.5.1.20. Turkey Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.5.1.21. Russia Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

5.5.1.22. Russia Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

5.5.1.23. Russia Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.5.1.24. Russia Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.5.1.25. Rest of Europe Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

5.5.1.26. Rest of Europe Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

5.5.1.27. Rest of Europe Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

5.5.1.28. Rest of Europe Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Oncology Drugs Market Outlook, 2019 - 2032

6.1. Asia Pacific Oncology Drugs Market Outlook, by Drug Class, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Chemotherapy

6.1.1.1.1. Alkylating Agents

6.1.1.1.2. Antimetabolites

6.1.1.1.3. Anti-tumour Antibiotics

6.1.1.1.4. Topoisomerase Inhibitors

6.1.1.1.5. Mitotic Inhibitors

6.1.1.1.6. Others

6.1.1.2. Targeted Therapy

6.1.1.2.1. Monoclonal Antibodies

6.1.1.2.2. Small molecule Inhibitors

6.1.1.3. Immunotherapy

6.1.1.3.1. Immune Checkpoint Inhibitors.

6.1.1.3.2. Cell Therapy and Gene Therapy

6.1.1.3.3. Oncolytic Virus Therapy

6.1.1.3.4. Immune System Modulators

6.1.1.3.5. Others

6.1.1.4. Hormonal Therapy

6.2. Asia Pacific Oncology Drugs Market Outlook, by Indication, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Breast Cancer

6.2.1.2. Lung Cancer

6.2.1.3. Prostate Cancer

6.2.1.4. Multiple Myeloma

6.2.1.5. Colorectal Cancer

6.2.1.6. Non-Hodgkin's Lymphoma

6.2.1.7. Kidney Cancer

6.2.1.8. Chronic lymphocytic Leukaemia

6.2.1.9. Melanoma

6.2.1.10. Others

6.3. Asia Pacific Oncology Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Oral

6.3.1.2. Injectable

6.4. Asia Pacific Oncology Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Hospital Pharmacies

6.4.1.2. Retail Pharmacies

6.4.1.3. Others

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Oncology Drugs Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. China Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

6.5.1.2. China Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

6.5.1.3. China Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.5.1.4. China Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.5.1.5. Japan Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

6.5.1.6. Japan Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

6.5.1.7. Japan Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.5.1.8. Japan Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.5.1.9. South Korea Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

6.5.1.10. South Korea Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

6.5.1.11. South Korea Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.5.1.12. South Korea Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.5.1.13. India Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

6.5.1.14. India Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

6.5.1.15. India Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.5.1.16. India Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.5.1.17. Southeast Asia Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

6.5.1.18. Southeast Asia Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

6.5.1.19. Southeast Asia Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.5.1.20. Southeast Asia Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.5.1.21. Rest of Asia Pacific Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

6.5.1.22. Rest of Asia Pacific Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

6.5.1.23. Rest of Asia Pacific Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

6.5.1.24. Rest of Asia Pacific Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Oncology Drugs Market Outlook, 2019 - 2032

7.1. Latin America Oncology Drugs Market Outlook, by Drug Class, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Chemotherapy

7.1.1.1.1. Alkylating Agents

7.1.1.1.2. Antimetabolites

7.1.1.1.3. Anti-tumour Antibiotics

7.1.1.1.4. Topoisomerase Inhibitors

7.1.1.1.5. Mitotic Inhibitors

7.1.1.1.6. Others

7.1.1.2. Targeted Therapy

7.1.1.2.1. Monoclonal Antibodies

7.1.1.2.2. Small molecule Inhibitors

7.1.1.3. Immunotherapy

7.1.1.3.1. Immune Checkpoint Inhibitors.

7.1.1.3.2. Cell Therapy and Gene Therapy

7.1.1.3.3. Oncolytic Virus Therapy

7.1.1.3.4. Immune System Modulators

7.1.1.3.5. Others

7.1.1.4. Hormonal Therapy

7.2. Latin America Oncology Drugs Market Outlook, by Indication, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Breast Cancer

7.2.1.2. Lung Cancer

7.2.1.3. Prostate Cancer

7.2.1.4. Multiple Myeloma

7.2.1.5. Colorectal Cancer

7.2.1.6. Non-Hodgkin's Lymphoma

7.2.1.7. Kidney Cancer

7.2.1.8. Chronic lymphocytic Leukaemia

7.2.1.9. Melanoma

7.2.1.10. Others

7.3. Latin America Oncology Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Oral

7.3.1.2. Injectable

7.4. Latin America Oncology Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Hospital Pharmacies

7.4.1.2. Retail Pharmacies

7.4.1.3. Others

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Oncology Drugs Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Brazil Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

7.5.1.2. Brazil Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

7.5.1.3. Brazil Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

7.5.1.4. Brazil Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.5.1.5. Mexico Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

7.5.1.6. Mexico Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

7.5.1.7. Mexico Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

7.5.1.8. Mexico Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.5.1.9. Argentina Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

7.5.1.10. Argentina Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

7.5.1.11. Argentina Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

7.5.1.12. Argentina Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.5.1.13. Rest of Latin America Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

7.5.1.14. Rest of Latin America Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

7.5.1.15. Rest of Latin America Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

7.5.1.16. Rest of Latin America Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Oncology Drugs Market Outlook, 2019 - 2032

8.1. Middle East & Africa Oncology Drugs Market Outlook, by Drug Class, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Chemotherapy

8.1.1.1.1. Alkylating Agents

8.1.1.1.2. Antimetabolites

8.1.1.1.3. Anti-tumour Antibiotics

8.1.1.1.4. Topoisomerase Inhibitors

8.1.1.1.5. Mitotic Inhibitors

8.1.1.1.6. Others

8.1.1.2. Targeted Therapy

8.1.1.2.1. Monoclonal Antibodies

8.1.1.2.2. Small molecule Inhibitors

8.1.1.3. Immunotherapy

8.1.1.3.1. Immune Checkpoint Inhibitors.

8.1.1.3.2. Cell Therapy and Gene Therapy

8.1.1.3.3. Oncolytic Virus Therapy

8.1.1.3.4. Immune System Modulators

8.1.1.3.5. Others

8.1.1.4. Hormonal Therapy

8.2. Middle East & Africa Oncology Drugs Market Outlook, by Indication, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Breast Cancer

8.2.1.2. Lung Cancer

8.2.1.3. Prostate Cancer

8.2.1.4. Multiple Myeloma

8.2.1.5. Colorectal Cancer

8.2.1.6. Non-Hodgkin's Lymphoma

8.2.1.7. Kidney Cancer

8.2.1.8. Chronic lymphocytic Leukaemia

8.2.1.9. Melanoma

8.2.1.10. Others

8.3. Middle East & Africa Oncology Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Oral

8.3.1.2. Injectable

8.4. Middle East & Africa Oncology Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Hospital Pharmacies

8.4.1.2. Retail Pharmacies

8.4.1.3. Others

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Oncology Drugs Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. GCC Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

8.5.1.2. GCC Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

8.5.1.3. GCC Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.5.1.4. GCC Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.5.1.5. South Africa Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

8.5.1.6. South Africa Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

8.5.1.7. South Africa Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.5.1.8. South Africa Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.5.1.9. Egypt Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

8.5.1.10. Egypt Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

8.5.1.11. Egypt Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.5.1.12. Egypt Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.5.1.13. Nigeria Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

8.5.1.14. Nigeria Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

8.5.1.15. Nigeria Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.5.1.16. Nigeria Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.5.1.17. Rest of Middle East & Africa Oncology Drugs Market by Drug Class, Value (US$ Bn), 2019 - 2032

8.5.1.18. Rest of Middle East & Africa Oncology Drugs Market by Indication, Value (US$ Bn), 2019 - 2032

8.5.1.19. Rest of Middle East & Africa Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019 - 2032

8.5.1.20. Rest of Middle East & Africa Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2023

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. GlaxoSmithKline

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. AstraZeneca plc

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. AbbVie

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Pfizer Inc.

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. Amgen Inc.

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Gilead Sciences, Inc.

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. F. Hoffmann-La Roche Ltd

9.3.7.1. Company Overview

9.3.7.2. Product Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. Bristol-Myers Squibb Company (Celgene Corp)

9.3.8.1. Company Overview

9.3.8.2. Product Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. Novartis AG

9.3.9.1. Company Overview

9.3.9.2. Product Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. Johnson & Johnson

9.3.10.1. Company Overview

9.3.10.2. Product Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. Merck & Co.

9.3.11.1. Company Overview

9.3.11.2. Product Portfolio

9.3.11.3. Financial Overview

9.3.11.4. Business Strategies and Development

9.3.12. Eli Lilly and Company

9.3.12.1. Company Overview

9.3.12.2. Product Portfolio

9.3.12.3. Financial Overview

9.3.12.4. Business Strategies and Development

9.3.13. Sanofi S.A

9.3.13.1. Company Overview

9.3.13.2. Product Portfolio

9.3.13.3. Financial Overview

9.3.13.4. Business Strategies and Development

9.3.14. Bayer AG

9.3.14.1. Company Overview

9.3.14.2. Product Portfolio

9.3.14.3. Financial Overview

9.3.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Drug Class Coverage |

|

|

Indication Coverage |

|

|

Route of Administration Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |